Wholesale Real Estate Contracts represent a critical juncture in the property investment industry, enabling a streamlined process of buying and selling before a property reaches the retail buyer. As a vital tool for investors and real estate professionals, these contracts foster opportunities, efficiency, and growth in the real estate market.

Whether you are an experienced professional or a newcomer interested in leveraging this unique investment strategy, this article will delve into the nuances and complexities of Wholesale Real Estate Contracts, complete with an easy-to-follow template to guide your next transaction.

Table of Contents

What Is A Wholesale Real Estate Contract?

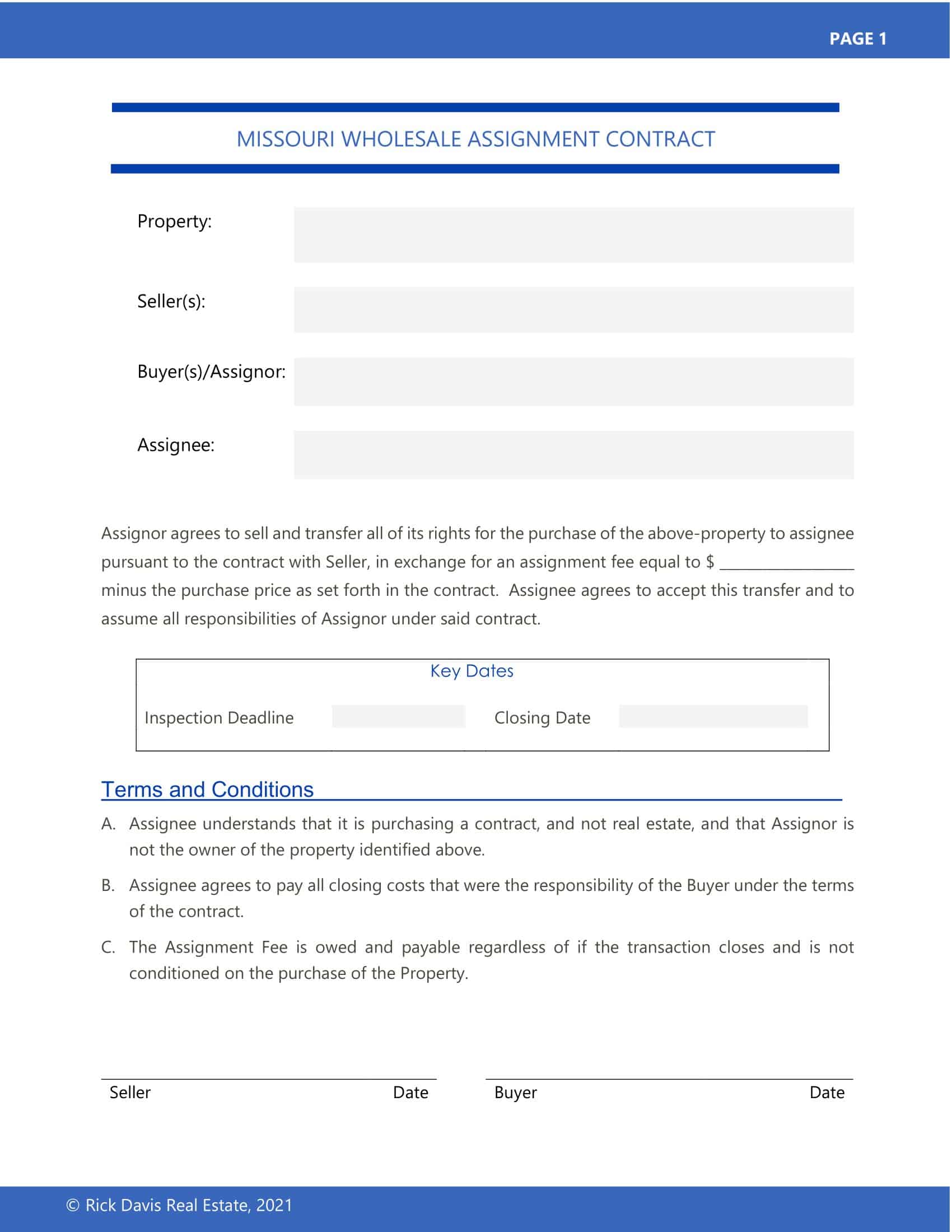

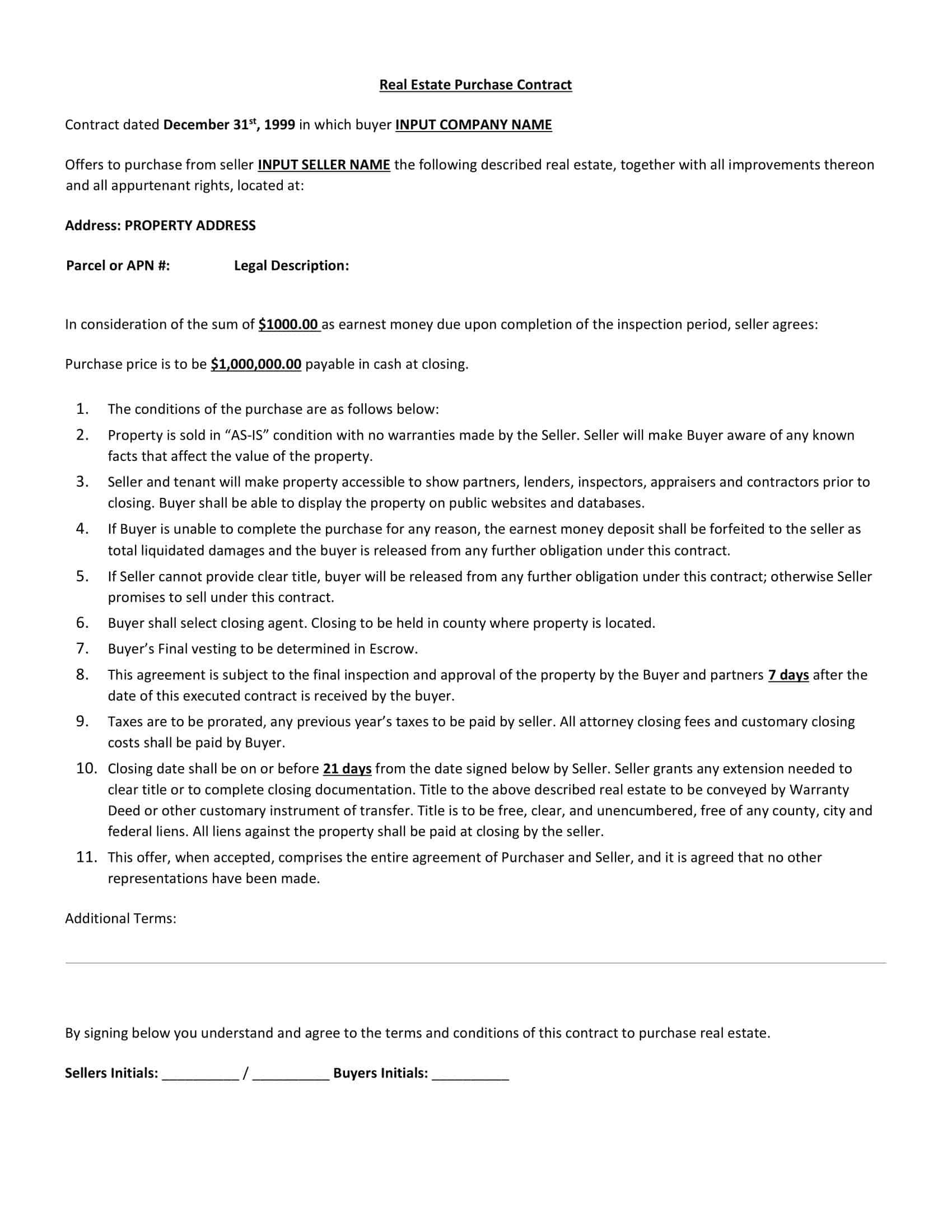

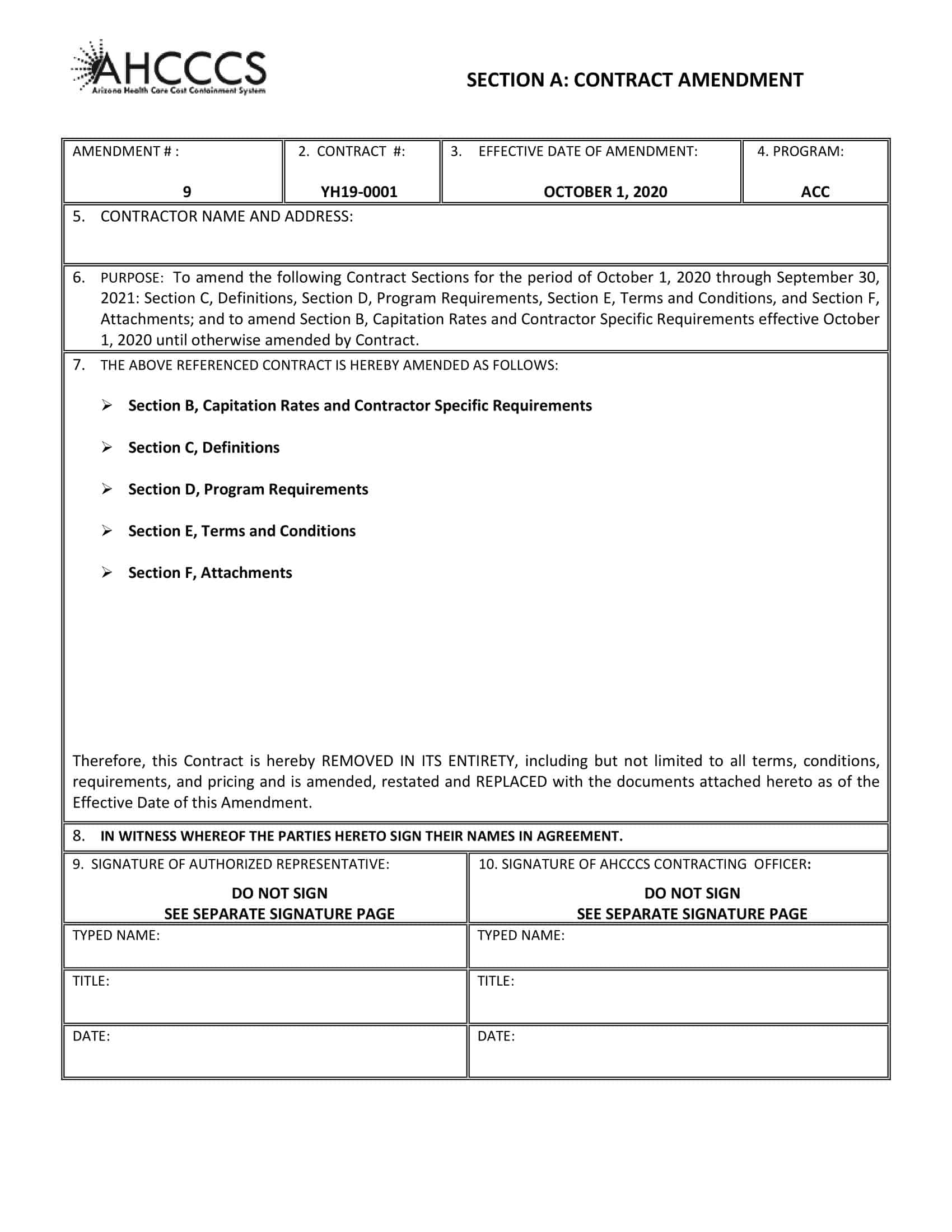

![Free Printable Wholesale Real Estate Contract Templates [PDF] Example 1 Wholesale Real Estate Contract](https://www.typecalendar.com/wp-content/uploads/2023/08/Wholesale-Real-Estate-Contract.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/08/Wholesale-Real-Estate-Contract-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/08/Wholesale-Real-Estate-Contract-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/08/Wholesale-Real-Estate-Contract-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/08/Wholesale-Real-Estate-Contract-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/08/Wholesale-Real-Estate-Contract-1200x675.jpg 1200w)

A Wholesale Real Estate Contract is a binding agreement between two parties, typically a real estate wholesaler and a seller, that allows the wholesaler to purchase a property with the intention of quickly reselling it to an end buyer at a higher price. Unlike traditional real estate transactions, the wholesaler never actually intends to own the property.

Instead, they work to find a buyer before the contract’s closing date, essentially serving as a middleman. This contract outlines the price, terms, and conditions of the sale, and it may include specific clauses that protect the wholesaler’s interest. By bridging the gap between sellers and buyers, a Wholesale Real Estate Contract offers a unique and potentially lucrative avenue for real estate investment.

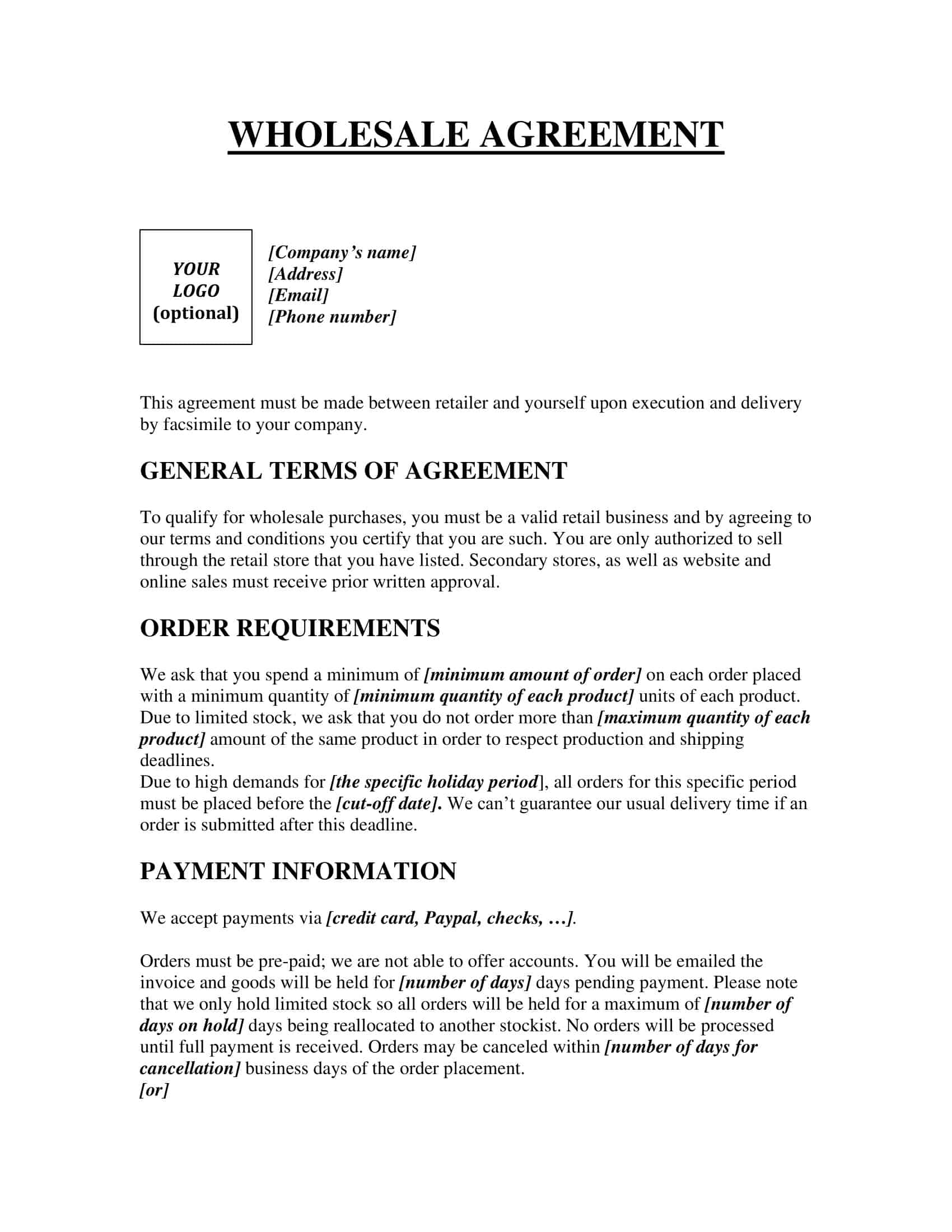

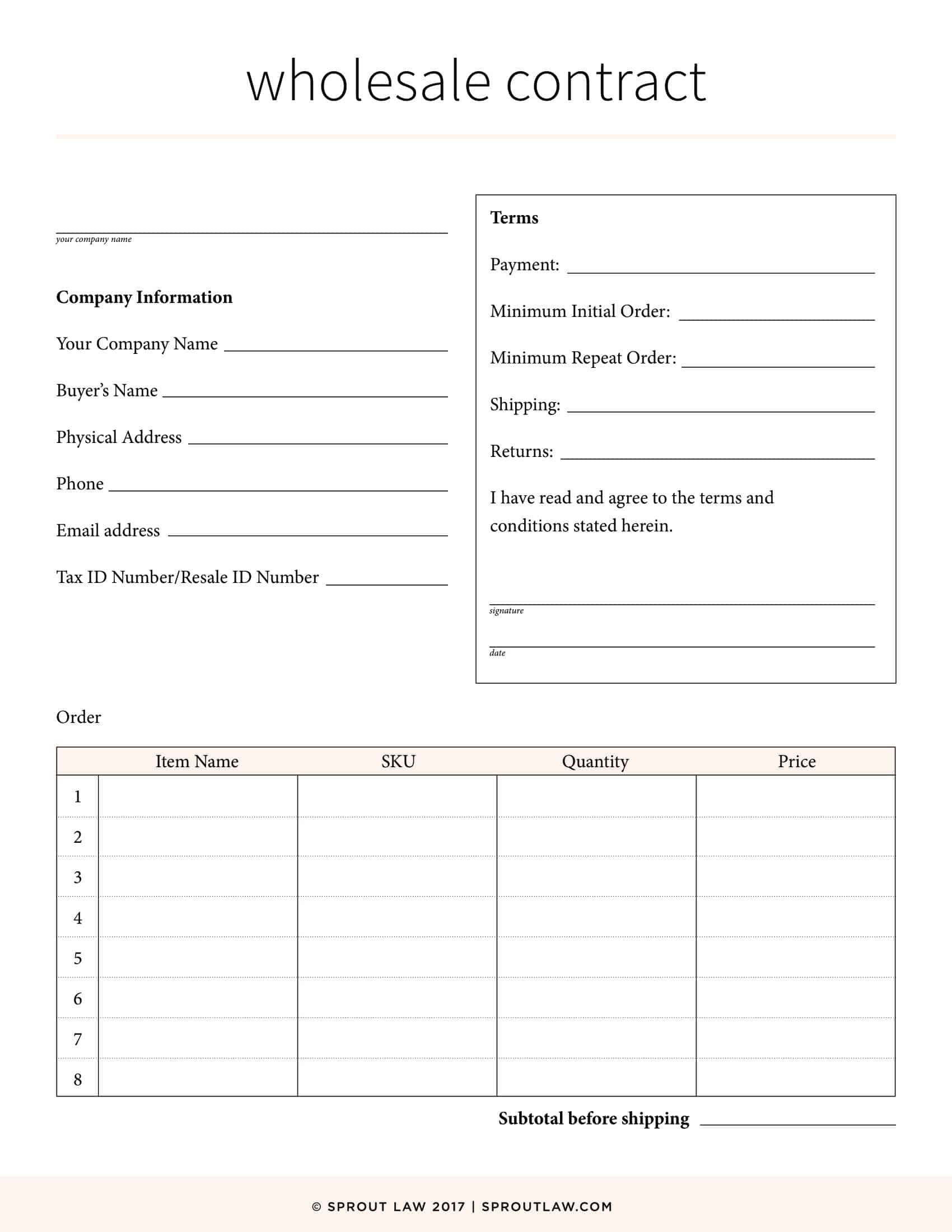

Wholesale Real Estate Contract Templates

Wholesaling real estate involves finding discounted properties and selling contracts to end buyers. Wholesalers use contract templates to facilitate deals. The templates allow custom terms while covering key information.

Wholesale contract templates identify the property address, price and closing date. They note any defects and inspection period. Earnest money and assignment fees are outlined. Templates have clauses for title contingencies and proof of funds. Terminations, transfers and extensions are detailed. Disclosures and disclaimers are included to limit liability.

Reliable wholesale templates enable smooth transactions for wholesalers. They can customize specifics like names, dates and fees. Using standardized templates guarantees proper terms are included. Following real estate norms brings validity. Templates help wholesalers work efficiently with buyers. They present professional agreements that give confidence. Wholesale real estate contract templates are essential for assigning equitable deals to end purchasers.

Is a wholesale real estate contract really important?

A Wholesale Real Estate Contract is more than just a document; it’s the cornerstone of a unique investment strategy in the real estate industry. Without this contractual agreement, a wholesaler is unable to secure the rights to market and subsequently assign the property to an end buyer. It’s the binding force that allows the wholesaler to step into the position of the buyer temporarily, without the financial burden of actually purchasing the property. The stipulations within the contract define the obligations of each party and the specific conditions under which the property may be sold, providing a clear roadmap for the transaction.

Beyond the legalities, the importance of a Wholesale Real Estate Contract also lies in its ability to create win-win situations for all involved parties. For the seller, it offers a rapid solution to sell their property, often in as-is condition. For the end buyer, it opens access to off-market deals that might not be available through traditional channels. And for the wholesaler, it provides the opportunity to earn a profit through the strategic connection of buyers and sellers without needing significant capital. This intricate dance of interests, expertly choreographed through the Wholesale Real Estate Contract, exemplifies its essential role in modern real estate investment.

Who uses a wholesaling contract?

A Wholesaling Contract is utilized by various players in the real estate industry, each with distinct roles and objectives.

- Real Estate Wholesalers: The primary users of a wholesaling contract are real estate wholesalers themselves. These individuals or entities identify potential investment properties, negotiate with sellers to agree on a price, and then use the contract to secure the right to sell the property to an end buyer. Wholesalers make a profit by selling the property at a higher price than what they contracted with the original seller.

- Sellers: Property owners looking to sell quickly may enter into a wholesaling contract with a real estate wholesaler. This can include homeowners in distressed situations, such as foreclosure or personal financial strain, as well as investors or banks looking to liquidate assets.

- End Buyers: These are typically real estate investors looking for investment opportunities, such as rehabbing and flipping or holding for rental income. They rely on wholesalers to find suitable properties, and the wholesaling contract ensures a clear and legal transfer of the property.

- Real Estate Professionals: Some real estate agents and brokers may engage in or facilitate wholesaling as part of their business model. They can use their industry knowledge and connections to find properties and buyers, using the wholesaling contract to formalize the deals.

What should a wholesale contract include?

A wholesale contract serves as a vital agreement between a wholesaler and a seller in the real estate investment arena. It outlines the terms and conditions for the purchase and resale of a property, functioning as both a legal document and a clear guide for all parties involved. Here’s a detailed guide to what a wholesale contract should include:

- Parties Involved:

- Seller Information: Full name, contact details, and address.

- Wholesaler Information: Full name, contact details, and address.

- Property Description:

- Legal Description: Detailed description of the property, including lot number, block number, and subdivision.

- Physical Address: Street address, city, state, and ZIP code.

- Inclusions & Exclusions: Any fixtures, appliances, or personal property included or excluded in the sale.

- Purchase Price and Terms:

- Purchase Price: The agreed-upon price that the wholesaler will pay the seller.

- Deposit: Any earnest money deposit, its amount, and how it will be held.

- Payment Terms: Outline of how and when the payment will be made.

- Assignment Clause:

- This clause allows the wholesaler to assign the contract to an end buyer, defining the conditions under which the contract can be assigned.

- Inspection Clause:

- Allows for property inspection, detailing the time frame and any related costs.

- Contingencies:

- Any conditions that must be met before the contract is binding, such as financing approval, property inspection satisfaction, or finding an end buyer.

- Closing Details:

- Closing Date: The date by which the sale must be finalized.

- Closing Costs: Details about who will pay for specific closing costs, such as title insurance, recording fees, and escrow fees.

- Closing Location: The place where the closing will occur, often an escrow or title company.

- Default and Remedies:

- Clauses outlining the consequences if either party defaults on their obligations.

- Warranties and Representations:

- Statements that the seller makes to assure the condition of the property, such as clear title, no hidden defects, compliance with zoning laws, etc.

- Disclosure Requirements:

- Any legally required disclosures, such as known defects or issues with the property.

- Governing Law:

- Specifies the state law that will govern the contract.

- Entire Agreement & Amendments:

- A clause stating that the contract represents the entire agreement between the parties and details how amendments can be made.

- Signatures:

- The contract should be signed and dated by all parties involved, indicating their agreement to the terms.

- Additional Provisions (if applicable):

- Any other unique or specific clauses relevant to the particular transaction.

How to Write a Wholesale Real Estate Contract

Wholesale real estate contracts are used by investors to purchase properties at a reduced price and then sell them to another buyer for a profit. The process involves several important steps and specific legal language that can vary by jurisdiction. Below, I’ll outline a general guide to writing a wholesale real estate contract, but please consult with a local real estate attorney or professional to ensure that the contract complies with all applicable laws and regulations in your area.

Step 1: Obtain Necessary Information

- Identify the Parties: Collect the full legal names, addresses, and contact information for both the buyer (you, the wholesaler) and the seller.

- Property Details: Gather detailed information about the property, including its legal description, address, and any identifiable features.

Step 2: Define Purchase Price and Terms

- Purchase Price: Clearly define the purchase price for the property.

- Earnest Money: Detail the earnest money deposit, if any, and the terms under which it might be refunded or forfeited.

- Closing Costs: Specify who will be responsible for paying closing costs, such as the buyer, seller, or a split between both.

- Closing Date: State the date by which the closing must occur.

Step 3: Include Contingency Clauses

- Inspection Contingency: Outline a time frame for property inspections and any requirements for repairs.

- Financing Contingency: If applicable, provide terms related to securing financing for the purchase.

- Assignment Clause: Since you plan to wholesale the property, include an assignment clause that allows you to transfer the contract to another buyer.

Step 4: Define Representations and Warranties

- Property Condition: Include a clause stating the current condition of the property, with any known defects or issues clearly listed.

- Legal Compliance: Include language confirming that the sale complies with all applicable laws and regulations.

- Title: Confirm that the seller holds clear title to the property and will transfer it free of any liens or encumbrances.

Step 5: Prepare Additional Documents

- Addenda: If there are any special conditions, additional agreements, or disclosures, attach them as addenda to the contract.

Step 6: Allow for Acceptance and Execution

- Offer Expiration: State a date and time by which the offer must be accepted, if any.

- Signatures: Provide spaces for the signatures of both the buyer and the seller, along with the date of signing.

- Witness/Notary: If required in your jurisdiction, include space for a witness or notary.

Step 7: Consult a Legal Professional

- Review: Have a real estate attorney or experienced professional review the contract to ensure it meets all legal requirements in your jurisdiction.

Step 8: Execute the Contract

- Present the Offer: Present the contract to the seller and negotiate any necessary adjustments.

- Sign the Contract: Once agreed upon, both parties should sign the contract, and any earnest money should be deposited as described in the contract.

Step 9: Fulfill the Contract Terms

- Follow Through: Comply with all terms, conditions, and deadlines outlined in the contract.

- Assign the Contract: If you intend to assign the contract to another buyer, ensure that you follow the proper legal process for doing so.

Step 10: Close the Deal

- Coordinate Closing: Work with a title company or real estate attorney to coordinate the closing.

- Finalize Transaction: At closing, ensure all documents are properly executed, and funds are exchanged.

Can You Get Out Of A Wholesale Real Estate Contract?

Wholesale real estate contracts are agreements where a wholesaler enters into a contract with a seller and then assigns that contract to an end buyer for a profit. However, getting out of such a contract isn’t always simple. The ability to exit a wholesale contract generally depends on the specific terms of the agreement and local laws. Most contracts include specific clauses that outline the conditions under which a party can exit the contract, such as a contingency clause for inspection or financing. If these are met, the wholesaler may have a legal way to back out of the contract without penalty.

However, without proper cause as defined within the contract, exiting a wholesale real estate contract can result in legal consequences. The seller might claim damages, or the end buyer could potentially pursue legal action if they feel the wholesaler did not fulfill their obligations. Consulting with a real estate attorney or professional who understands the local laws and specific contract terms can provide the best guidance on whether or not exiting the contract is a viable option. Always being upfront and transparent with all parties involved might also aid in reaching an amicable solution if one wishes to exit the contract.

Wholesaling vs. Flipping

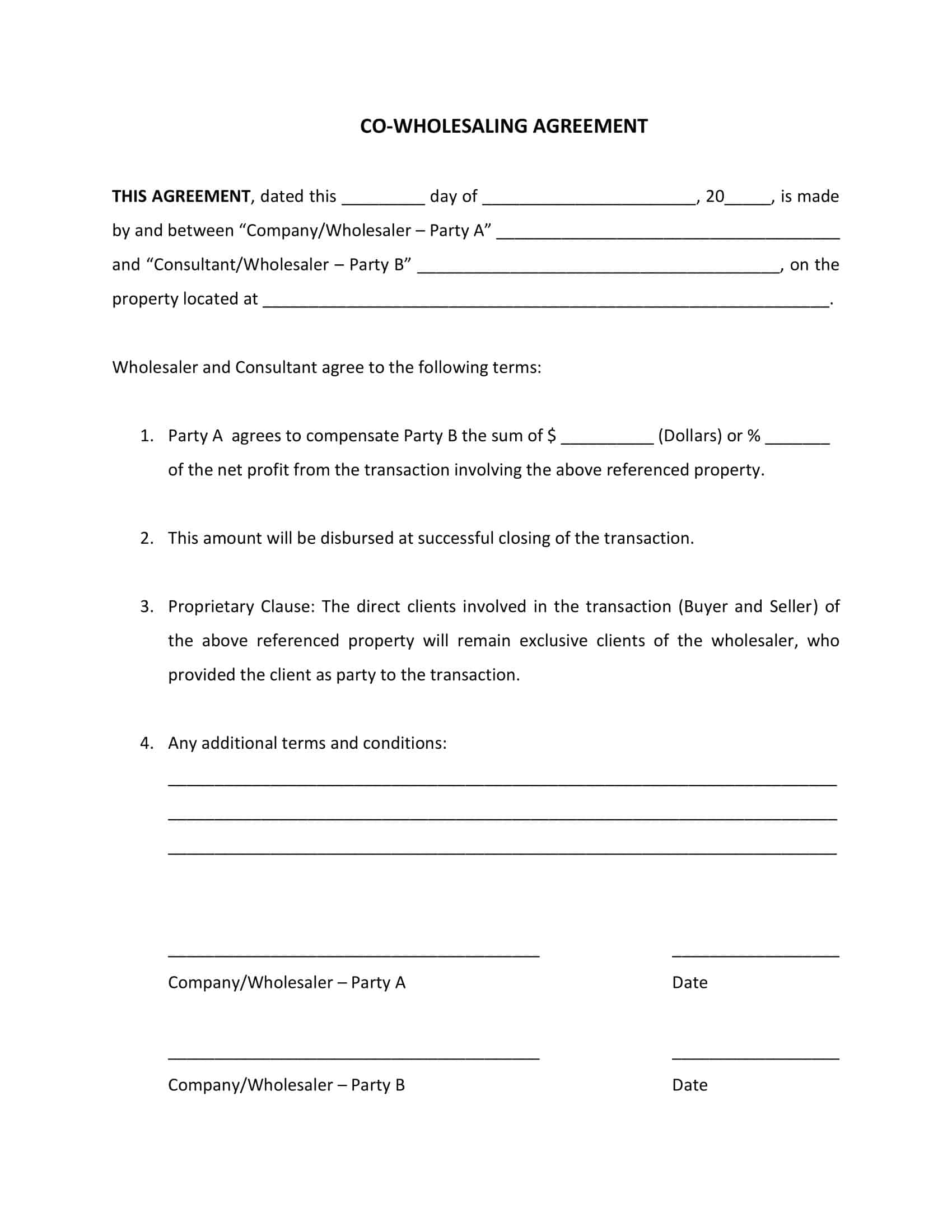

Wholesaling and flipping are two distinct real estate investment strategies, each with its unique features, risks, and rewards.

Wholesaling

1. Process: Wholesaling involves identifying a property, often undervalued, and then entering into a contract with the seller. The wholesaler then assigns this contract to an end buyer, often an investor or rehabber, for a profit. The wholesaler never takes ownership of the property.

2. Investment: Wholesaling usually requires less capital, as the wholesaler is not buying, repairing, or selling the property themselves. Their main investment is in marketing and finding motivated sellers.

3. Risk: The risk in wholesaling is typically lower than flipping, as the wholesaler isn’t responsible for repairs or holding costs. If they can’t find a buyer, they may lose their deposit, but their exposure is often limited.

4. Time Frame: Wholesaling can be quicker since it doesn’t involve renovation or managing a sale. The focus is on quickly finding a buyer to assign the contract to.

5. Profit: Profits can be slimmer in wholesaling, as the wholesaler is essentially earning a fee for connecting a buyer with a seller.

6. Skills Required: Key skills include negotiation, marketing, networking, and understanding real estate contracts and market values.

Flipping

1. Process: Flipping involves purchasing a property, often one that needs significant repairs or updating, and then renovating it to sell at a higher price. The flipper takes full ownership of the property.

2. Investment: Flipping requires more capital, as the investor must purchase the property and fund the renovation. There may also be holding costs such as mortgage payments, taxes, and insurance.

3. Risk: The risks are higher in flipping, as the investor is responsible for the renovation, market changes, and any unexpected issues that may arise during the rehab process.

4. Time Frame: Flipping generally takes more time due to the renovation process, and unexpected delays can add to the holding costs.

5. Profit: The potential profits can be higher in flipping, reflecting the higher investment and risk. However, miscalculations in renovation costs or market changes can turn potential profits into losses.

6. Skills Required: Successful flipping requires knowledge of construction, project management, real estate markets, and potentially interior design.

- While both strategies are involved in the real estate investment arena, they appeal to different types of investors. Wholesaling suits those who want to work more quickly with less risk and capital, acting as intermediaries. Flipping, on the other hand, involves greater risks and rewards, appealing to those who have the capital, skills, and desire to be more hands-on in the renovation and selling process. Both strategies require diligence, research, and understanding of the local real estate market to be successful.

FAQs

Is Wholesaling Real Estate Legal?

Wholesaling is legal in most jurisdictions, but specific laws and regulations may apply. Transparency and adherence to local real estate laws are essential. It’s advised to consult with a real estate attorney or local authorities to ensure compliance with all relevant legal requirements.

Can You Make Money Wholesaling Real Estate?

Yes, many investors make money through wholesaling real estate. However, it requires strong marketing, networking, negotiation skills, and an understanding of the local market. Profits can vary widely depending on the deal and market conditions.

Do You Need a License to Wholesale Real Estate?

The licensing requirements for wholesaling real estate vary by jurisdiction. In some areas, a real estate license may be required, while in others, it may not be. It’s essential to consult with local real estate authorities or legal professionals to understand the specific requirements in your area.

What Are the Risks of Wholesaling Real Estate?

While wholesaling may have lower risks compared to other real estate investment strategies, there are still potential risks, including difficulties in finding buyers, potential legal challenges, loss of earnest money deposits, and potential damage to reputation if deals fall through.

How Do I Get Started in Wholesaling Real Estate?

Getting started in wholesaling requires research, education, and planning. It involves understanding the local market, building a network, finding motivated sellers, and understanding legal contracts. Many wholesalers start by taking courses, attending real estate investment groups, or finding a mentor in the field.

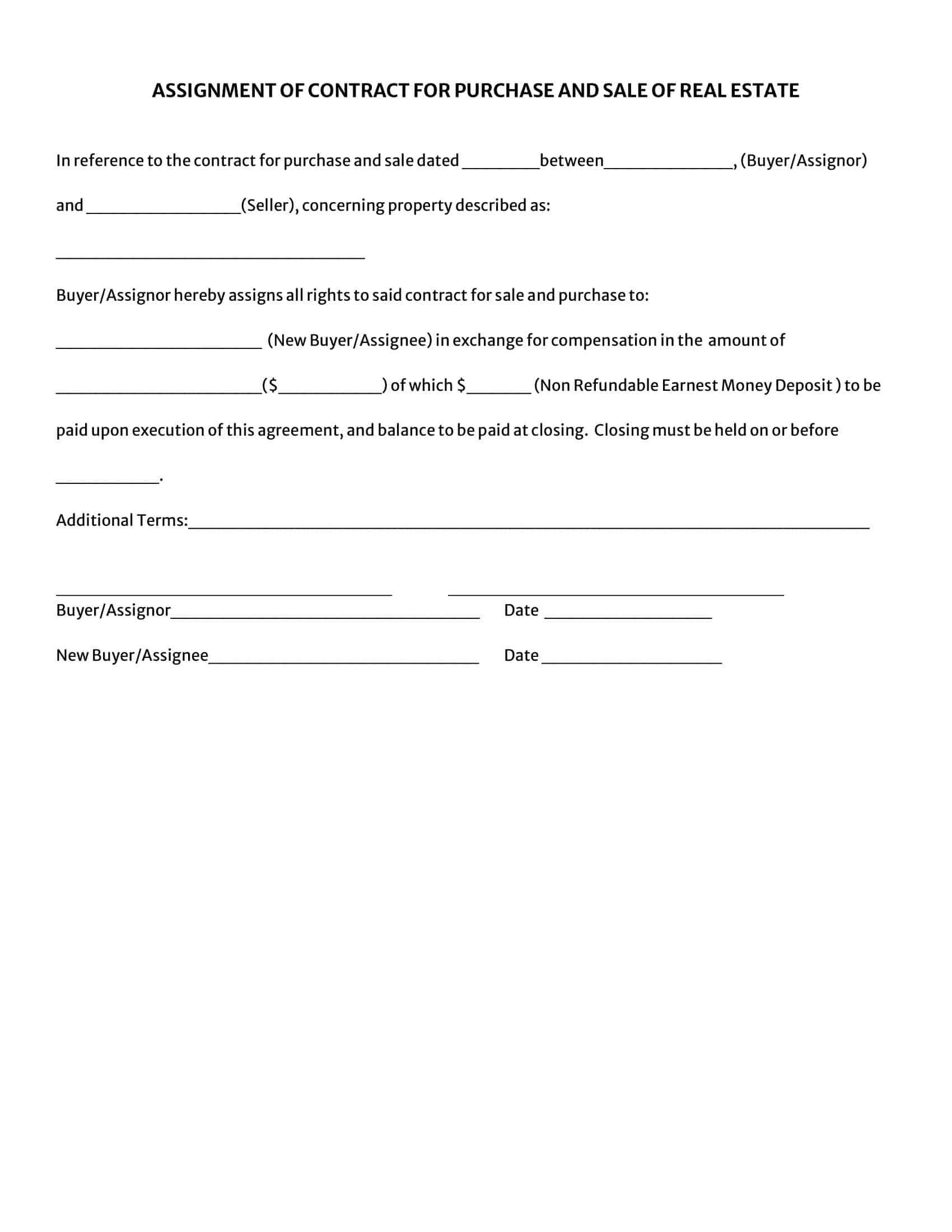

What Are Assignment Contracts in Wholesaling?

An contract in wholesaling is an agreement that allows the wholesaler to assign their rights and obligations under the original contract with the seller to a new end buyer. This is how the wholesaler connects the seller and the buyer without taking ownership of the property.

![%100 Free Hoodie Templates [Printable] +PDF 2 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 3 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Offer to Purchase Real Estate Form Templates [PDF, Word] 4 Offer To Purchase Real Estate](https://www.typecalendar.com/wp-content/uploads/2023/05/Offer-To-Purchase-Real-Estate-1-150x150.jpg)