If you are in the process of starting a new business, expanding an existing one, or relocating to a new commercial property, you will need to fill out a commercial lease application. This application is a crucial step in the process of leasing a commercial space and can seem overwhelming due to the amount of information required by the landlord.

Landlords typically ask for a lot of information from potential tenants to ensure that their businesses are financially secure and able to make the rent payment each month. While the application process may be time-consuming and extensive, it is important to provide the necessary information to increase your chances of securing the commercial space you desire.

Table of Contents

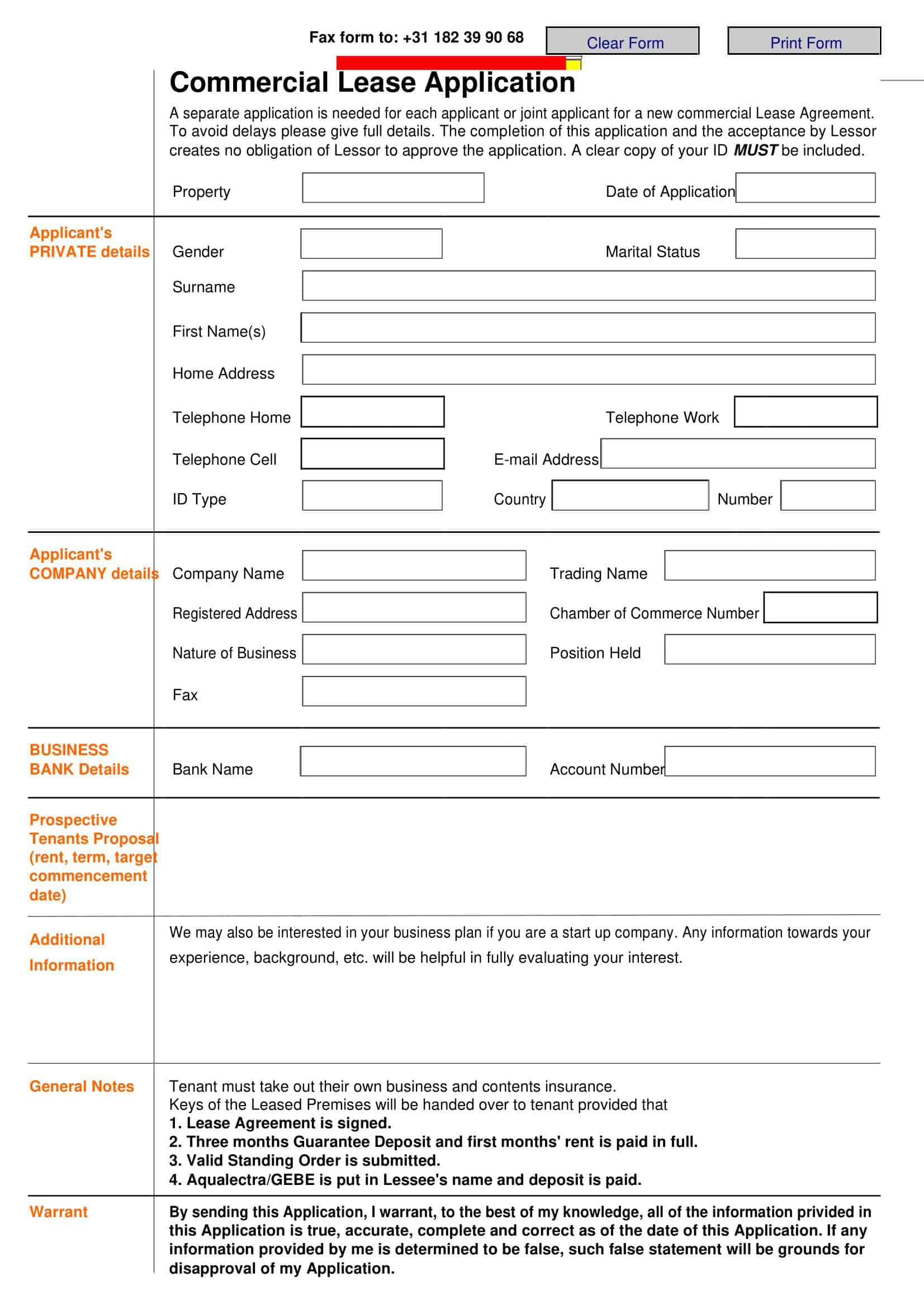

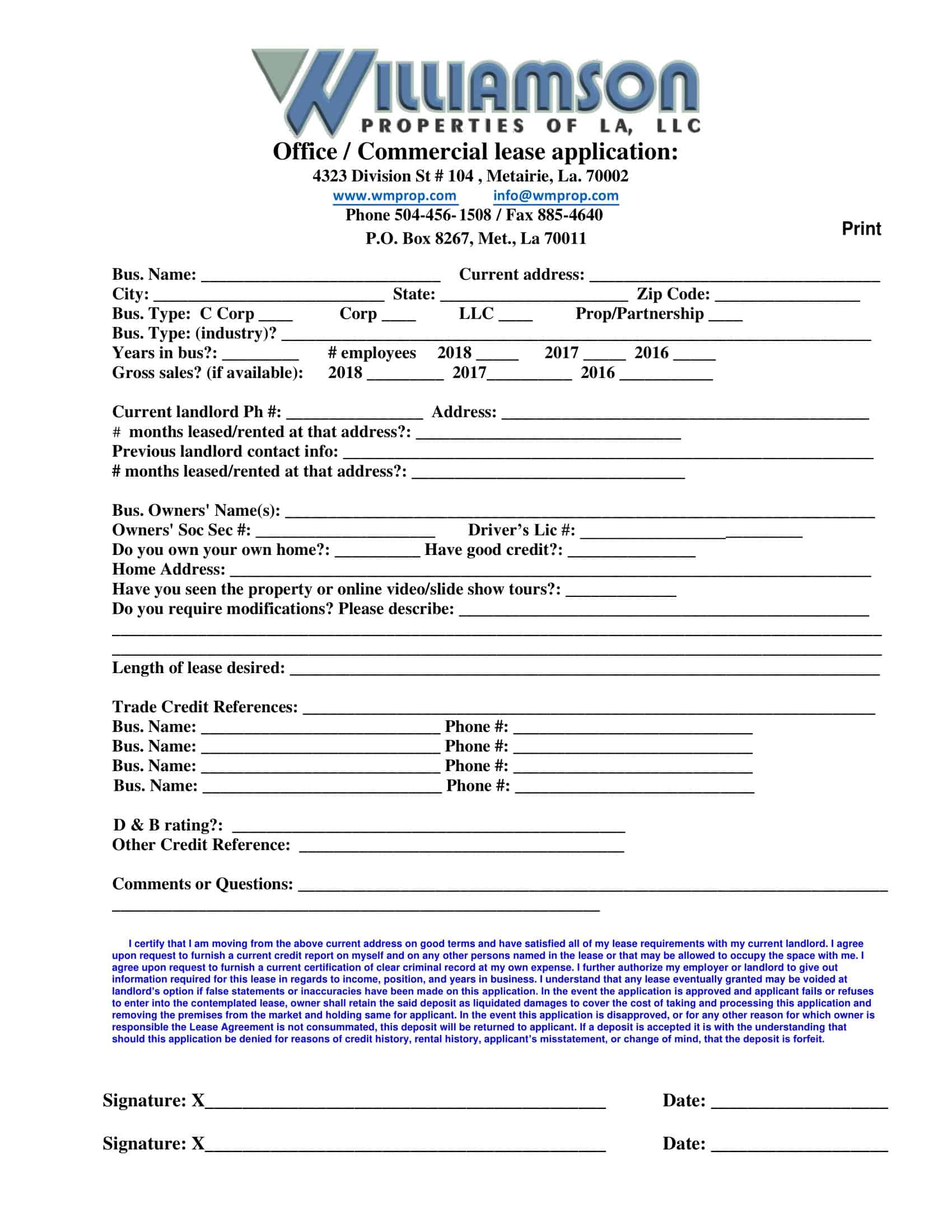

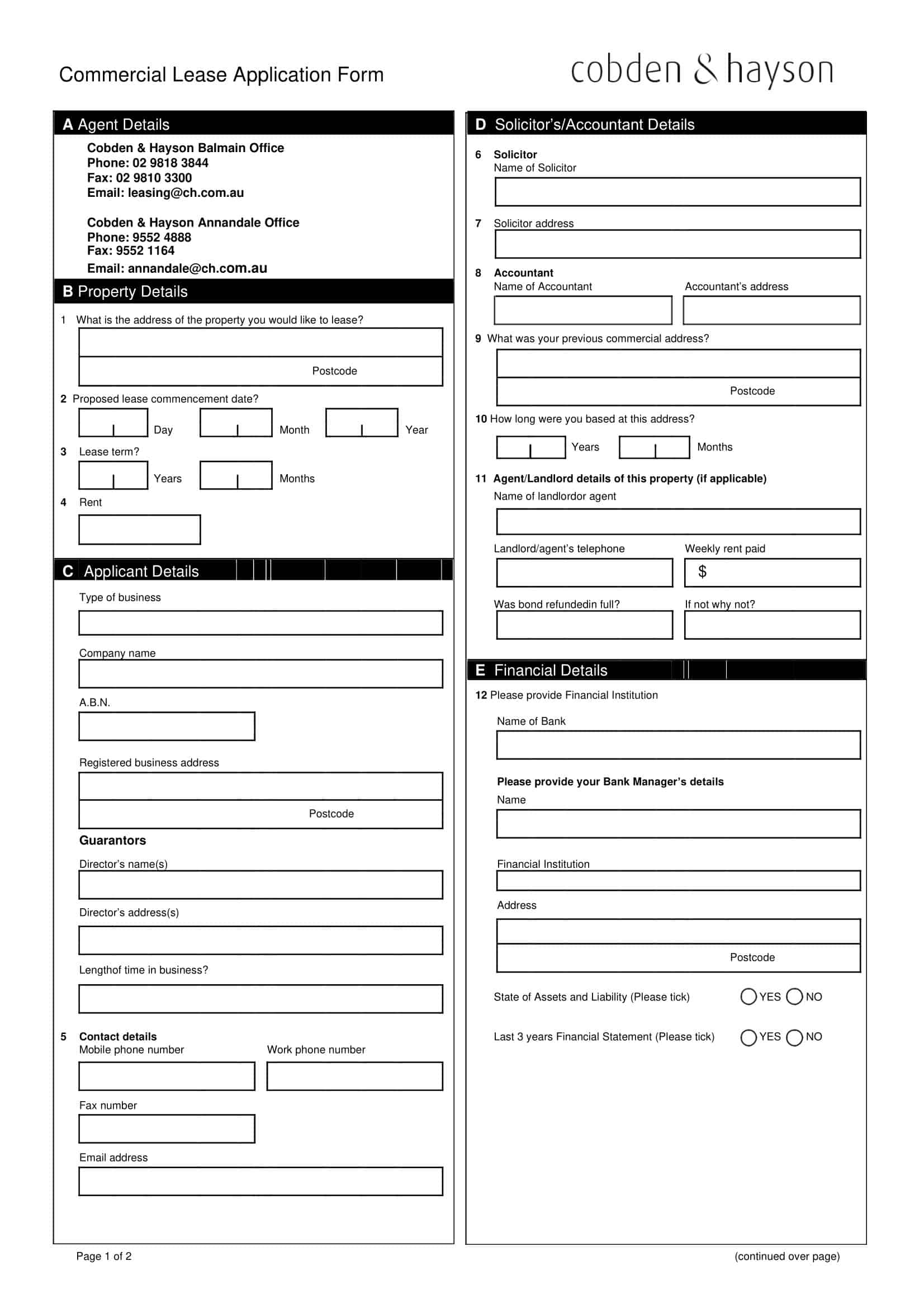

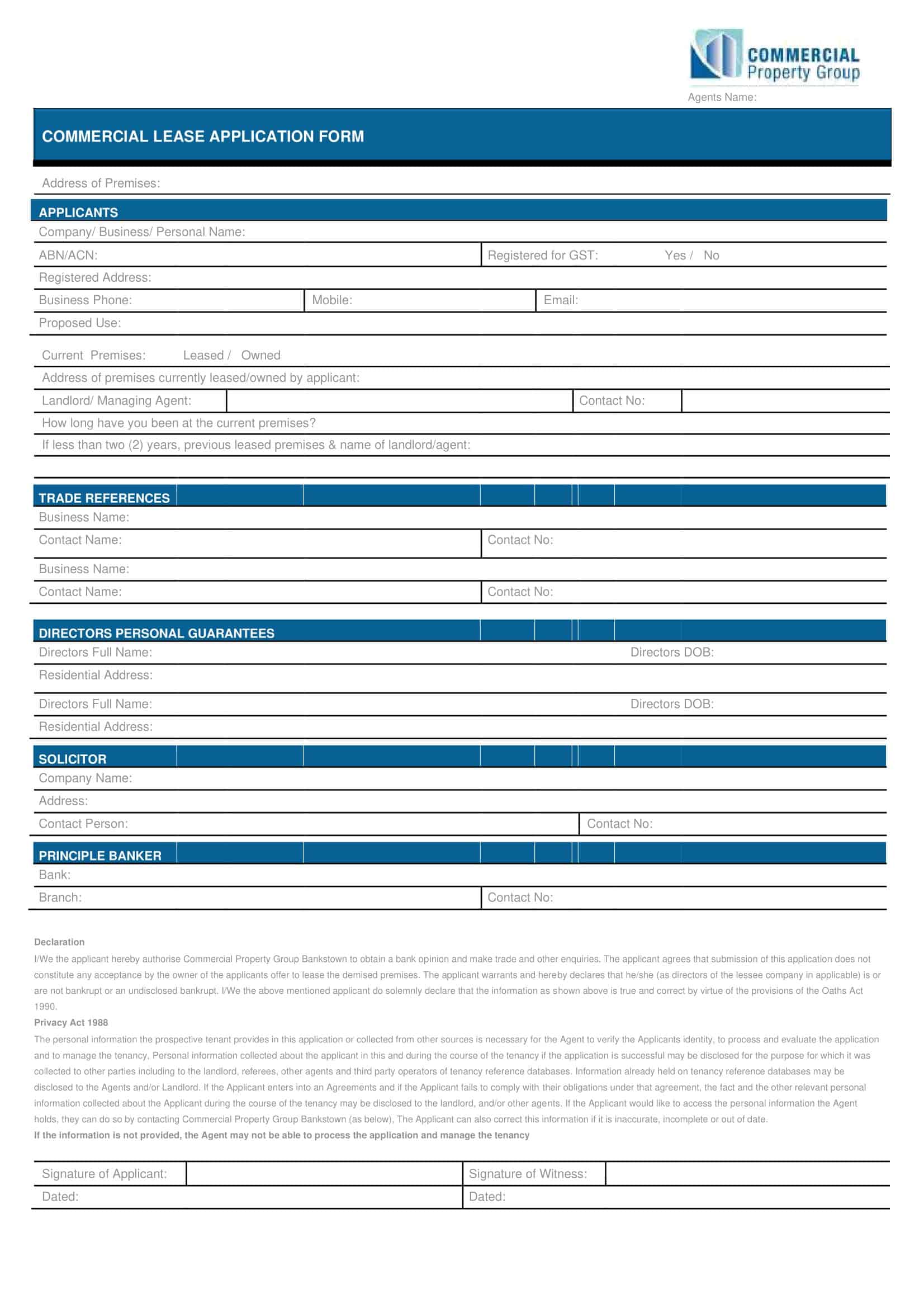

Commercial Lease Application Templates

Commercial lease agreement templates are pre-designed documents that provide a structured format for creating legally binding contracts between landlords and tenants for the rental of commercial properties. These templates offer a convenient and professional way to outline the terms and conditions of the lease, ensuring clarity and protection for both parties involved.

Commercial lease agreement templates typically include sections that address important aspects such as lease duration, rental payments, security deposits, maintenance responsibilities, permitted use of the premises, renewal options, and any additional provisions or restrictions specific to the commercial property. They may also incorporate sections for documenting tenant information, property details, and any agreed-upon modifications or improvements.

Using a commercial lease agreement template helps landlords and tenants establish a comprehensive understanding of their rights and obligations regarding the commercial property. The template provides a structured format that simplifies the process of creating the lease and ensures that all necessary details are properly documented and communicated.

What is a Commercial Lease Application?

A commercial lease application is a document that a landlord or property owner requires potential tenants to complete as part of the process of leasing a commercial property. The application is designed to help the landlord or property owner determine if the potential tenant is a suitable fit for the commercial space and has the financial ability to meet the rental obligations.

The application typically asks for detailed information about the business, such as its legal name, business type, contact information, and financial statements. The landlord may also request personal information about the business owner, such as their social security number and credit history. Once the application is complete, the landlord will review it along with other information, such as references and background checks, to decide whether to approve the tenant for the commercial space.

Importance of Commercial Lease Application

A commercial lease application is important for both the landlord and the tenant as it helps to ensure a smooth and successful leasing process. Here are some reasons why a commercial lease application is important:

Helps Landlords Assess Suitability: The commercial lease application provides the landlord with important information about the tenant’s business, including financial statements and references, that help them assess the tenant’s suitability for the commercial space. This information helps landlords to select tenants who are likely to be successful and pay rent on time.

Protects Both Parties: A commercial lease application typically includes terms and conditions that protect both the landlord and tenant. For example, the application may include clauses related to rent payments, security deposits, insurance requirements, maintenance responsibilities, and other important details of the lease agreement.

Reduces Misunderstandings: The commercial lease application sets clear expectations for both the landlord and tenant, which helps reduce misunderstandings and disagreements during the leasing process. Having clear expectations up front can also help avoid legal disputes down the line.

Streamlines the Leasing Process: The commercial lease application can help streamline the leasing process by providing the landlord with all the necessary information they need to evaluate the tenant’s suitability. This can help save time and ensure a more efficient process for both parties.

Who needs a Commercial Lease Application?

A commercial lease application is typically required by landlords or property owners who are leasing a commercial space to potential tenants. This may include landlords who own office buildings, retail spaces, industrial warehouses, or other types of commercial properties. Landlords use the information provided in the application to determine if a potential tenant is a suitable fit for the commercial space and has the financial ability to meet the rental obligations.

Therefore, if you are a business owner looking to lease a commercial space, you will likely need to complete a commercial lease application as part of the leasing process. This is true whether you are starting a new business, expanding an existing one, or relocating to a new commercial space.

What can a landlord ask on a rental application?

A landlord can ask a variety of questions on a rental application in order to assess the tenant’s suitability and ability to pay rent. While specific questions can vary depending on the landlord and the rental property, some common questions include:

Personal Information: Full name, current address, phone number, email address, and social security number.

Employment Information: Current and past employment information, including job titles, employers, length of employment, and income.

Rental History: Current and past rental information, including the name and contact information of previous landlords, rent payment history, and reasons for leaving.

References: Personal and professional references, including their contact information.

Credit and Background Information: Consent to run a credit check, criminal background check, and eviction history.

Pets and Occupants: Information about any pets the tenant has and who will be living in the rental unit.

Other Information: Any other information the landlord feels is necessary to evaluate the tenant’s suitability, such as current debts, smoking habits, or preferred move-in date.

Types Of Commercial Lease Agreements

There are several types of commercial lease agreements, each with different terms and conditions. Here are some common types of commercial lease agreements:

Gross Lease: In a gross lease, the tenant pays a fixed monthly rent that includes all operating expenses, such as property taxes, insurance, and maintenance. This type of lease is often used for office spaces, retail spaces, and small commercial properties.

Net Lease: In a net lease, the tenant pays a lower base rent, and in addition, they are responsible for a portion of the operating expenses such as property taxes, insurance, maintenance and utilities.

There are three types of net leases: single net lease (where the tenant pays property tax in addition to the base rent), double net lease (where the tenant pays property tax and insurance in addition to the base rent), and triple net lease (where the tenant pays all property-related costs in addition to the base rent).

Percentage Lease: In a percentage lease, the tenant pays a base rent plus a percentage of their sales revenue. This type of lease is often used for retail spaces, such as shopping malls or strip malls.

Modified Gross Lease: In a modified gross lease, the tenant and landlord share operating expenses, but the details of who pays what can be negotiated. It is often used for larger commercial properties, where the expenses are higher.

Ground Lease: In a ground lease, the tenant leases the land from the property owner and is responsible for constructing any buildings on the land. The tenant usually pays rent for the land, but not for the buildings.

Build-to-Suit Lease: In a build-to-suit lease, the landlord builds a custom property to the tenant’s specifications, and the tenant agrees to lease the property for a specified period. This type of lease is often used for large commercial properties, such as office buildings or industrial facilities.

Short-term Lease: A short-term lease typically lasts for less than one year and is often used for pop-up shops, seasonal businesses, or businesses that are just starting out.

Long-term Lease: A long-term lease usually lasts for several years and is often used for established businesses or businesses that require a longer commitment, such as manufacturing or distribution facilities.

Renewal Option Lease: A renewal option lease allows the tenant to extend the lease for an additional term, usually with the same terms and conditions. This type of lease can provide stability for a business that plans to operate in the same location for an extended period.

Sublease: A sublease is a lease agreement between a tenant and a third party, where the original tenant leases all or part of the space to the subtenant. The original tenant remains responsible for the lease payments and may be liable if the subtenant violates the terms of the lease.

Assignment Lease: An assignment lease is a lease agreement that allows the original tenant to transfer their rights and obligations to another party. The new tenant takes over the lease and becomes responsible for all rent and other obligations.

Co-Tenancy Lease: A co-tenancy lease is a lease agreement that allows multiple tenants to share a space. This type of lease is often used in shopping malls or office buildings, where multiple businesses occupy the same space.

Essential Information in a Commercial Lease Application Form

A commercial lease application form typically collects information about the prospective tenant and their business. Here is some information that may be included on a commercial lease application form:

Business Information: This includes the name of the business, type of business, business address, and contact information.

Business History: This includes the length of time the business has been in operation, number of employees, and business structure (e.g., LLC, corporation, partnership).

Financial Information: This includes the annual revenue, net profit, and credit history of the business. The landlord may also request bank statements, tax returns, and financial statements.

Personal Information: This includes the name, address, and contact information of the person responsible for the lease, such as the business owner or manager.

Landlord References: The application may ask for contact information for previous landlords, so the landlord can verify the applicant’s rental history.

Guarantor Information: If the business is new or has poor credit, the landlord may require a personal guarantor to co-sign the lease. The application may request the guarantor’s personal and financial information.

Other Information: The application may include additional questions, such as the reason for moving, the desired lease term, and the desired move-in date.

The information collected on a commercial lease application form is used by the landlord to evaluate the prospective tenant’s ability to pay rent and abide by the terms of the lease. The landlord may use the information to conduct a background check, verify references, and assess the financial stability of the business. It is important to fill out the application form completely and accurately to increase the chances of being approved for the lease.

FAQs

How long does it take for a commercial lease application to be approved?

The timeline for approval can vary depending on the landlord and the complexity of the application. In some cases, approval may be granted within a few days, while in other cases it may take several weeks.

Can a landlord reject my commercial lease application?

Yes, a landlord can reject a commercial lease application for a variety of reasons, such as the tenant having a poor credit history or not having enough income to meet the rent payments. However, landlords must comply with fair housing laws and cannot reject an applicant based on certain protected characteristics, such as race or religion.

Can I negotiate the terms of a commercial lease?

Yes, you can negotiate the terms of a commercial lease, including the rent, lease term, and other provisions. It is often a good idea to have a commercial real estate attorney review the lease and help with the negotiation process.

What should I do before signing a commercial lease?

Before signing a commercial lease, you should carefully review the lease terms and make sure you understand all the provisions. You may also want to have an attorney review the lease to ensure that it is fair and reasonable. Additionally, it’s a good idea to visit the property and make sure it meets your business’s needs.

What are some common mistakes to avoid when filling out a commercial lease application?

Some common mistakes to avoid when filling out a commercial lease application include providing inaccurate or incomplete information, not disclosing all required information, and failing to provide supporting documentation. It’s important to carefully review the application and provide all the information and documentation that is requested.

Are there any costs associated with submitting a commercial lease application?

It is common for landlords to charge an application fee to cover the costs of processing the application, such as running credit and background checks. The fee may vary depending on the landlord and the size and complexity of the application.

What happens after a commercial lease application is approved?

After a commercial lease application is approved, the landlord will typically present the tenant with a lease agreement for review and signature. Once the lease is signed, the tenant will typically need to pay a security deposit and any first month’s rent before moving in.

What should I do if my commercial lease application is rejected?

If your commercial lease application is rejected, it’s important to understand the reasons why and try to address any issues that may have contributed to the rejection. You may also want to consider applying to other properties or working with a commercial real estate agent to find other options that may be a better fit for your business.

What are some important provisions to look for in a commercial lease agreement?

Some important provisions to look for in a commercial lease agreement include the lease term, rent amount and payment terms, renewal options, maintenance and repair responsibilities, and any restrictions on how the property can be used. It’s important to carefully review all the provisions and make sure you understand what is expected of you as a tenant.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Lease Addendum Templates [PDF, Word] 2 Lease Addendum](https://www.typecalendar.com/wp-content/uploads/2023/04/Lease-Addendum-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)