In business, there are times when customers need to request from the bank to assure that they will fulfill commitments made to suppliers. They can make this request through a letter of guarantee. You can use this letter in equipment leasing contracts and when dealing with large companies with the assets required by another party interested in a specific type of contract.

Table of Contents

What is a letter of guarantee?

A letter of guarantee is a written assurance that a person, entity, or organization will fulfill the obligations of a contract they have entered into with another person, entity, or organization. A bank can use this letter of guarantee to assure a customer that when buying the goods from the supplier, you will be able to deliver them.

A letter of guarantee is a document that gives a “guarantee” on its face. It is generally used in tenders and projects. However, it is widely used in terms of customer limits in the purchase and sale of goods. The person who will buy goods or services gives a certain amount of letter of guarantee to the seller and opens a limit for himself before the company. Thus, he can easily make his purchases and sales in line with this limit.

The letter of guarantee consists of a text. In the text, it is stated that the work done is guaranteed as much as the amount written in that letter. The format of the text is usually determined by the given institutions. But there are some situations that do not change and must be present.

One of them is the word that indicates that if the guarantee is for a period of time if it is not valid, it is indefinite. At the same time, the issuance date, the amount guaranteed, the bank, the institution to be given, and the necessary signatures are the factors that should be in a letter of guarantee. The remaining parts can be determined by the institution to which the letter of guarantee will be given.

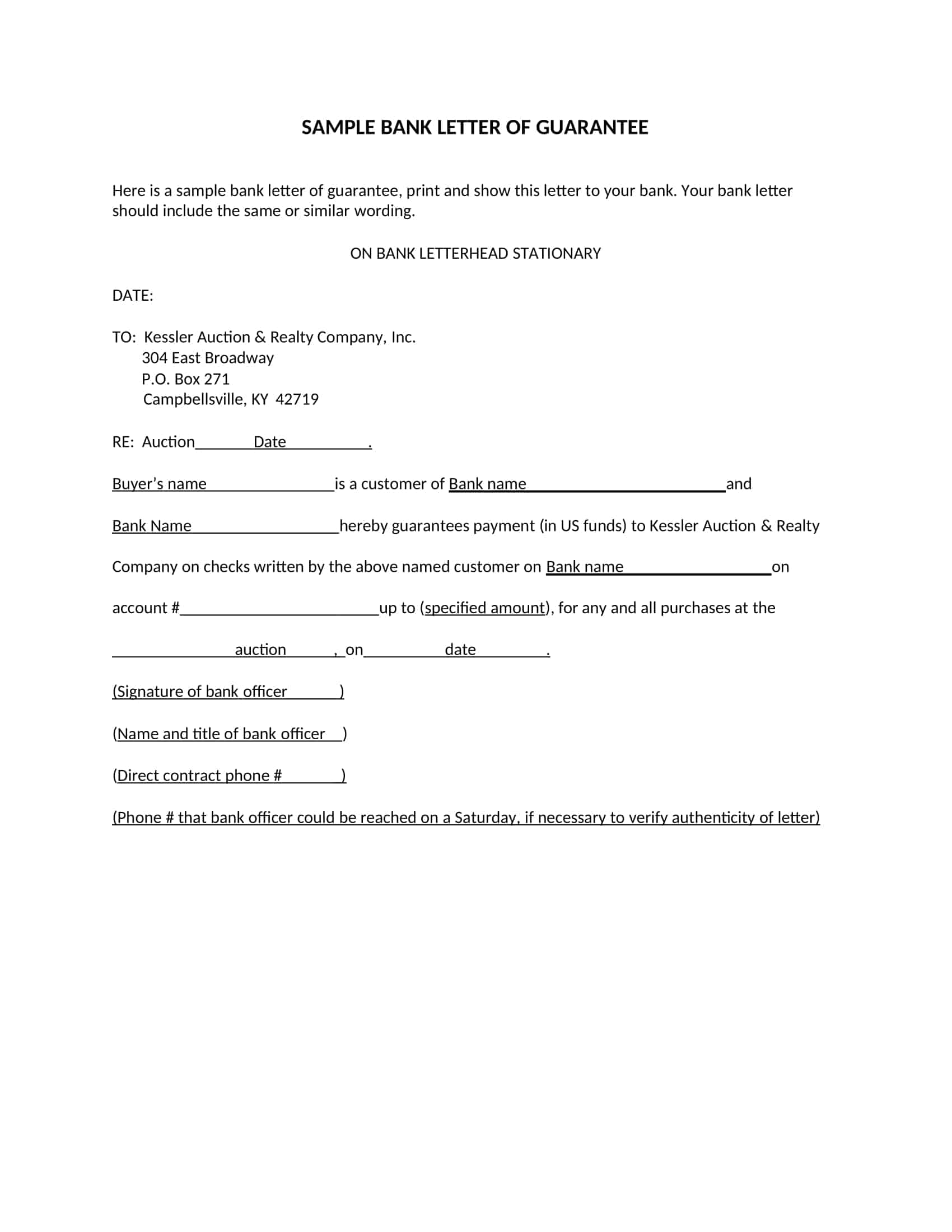

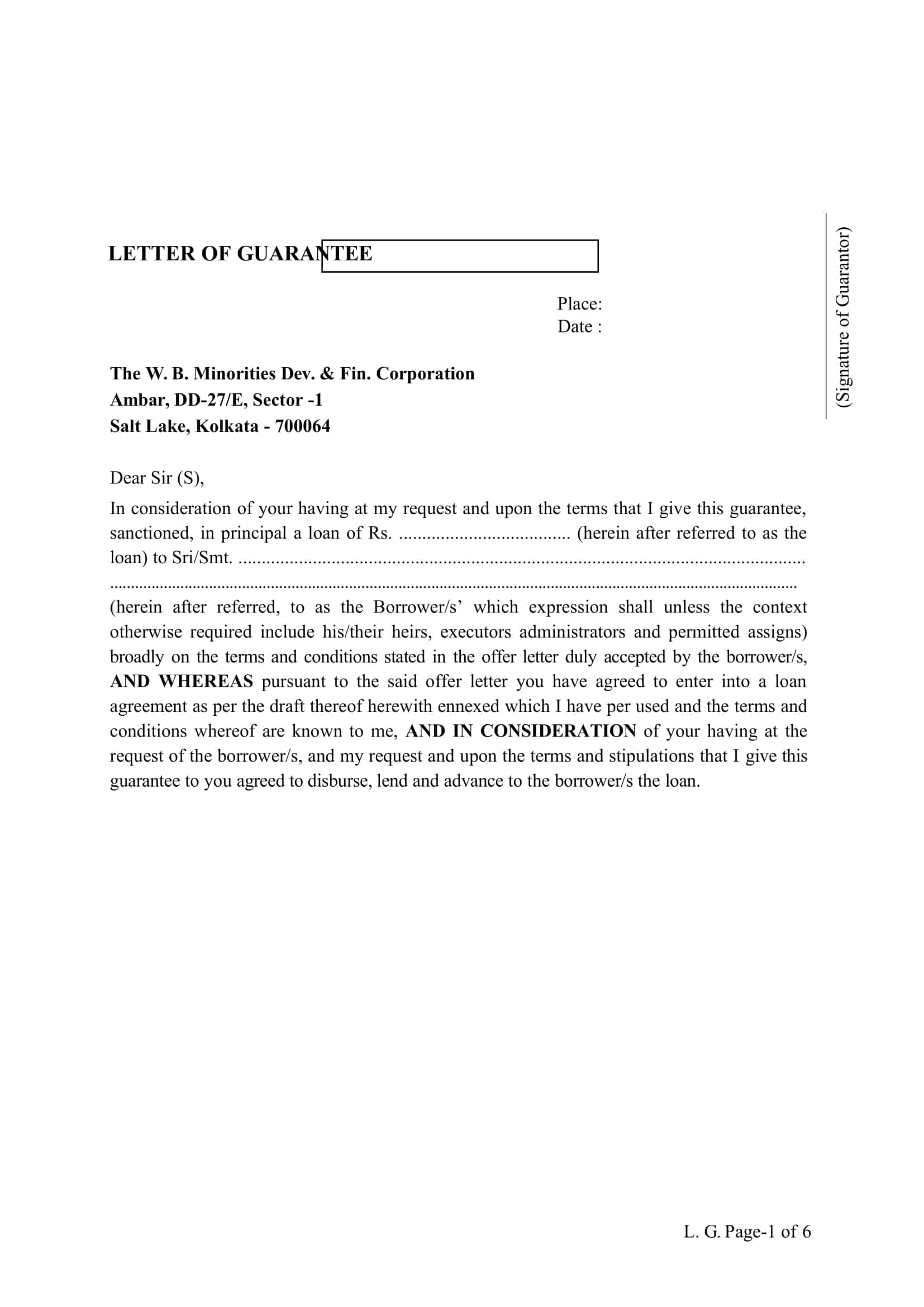

Letter Of Guarantee Templates

Ensure peace of mind and secure your business transactions with our comprehensive collection of Letter of Guarantee Templates. These templates provide a standardized format for creating legally binding guarantees between parties, offering financial protection and assurance for various business arrangements. Whether you’re entering into a contract, applying for a loan, or engaging in international trade, our templates offer customizable sections to specify the terms and conditions, obligations, and liabilities of the guarantor.

With clear language and professional formatting, these templates enable you to easily draft and customize letters of guarantee tailored to your specific needs. By using our pre-designed templates, you can save time, ensure accuracy, and establish trust and confidence with your business partners. Don’t leave important agreements to chance – utilize our Letter of Guarantee Templates to protect your interests and foster strong business relationships.

How does a letter of guarantee work?

To use a letter of guarantee, you must apply to the bank. In your application, you specify how much of a letter you need and send the desired text format. Necessary examinations are made by the bank on your behalf, and if your limits are available at the bank, the letter of guarantee template is prepared as desired. In this way, you will be responsible to the bank for the amount written on the letter of guarantee you have.

The bank, on the other hand, will be responsible to the institution to which you will give this letter. You forward the letter you receive to the institution, and you gain authorization to take specific actions in the institution. In other words, your guarantee is as much as the amount you offer; You may be subject to transactions such as service or trade.

When we think in terms of the institution to which the letter of guarantee is given, we can say that the company guarantees itself. The person to whom the letter is received can buy and sell goods as they wish in return for the specified amount. But one thing to pay attention to here is the duration of the letter. If there will be a sale of goods, it is important that the maturity is less than this period so that when the letter of guarantee expires, you will have to take your debt for the goods by your own methods.

You don’t have any guarantee. If you have a sale of goods that are not paid in due time, you can have the letter reimbursed. So, you can get your debt back by applying to the bank. But if the letter of guarantee has expired, it is useless; it is straight garbage. No rights can be claimed. Therefore, the person holding the letter of guarantee should be careful in such cases.

How to Get a Letter of Guarantee?

Persons or institutions that need a letter of guarantee; can request a letter of guarantee by applying to the bank of which they are customers.

Parties to the Letter of Guarantee

There are three main parties in the letters of guarantee.

Guarantor: The Bank that issued the letter.

Beneficiary: The person whose debt is guaranteed by the bank, that is, the debtor.

Addressee: The creditor or the transaction is the flat, institution, or other real and legal persons.

Types of Letters of Guarantee

- Tender Guarantee

- Performance Guarantee

- Advance Payment Guarantee

- Retention Money Guarantee

- Warranty

- Payment Guarantee

- Standby Letter Of Credit (Sblc)

Conclusion

Letters of guarantee may be issued in a range of different forms, serve different types of purposes and cover very other subject matters. They are also required by many different kinds of parties and can be classified according to their applicability and issue date. Despite these differences, however, letters of guarantee share one defining feature: they all come with an expiration period. An expiry period is a specific time limit after which a particular type of letter becomes invalidly issued as per the provisions written within it.

FAQs

How do you write a letter to guarantee?

When writing a letter of guarantee, formally establish yourself or company as the guarantor willing to cover the debts or obligations of the other party. Specify the exact obligations you are guaranteeing, terms like loan amounts and payment schedules, and durations. Have it signed and witnessed.

How do you write a simple guarantor letter?

A simple guarantor letter states: your relationship and intent to guarantee the applicant’s rental payment obligations, your qualifications and income demonstrating ability to cover costs if they default, statement accepting legal responsibilities as guarantor, dated signature with contact information verified.

How do you write a guarantee agreement?

A guarantee agreement letter clearly details 1) Parties involved 2) The recipient’s key obligations 3) Exactly what the guarantor promises to cover – sums, payments etc 4) Duration/Expiry 5) How to revoke 6) Signatures with witnesses to make it legally enforceable.

What is an example of a financial guarantee letter?

For example: “This letter formally guarantees Company XYZ’s financial loan obligations owed to Lender ABC up to the principal amount of $500,000 in the event Company XYZ fails repayments.”

Who writes a guarantee letter?

A guarantor with strong financial standing writes the guarantee, promising to assume debts/obligations if the other party who is the primary obligor fails to repay or defaults on critical responsibilities. Both parties sign.

What is the difference between a letter of support and a letter of guarantee?

A support letter endorses someone’s character or capabilities, while a guarantee letter legally binds the guarantor to pay on someone’s debts/loans and make good on their financial obligations if that person fails to do so themselves.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 2 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 3 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)