A trust agreement is a legal document that outlines the terms and conditions for the establishment and management of a trust. It is a contract between the trustor, who transfers ownership rights of one or more assets to one or more trustees, and the trustees, who are responsible for managing and distributing the assets according to the terms of the trust.

The trust agreement outlines the purpose of the trust, the assets included, the powers and responsibilities of the trustees, and any reporting and compensation requirements. It is a crucial document for anyone looking to establish a trust for the protection and preservation of assets for future generations or for a specific purpose.

Table of Contents

Trust Agreement Templates

Establish clear guidelines and protect your assets with our comprehensive collection of Trust Agreement Templates. A trust agreement is a legal document that outlines the terms and conditions for the management and distribution of assets held in a trust. Our customizable and printable templates provide a structured framework for creating a trust agreement tailored to your specific needs.

Whether you’re setting up a revocable living trust, a charitable trust, or a special needs trust, our templates cover essential aspects such as the trustee’s responsibilities, beneficiary provisions, asset details, and any additional provisions specific to your situation.

By utilizing our Trust Agreement Templates, you can ensure the proper administration of your assets, protect your beneficiaries’ interests, and minimize potential conflicts. Streamline the process of establishing a trust, maintain legal compliance, and safeguard your assets with our user-friendly templates. Download now and confidently create trust agreements that provide peace of mind and secure your legacy.

Key components of a trust agreement

The important elements of a trust agreement include:

Grantor or Settlor: The person or entity creating the trust.

Trustees: The individuals or entities responsible for managing and administering the trust assets.

Beneficiaries: The individuals or entities who will benefit from the trust.

Purpose of the trust: The specific reason or objective for which the trust is established, such as providing for the care of a beneficiary or preserving assets for future generations.

Assets: The specific property or assets that are being transferred into the trust.

Powers and Duties of Trustees: The specific rights and responsibilities of the trustees in managing and administering the trust assets.

Distribution of Trust assets: The terms and conditions for the distribution of trust assets to the beneficiaries.

Duration of the Trust: The specific period of time for which the trust will exist and the conditions that will bring the trust to an end.

Reporting and Accounting: The requirements for the trustees to provide information and account for the trust assets.

Amendment and Termination: The terms and conditions for amending or terminating the trust.

Governing Law: The jurisdiction and the laws that will govern the trust agreement.

Compensation of Trustees: The terms and conditions for paying the trustees for their services.

Testamentary Trust vs Living Trust: What’s the Difference?

Testamentary trusts and living trusts are two different types of trusts with distinct characteristics.

A testamentary trust is established through a will and only becomes effective after the death of the grantor. The grantor’s will includes instructions for the creation of the trust and the distribution of assets to the beneficiaries. This type of trust is often used to provide for minor children or other beneficiaries who are not capable of managing their own affairs.

A living trust, also known as an inter vivos trust, is established during the grantor’s lifetime and becomes effective as soon as it is created. The grantor transfers ownership of their assets to the trust while they are still alive, and can still use the assets and receive income from them while they are alive. Living trusts are often used to avoid probate and to protect assets from creditors or to manage them while the grantor is incapacitated.

In summary, a testamentary trust is established after the grantor’s death through their will, while a living trust is established during the grantor’s lifetime. Living trusts can be revocable or irrevocable, and can have different tax implications. It’s important to consult with a lawyer and a financial advisor to understand which type of trust will best suit your needs and goals.

Do I Need an Attorney for My Living Trust?

It is better to ask help from a lawyer when making a trust agreement because trusts are legal documents that must comply with state and federal laws. A lawyer can provide guidance on the legal requirements for creating a trust and ensure that the trust agreement is properly drafted and executed.

A lawyer can also help you understand the different types of trusts available and help you choose the one that best fits your needs and goals. They can also assist you with the process of transferring assets into the trust, and ensure that the trust is properly funded.

Additionally, a lawyer can help you navigate the tax implications of creating a trust, and provide advice on how to structure the trust in a tax-efficient manner. They can also advise on the ongoing administration of the trust, and can assist with the appointment and removal of trustees.

Lastly, a lawyer can help you plan for potential contingencies, such as incapacity or death of the grantor, and ensure that the trust provides protection for the beneficiaries and assets in case of unforeseen events.

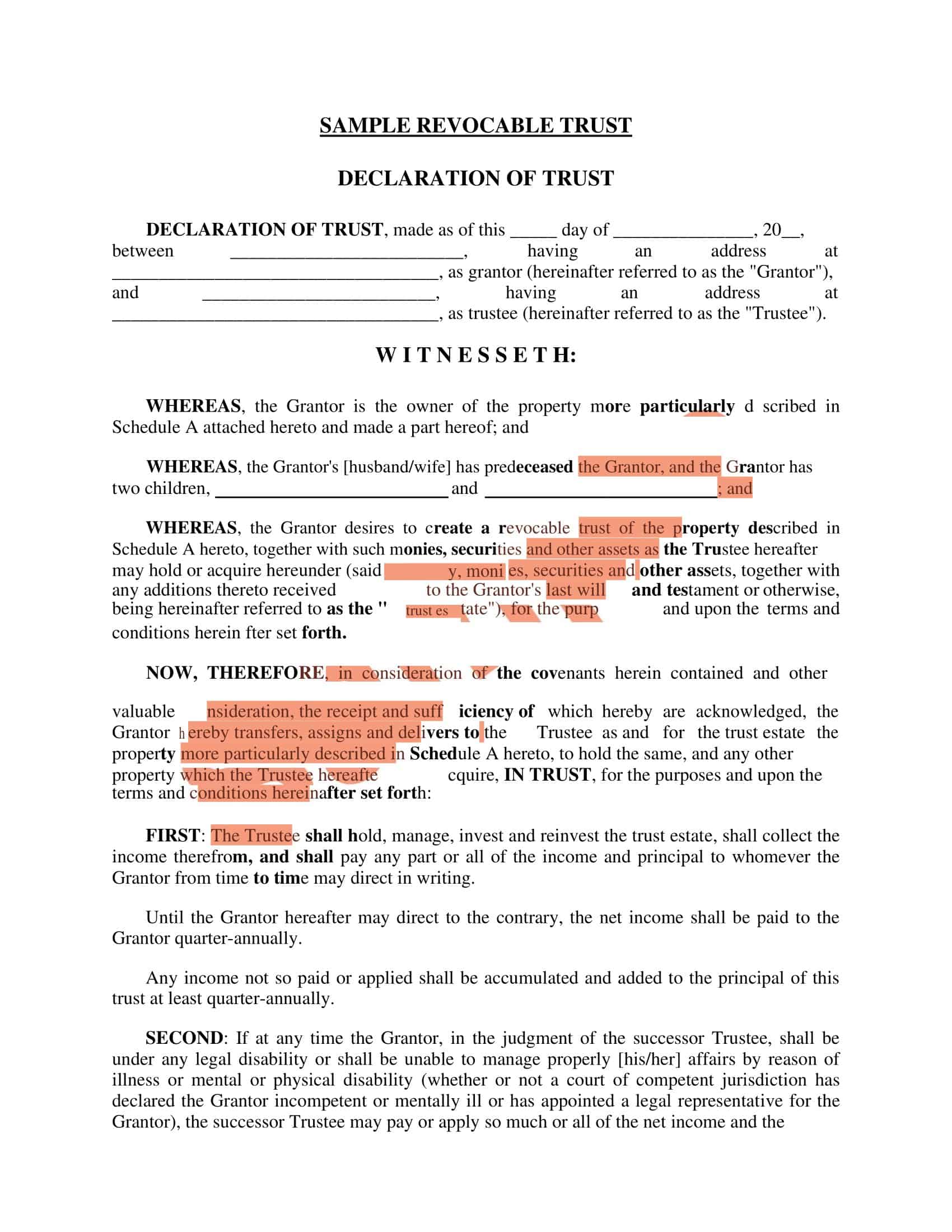

Revocable Living Trusts

A revocable trust agreement, also known as a living trust, is a type of trust where the grantor retains the ability to make changes to the trust or terminate it during their lifetime. The grantor can also change the terms of the trust, the trustees or the beneficiaries, or even revoke the trust entirely, if they so choose.

With a revocable trust, the grantor can also act as the trustee, retaining control over the assets in the trust and receiving income from them during their lifetime. Upon the grantor’s death, the trust becomes irrevocable and the assets are distributed to the beneficiaries according to the terms of the trust.

Revocable trusts are often used as an estate planning tool to avoid probate, as the assets are transferred to the trust during the grantor’s lifetime, bypassing the court-supervised probate process. They can also provide asset protection for the grantor during their lifetime, as the assets are not subject to creditors’ claims or lawsuits, and can also be used to manage assets in case of incapacity or disability.

Land Trust Agreement

A land trust agreement is a type of trust agreement that is used to hold legal title to real property, such as land, buildings, or other real estate assets. In this type of trust, the grantor, also known as the trustor, transfers ownership of the property to the trust, and the trust holds legal title to the property on behalf of the beneficiaries.

The grantor can appoint one or more trustees to manage the property on behalf of the beneficiaries and can specify the terms and conditions for the use, management, and distribution of the property in the trust agreement. The grantor can also retain the right to use or occupy the property during their lifetime, or can lease the property to third parties.

Land trusts are often used as a way to hold property in a confidential manner, as the trust agreement does not have to be recorded in public records, and the name of the beneficiaries and the terms of the trust are not disclosed to the public. This can provide privacy and anonymity to the grantor and the beneficiaries.

They can also be used as a way to hold property for investment purposes, to protect the property from creditors’ claims, or to manage property for tax benefits.

FAQs

What are the terms of a Trust Agreement?

The terms of a trust agreement will vary depending on the type of trust and the specific goals of the grantor. However, common terms include the name of the trust, the purpose of the trust, the trustees and beneficiaries, the distribution of assets, and the rules for managing and investing the trust’s assets.

How can I amend or terminate a Trust Agreement?

The terms of the trust agreement will dictate how the trust can be amended or terminated. Some trusts may be amended by the grantor, while others may require the approval of the beneficiaries or a court. Trusts can be terminated by the grantor, by the court, or by the occurrence of a specific event outlined in the trust agreement.

What is the role of a Trustee in a Trust Agreement?

A trustee is the person or entity responsible for managing and administering the trust according to the terms outlined in the trust agreement. They are responsible for managing the trust’s assets, making decisions about investments and distributions, and ensuring that the trust’s purpose is carried out. They have a fiduciary duty to act in the best interest of the trust’s beneficiaries.

What happens to the assets in a Trust Agreement when the grantor dies?

When the grantor of a trust dies, the assets in the trust will be distributed according to the terms outlined in the trust agreement. This can include transferring assets to the beneficiaries, using the assets to pay for the grantor’s final expenses, or continuing to hold the assets in trust for the beneficiaries.

What happens if a Trust Agreement is not followed?

If a trustee fails to follow the terms of the trust agreement, they may be held liable for any damages or losses that result. The beneficiaries of the trust may also have legal remedies available to them, such as asking a court to remove the trustee or to require the trustee to take specific actions.

Is a Trust Agreement public record?

Trust agreements are generally not considered public record, meaning that the terms of the trust and the identity of the grantor, trustee, and beneficiaries are not publicly disclosed. However, certain information about the trust may be required to be filed with the court or other government agencies in certain circumstances.

What are the benefits of a Trust Agreement?

A trust agreement can provide many benefits, including:

- Protecting assets from creditors

- Reducing estate and gift taxes

- Providing for the transfer of wealth to future generations

- Helping to manage assets for individuals who are unable to manage them on their own

- Allowing for charitable giving

- Helping to ensure that assets are distributed according to the grantor’s wishes.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)