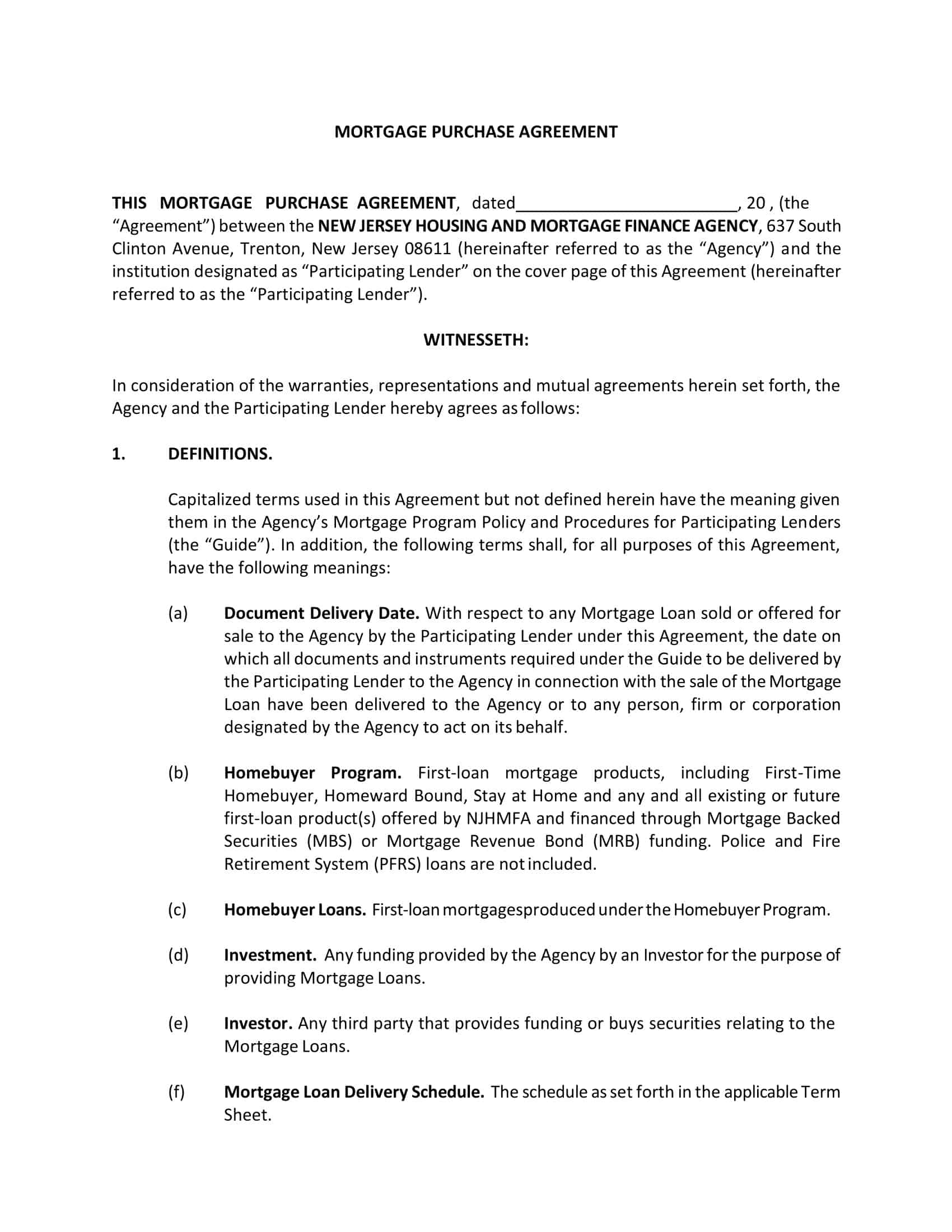

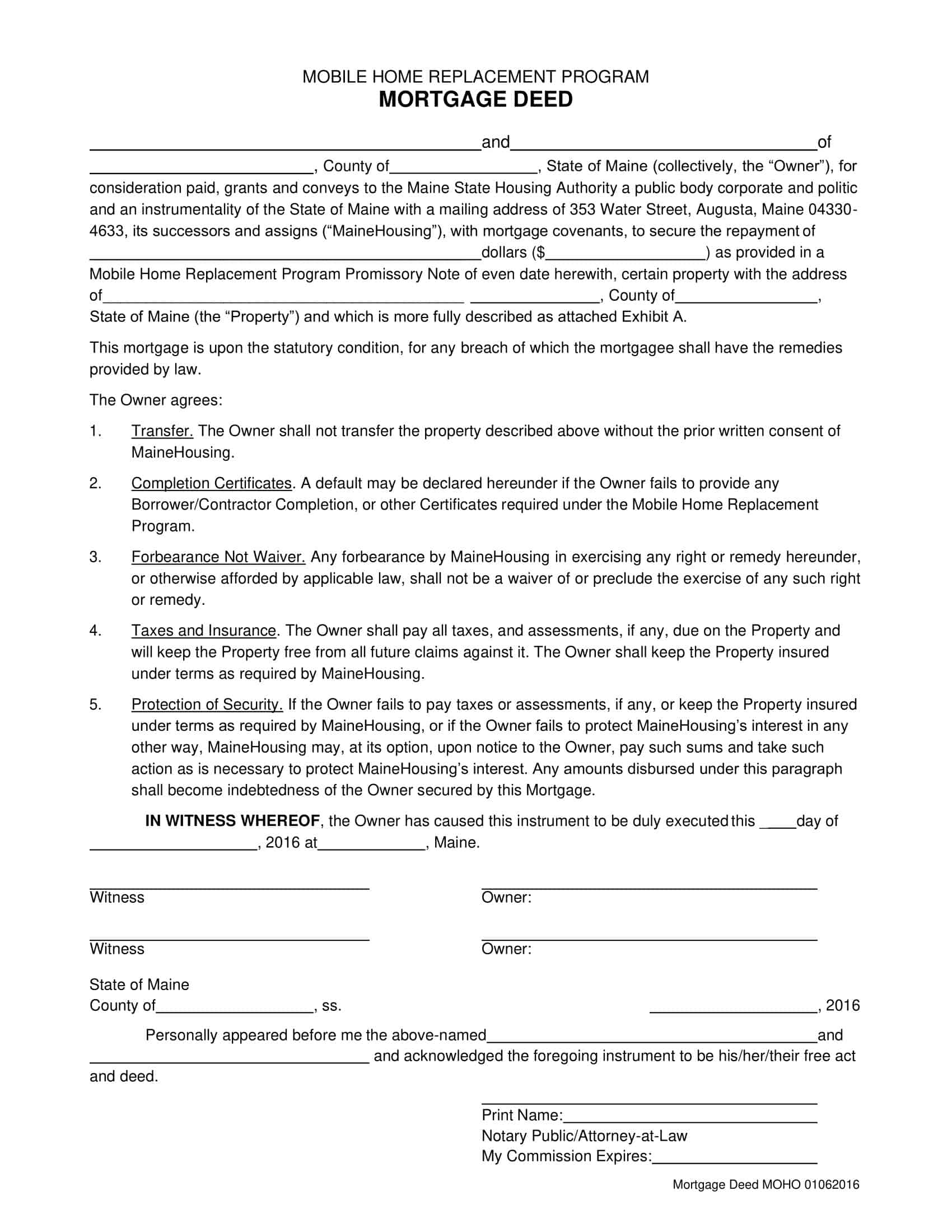

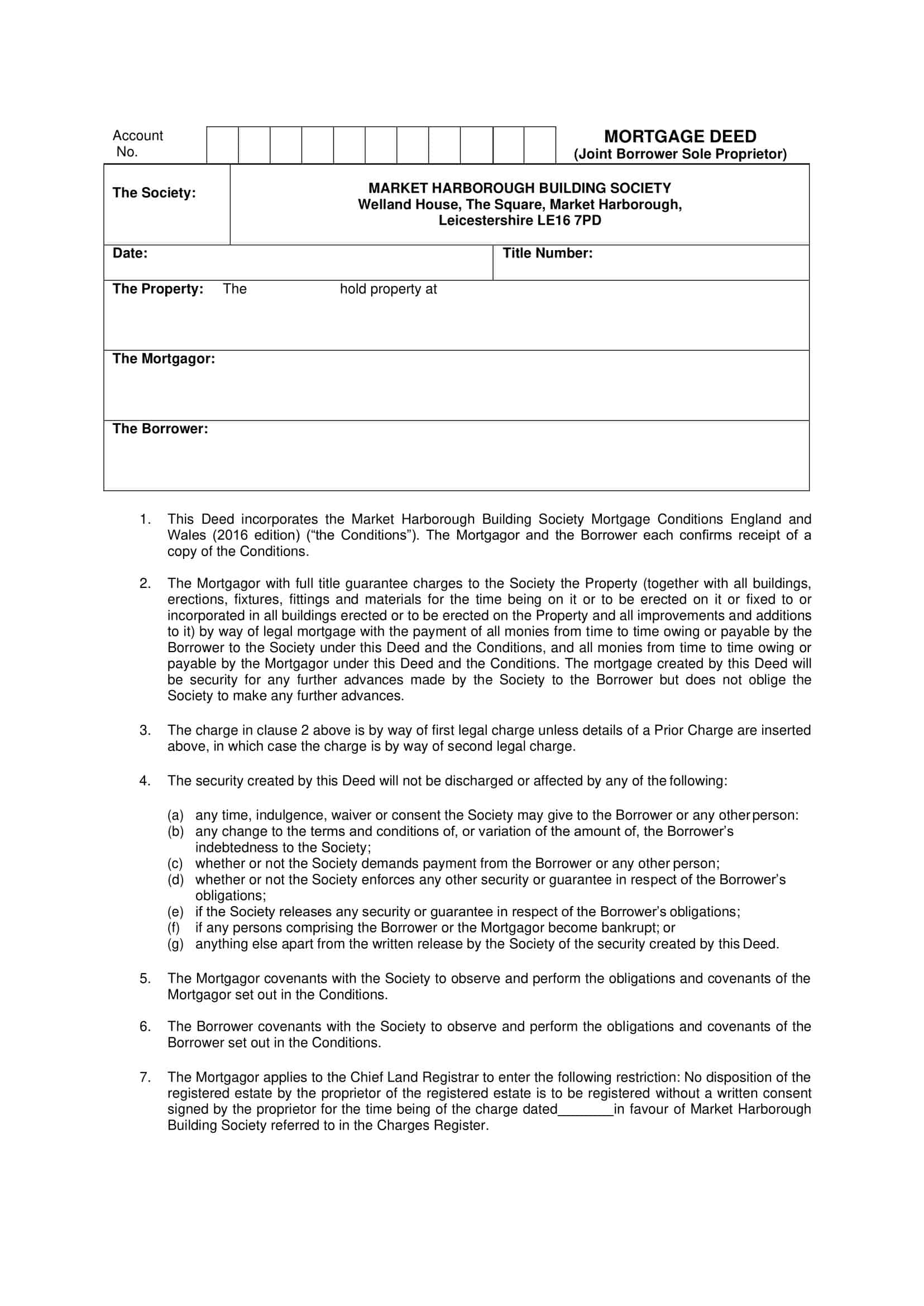

When crafting a mortgage deed, it’s essential to consult other mortgage contracts or refer to a sample mortgage agreement to ensure you include all necessary components. Numerous mortgage note examples are available, but it’s crucial to verify that you’re examining the appropriate type of mortgage for your deed drafting process.

Securing the accurate terminology and appropriate clauses for your mortgage deed is of utmost importance. This vital document must be written precisely, as any errors could lead to complications in delineating the responsibilities and rights of both borrower and lender. Utilizing this guidance will assist you in creating a mortgage deed that functions as intended and fulfills its purpose when called upon.

Table of Contents

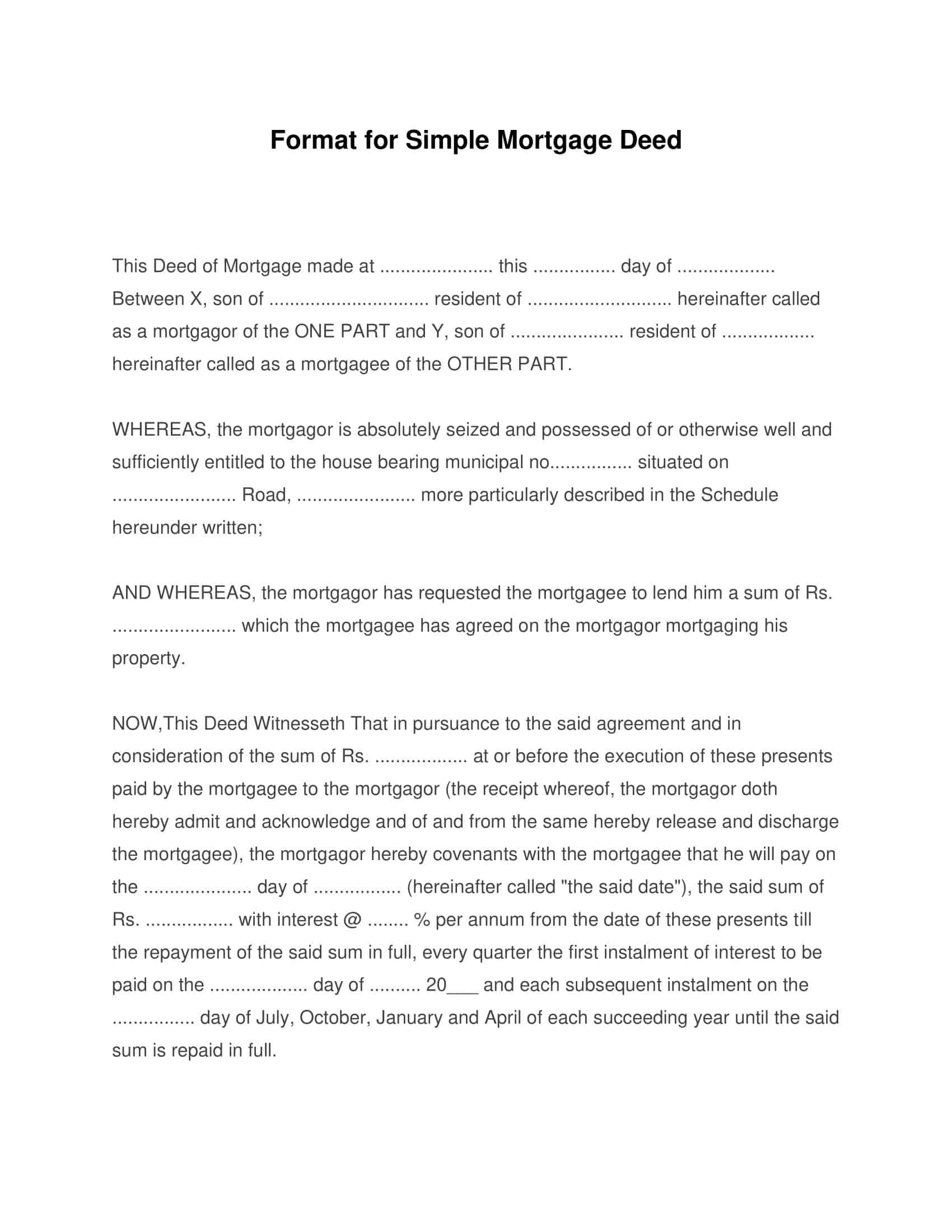

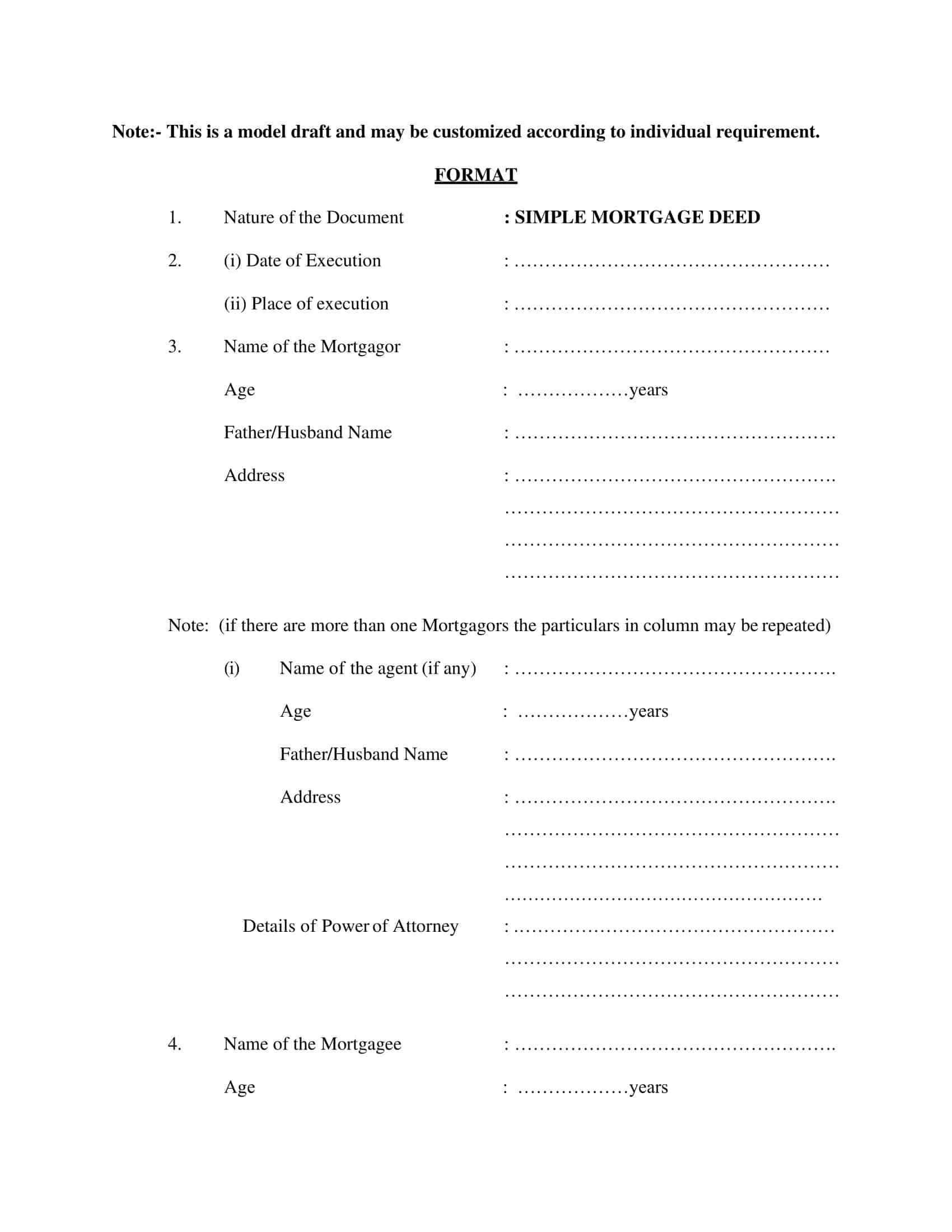

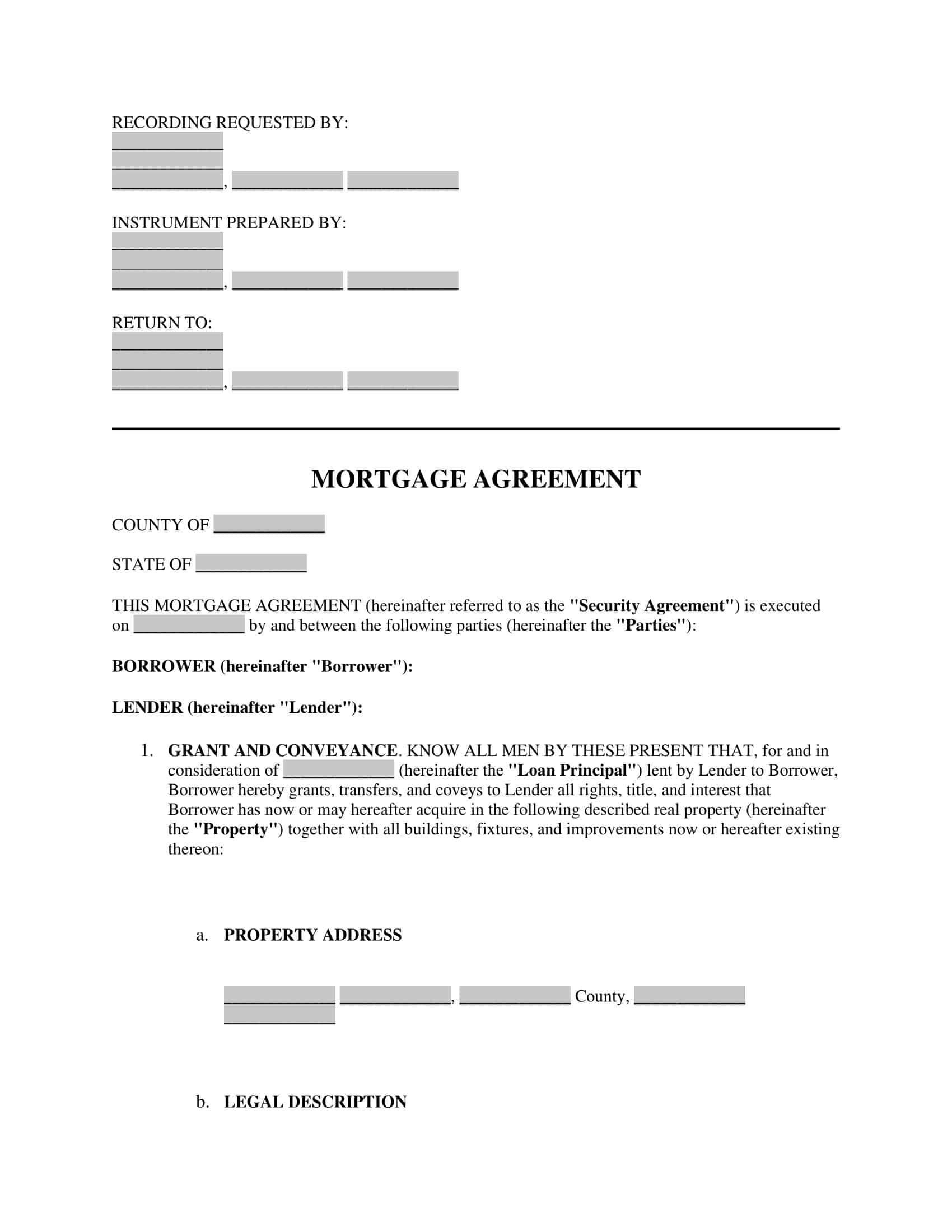

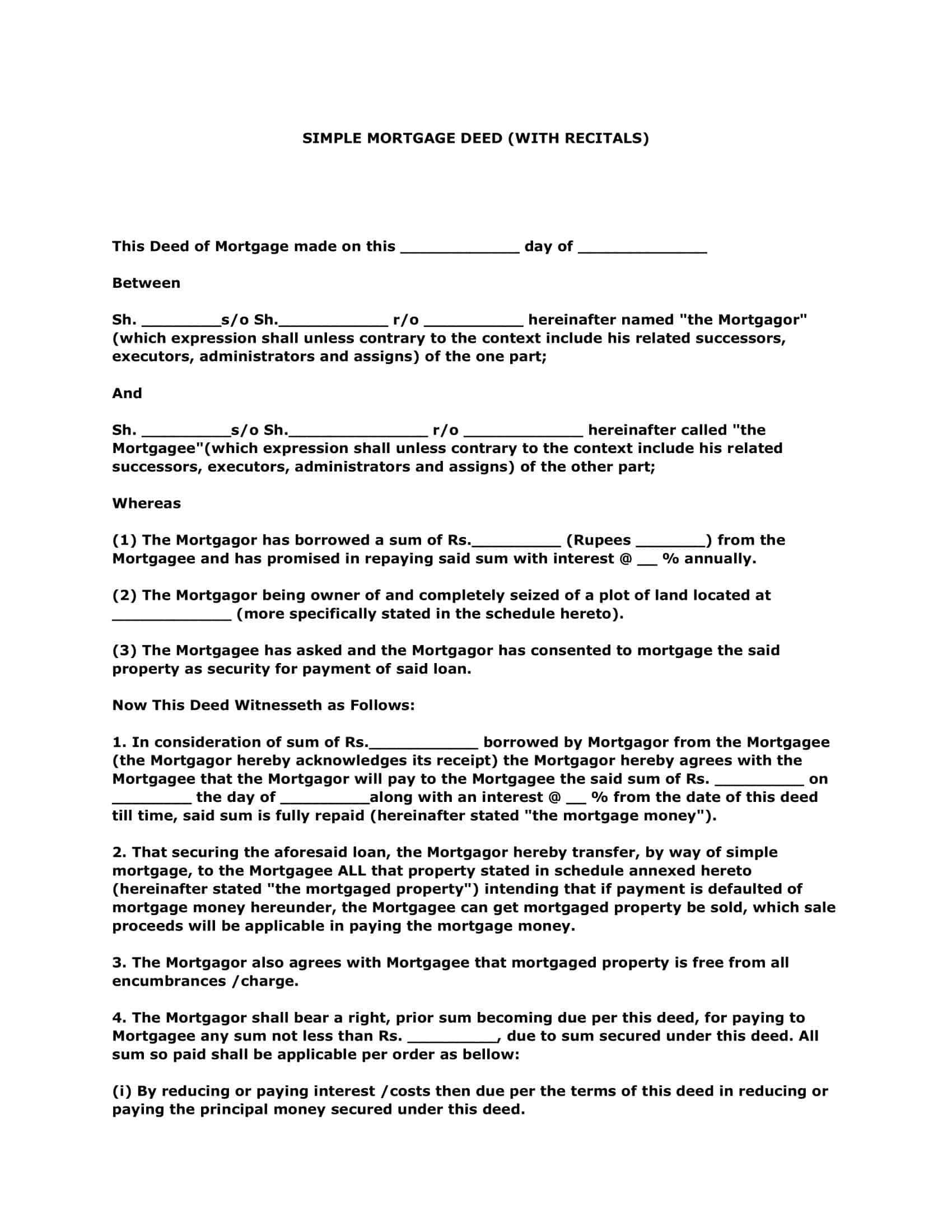

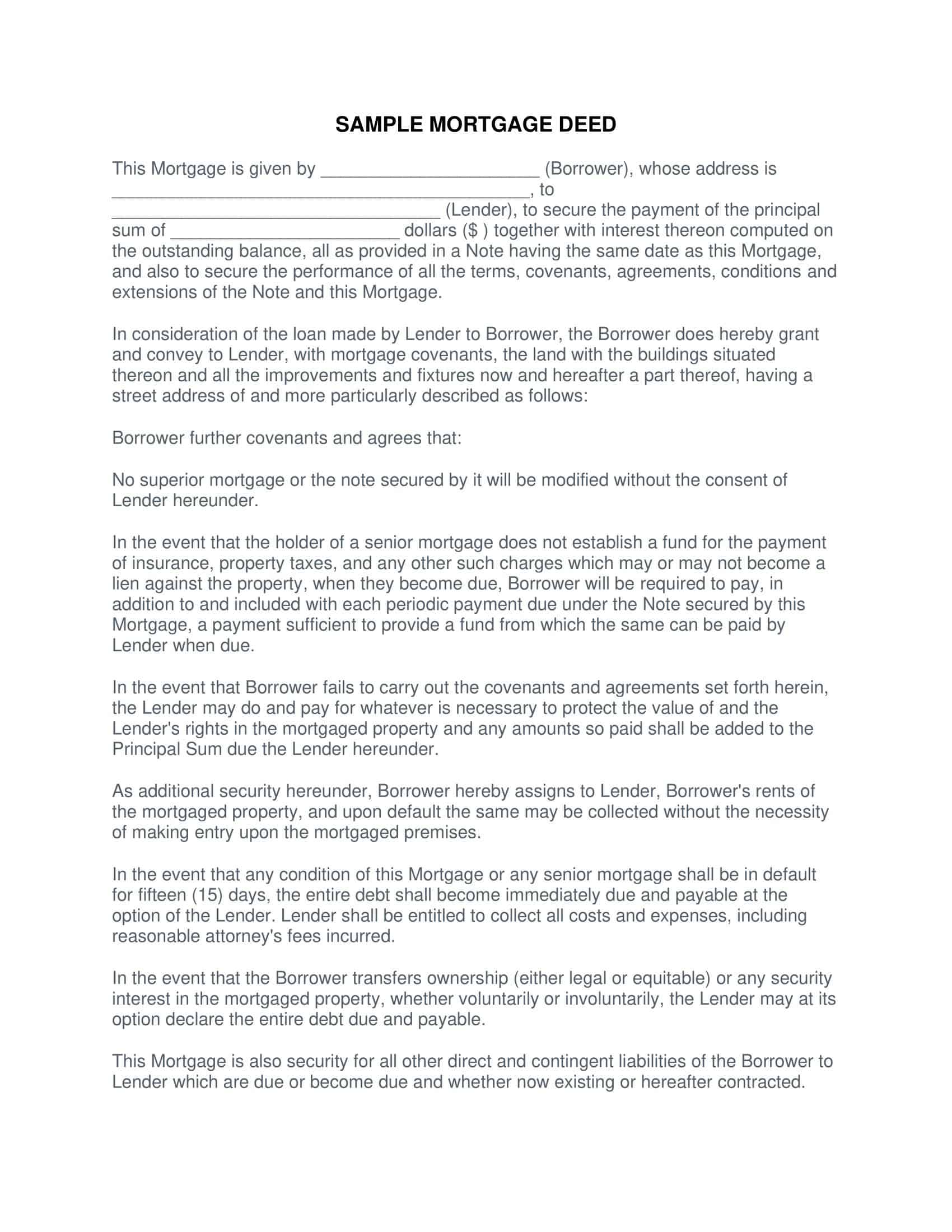

Mortgage Deed Templates

A mortgage deed template is a standardized legal document that outlines the terms and conditions of a mortgage agreement between a lender and a borrower. This document serves as a written record of the mortgage transaction and provides the necessary information to protect the rights of both parties involved.

It’s important to note that while mortgage deed templates provide a structured framework for mortgage agreements, they should be customized to fit the specific circumstances and requirements of the parties involved. It is recommended to seek legal advice to ensure compliance with applicable laws and regulations and to address any unique considerations that may arise.

What is a mortgage deed?

A mortgage deed is a legal document that establishes a security interest in a property, serving as collateral for a loan, typically a mortgage loan. This deed outlines the terms and conditions under which the borrower, also known as the mortgagor, agrees to repay the loan to the lender, referred to as the mortgagee.

The mortgage deed includes essential information such as the names of the borrower and lender, the property’s legal description, the loan amount, interest rate, repayment terms, and any other relevant provisions or covenants. It also sets forth the rights and obligations of both parties, including the lender’s right to foreclose on the property if the borrower fails to meet the loan obligations.

Once signed by both parties, the mortgage deed is typically recorded in the public land records office, which makes the security interest in the property enforceable and provides notice to any potential future buyers or lenders of the property’s encumbrance.

Mortgage deeds differ from the following documents, and they may be utilized in conjunction with them:

- Loan Agreement

- Promissory Note

Trust Deed vs Mortgage Deed

While both a mortgage and a deed of trust serve as instruments to secure repayment of a loan using real property as collateral, they have distinct features and involve different parties and processes.

Parties involved

Mortgage: In a mortgage, there are two main parties: the borrower (mortgagor) and the lender (mortgagee).

Deed of Trust: In a deed of trust, there are three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party called the trustee, who holds the legal title to the property until the loan is repaid.

Foreclosure process

Mortgage: If the borrower defaults on the loan, the lender must go through a judicial foreclosure process, which involves filing a lawsuit and obtaining a court order to foreclose on the property. This process can be lengthy and costly.

Deed of Trust: In the event of a default, the trustee can initiate a non-judicial foreclosure, which does not require court intervention. The trustee follows the procedures outlined in the deed of trust and state law, typically involving a public auction. This process is usually faster and less expensive compared to a judicial foreclosure.

Geographic usage

Mortgage: Mortgages are commonly used in states that follow the judicial foreclosure process.

Deed of Trust: Deeds of trust are more prevalent in states that allow non-judicial foreclosures.

Ultimately, the choice between a mortgage and a deed of trust depends on the state laws and the preference of the lender. Both instruments function to secure the loan with the property as collateral but follow different processes and involve a different number of parties.

Importance of a Mortgage Deed

A mortgage deed holds significant importance in the context of real estate transactions and financing. The primary reasons for its importance are as follows:

Security for the lender: A mortgage deed serves as a legal instrument that secures the lender’s interest in the property, ensuring they have a claim on the collateral (property) if the borrower fails to repay the loan as agreed.

Defines the terms and conditions: The mortgage deed outlines the specific terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and the rights and obligations of both the borrower and lender. This clarity helps avoid potential misunderstandings or disputes.

Establishes a public record: Once signed and executed, the mortgage deed is recorded in the public land records office, making the security interest in the property enforceable and providing notice to potential buyers and other lenders of the existing encumbrance on the property. This public record helps maintain transparency and order in the real estate market.

Legal remedy in case of default: The mortgage deed provides the lender with a legal remedy in the event of borrower default. Depending on the state’s laws, the lender can initiate a foreclosure process (either judicial or non-judicial) to recover their investment by seizing and selling the property.

Facilitates property transfer: When a borrower wishes to sell a mortgaged property, the mortgage deed helps establish the outstanding loan balance and the process to follow for releasing the property’s title. The mortgage deed provides a legal framework for satisfying the loan obligation and transferring the property free and clear to the new owner.

Types of Mortgage Deeds

Mortgage deeds can take various forms, depending on the type of mortgage, the terms of the loan, and the specific needs of the borrower and lender. Here are some common types of mortgage deeds:

Conventional Mortgage Deed: This is the most common type of mortgage deed, used for traditional mortgages provided by banks, credit unions, or other financial institutions. It outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and the rights and responsibilities of both parties.

FHA Mortgage Deed: This type of mortgage deed is associated with loans insured by the Federal Housing Administration (FHA). FHA loans typically have more lenient qualification requirements and allow borrowers with lower credit scores or smaller down payments to obtain a mortgage. The mortgage deed for an FHA loan includes specific provisions related to the FHA insurance and requirements.

VA Mortgage Deed: A VA mortgage deed is used for loans guaranteed by the U.S. Department of Veterans Affairs. These loans are available to eligible veterans, active-duty service members, and certain surviving spouses. A VA mortgage deed contains provisions unique to VA loans, such as the absence of a down payment requirement and restrictions on certain closing costs.

Reverse Mortgage Deed: A reverse mortgage deed is used for a specific type of loan available to homeowners aged 62 or older, allowing them to convert a portion of their home equity into cash while retaining ownership of the property. The deed outlines the terms and conditions of the reverse mortgage, including how the loan will be repaid and the homeowner’s responsibilities regarding property taxes, insurance, and maintenance.

Adjustable-Rate Mortgage (ARM) Deed: An ARM mortgage deed is associated with a loan that has an adjustable interest rate. The deed outlines the terms and conditions of the loan, including the initial fixed-rate period, the adjustment frequency, and the limits (caps) on interest rate changes.

Balloon Mortgage Deed: This type of mortgage deed is used for loans with a shorter term, usually five to seven years, and a large “balloon” payment due at the end of the term. The deed outlines the loan’s terms, including the regular payments and the lump-sum payment due at the end.

Interest-Only Mortgage Deed: An interest-only mortgage deed is associated with loans where the borrower is only required to pay the interest on the loan for a specified period, typically five to ten years. After this period, the loan payment increases to cover both principal and interest. The deed details the terms and conditions of the loan, including the interest-only period and the subsequent payment adjustments.

Key Elements of a Mortgage Deed

A mortgage deed is a crucial legal document that outlines the terms and conditions of a loan secured by real property. It serves as an agreement between the borrower and lender and includes important information related to the loan and the rights and obligations of both parties. Here are the key elements of a mortgage deed:

Parties to the agreement: The mortgage deed should clearly identify the borrower (mortgagor) and the lender (mortgagee), including their names and contact information.

Legal description of the property: The mortgage deed should contain a detailed legal description of the property being used as collateral, including its address, parcel number, and any other relevant identifiers.

Loan amount: The principal amount of the loan should be clearly stated, along with any additional costs, such as fees or points, if applicable.

Interest rate: The interest rate applicable to the loan, whether fixed or adjustable, should be specified. If the loan has an adjustable interest rate, the deed should outline the initial fixed-rate period, the adjustment frequency, and the limits (caps) on interest rate changes.

Repayment terms: The mortgage deed should include the terms of repayment, such as the loan term, the frequency of payments, the due date for each payment, and any penalties or fees associated with late payments or prepayments.

Rights and obligations of the borrower: The borrower’s responsibilities should be outlined, including maintaining the property, paying property taxes and insurance, and complying with any other requirements stipulated by the lender.

Rights and obligations of the lender: The lender’s rights should be specified, such as the right to collect loan payments, inspect the property, or require the borrower to maintain specific insurance coverage.

Default and foreclosure provisions: The mortgage deed should clearly define what constitutes a default and outline the lender’s rights and remedies in case of default, including the foreclosure process and any applicable fees or costs.

Escrow account: If the lender requires the borrower to establish an escrow account for property taxes and insurance, the deed should include details about the account, such as the initial deposit, monthly contributions, and the lender’s responsibility for disbursing the funds.

Legal covenants and warranties: The mortgage deed may contain various legal covenants, such as the borrower’s representation that they are the lawful owner of the property and that the property is free of encumbrances, except as stated in the deed.

Governing law: The mortgage deed should specify the governing law, which is typically the law of the state where the property is located.

Signatures and notarization: The mortgage deed must be signed by both the borrower and the lender or their authorized representatives. The borrower’s signature should typically be notarized to ensure the deed’s enforceability.

Recording: After execution, the mortgage deed should be recorded in the public land records office of the county where the property is located. This recording establishes the lender’s priority interest in the property and provides public notice of the encumbrance.

These key elements are essential in drafting a comprehensive mortgage deed that accurately reflects the terms of the loan and protects the interests of both the borrower and the lender.

Judicial vs. Non-Judicial Foreclosure

Judicial foreclosure and non-judicial foreclosure are two distinct methods for lenders to recover their investment when a borrower defaults on a mortgage loan. The primary differences between them are the level of court involvement, the timeline, and the procedures followed.

Court involvement

Judicial foreclosure: In a judicial foreclosure, the lender must file a lawsuit in court and obtain a court order authorizing the foreclosure. The court oversees the foreclosure process, and the borrower has an opportunity to present a defense or negotiate a resolution before the property is sold.

Non-judicial foreclosure: In a non-judicial foreclosure, the lender does not need to obtain a court order, and the process takes place outside of the court system. The foreclosure is conducted according to the provisions outlined in the deed of trust and applicable state laws. The borrower typically has fewer opportunities to contest the foreclosure or negotiate a resolution.

Timeline

Judicial foreclosure: The judicial foreclosure process can be lengthy, sometimes taking several months to more than a year, depending on the court’s workload and the complexity of the case.

Non-judicial foreclosure: Non-judicial foreclosures are generally faster than judicial foreclosures, as they do not involve the court system. The timeline varies depending on state laws and the specific provisions of the deed of trust but is typically shorter than a judicial foreclosure.

Procedures

Judicial foreclosure: The lender initiates the process by filing a complaint with the court, serving the borrower with a summons, and providing notice of the lawsuit. The borrower can then respond, and the case proceeds through discovery, hearings, and potentially a trial. If the court grants a judgment in favor of the lender, the property is sold at a judicial sale, usually through a public auction.

Non-judicial foreclosure: The procedures for non-judicial foreclosures are determined by state law and the deed of trust. Common steps include the lender issuing a notice of default to the borrower, followed by a notice of sale, and then conducting a public auction. The borrower may have limited options to halt the process, such as by curing the default within a specified time frame or filing a lawsuit to challenge the foreclosure.

The choice between judicial and non-judicial foreclosure depends on the type of security instrument used (mortgage or deed of trust), the state’s laws, and the lender’s preference. Both methods aim to protect the lender’s interest and recover their investment, but they differ in terms of court involvement, timeline, and procedures.

How to write a Mortgage Deed

Writing a mortgage deed requires a clear understanding of the loan terms, the parties involved, and the legal requirements in the jurisdiction where the property is located. Here’s a step-by-step guide to help you write a mortgage deed:

Step 1: Identify the parties

Clearly state the names and contact information of the borrower (mortgagor) and the lender (mortgagee).

Example: Borrower (Mortgagor): John Doe, 123 Main St, Anytown, USA; Lender (Mortgagee): ABC Bank, 456 Bank St, Anytown, USA.

Step 2: Provide the legal description of the property

Include a detailed legal description of the property being used as collateral, such as its address, parcel number, and any other relevant identifiers.

Example: Property: 123 Main St, Anytown, USA; Parcel Number: 12-345-678.

Step 3: Specify the loan amount and related costs

Clearly state the principal loan amount, along with any additional costs, such as fees or points, if applicable.

Example: Principal amount: $200,000; Origination fee: $2,000; Total loan amount: $202,000.

Step 4: Detail the interest rate and payment terms

Specify the interest rate, whether fixed or adjustable, and outline the repayment terms, including the loan term, payment frequency, and due date.

Example: Interest rate: 4% fixed; Loan term: 30 years; Payment frequency: Monthly; Payment due date: 1st of each month.

Step 5: Outline the borrower’s rights and obligations

Describe the borrower’s responsibilities, including maintaining the property, paying property taxes and insurance, and complying with any other lender requirements.

Example: Borrower shall maintain the property in good repair, pay all property taxes and assessments when due, and keep the property insured against loss by fire and other hazards.

Step 6: Specify the lender’s rights and obligations

Outline the lender’s rights, such as collecting loan payments, inspecting the property, or requiring the borrower to maintain specific insurance coverage.

Example: Lender has the right to collect loan payments, inspect the property upon reasonable notice, and require borrower to maintain hazard insurance on the property.

Step 7: Include default and foreclosure provisions

Define what constitutes a default and describe the lender’s rights and remedies in case of default, including the foreclosure process and any applicable fees or costs.

Example: Default occurs if the borrower fails to make a payment when due or breaches any other obligation in the mortgage deed. In case of default, the lender may initiate foreclosure proceedings according to applicable state law.

Step 8: Add any additional covenants, warranties, or provisions

Include any legal covenants, warranties, or other provisions relevant to the mortgage, such as representations about the borrower’s ownership or the property’s encumbrances.

Example: Borrower represents and warrants that they are the lawful owner of the property and that the property is free and clear of all liens and encumbrances, except as stated in this mortgage deed.

Step 9: Specify the governing law

Identify the governing law, typically the law of the state where the property is located.

Example: This mortgage deed shall be governed by and construed in accordance with the laws of the State of New York.

Step 10: Obtain signatures and notarization

Ensure that the mortgage deed is signed by both the borrower and the lender or their authorized representatives, and have the borrower’s signature notarized.

Example: Borrower’s signature: ______________________; Lender’s signature: ______________________; Notary Public: ______________________.

Step 11: Record the mortgage deed

After execution, record the mortgage deed in the public land records office of the county where the property is located. This recording establishes the lender’s priority interest in the property and provides public notice of the encumbrance.

Example: After obtaining the necessary signatures and notarization, submit the mortgage deed to the County Recorder’s Office in the county where the property is located for recording. Pay the required recording fees, and ensure that the recorded mortgage deed is returned to the lender or their designated agent.

Following these steps will help you draft a comprehensive mortgage deed that accurately outlines the terms of the loan and protects the interests of both the borrower and the lender. Remember to consult an attorney or real estate professional if you have questions or need assistance with specific requirements in your jurisdiction.

FAQs

How is a mortgage deed recorded?

A mortgage deed is recorded in the public land records office of the county where the property is located. This process establishes the lender’s priority interest in the property and provides public notice of the mortgage.

Can a mortgage deed be modified?

Yes, a mortgage deed can be modified through a process called loan modification. Both the borrower and the lender must agree to the changes, and the modified mortgage deed must be recorded in the public land records office.

What happens if a borrower defaults on a mortgage deed?

If a borrower defaults on a mortgage deed, the lender has the right to initiate foreclosure proceedings to recover their investment. The foreclosure process can be either judicial or non-judicial, depending on the type of security instrument used and the applicable state laws.

What is the difference between a mortgage deed and a promissory note?

A mortgage deed is a legal document that secures a loan using real property as collateral, while a promissory note is an IOU that outlines the borrower’s promise to repay the loan according to specific terms. The mortgage deed establishes the rights and obligations of the borrower and lender concerning the property, while the promissory note focuses on the repayment terms of the loan.

Can a mortgage deed be transferred?

Yes, a mortgage deed can be transferred through a process called assignment. The lender can assign or sell their interest in the mortgage to another party, who then becomes the new mortgagee. The assignment must be recorded in the public land records office to be legally enforceable.

How do I obtain a copy of my mortgage deed?

You can obtain a copy of your mortgage deed by visiting the public land records office in the county where the property is located. You may also be able to access the recorded mortgage deed online through the county recorder’s website, depending on the availability of online records in your area.

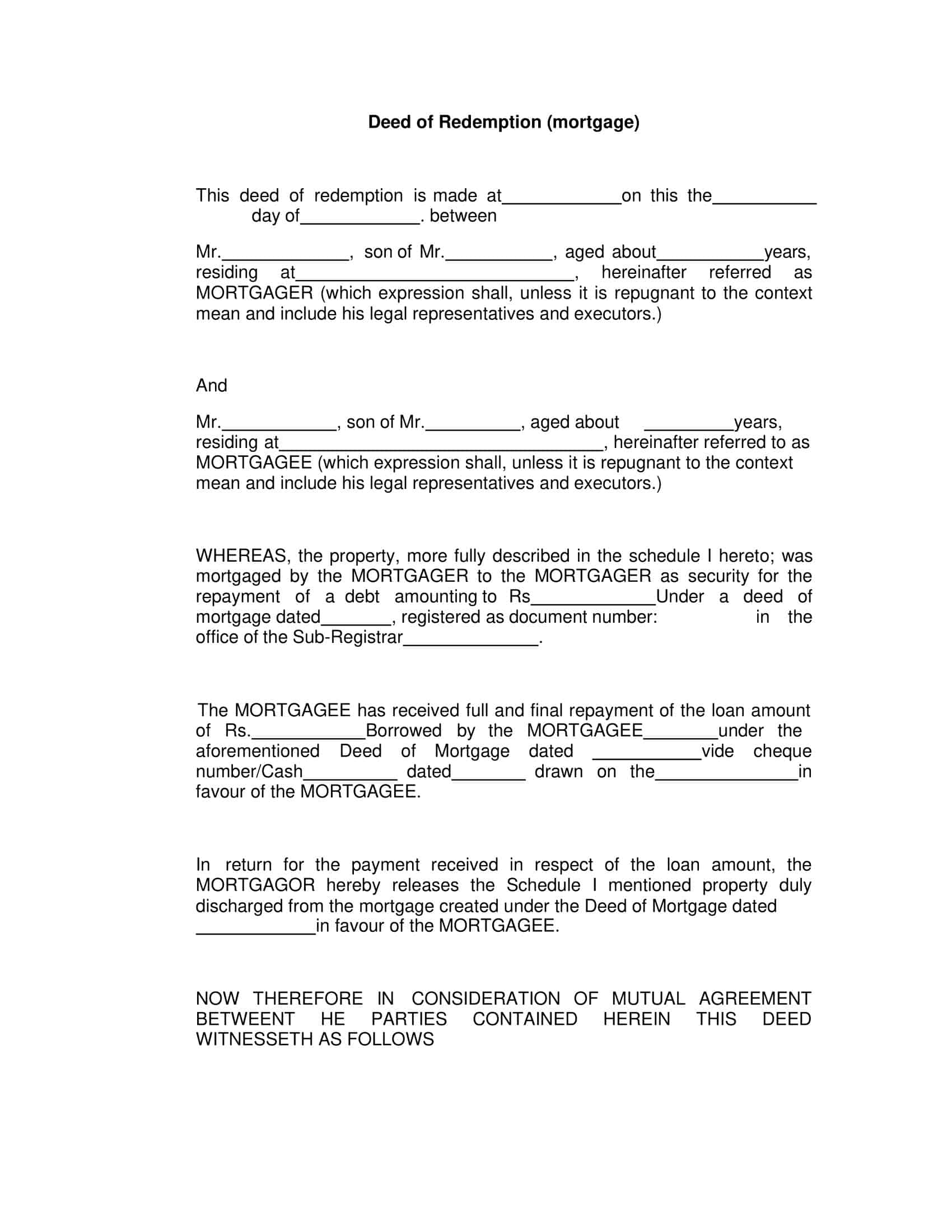

What is a satisfaction of mortgage?

A satisfaction of mortgage is a document filed by the lender in the public land records office when the borrower has fully repaid the mortgage loan. It releases the property from the mortgage lien and indicates that the borrower no longer owes any debt to the lender.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)