Are you getting ready to move into a brand new apartment? It’s an exciting time, for sure! But before you can start packing up your boxes, you need to make sure you’ve got approval from your landlord or property manager. And the key to getting that approval?

Filling out the rental application form accurately. This document gives your landlord a better idea of who you are and why you’d make a great tenant. So, let’s dive into everything you need to know about filling out this important form.

Table of Contents

What Is a Rental Application Form?

A rental application form is a crucial document in the process of securing a rental property. It’s a standard form that a prospective tenant fills out to provide information about themselves to the landlord or property manager. The form is designed to give the landlord a better understanding of the tenant’s background, financial stability, and ability to meet the obligations of the rental agreement.

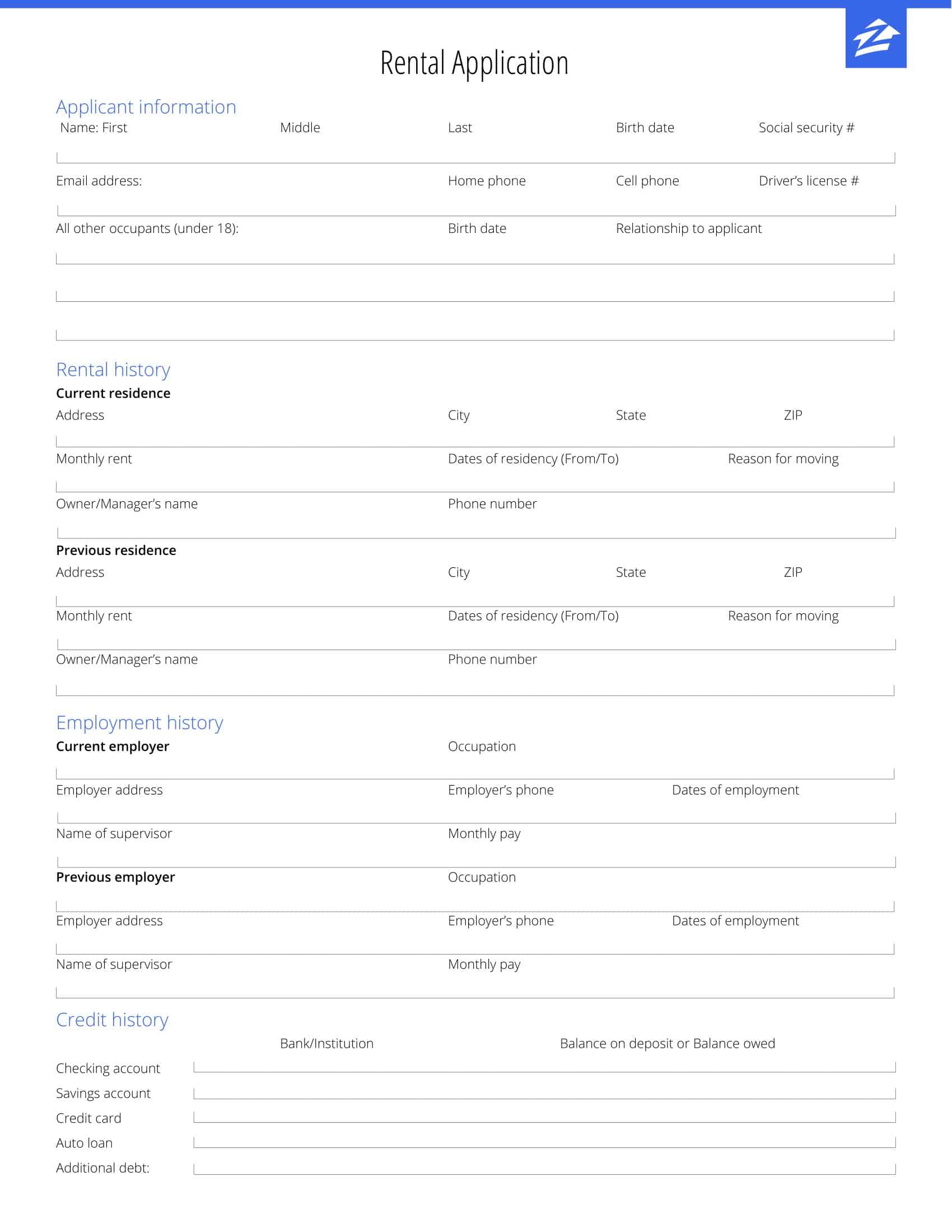

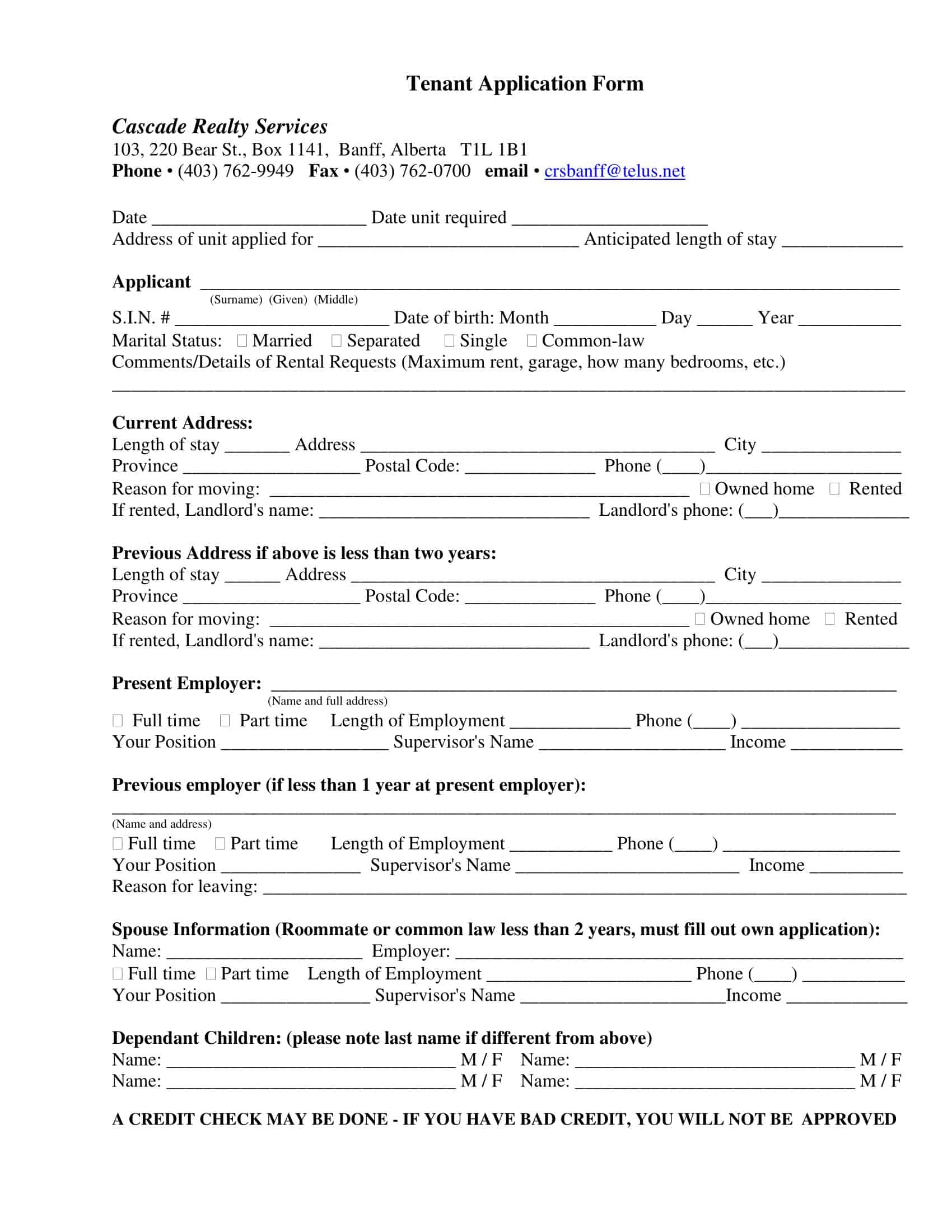

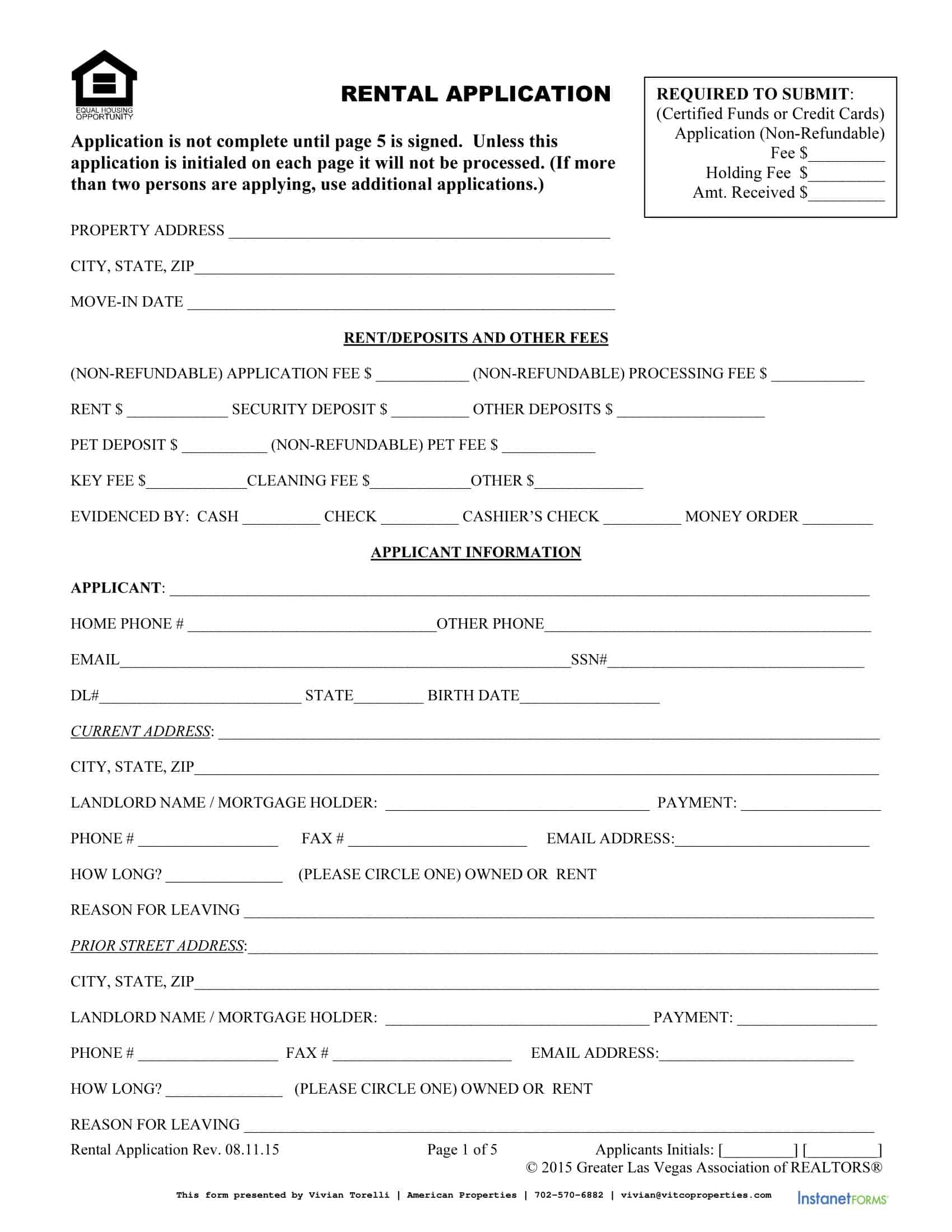

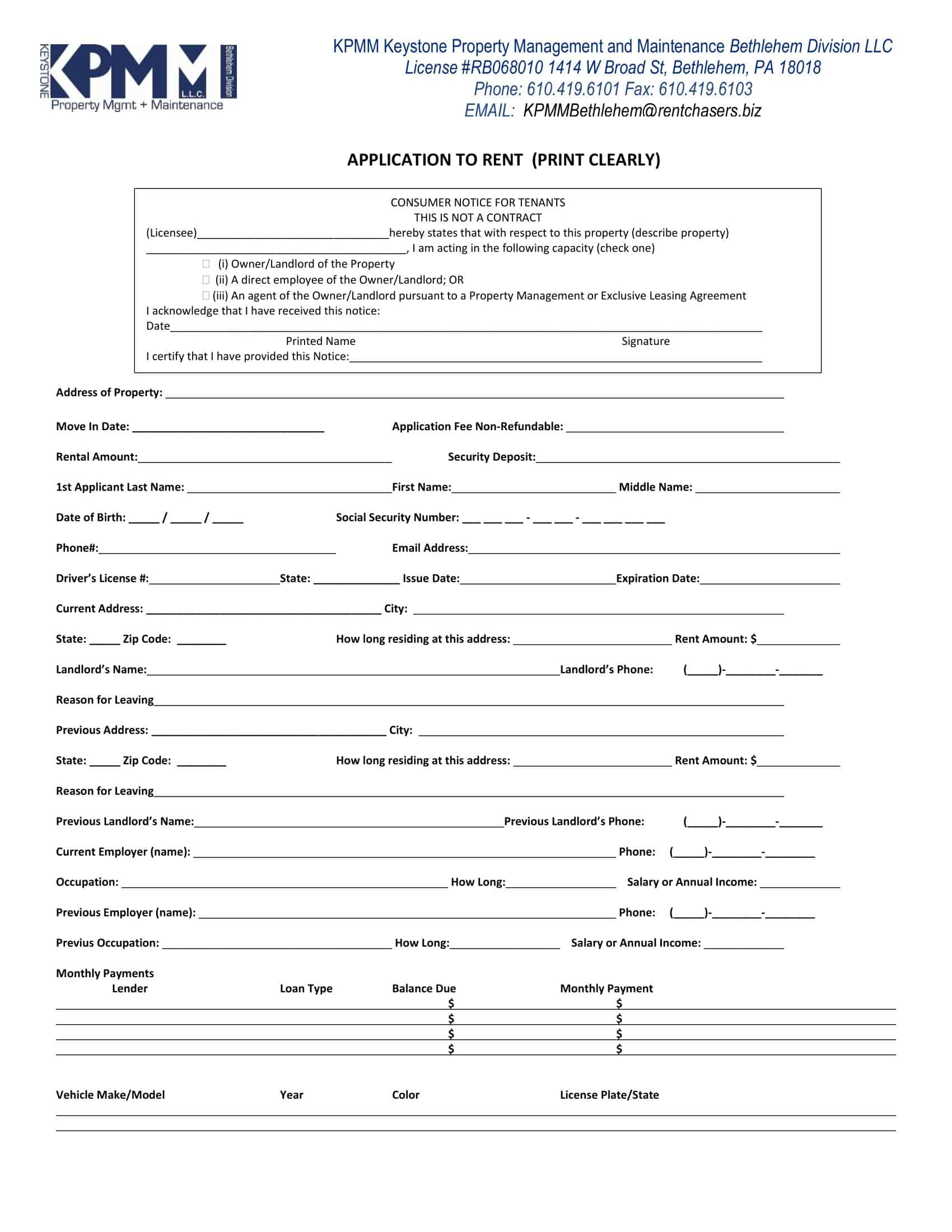

The rental application form usually asks for personal information such as the applicant’s full name, current address, social security number, employment information, and rental history. It may also ask for the names and contact information of references, such as previous landlords or coworkers. In some cases, the form may also require a fee to be paid, which is often used to cover the cost of a background check.

The information provided in the rental application form is used by the landlord to determine the tenant’s eligibility to rent the property. By evaluating the applicant’s financial stability, rental history, and other factors, the landlord can determine whether the tenant is likely to be a responsible, trustworthy, and reliable tenant. Therefore, it’s important to take the time to fill out the form completely and accurately, as this will increase your chances of being approved for the rental property.

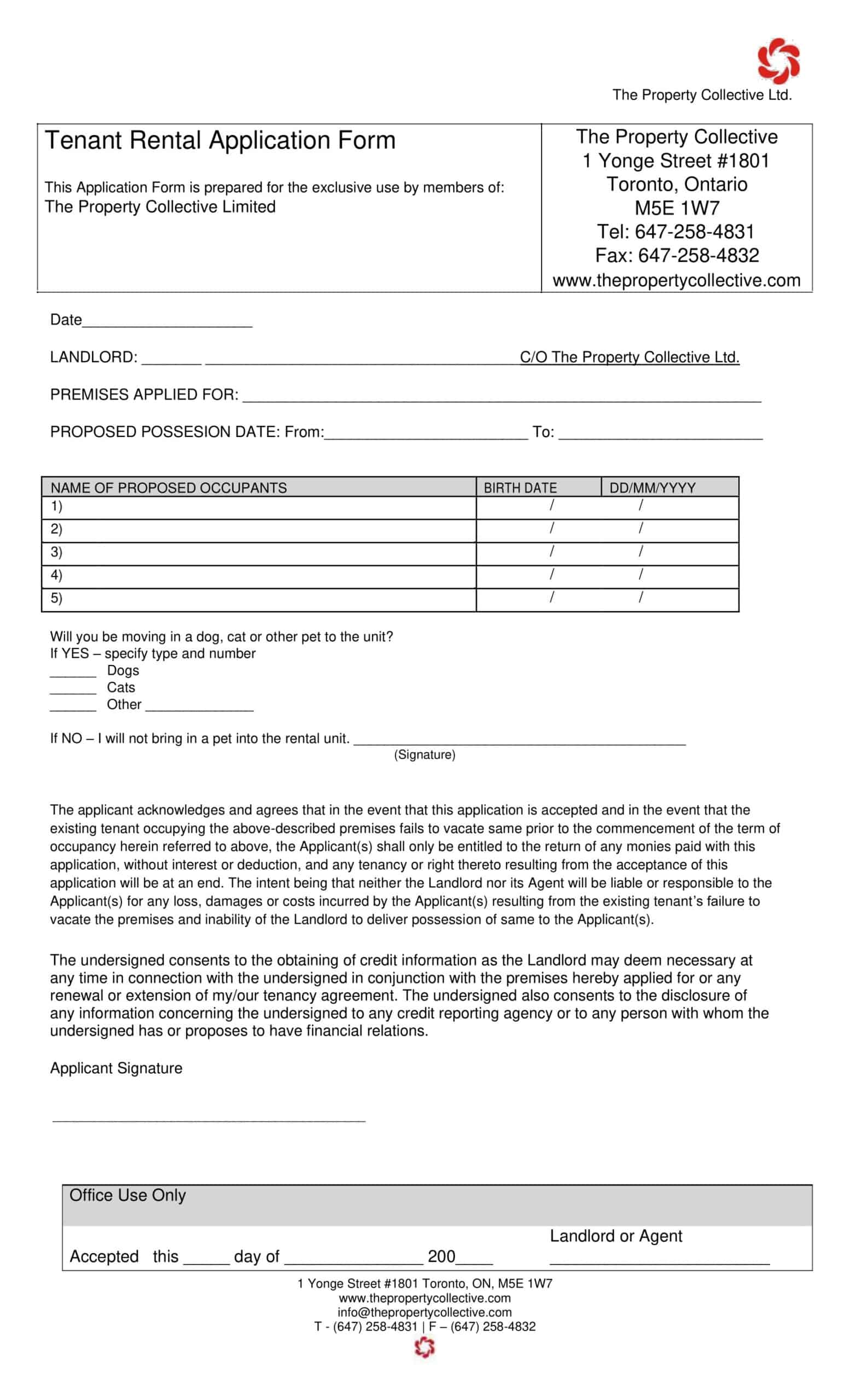

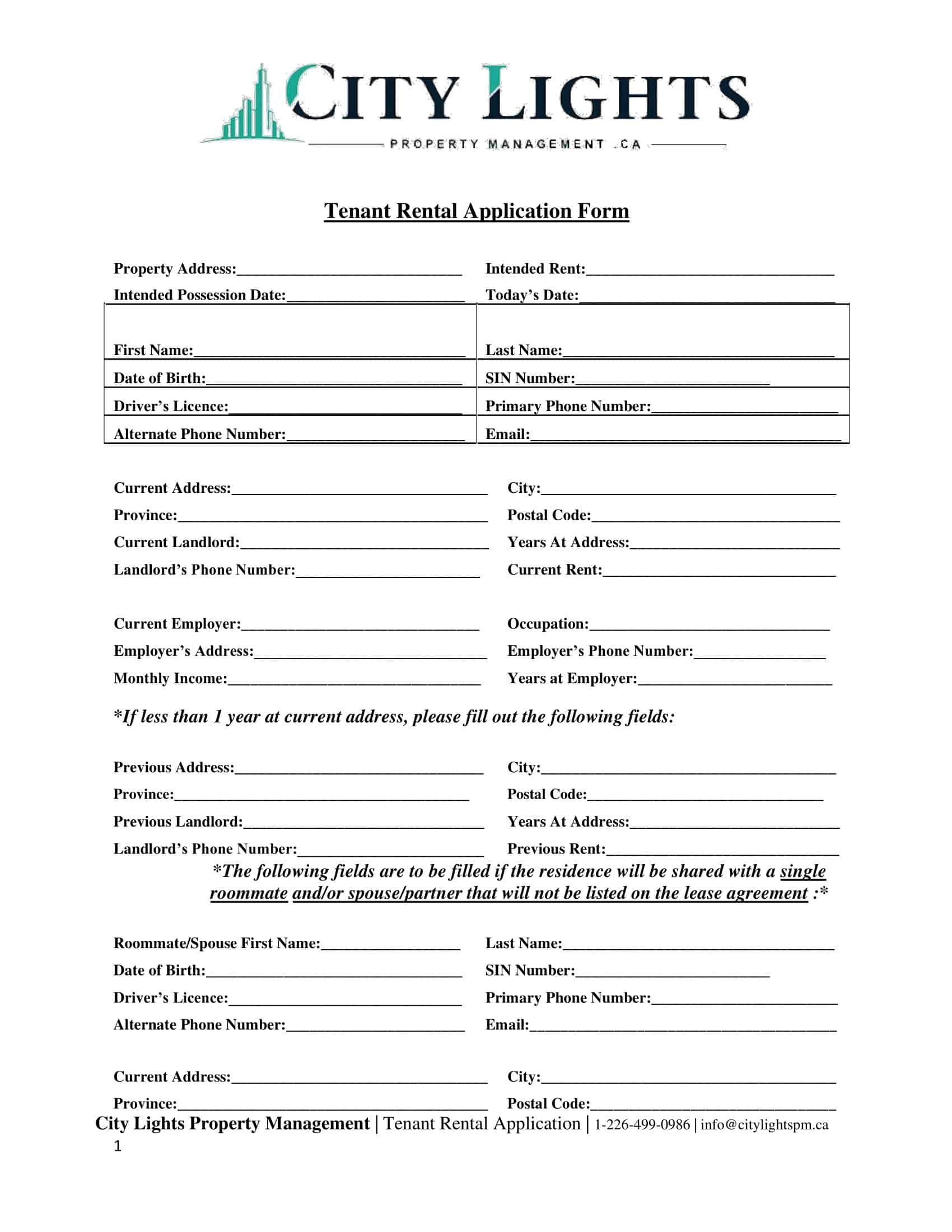

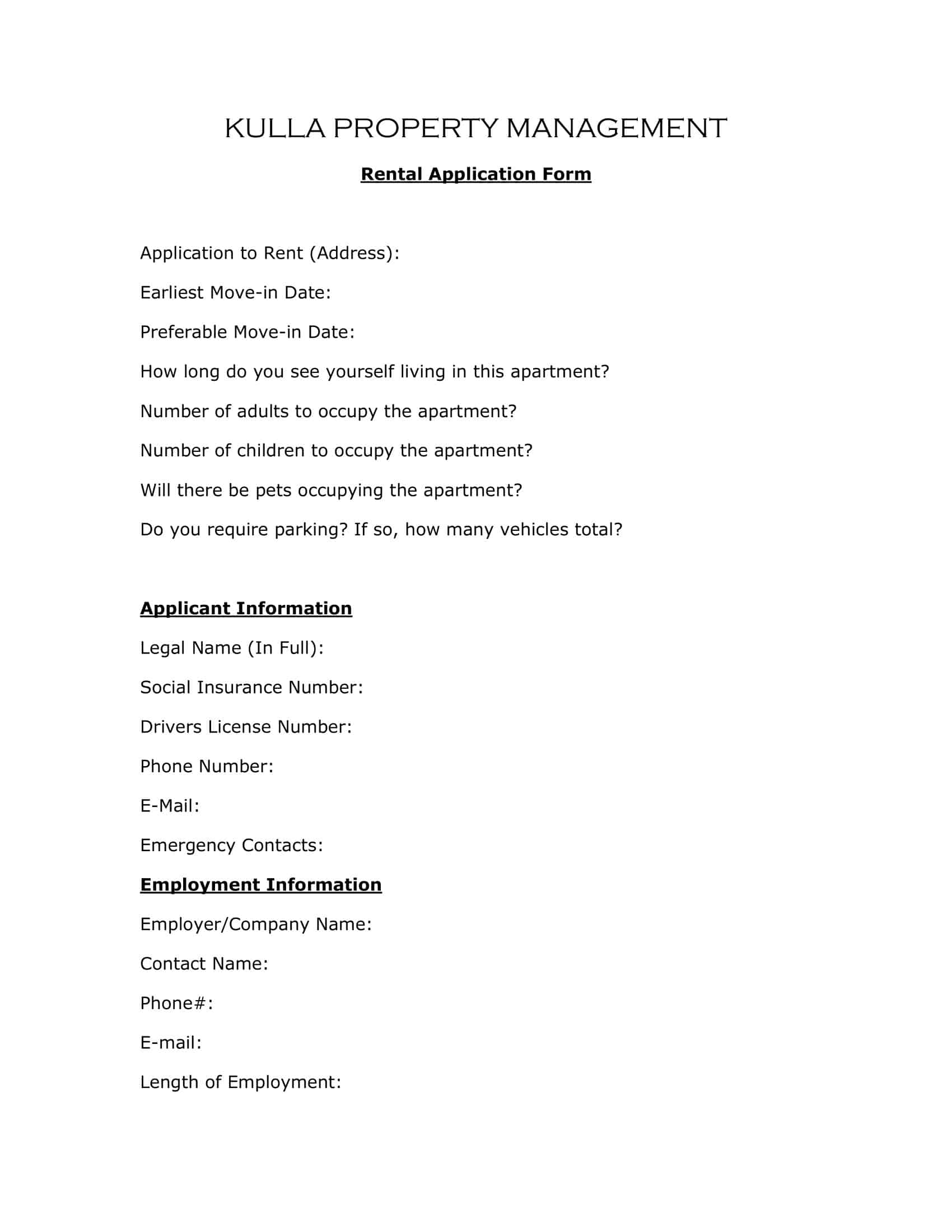

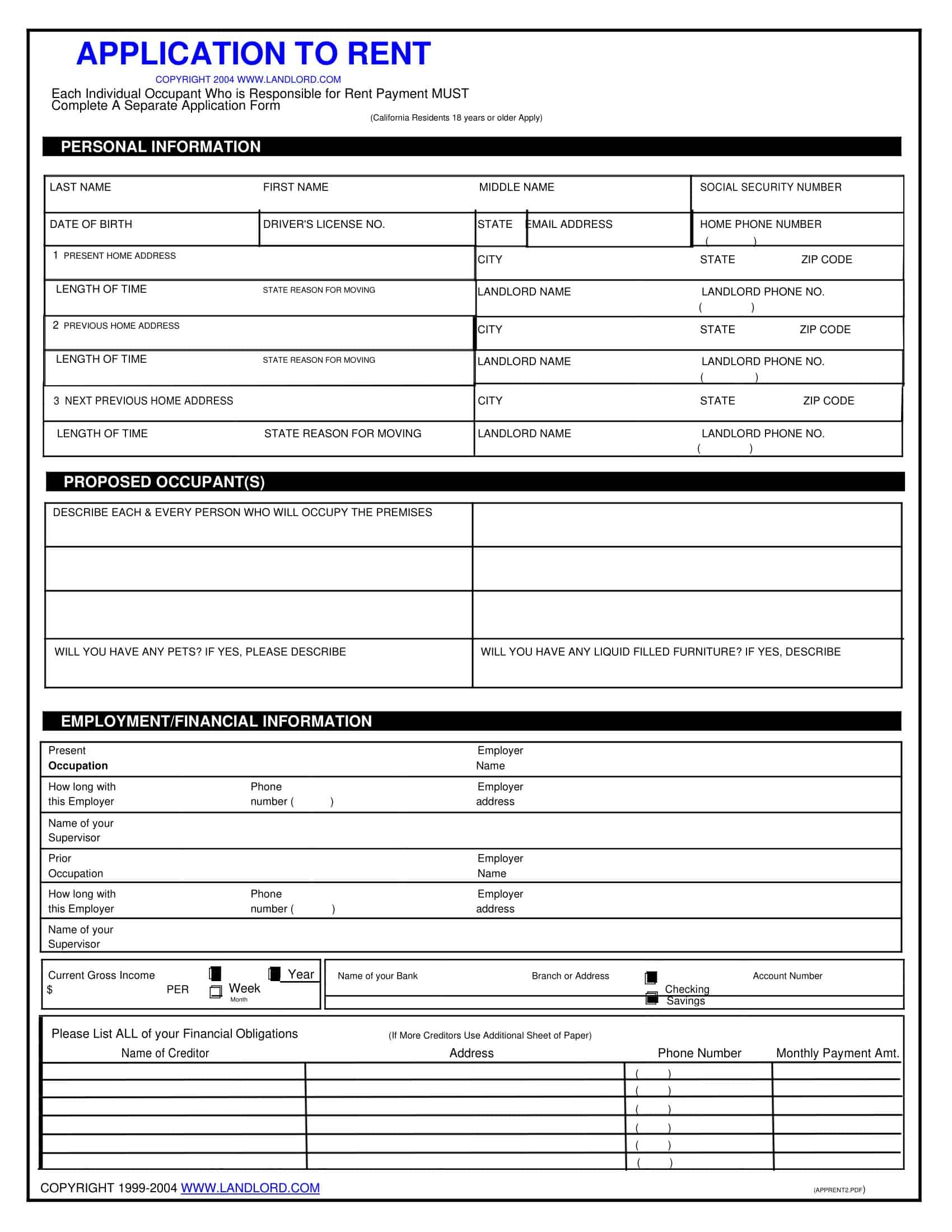

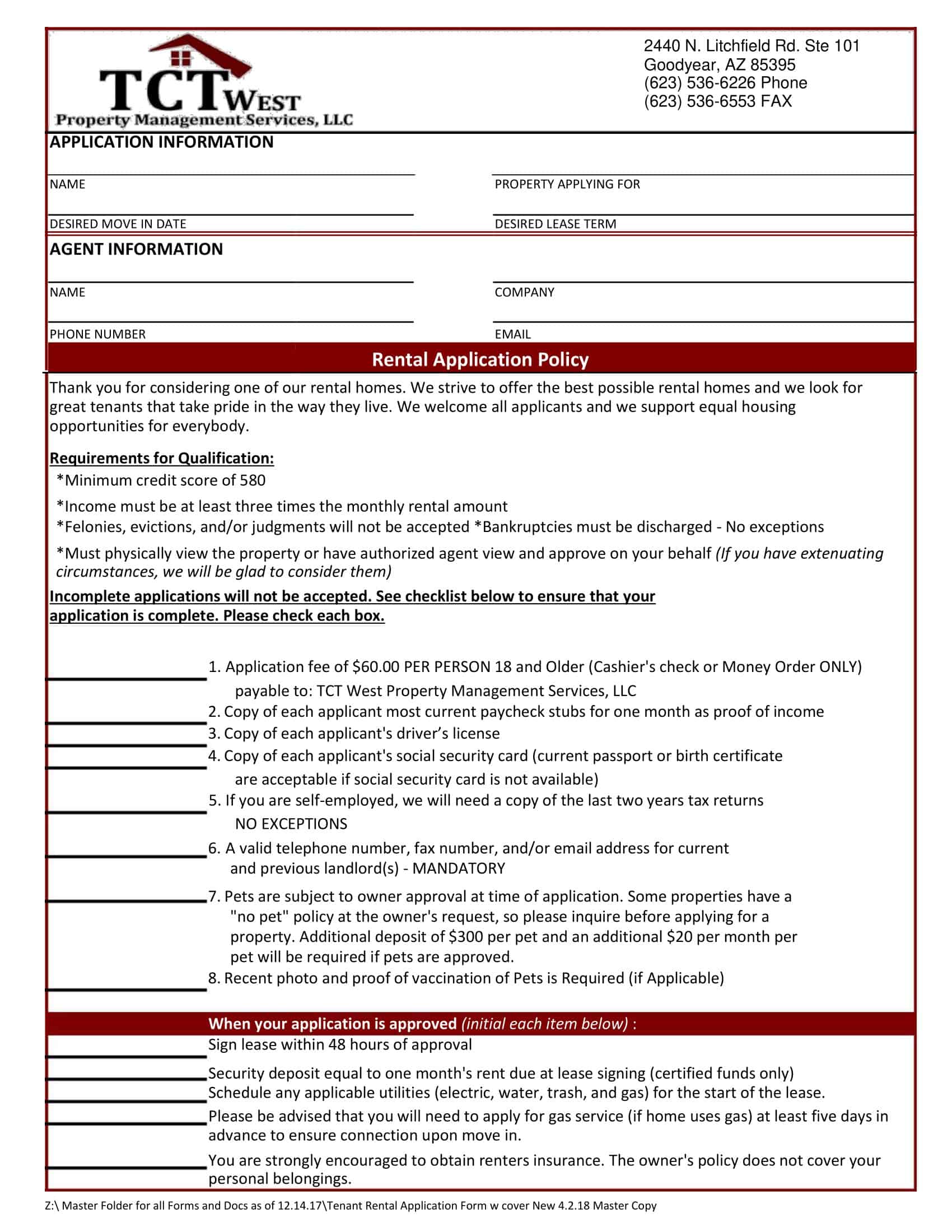

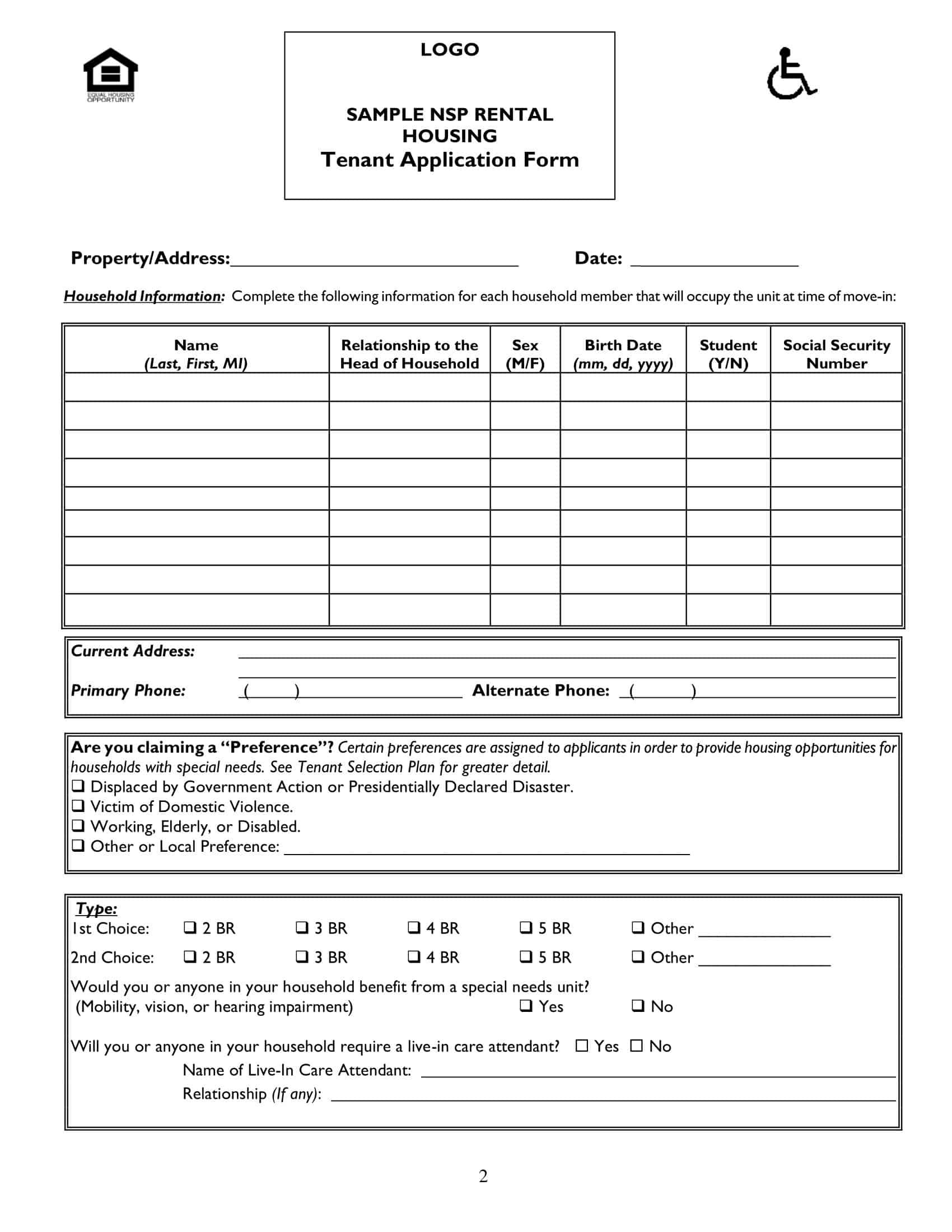

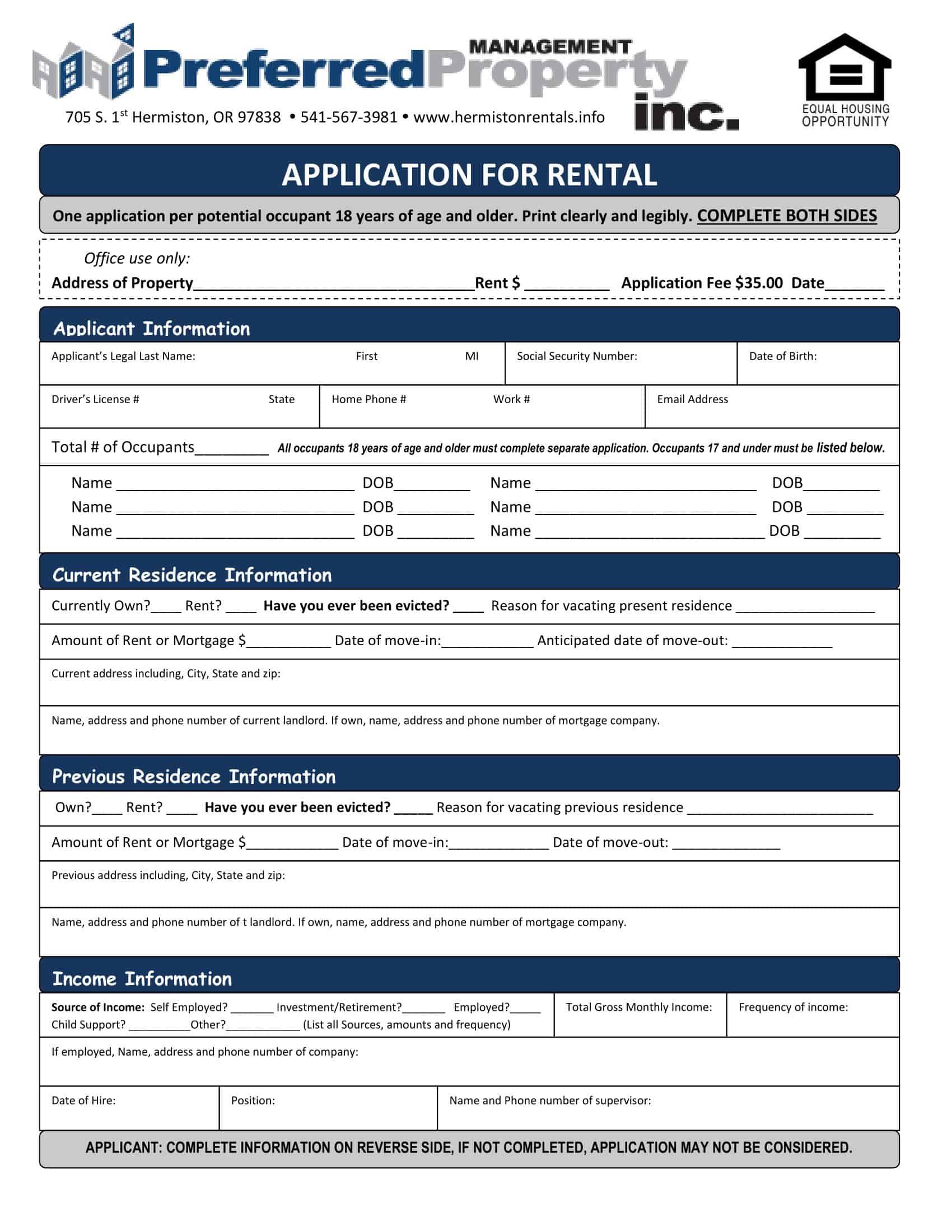

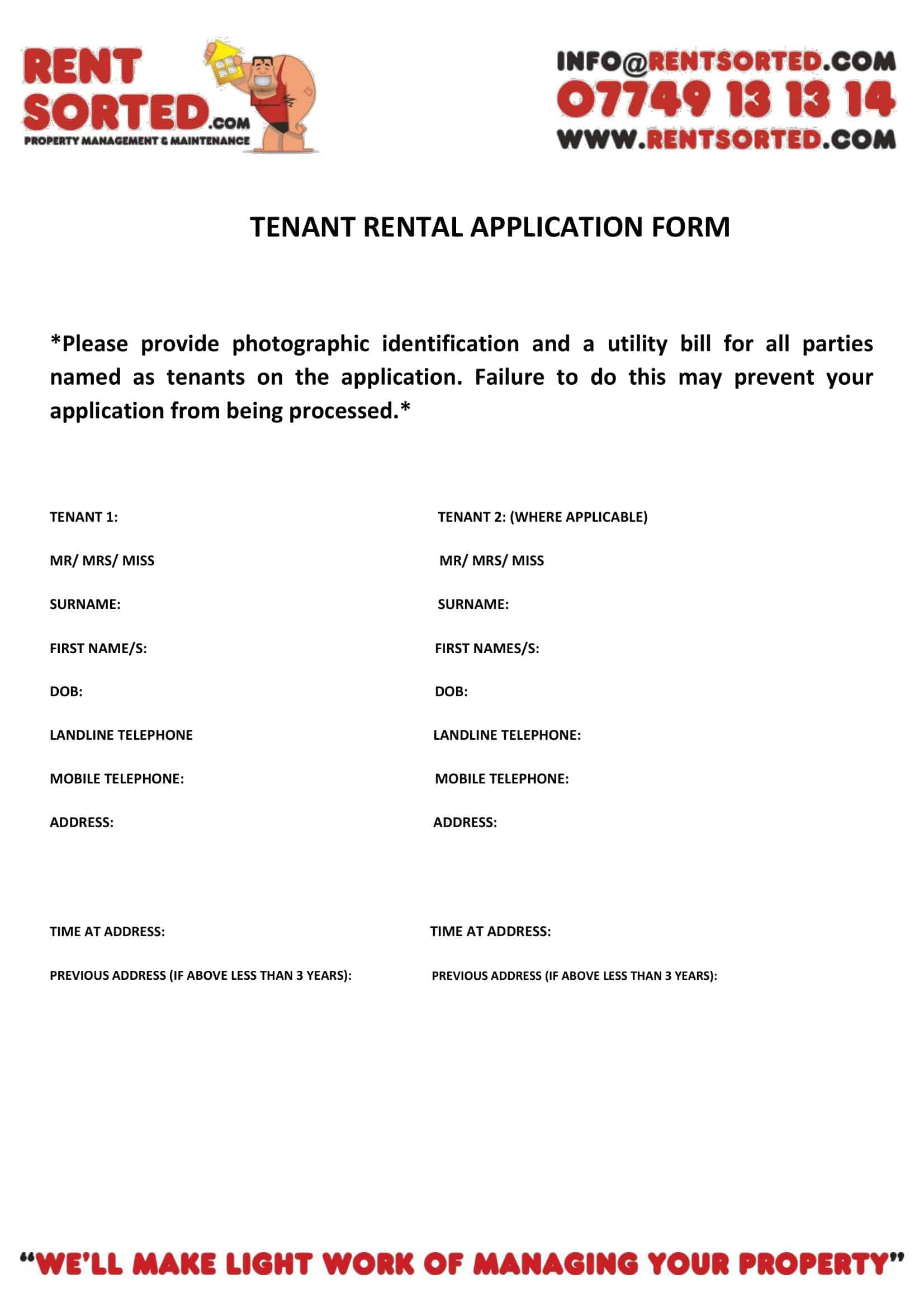

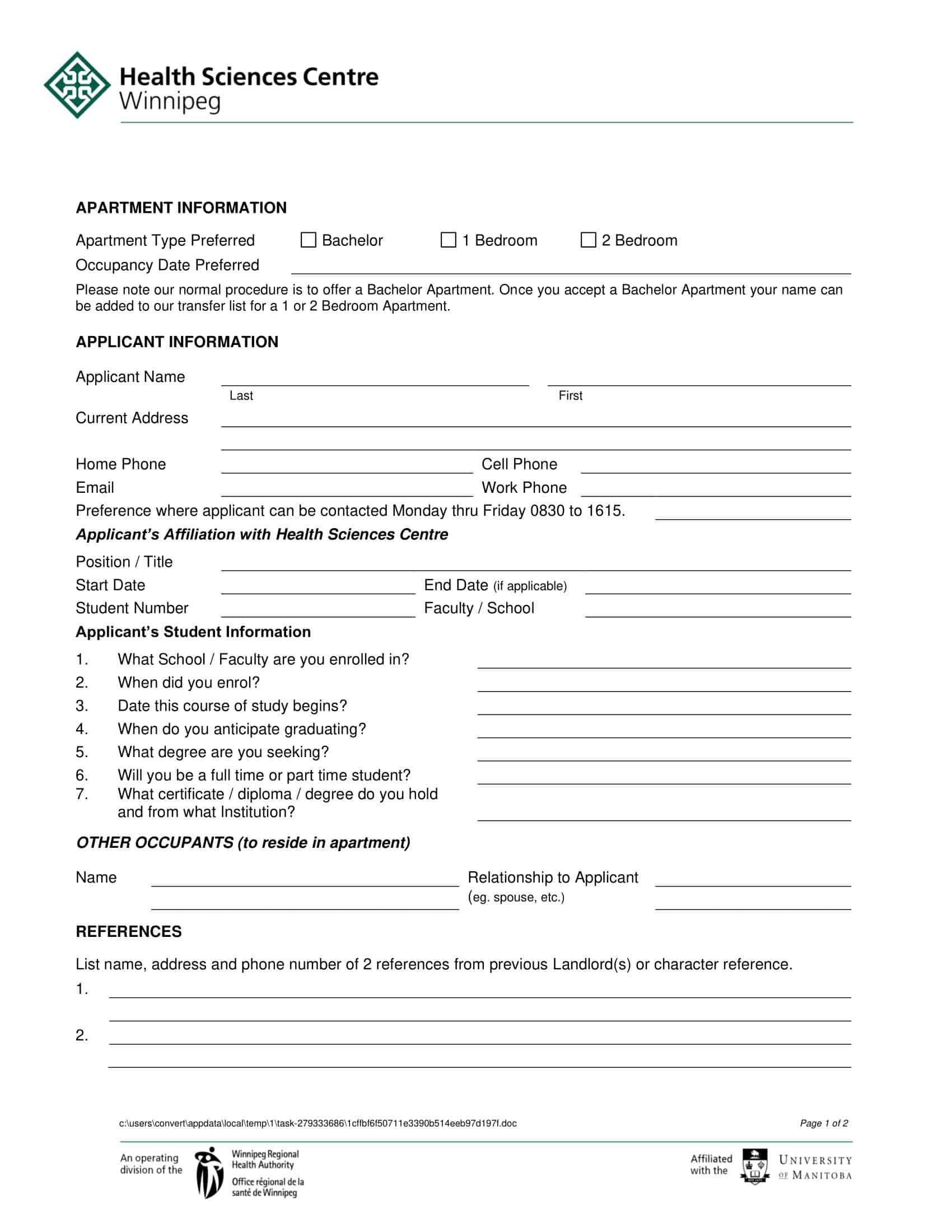

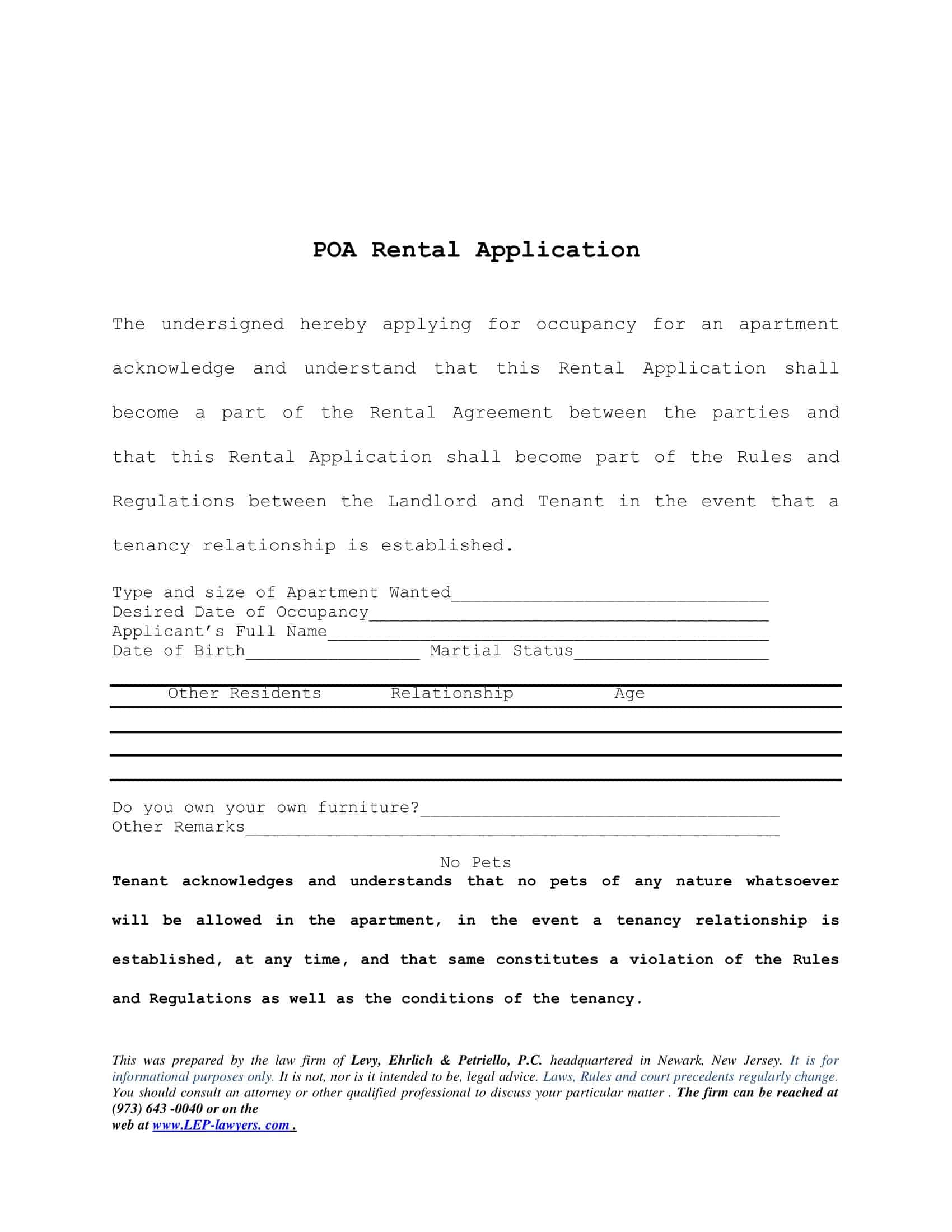

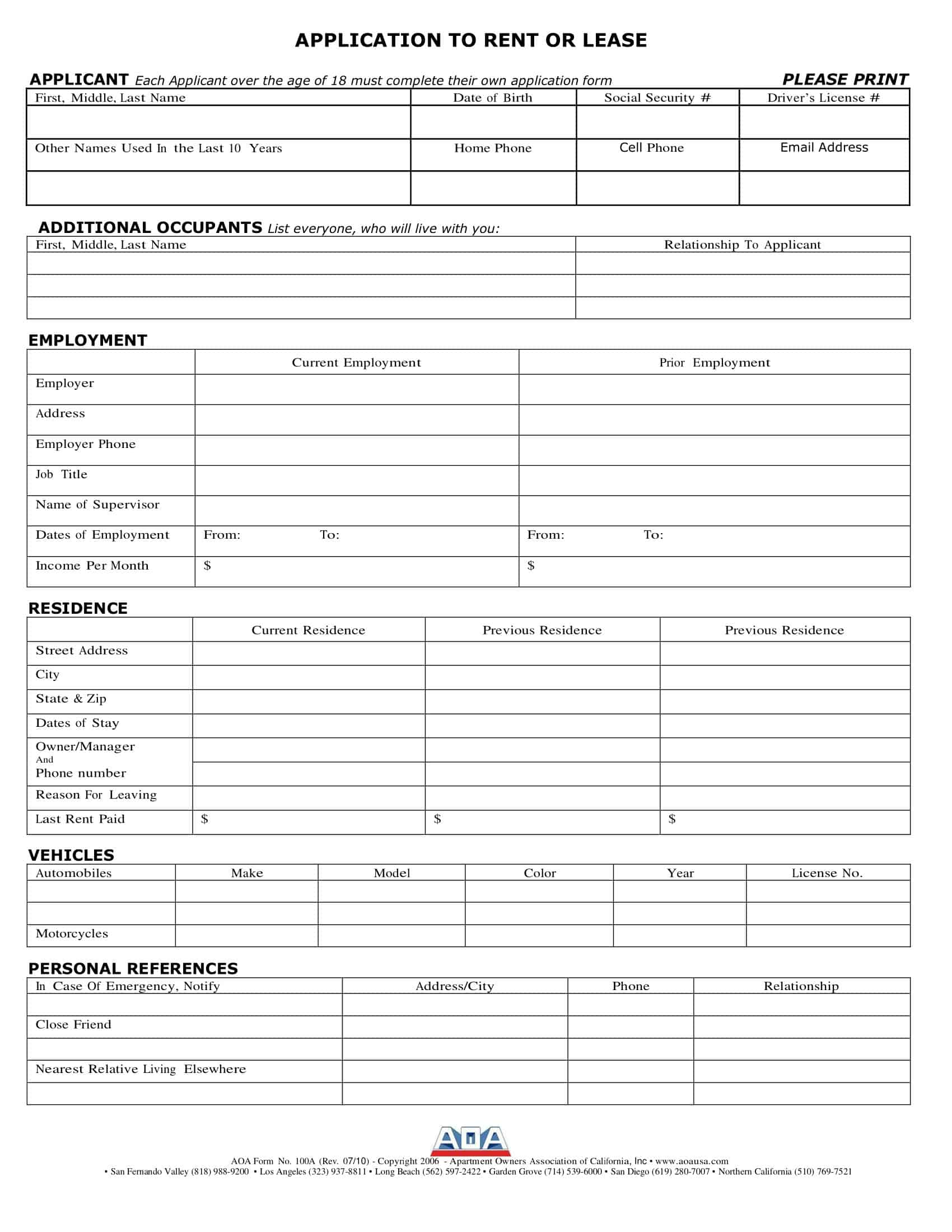

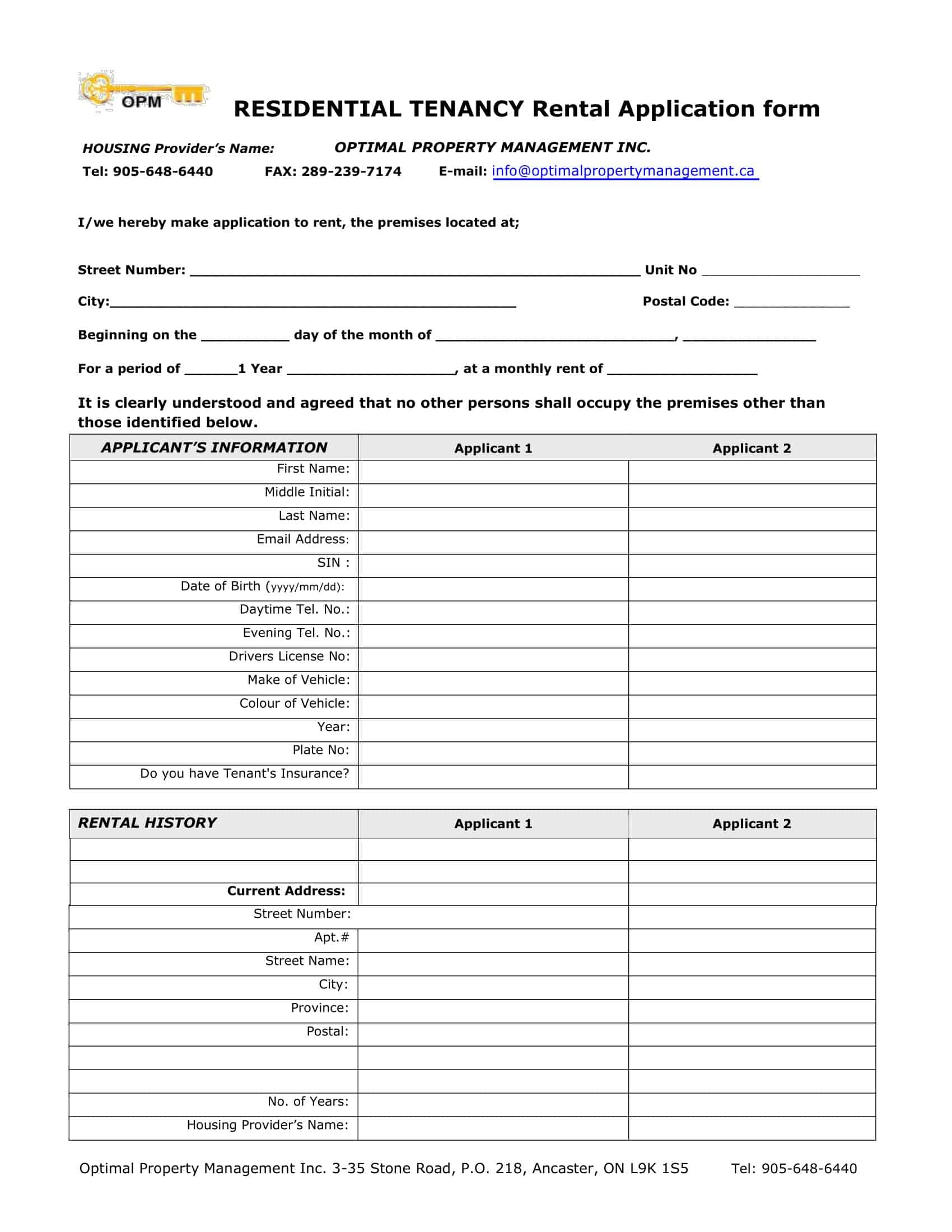

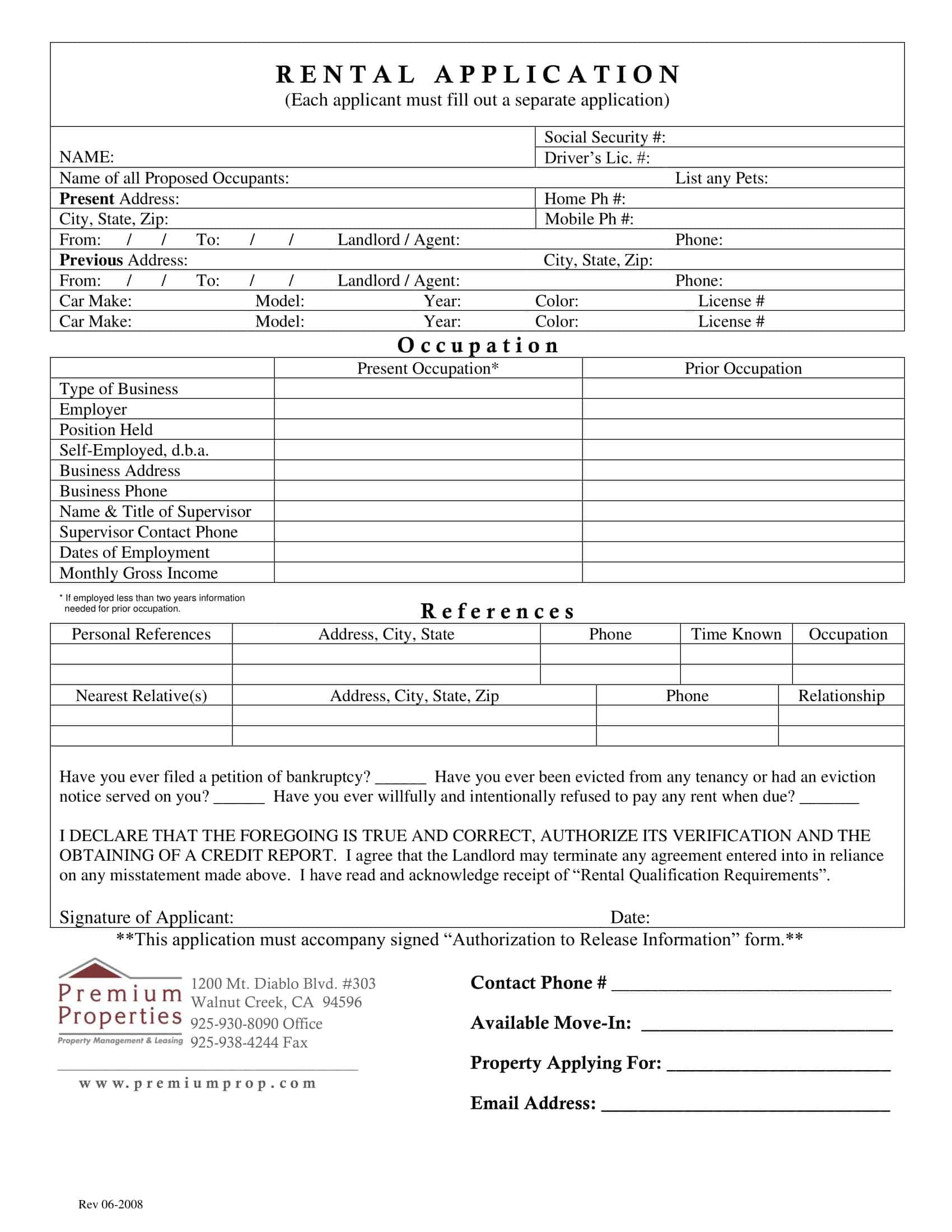

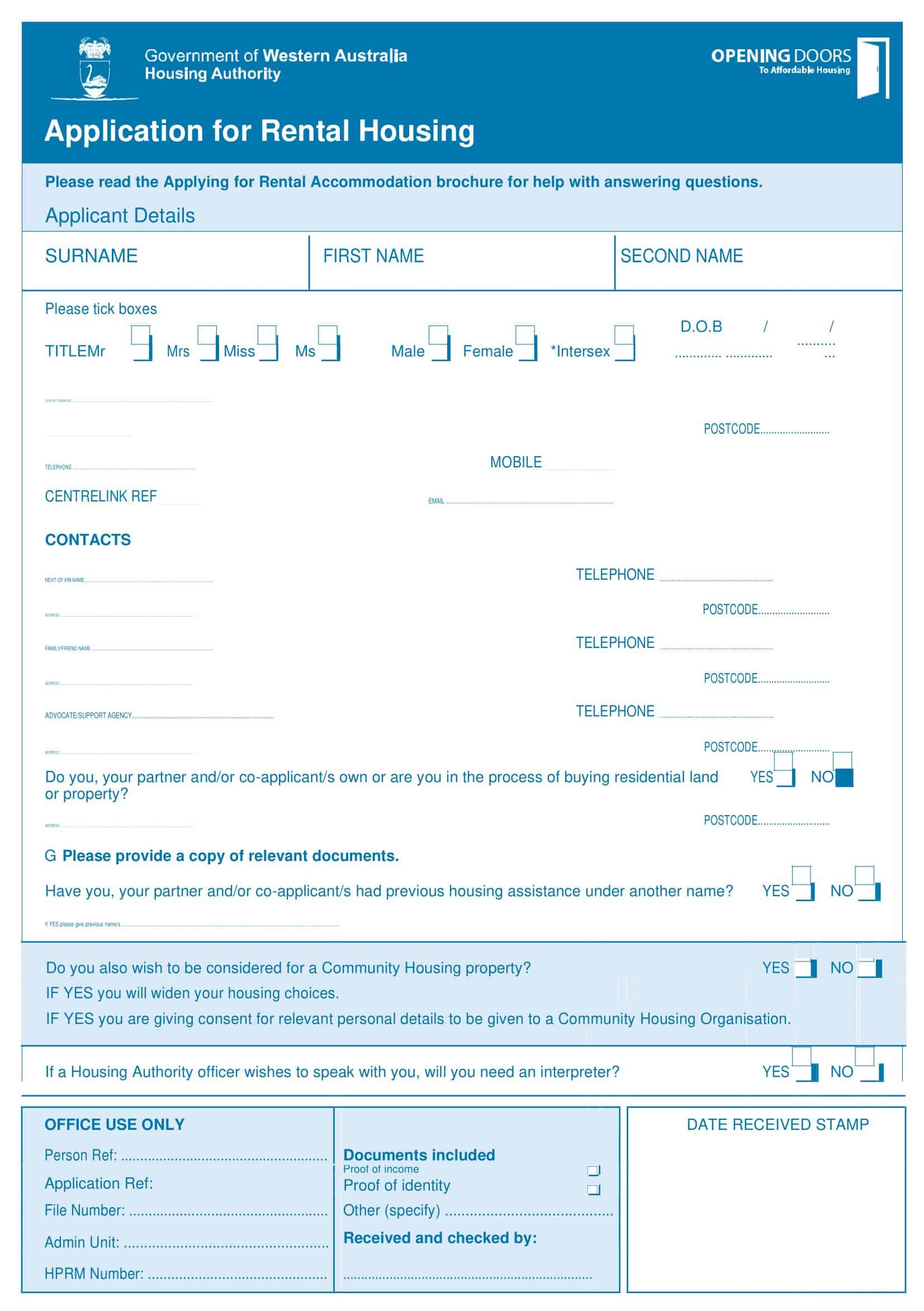

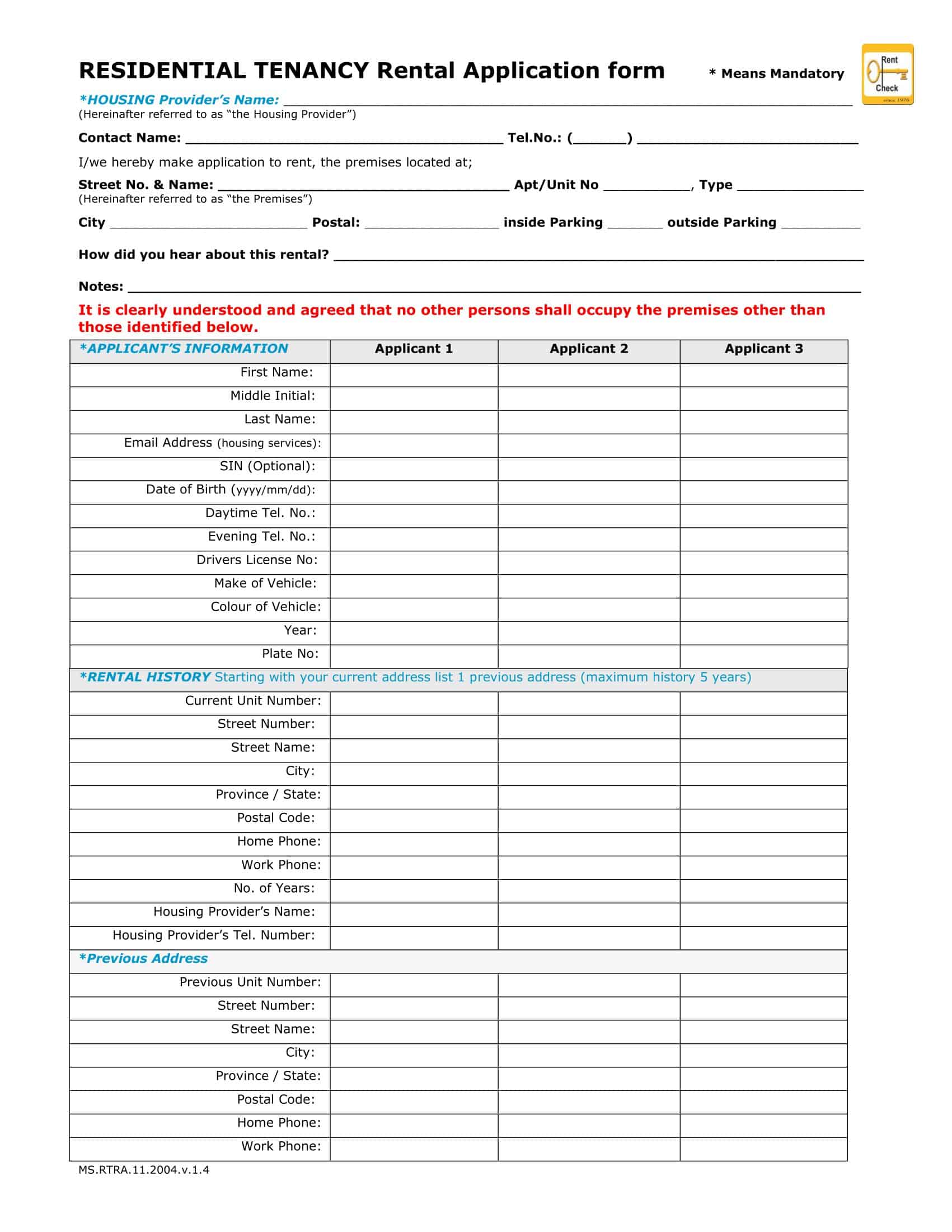

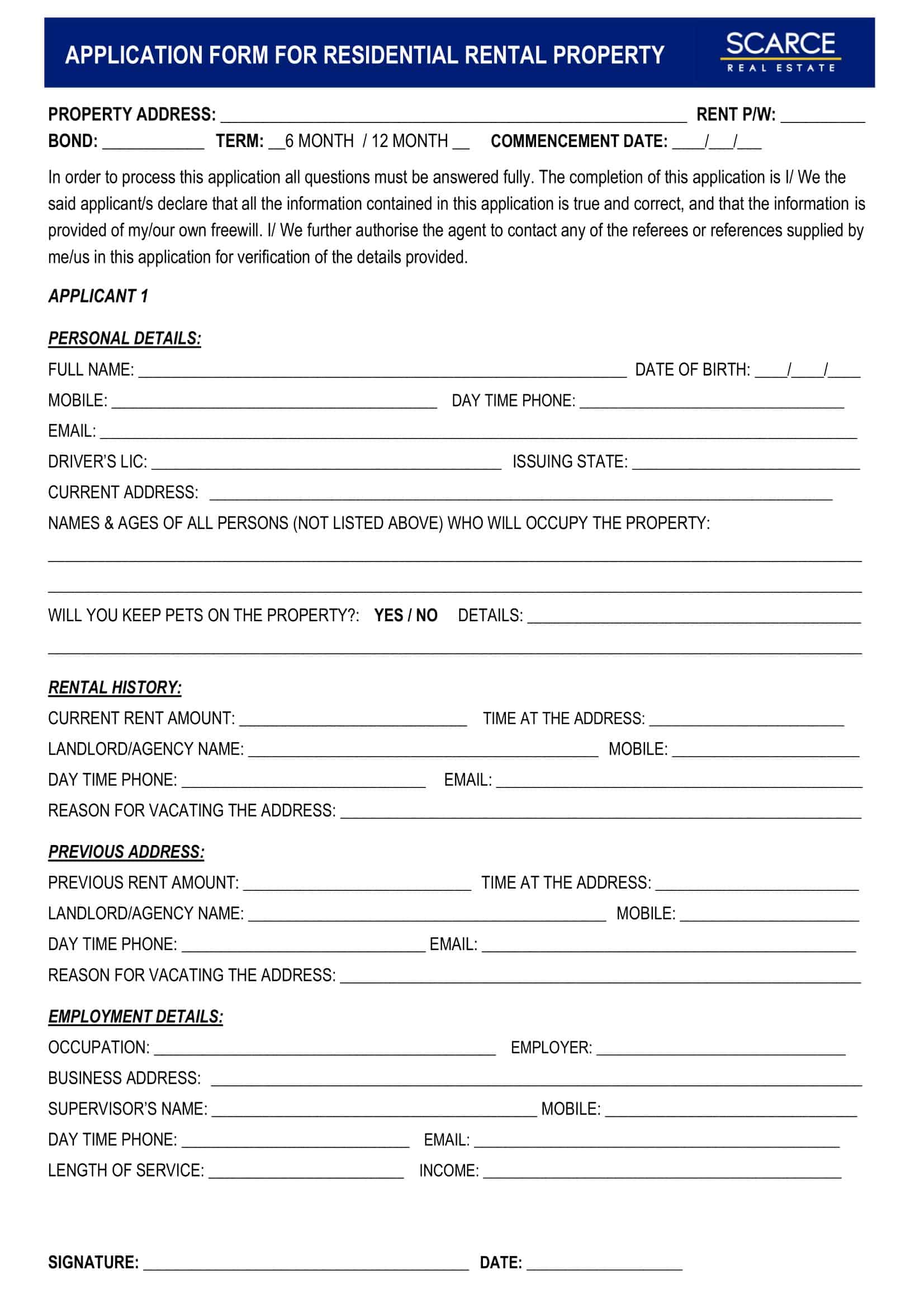

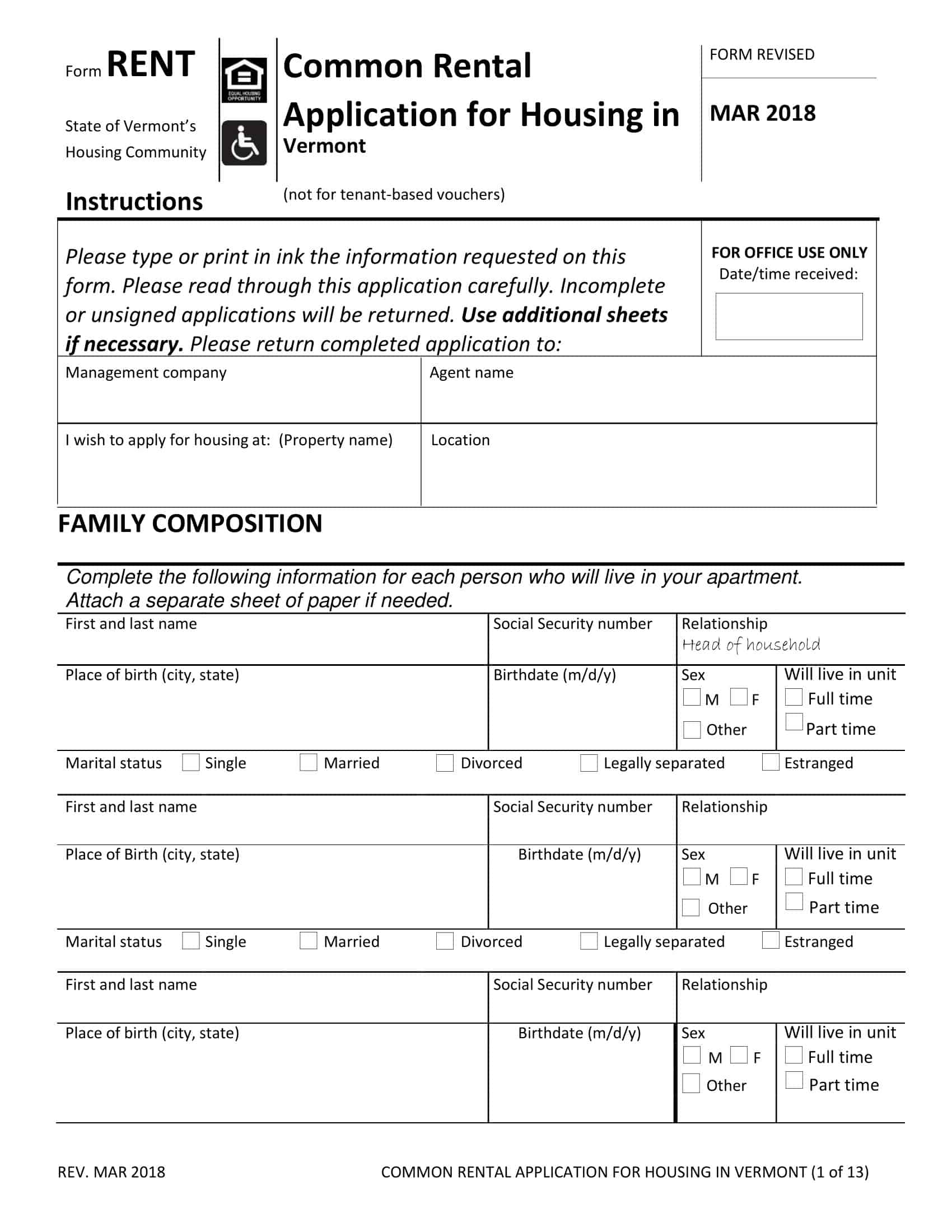

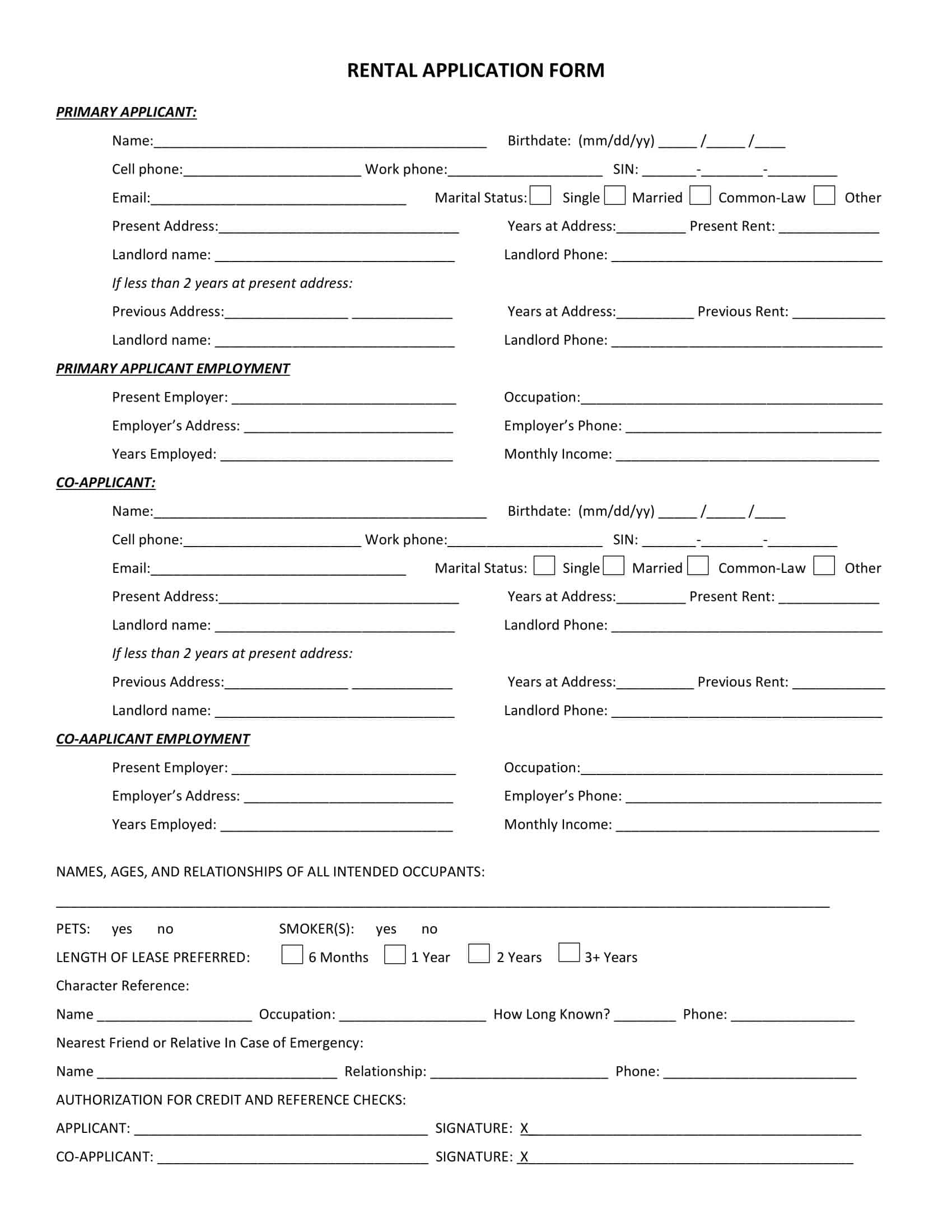

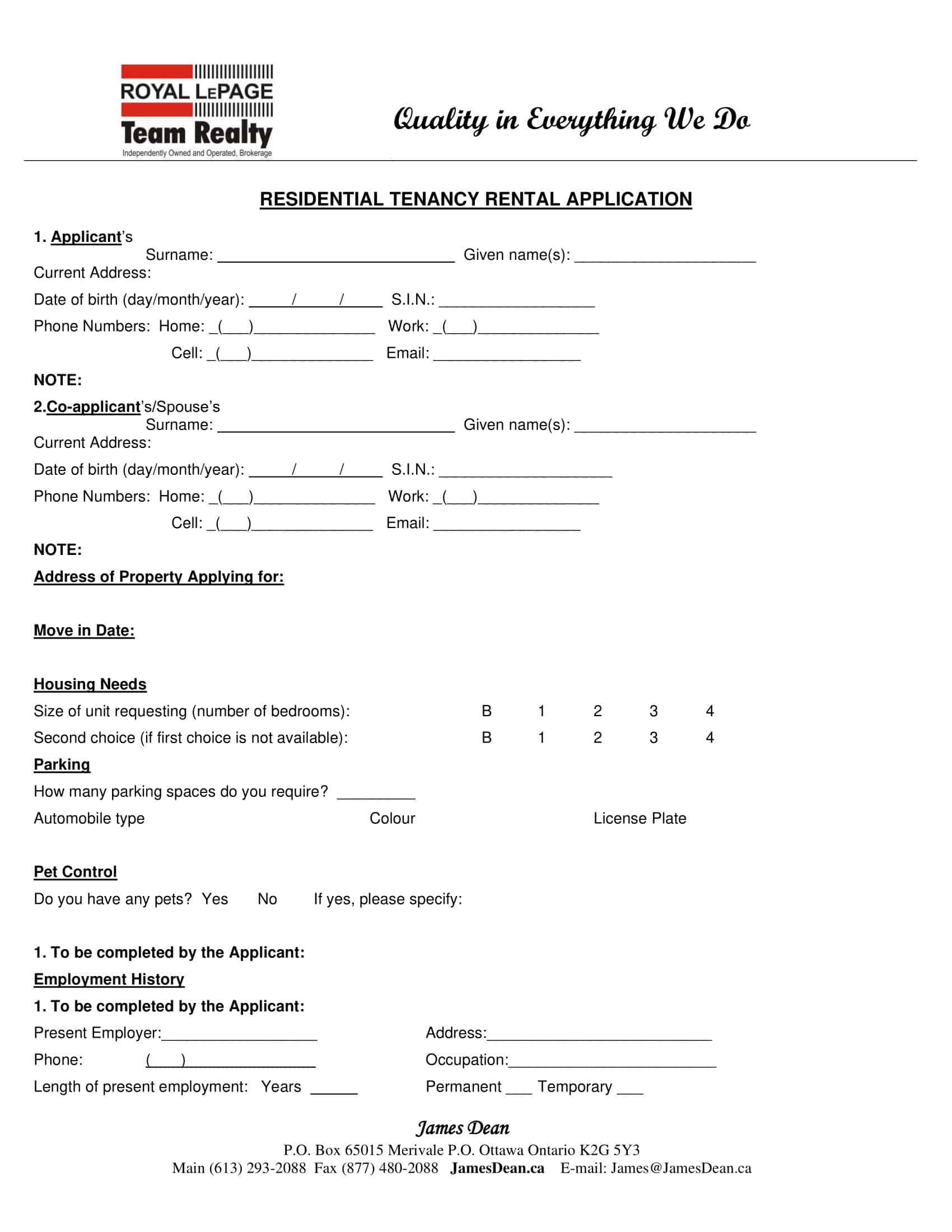

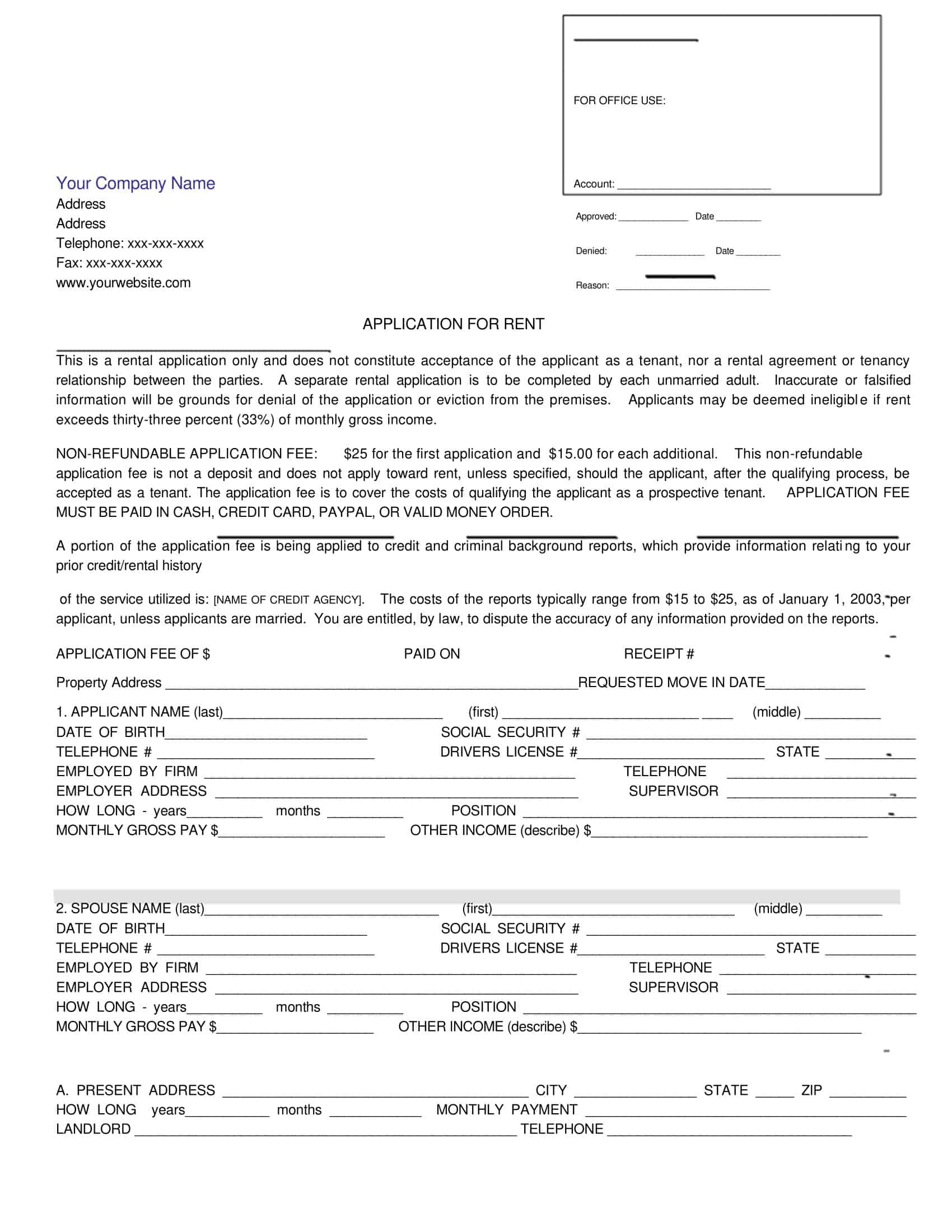

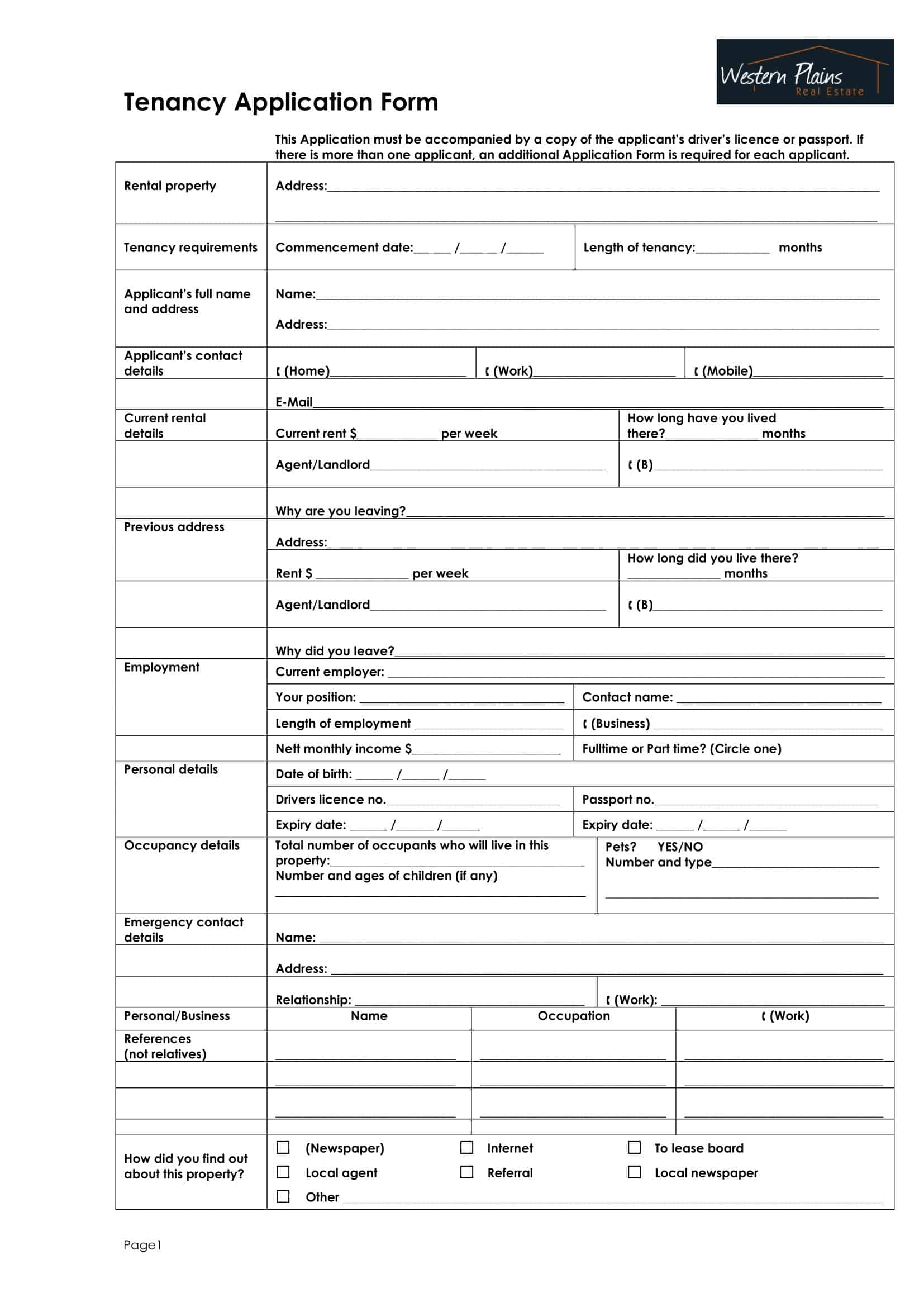

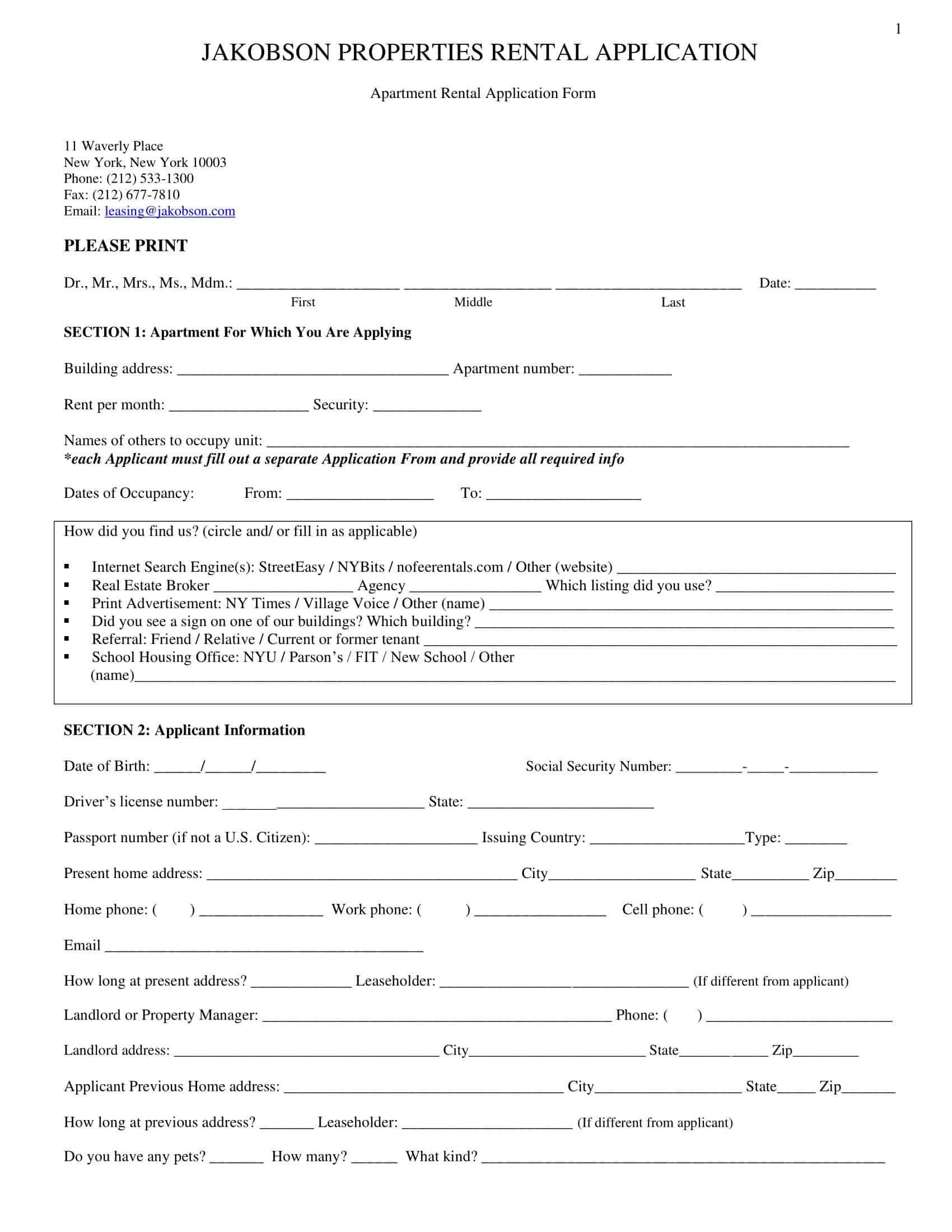

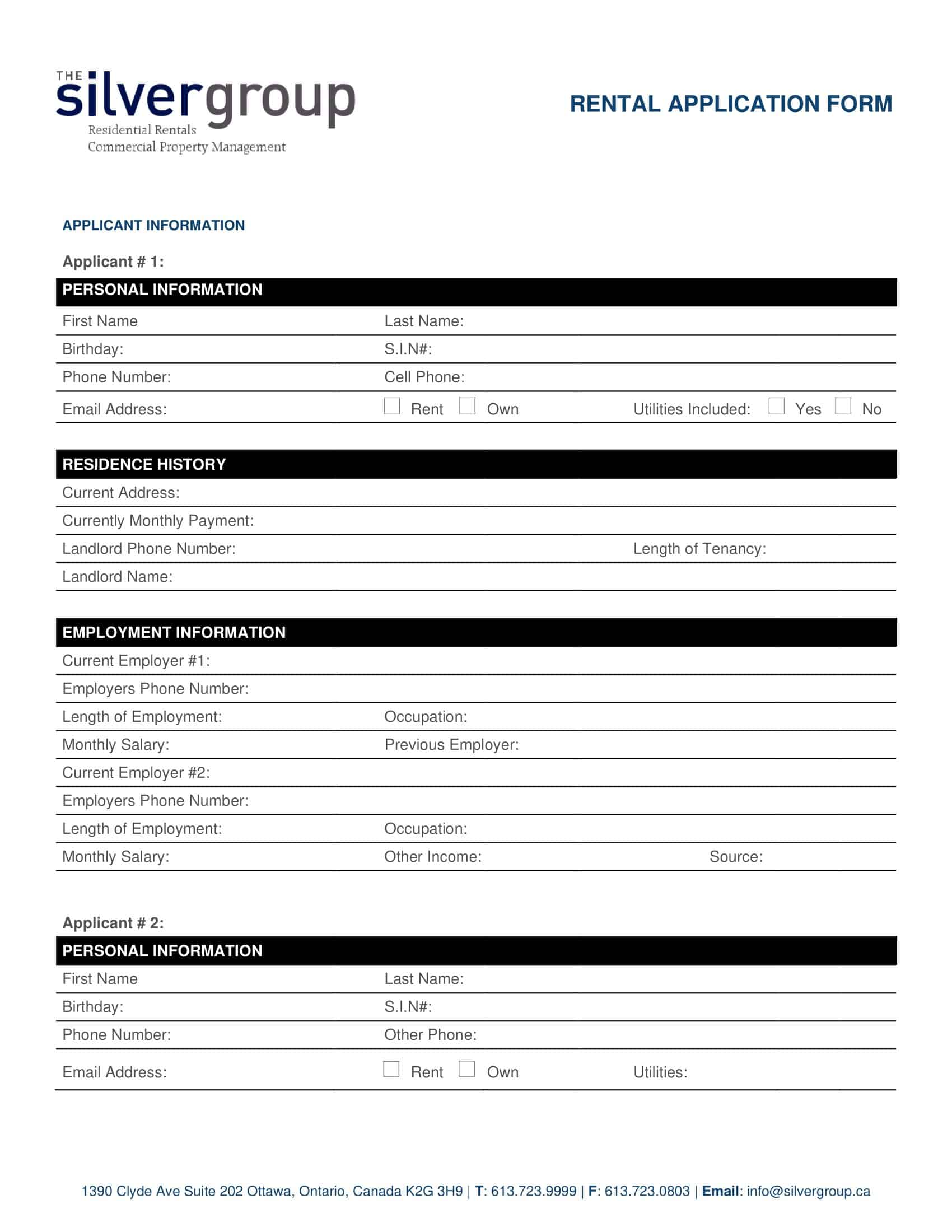

Rental Application Form Templates

A Rental Application Form Template is a standardized document used by landlords or property management companies to collect essential information from prospective tenants. It provides a structured format for gathering details about the applicant’s personal information, employment history, rental history, and references. Rental Application Form Templates ensure consistency, efficiency, and proper documentation in the tenant screening process.

Rental Application Form Templates streamline the tenant screening process, ensuring that landlords collect all necessary information consistently from prospective tenants. These templates help landlords make informed decisions by assessing applicants’ financial stability, rental history, and references. Rental Application Form Templates also serve as documentation for legal and administrative purposes, demonstrating that the tenant selection process is fair and non-discriminatory. They are valuable tools for landlords and property management companies in efficiently managing rental applications and selecting qualified tenants for their properties.

Types of Rental Application Form

There are several types of rental application forms, each serving a different purpose or catering to specific requirements. These forms help landlords and property managers screen potential tenants and collect relevant information to make informed decisions. Here is a comprehensive explanation of the most common types of rental application forms:

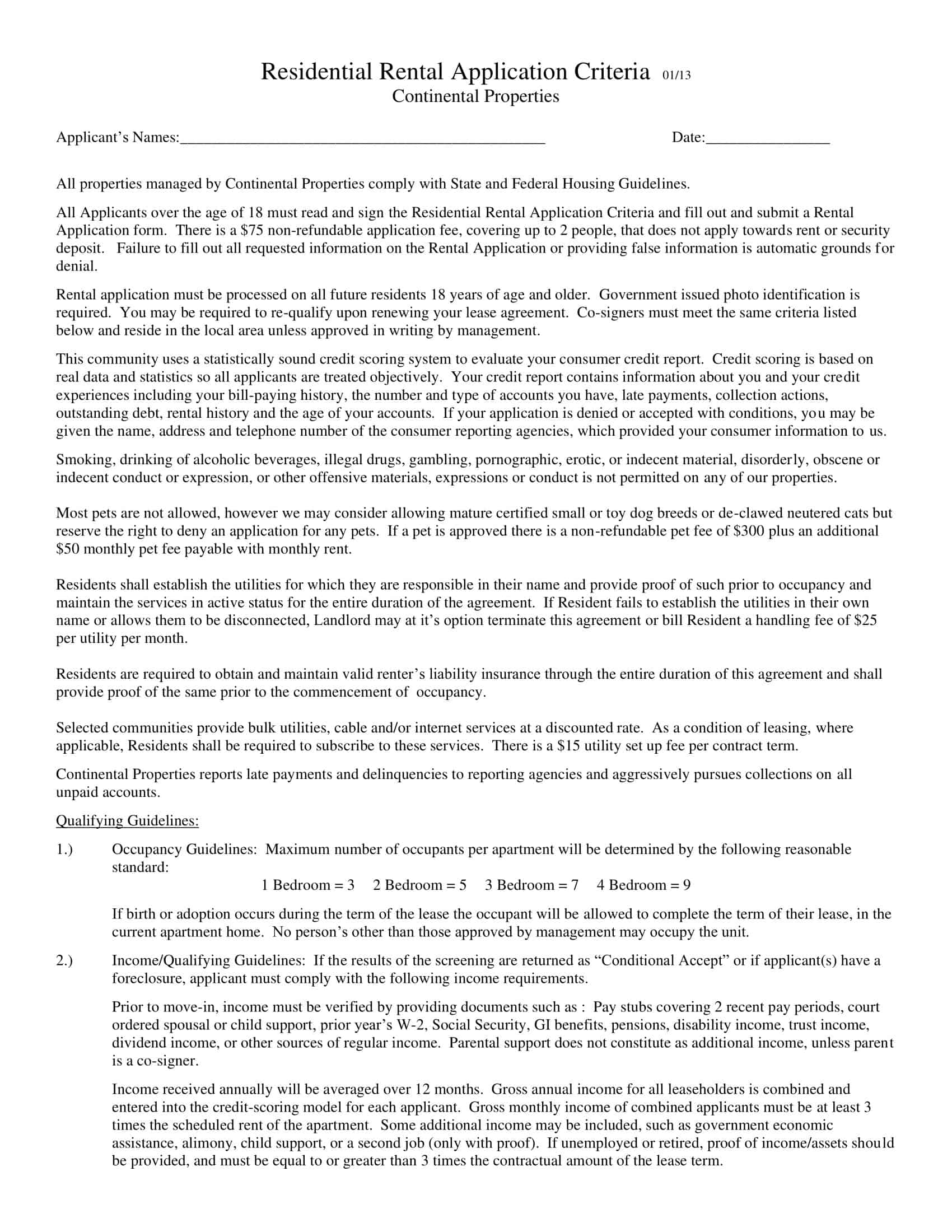

Standard Rental Application Form

This is the most common rental application form used by landlords and property management companies. It collects essential information about prospective tenants, such as personal details, rental history, employment and income information, references, and consent for background and credit checks. The purpose of this form is to provide a comprehensive overview of the applicant’s qualifications, reliability, and financial stability.

Co-signer/Guarantor Application Form

A co-signer or guarantor application form is used when a prospective tenant may not meet the income or credit requirements on their own. This form collects information about the co-signer or guarantor, who agrees to take responsibility for the rent if the tenant fails to pay. The form typically requests the co-signer’s personal details, employment and income information, credit history, and references. It’s important to note that co-signers/guarantors should have a good credit score and stable income to qualify.

Roommate Rental Application Form

This form is specifically designed for situations where multiple unrelated individuals will be sharing a rental property. It collects information about each roommate, including personal details, rental history, employment and income information, and references. This form helps landlords evaluate the compatibility and financial stability of each potential roommate to minimize conflicts and ensure a harmonious living arrangement.

Commercial Rental Application Form

A commercial rental application form is used for businesses looking to rent commercial spaces such as offices, retail stores, or warehouses. This form collects information about the business entity, including its legal structure (e.g., sole proprietorship, partnership, corporation), business history, financial statements, and tax returns. Additionally, it may request personal details and credit history of the business owner(s) or principal(s). The purpose of this form is to assess the financial stability of the business and its ability to meet the terms of the commercial lease.

Student Rental Application Form

This type of rental application form caters specifically to students who may not have an extensive rental or credit history. It collects information about the student’s personal details, educational institution, course of study, expected graduation date, and source of income (if applicable). In many cases, a student rental application form will also require a co-signer or guarantor (usually a parent or guardian) to ensure that the rent will be paid.

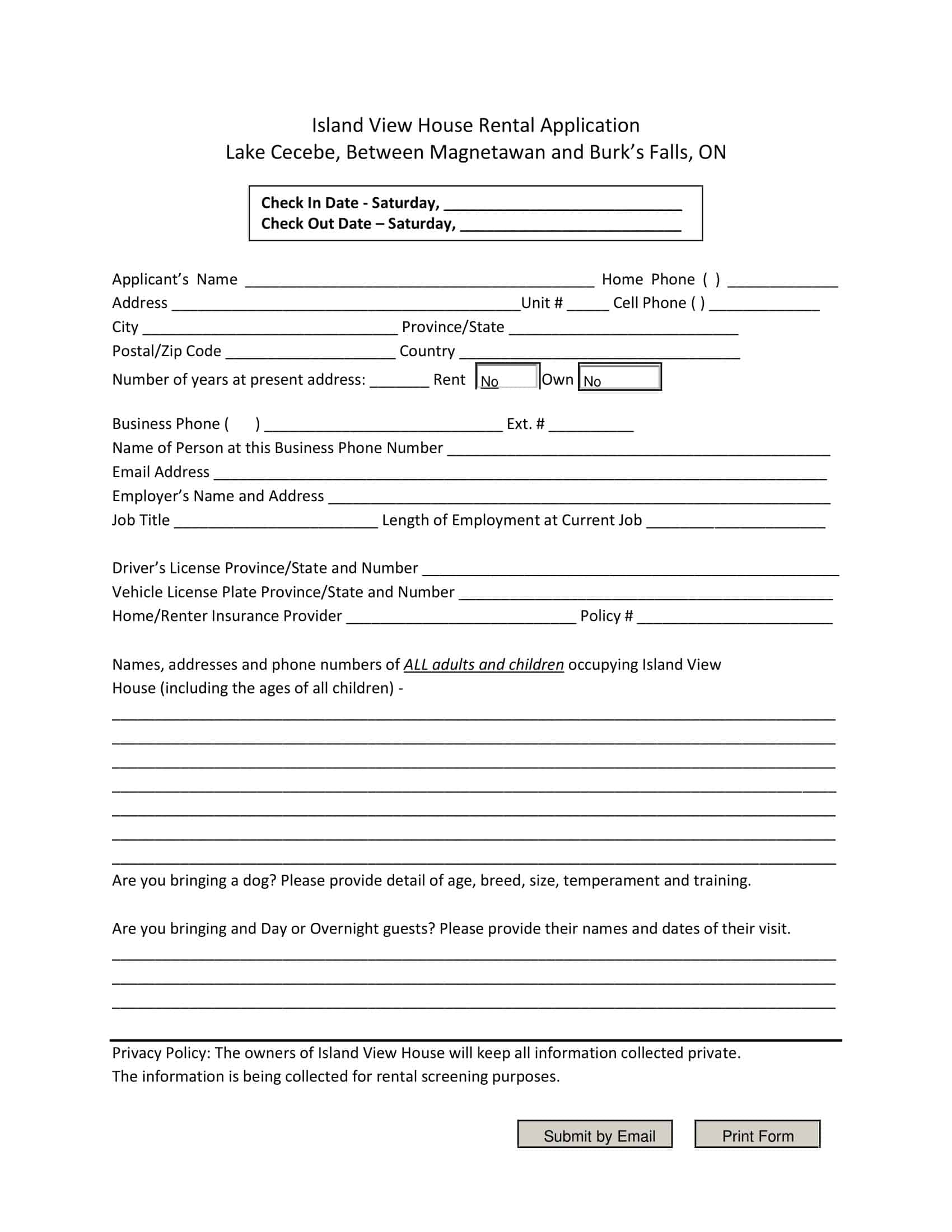

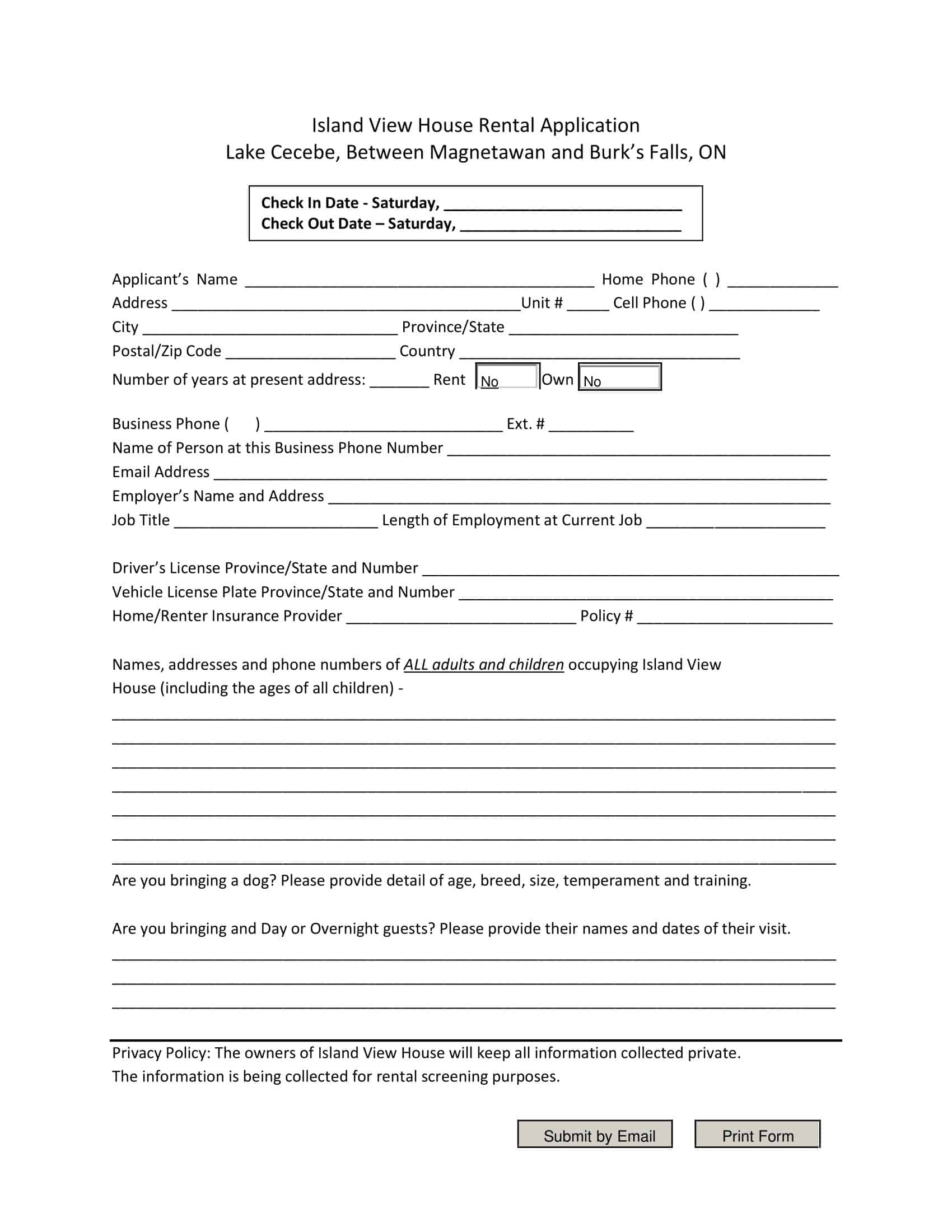

Short-Term or Vacation Rental Application Form

This form is designed for short-term or vacation rentals, such as Airbnb or VRBO properties. It collects information about the prospective renter’s personal details, rental dates, number of occupants, and any special requests or requirements. The primary purpose of this form is to ensure that the renter understands and agrees to the terms of the short-term rental and to confirm the renter’s identity.

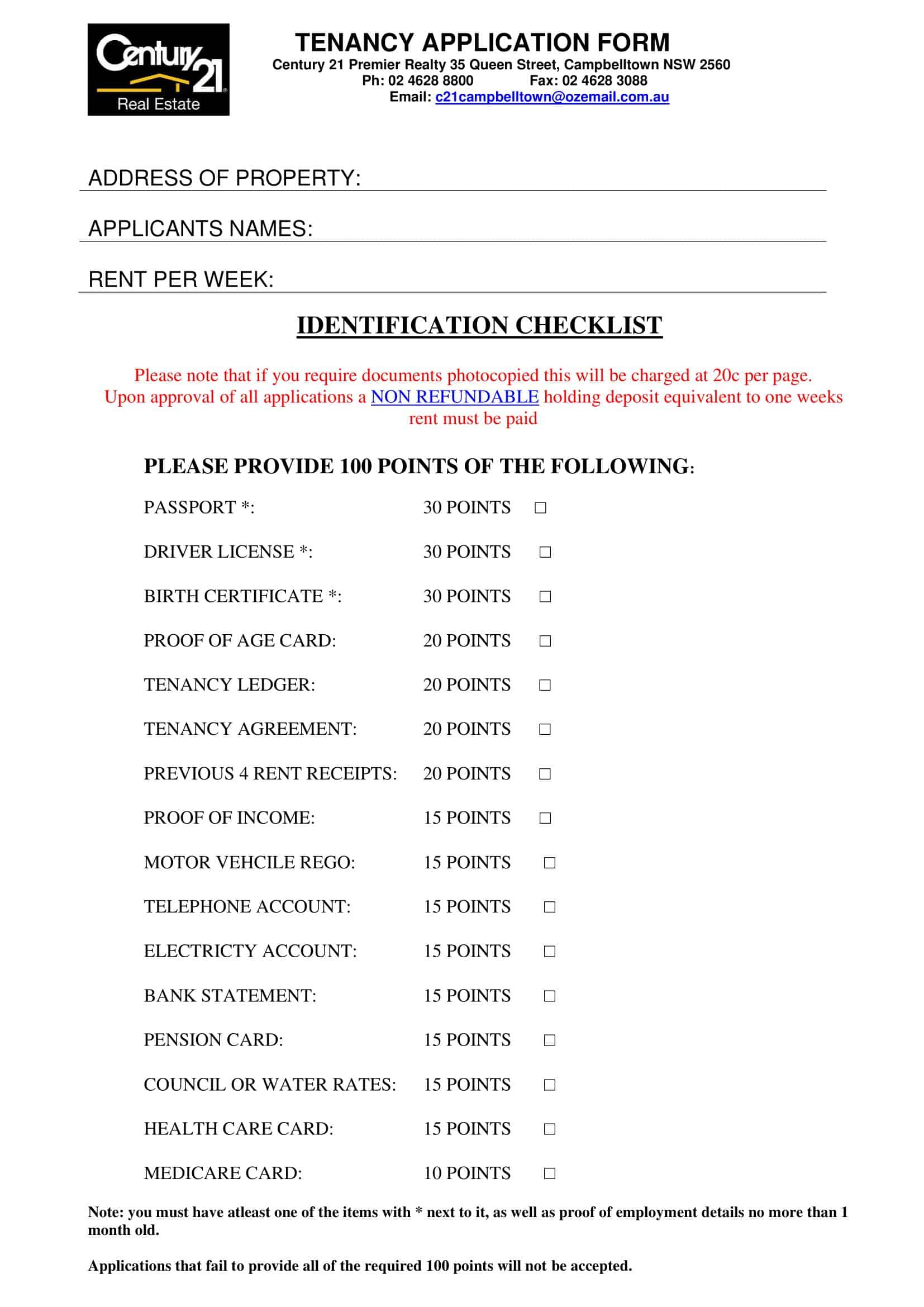

Credit references on a rental application

When preparing a standardized rental application for prospective tenants, it’s crucial to inform them of the need to obtain their credit history and request credit references. These references are particularly important for first-time renters or those with poor credit or past difficulties in meeting rent obligations. In most cases, credit references are a mandatory component of rental applications for all applicants.

Credit references serve as a means for property owners to validate an applicant’s payment track record. Typically, these references are provided by other businesses or previous landlords who can attest to the applicant’s timely payments and creditworthiness. For individuals with a history of challenged credit, these references can be especially valuable. Since credit reports may take over a year to reflect improved payment habits, credit references can significantly contribute to securing a rental for those who have overcome past financial setbacks.

How long does a rental application take?

The rental application procedure can be time-consuming, even when utilizing online forms. Applicants must fill out extensive information on these forms and ensure they are accurate and comprehensive. Typically, the process of completing a rental application takes a minimum of 30 minutes, followed by a waiting period of up to a week for background checks and other documentation to be returned to the landlord for a decision.

It is advisable for prospective tenants to anticipate a waiting period of at least one week after submitting their application before receiving an approval or rejection. The duration may extend beyond a week if complications arise in obtaining the applicant’s credit report or if background checks experience delays. Since most background checks are conducted by external parties, this factor can introduce a significant lag in the rental approval process that is beyond the landlord’s control.

What occurs once the rental application has been completed and submitted?

After filling out a rental application, several steps occur before a potential tenant receives approval or denial. Here is a detailed breakdown of the process:

Submission: Applicants submit their completed rental application, either online or in-person, to the landlord or property management company. It’s essential to ensure that all necessary supporting documents, such as proof of income, identification, and references, are included.

Review: The landlord or property manager reviews the application to ensure it is complete and meets the initial criteria for renting, such as income level and rental history. If any information is missing or unclear, they may contact the applicant for clarification.

Credit Check: The landlord or property manager conducts a credit check to evaluate the applicant’s creditworthiness and financial stability. This step typically involves obtaining a credit report and credit score.

Background Check: A background check is performed to assess the applicant’s rental, criminal, and employment history. This may include verifying references, contacting previous landlords, and checking for any criminal records or eviction history.

Decision: After reviewing all the gathered information, the landlord or property manager makes a decision. They may approve the application, deny it, or request additional information or documentation.

Communication: The applicant is informed of the decision, typically via phone, email, or in-person. If approved, the landlord or property manager will discuss the lease terms, security deposit, move-in date, and any other pertinent details. If denied, they may provide a reason or suggest alternative rental options.

Signing the Lease: If the applicant agrees to the lease terms, both parties sign the lease agreement, and the tenant pays the security deposit and any other required fees.

Move-in: Upon successful completion of all the steps, the tenant can move into the rental property on the agreed-upon date.

Filling Out a Rental Application: A Comprehensive Step-by-Step Guide

Renting a new apartment or house can be an exciting yet daunting experience, particularly for first-time renters. The rental application is a critical step in securing the property you want, so it’s important to understand how to complete it accurately and thoroughly. In this comprehensive guide, we will walk you through the process step by step, ensuring you put your best foot forward in your quest for the perfect rental.

Gather essential documents

Before you start filling out your rental application, gather all the necessary documents that you may need to provide. This typically includes:

Proof of identity (e.g., driver’s license, passport)

Proof of income (e.g., recent pay stubs, bank statements, or tax returns)

Employment verification (e.g., a letter from your employer)

Rental history (e.g., contact information for previous landlords)

Personal references (e.g., friends, colleagues, or family members who can vouch for your character)

A credit report (some landlords may require this, but not all)

Understand the rental application process

Each rental application process may differ depending on the landlord or property management company. Familiarize yourself with their specific requirements to avoid any surprises or delays in your application.

Read the rental application thoroughly

Before you begin filling out the application, read it carefully to understand the information being requested and ensure you have everything you need to proceed. If there are any parts of the application that you are unsure about, contact the landlord or property management company for clarification.

Provide accurate and complete information

When filling out the rental application, it’s essential to provide accurate and complete information. This includes your full legal name, date of birth, social security number, current address, phone number, and email address.

Detail your rental history

List your previous rental addresses for the past 2-3 years, including the landlord’s contact information. Be prepared to provide explanations for any gaps in your rental history, such as periods of time when you were living with family or traveling.

Provide employment and income information

In this section, you’ll need to provide details about your current employment, including the name of your employer, your job title, your monthly income, and the duration of your employment. If you have multiple sources of income, include information for each. Some applications may also require you to provide information about your past employment.

List additional occupants and pets

If you plan on having roommates or family members living with you, include their information on the application as well. If you have pets, provide details about their breed, weight, and any applicable pet deposits or fees required by the landlord.

Provide personal references

Include the names and contact information for at least two personal references who can vouch for your character and responsibility. These references should not be family members and could include friends, coworkers, or mentors.

Consent to a background and credit check

Many rental applications will include a section where you must consent to a background and credit check. Read this section carefully, as it may include important information about your rights as a tenant and how your personal information will be used.

Pay the application fee

Rental applications often come with a non-refundable application fee to cover the cost of processing your application and conducting background checks. Be prepared to pay this fee, which typically ranges from $25 to $50, when submitting your application.

Review and sign the application

Before submitting your rental application, double-check all of the information you provided to ensure it’s accurate and complete. Sign the application to confirm that the information you’ve provided is true and correct.

Submit the rental application

Once you’ve completed and reviewed your rental application, submit it to the landlord or property management company as instructed. This may involve uploading the application and supporting documents through an online portal, emailing them, or delivering hard copies in person. Ensure you follow their specific submission guidelines to avoid delays or miscommunications.

Follow up on your application

After submitting your application, wait for the landlord or property management company to process it. This can take anywhere from a few days to a couple of weeks, depending on their workload and the thoroughness of their background checks. If you haven’t heard back within a reasonable timeframe, follow up with a polite email or phone call to inquire about the status of your application. This demonstrates your continued interest in the property and serves as a reminder for them to expedite the process.

Prepare for a possible interview

In some cases, the landlord or property manager may request an in-person or virtual interview before approving your application. This is an opportunity for them to get to know you better and ask any follow-up questions about your application. Be prepared to discuss your rental history, employment, and personal references. Present yourself professionally and maintain a positive attitude throughout the interview.

Await the decision

Once your application has been reviewed and you’ve completed any additional interviews, you’ll need to wait for the landlord or property manager to make a decision. They may be considering multiple applicants, so it’s important to remain patient during this period.

Respond promptly to an approval or denial

If your rental application is approved, congratulations! Respond promptly to the landlord or property manager to secure the property and discuss the next steps, such as signing the lease, paying the security deposit, and scheduling a move-in date.

If your application is denied, ask for an explanation and take the time to understand the reasons behind the decision. This feedback can help you improve your rental application for future submissions. Remember to stay courteous and professional even in the face of rejection, as you never know when you might encounter the same landlord or property manager in the future.

FAQs

Why do I need to fill out a rental application?

Filling out a rental application is a crucial step in the rental process. It allows the landlord or property manager to evaluate your qualifications as a tenant and determine if you are a good fit for the property. A well-prepared application demonstrates your seriousness about renting the property and increases your chances of being selected as a tenant.

How much does it cost to submit a rental application?

Rental application fees typically range from $25 to $50. These non-refundable fees cover the cost of processing your application and conducting background and credit checks. The cost may vary depending on the landlord or property management company.

Can I be denied a rental application?

Yes, landlords or property managers can deny a rental application for various reasons, such as insufficient income, poor credit history, negative rental history, or failure to meet the property’s specific requirements. If your application is denied, it’s essential to understand the reasons behind the decision and take steps to address them before applying for another rental property.

What if I have a co-signer or guarantor?

If you have a co-signer or guarantor, they will need to complete a separate application form and provide their personal, employment, and financial information. Co-signers and guarantors are responsible for paying the rent if the primary tenant fails to do so. They should have a good credit score and stable income to qualify as a co-signer or guarantor.

How can I increase my chances of approval?

To increase your chances of approval, ensure that your rental application is accurate, complete, and well-prepared. Provide all the necessary documents, double-check your information, and present yourself professionally when communicating with the landlord or property manager. Additionally, maintaining a good rental and credit history and having a stable income will improve your chances of being approved.

Can I submit a rental application without viewing the property?

While it’s possible to submit a rental application without viewing the property, it’s not recommended. It’s essential to inspect the property in person or through a virtual tour to ensure it meets your needs and expectations. By viewing the property, you can also assess the neighborhood and ask the landlord or property manager any questions you may have.

Do I need renter’s insurance?

While renter’s insurance is not always required, it’s highly recommended. Renter’s insurance protects your personal belongings in the event of theft, fire, or other damages. It can also provide liability coverage if someone is injured while on the property. Some landlords may require tenants to obtain renter’s insurance as part of the lease agreement.

Can a landlord or property manager charge a higher application fee for certain applicants?

No, application fees should be consistent for all applicants. Charging higher fees based on race, religion, or other protected characteristics is considered discriminatory and illegal under the Fair Housing Act.

What if I need to break the lease early?

If you need to break the lease early, review the lease agreement to understand the terms and conditions related to early termination. Some leases may include a clause specifying the penalties or fees associated with breaking the lease early. Communicate with your landlord or property manager as soon as possible to discuss your situation and negotiate a mutually agreeable solution.

What happens after my rental application is approved?

Once your rental application is approved, the landlord or property manager will typically contact you to discuss the next steps. These may include:

Signing the lease agreement: Review the lease thoroughly, ask any questions, and make sure you understand the terms and conditions before signing.

Paying the security deposit: This deposit is usually equivalent to one month’s rent and is meant to cover any potential damages or unpaid rent. It’s typically refundable, provided you meet the terms of the lease and leave the property in good condition.

Paying the first month’s rent: You’ll need to pay your first month’s rent upfront, usually before or on the day you move in.

Arranging for utilities: Set up utility accounts (e.g., electricity, gas, water) in your name and ensure they’re connected by the time you move in.

Scheduling a move-in date: Coordinate with the landlord or property manager to determine a suitable move-in date and arrange for the keys to be handed over.

After completing these steps, you can move into your new rental property and enjoy your new home. Remember to be a responsible tenant by paying rent on time, maintaining the property, and adhering to the terms of your lease agreement.

What if I have a poor credit history or no credit history at all?

If you have a poor credit history or no credit history, it may be more challenging to secure a rental property. However, there are steps you can take to improve your chances of approval:

Provide a co-signer or guarantor with good credit who agrees to take responsibility for the rent if you fail to pay.

Offer a larger security deposit to demonstrate your commitment and financial responsibility.

Provide proof of steady employment and income to show your ability to pay rent.

Submit personal references who can vouch for your character and financial responsibility.

Can a landlord or property manager discriminate against me based on race, religion, or other protected characteristics?

No, it’s illegal for a landlord or property manager to discriminate against potential tenants based on race, color, national origin, religion, sex, familial status, or disability under the Fair Housing Act. If you believe you have been discriminated against, you can file a complaint with the U.S. Department of Housing and Urban Development (HUD) or consult with an attorney specializing in housing discrimination.

Can a landlord or property manager ask about my criminal history?

Yes, landlords and property managers can ask about your criminal history as part of the background check process. However, they must treat all applicants consistently and fairly. They should consider factors such as the nature and severity of the crime, the time that has passed since the conviction, and any evidence of rehabilitation when evaluating your application.

How can I make my rental application stand out from others?

To make your rental application stand out, consider the following tips:

Submit a well-organized, complete, and accurate application with all the required documents.

Write a cover letter introducing yourself and explaining why you’re interested in the property.

Highlight your strengths as a tenant, such as a stable income, good rental history, and responsible character.

Be responsive and professional in your communication with the landlord or property manager.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)