The Articles of Incorporation is a legal document that is filed with a state government in order to establish a corporation. It outlines the basic structure of the company, including its name, purpose, and the number of shares of stock it is authorized to issue. The articles also detail the responsibilities of the corporation’s directors, officers, and shareholders.

The information provided in the Articles of Incorporation serves as the foundation for the corporation’s bylaws and helps determine the legal and financial structure of the company. Filing the Articles of Incorporation is a crucial step in the process of starting a corporation and helps ensure that the business is properly organized and in compliance with state laws.

Table of Contents

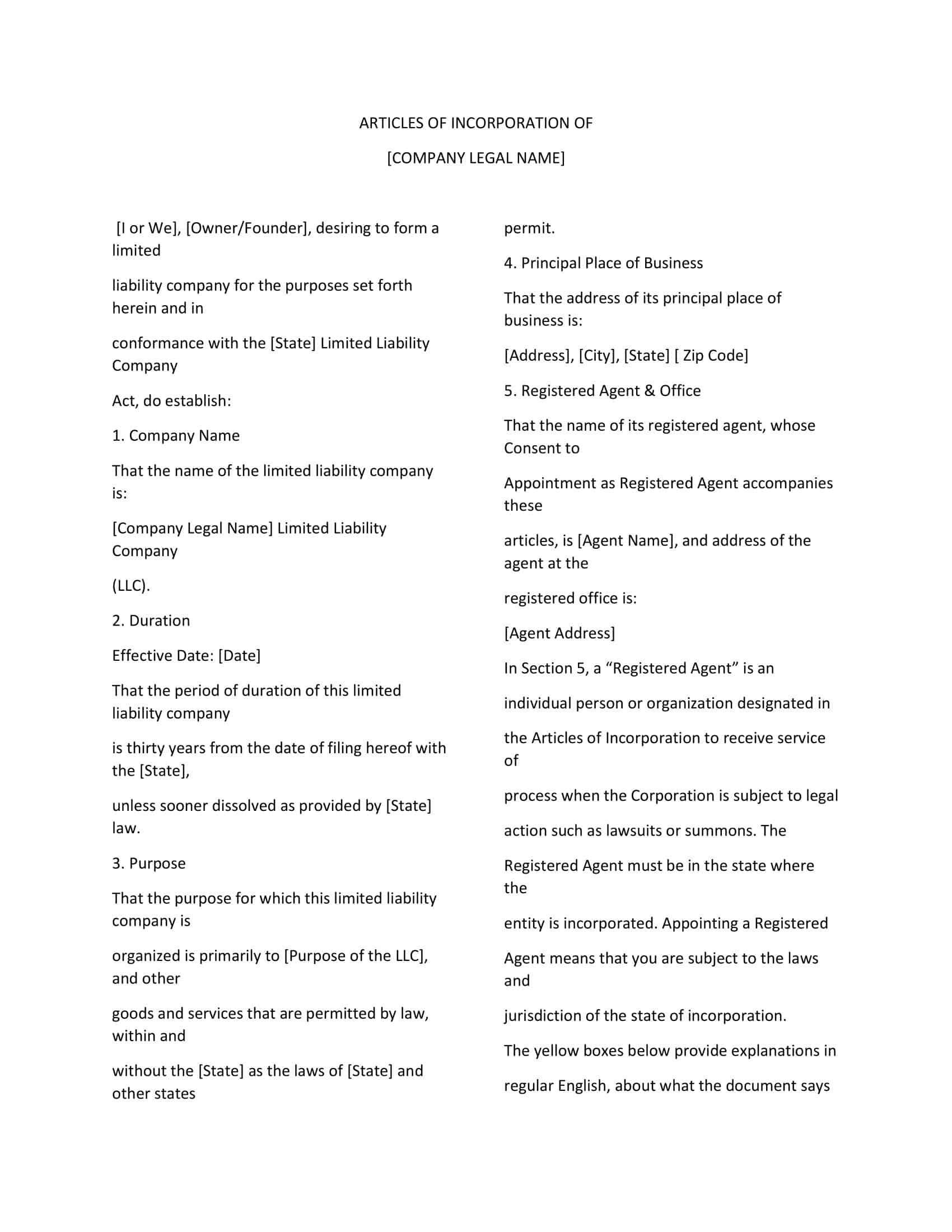

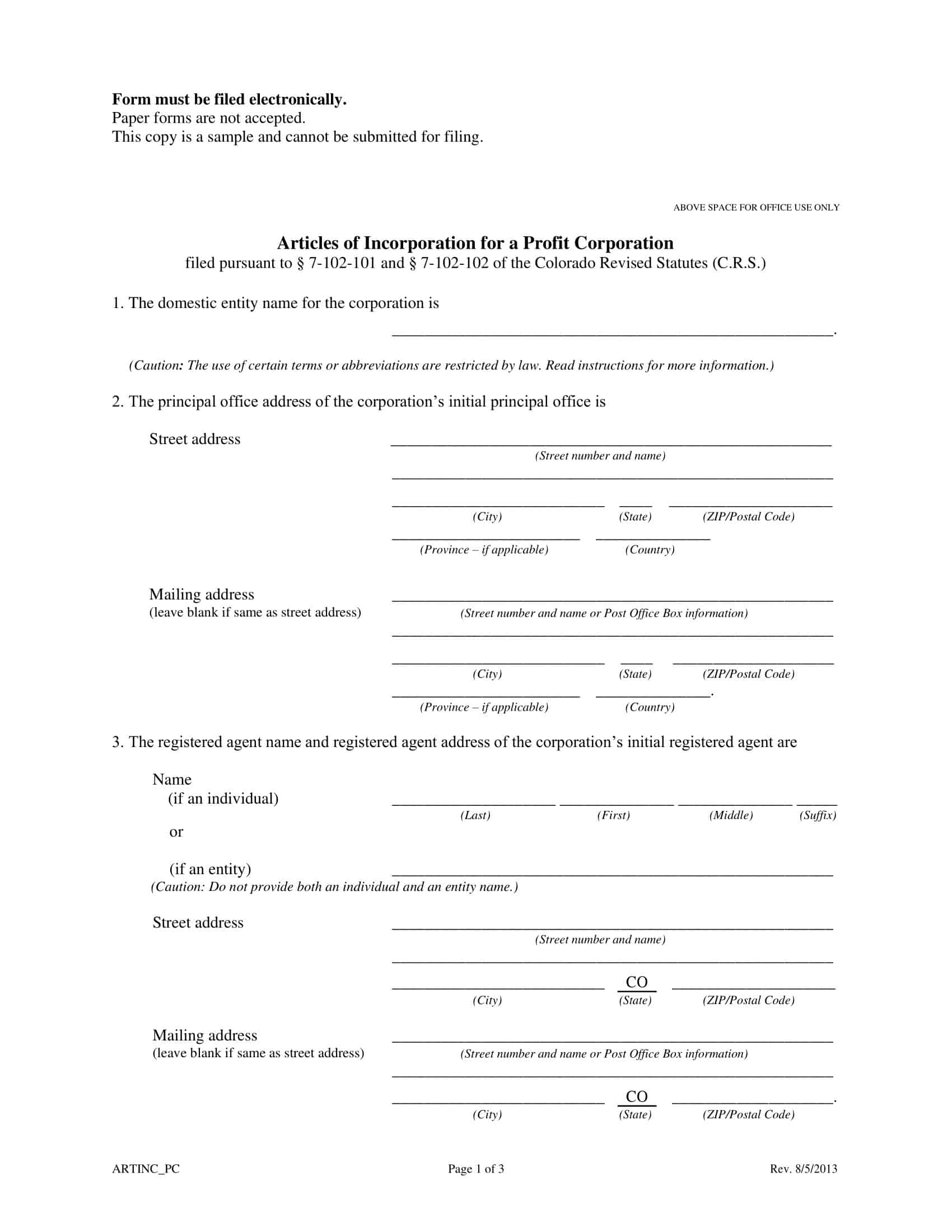

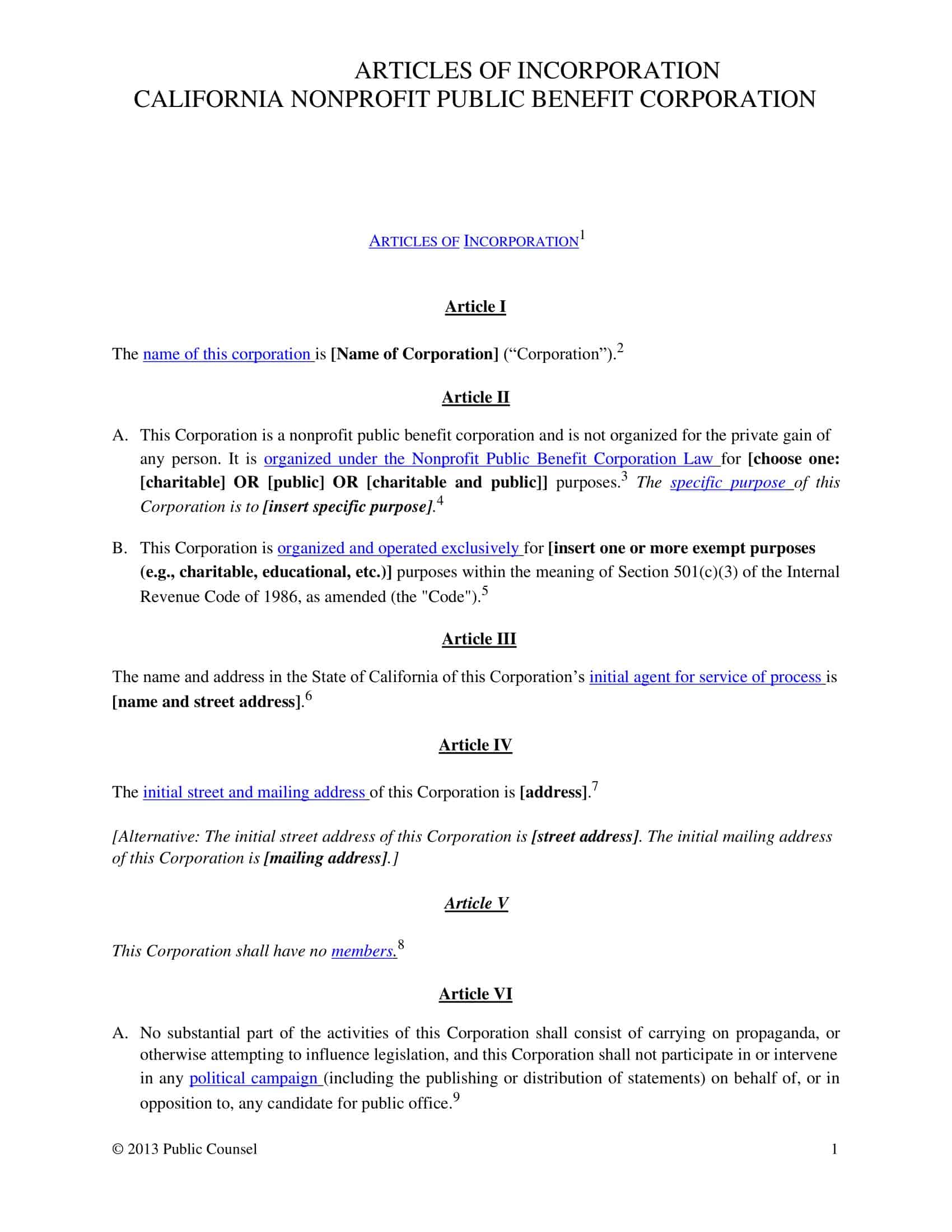

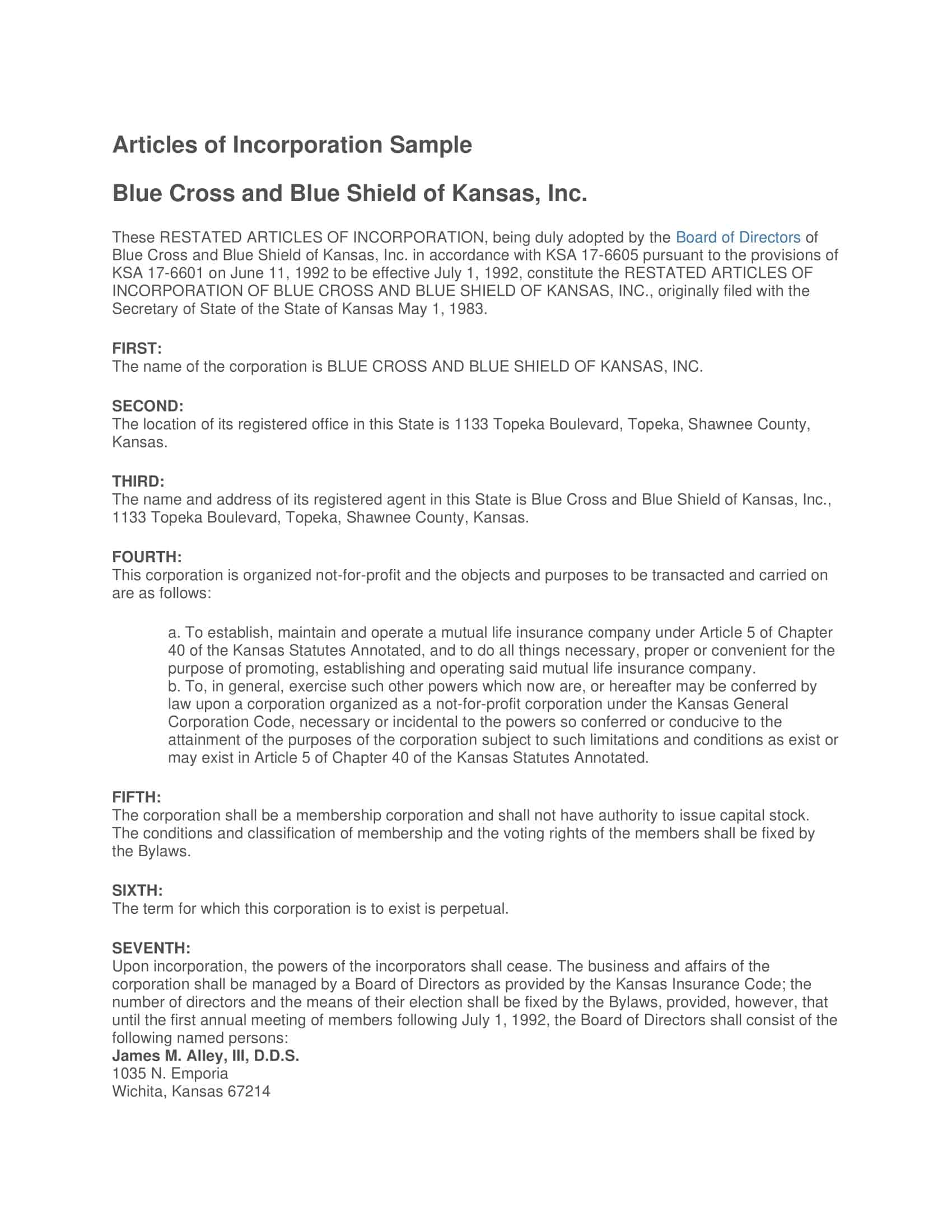

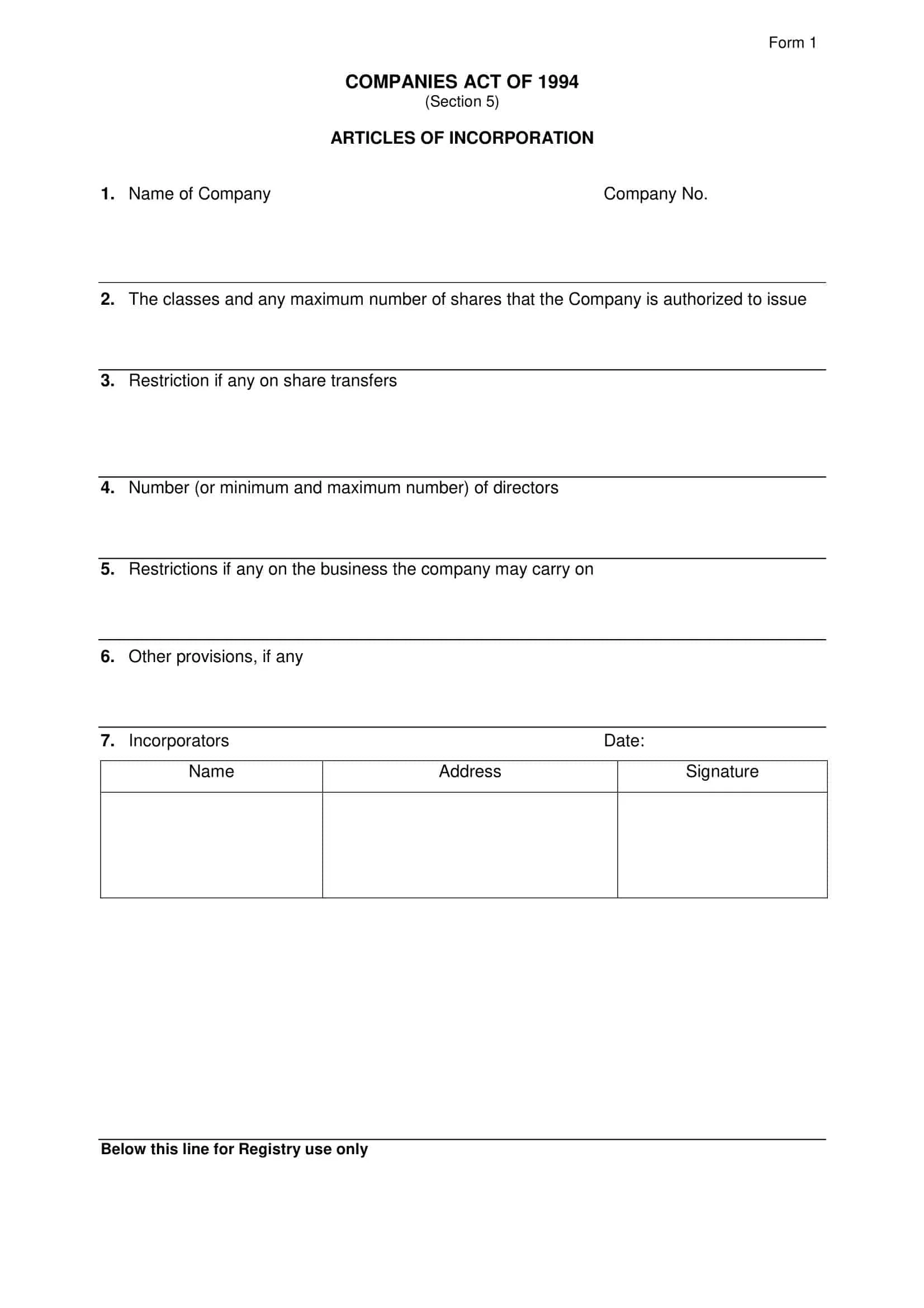

Articles of Incorporation Templates

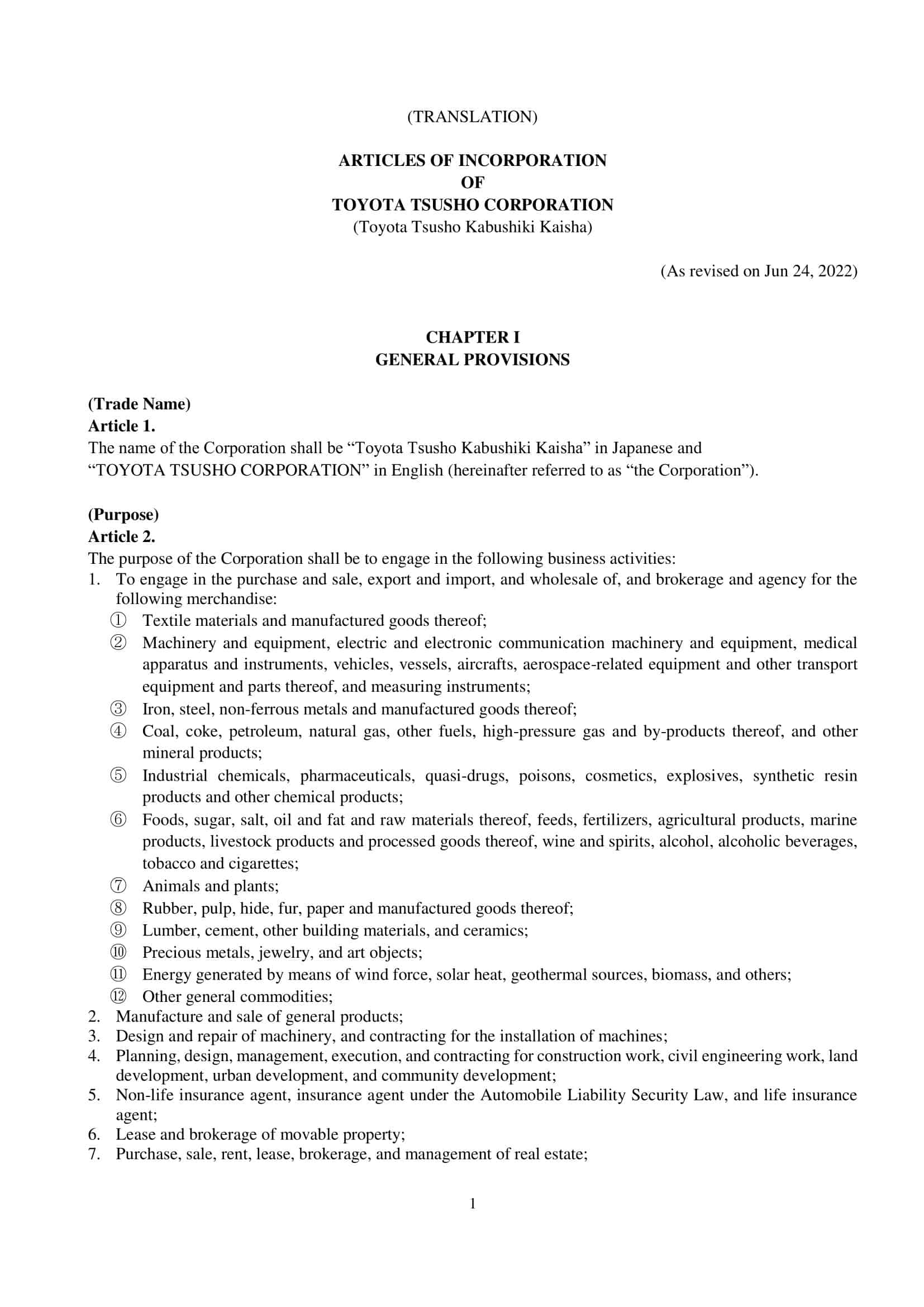

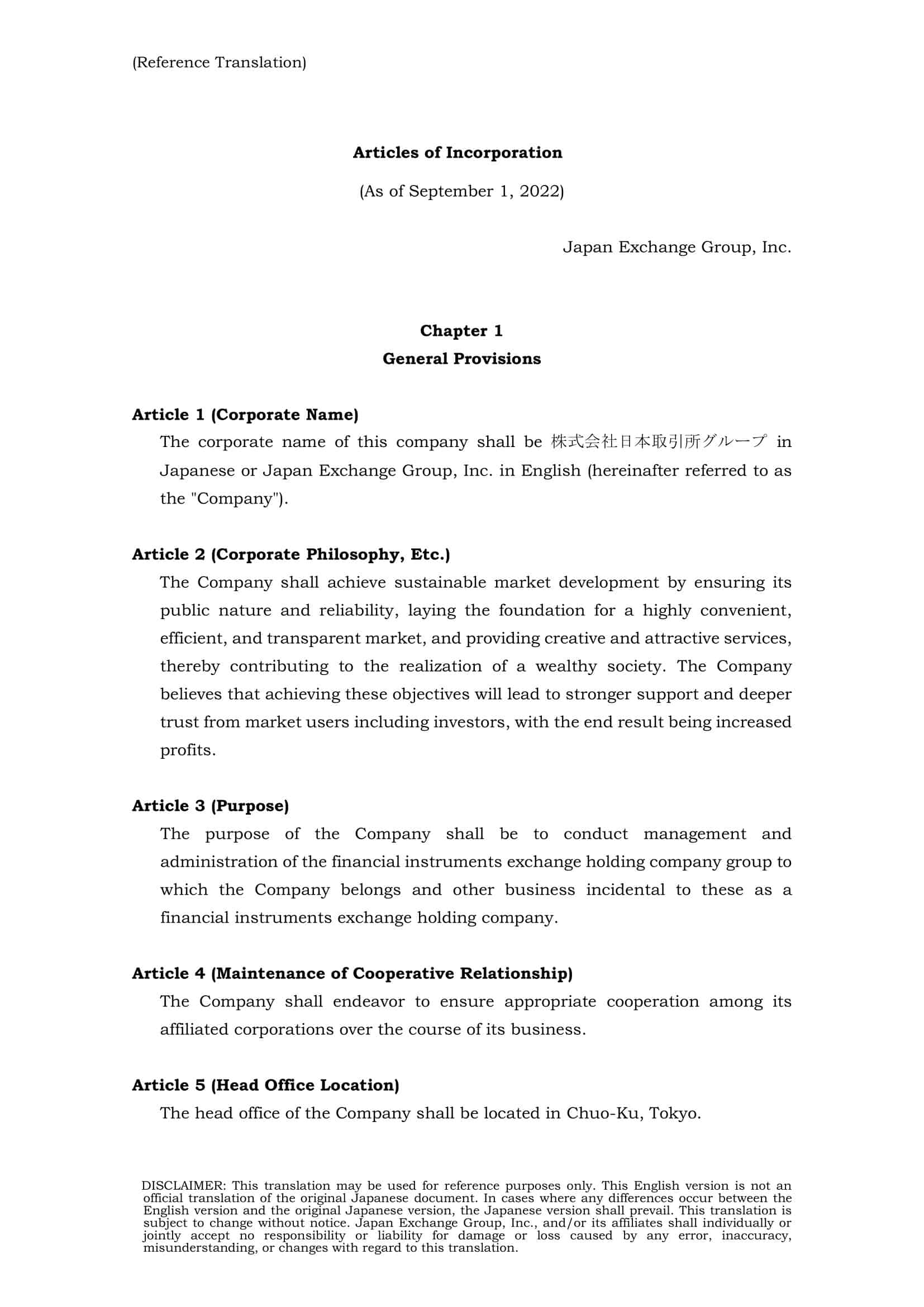

Articles of Incorporation Templates are standardized documents that serve as the foundational legal documents for creating a corporation. These templates provide a structured format for outlining essential information about the corporation, its purpose, structure, and governance. They ensure consistency and compliance with legal requirements when establishing a corporation. Articles of Incorporation serve as a crucial reference for shareholders, directors, and regulatory authorities, outlining the fundamental aspects of the corporation’s formation and operation.

Articles of Incorporation Templates provide a standardized framework for creating legally valid and compliant documents when establishing a corporation. However, it is important to note that specific legal requirements may vary by jurisdiction. It is crucial to consult legal professionals or relevant authorities to ensure compliance with specific guidelines and regulations in the jurisdiction where the corporation is being formed.

By using Articles of Incorporation Templates, individuals and organizations can streamline the process of creating a corporation, ensuring that all necessary information and legal requirements are included. These templates provide a comprehensive and consistent format for documenting the essential elements of the corporation’s formation, facilitating proper governance and compliance with legal obligations.

Understanding Articles of Incorporation

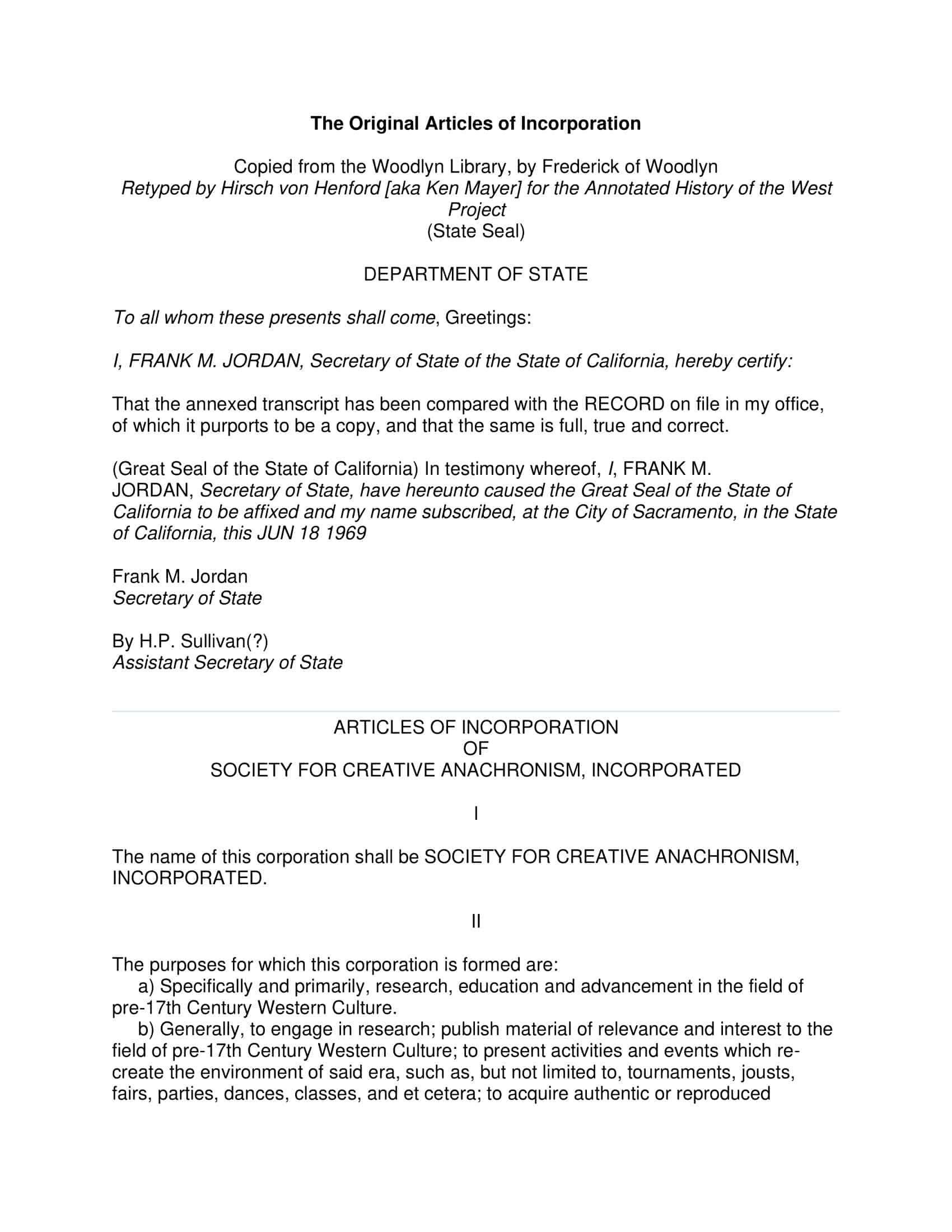

Articles of Incorporation (also known as a Certificate of Incorporation or Corporate Charter) are the formal legal documents that establish a corporation as a separate legal entity from its owners. They are typically filed with the state government and include key information about the corporation, such as its name, address, purpose, number of authorized shares of stock, and the names and addresses of the initial directors.

Here are some of the key components of Articles of Incorporation:

Corporation Name: This is the name by which the corporation will be known. The name must be distinguishable from the names of other corporations already on file with the state government.

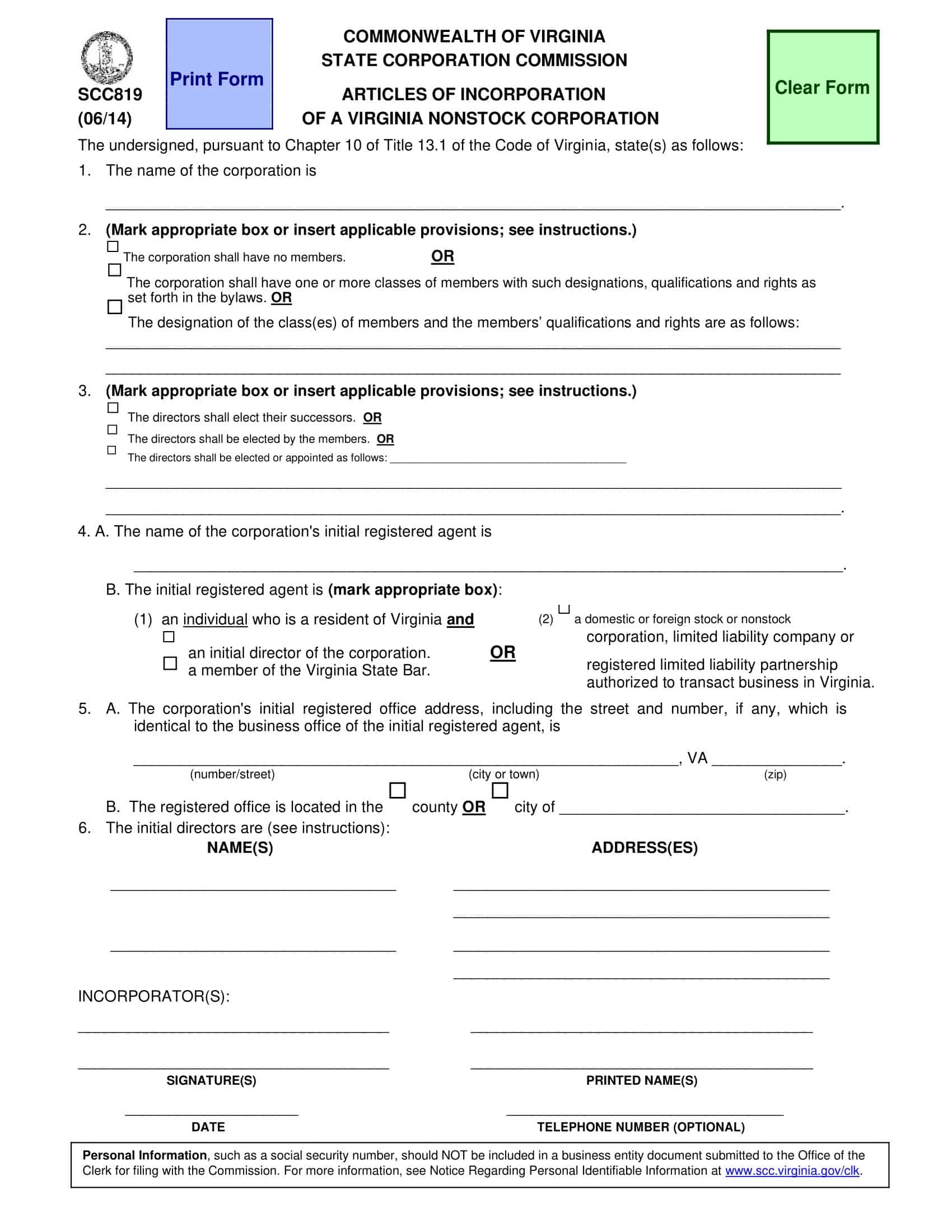

Registered Agent: This is an individual or company that is designated to receive official legal and tax documents on behalf of the corporation.

Purpose: This is a statement of the purpose for which the corporation was formed. It is often a general statement, such as “to engage in any lawful business activity.”

Authorized Shares: This is the number of shares of stock that the corporation is authorized to issue. This number can be increased or decreased in the future by amending the Articles of Incorporation.

Incorporators: The names and addresses of the individuals who are responsible for forming the corporation are listed in the Articles of Incorporation.

Directors: The Articles of Incorporation may also include the names and addresses of the initial directors of the corporation.

It’s important to note that the requirements for Articles of Incorporation vary by state, so it’s a good idea to consult with a corporate attorney to ensure that the document you file complies with the relevant state laws. Additionally, the Articles of Incorporation can be amended in the future if the corporation’s circumstances change.

Why are articles of incorporation important?

Articles of Incorporation are important for several reasons:

Legal Recognition: By filing the Articles of Incorporation with the state government, the corporation is recognized as a separate legal entity from its owners. This means that the corporation can enter into contracts, sue and be sued, and own assets in its own name.

Limited Liability Protection: One of the key benefits of incorporating is limited liability protection. This means that the personal assets of the owners (also known as shareholders or stockholders) are protected in the event that the corporation is sued or incurs debt. The owners are typically only at risk for the amount of money they have invested in the corporation.

Credibility: Incorporating a business can lend credibility to the company and make it easier to attract investment or secure business loans. The legal recognition of the corporation as a separate entity can also make it easier to do business with other companies.

Easier Transfer of Ownership: Incorporating a business makes it easier to transfer ownership of the company. Shares of stock in a corporation can be bought and sold, which allows for a smooth transition of ownership when the original owners retire or sell their stake in the company.

Continued Existence: A corporation has a perpetual life, meaning that it can continue to exist even if its owners change. This is in contrast to a sole proprietorship or partnership, which ceases to exist when the owner(s) die or retire.

What is the purpose of articles of incorporation?

The purpose of Articles of Incorporation is to establish a corporation as a separate legal entity from its owners and provide the legal framework for its operation. The Articles of Incorporation serve several important functions, including:

Defining the Corporation: The Articles of Incorporation define the corporation, including its name, address, and purpose. This helps to establish the corporation as a distinct entity from its owners and sets the framework for its operations.

Creating Limited Liability Protection: The Articles of Incorporation help to create limited liability protection for the corporation’s owners. This means that the personal assets of the owners (also known as shareholders or stockholders) are protected in the event that the corporation is sued or incurs debt. The owners are typically only at risk for the amount of money they have invested in the corporation.

Establishing Ownership Structure: The Articles of Incorporation help to establish the ownership structure of the corporation, including the number of authorized shares of stock and the rights and responsibilities of the owners.

Providing for Transfer of Ownership: The Articles of Incorporation provide for the transfer of ownership of the corporation through the buying and selling of shares of stock. This allows for a smooth transition of ownership when the original owners retire or sell their stake in the company.

Facilitating Business Operations: The Articles of Incorporation help to facilitate the day-to-day business operations of the corporation by defining the roles and responsibilities of the corporation’s officers and directors.

Articles of Incorporation vs. Bylaws

Bylaws and Articles of Incorporation are two important documents that define the rules and regulations for a corporation. However, they serve different purposes and have different focuses.

Articles of Incorporation are the formal legal documents that establish a corporation as a separate legal entity from its owners. They include key information about the corporation, such as its name, address, purpose, number of authorized shares of stock, and the names and addresses of the initial directors.

Bylaws, on the other hand, are the internal rules and regulations that govern the corporation’s operations. They cover a wide range of topics, such as the duties and responsibilities of the corporation’s officers and directors, the procedures for conducting meetings, and the process for amending the bylaws.

In summary, the Articles of Incorporation are focused on establishing the corporation as a separate legal entity and defining its structure, while the bylaws are focused on governing the day-to-day operations of the corporation. The two documents complement each other, with the Articles of Incorporation providing the overarching framework for the corporation and the bylaws providing the specific details on how the corporation will function.

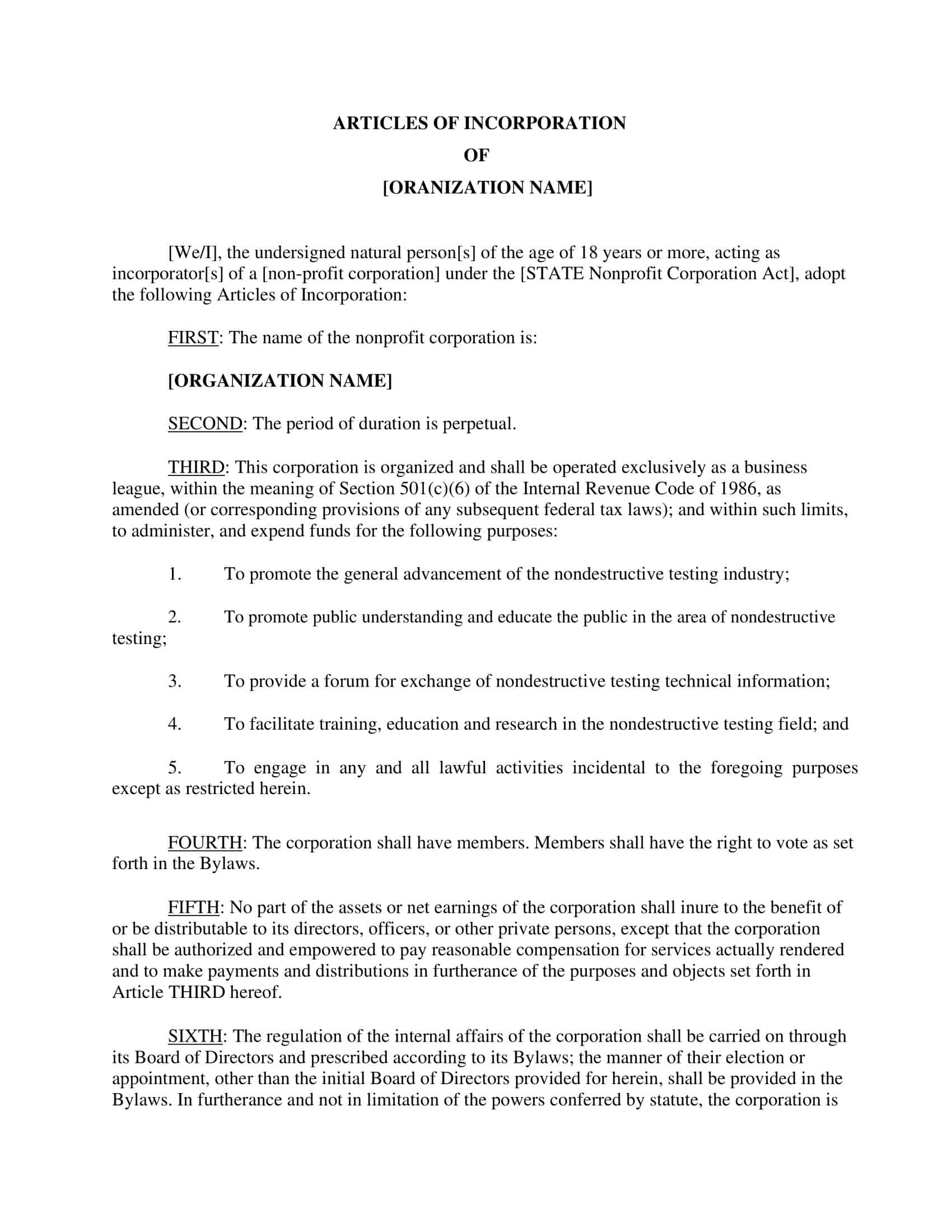

Which Types of Businesses Can Use Articles of Incorporation?

Articles of Incorporation, also known as a corporate charter or a certificate of incorporation, is a document that outlines the basic rules for how a corporation will be governed and structured. This document is filed with the state government, typically with the Secretary of State, to legally create a corporation.

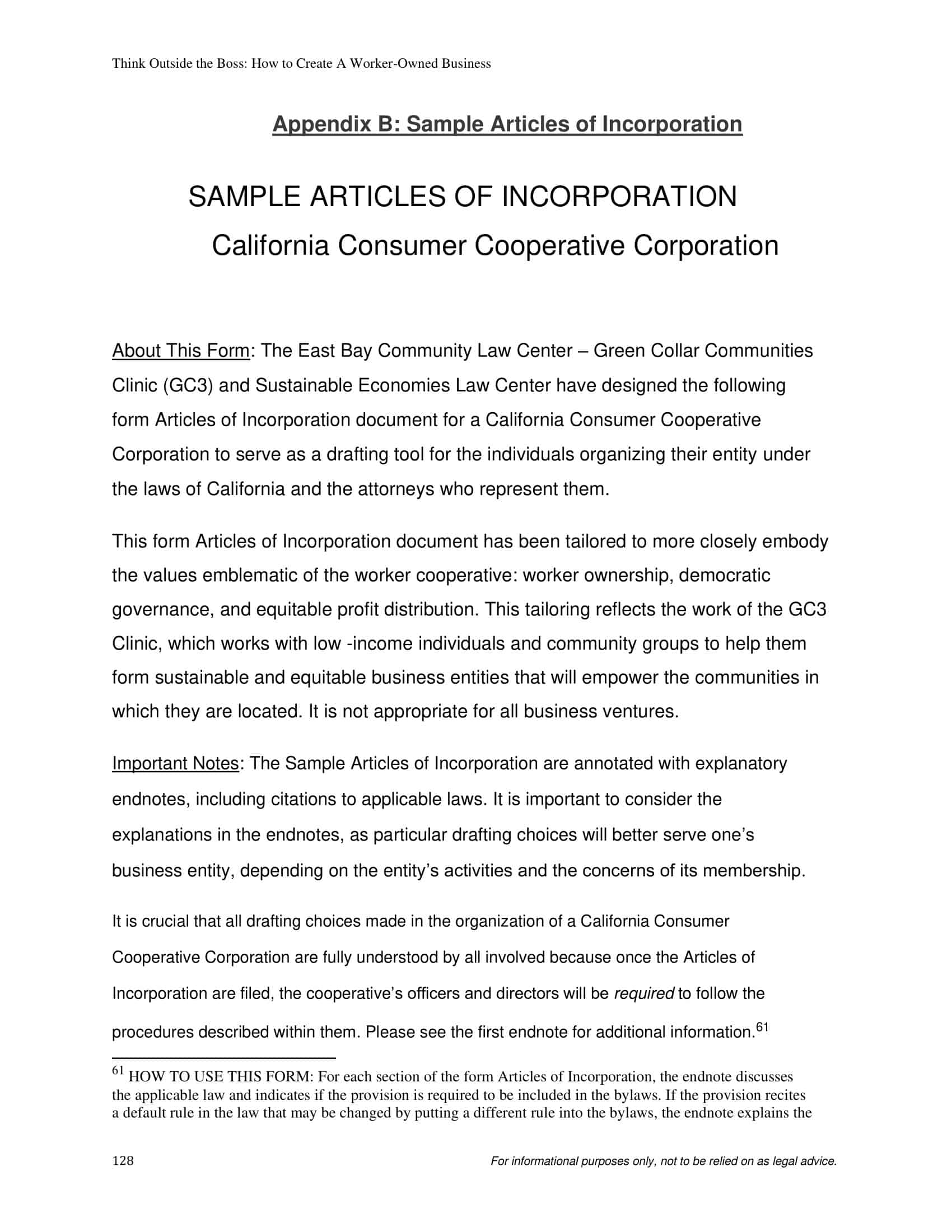

Articles of Incorporation can be used by a variety of business types, including:

C Corporations: A C Corporation is the most common type of corporation, and it is taxed as a separate entity from its owners.

S Corporations: An S Corporation is a type of corporation that is taxed as a pass-through entity, meaning the company’s income is reported on the personal tax returns of its owners.

Limited Liability Companies (LLCs): An LLC is a type of business structure that combines the liability protection of a corporation with the tax benefits of a partnership.

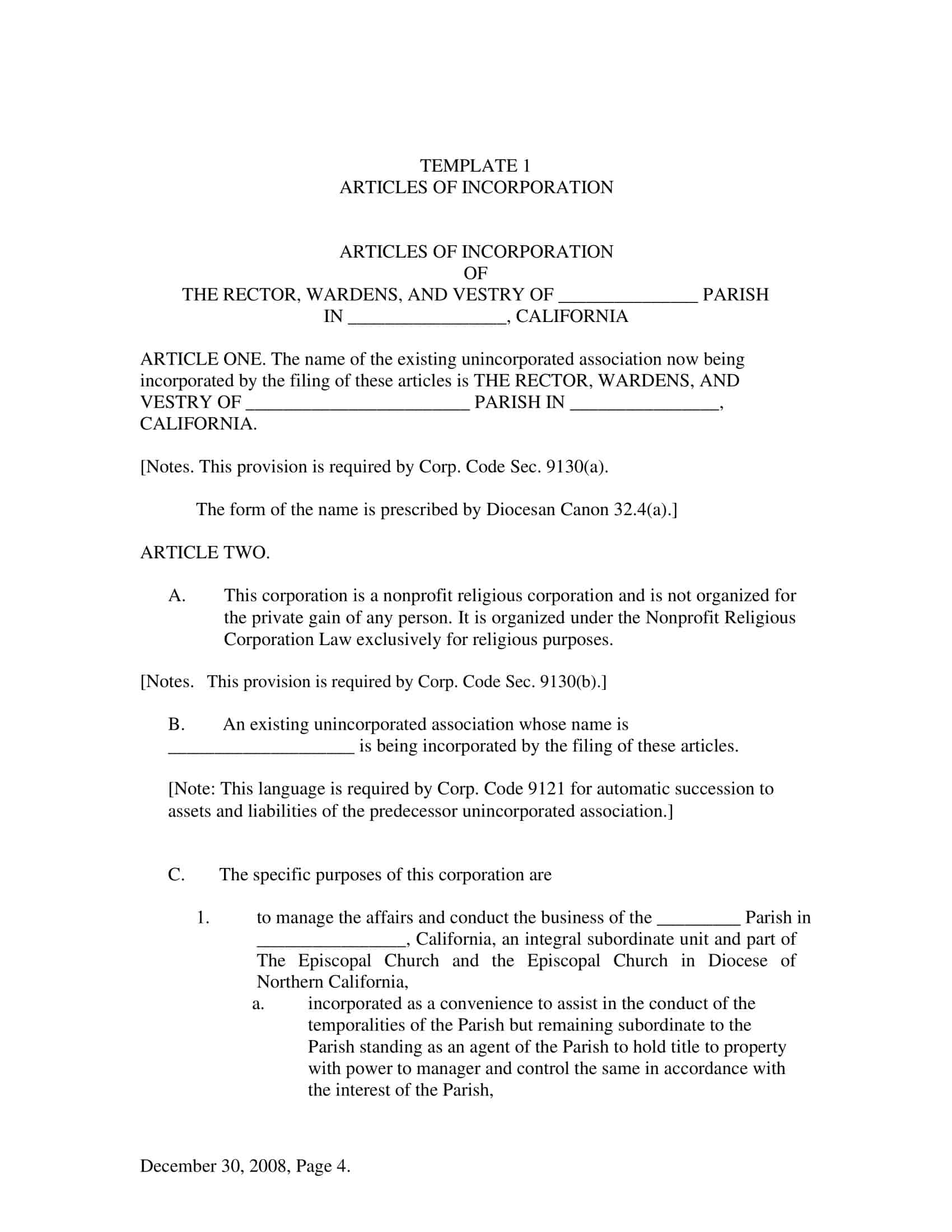

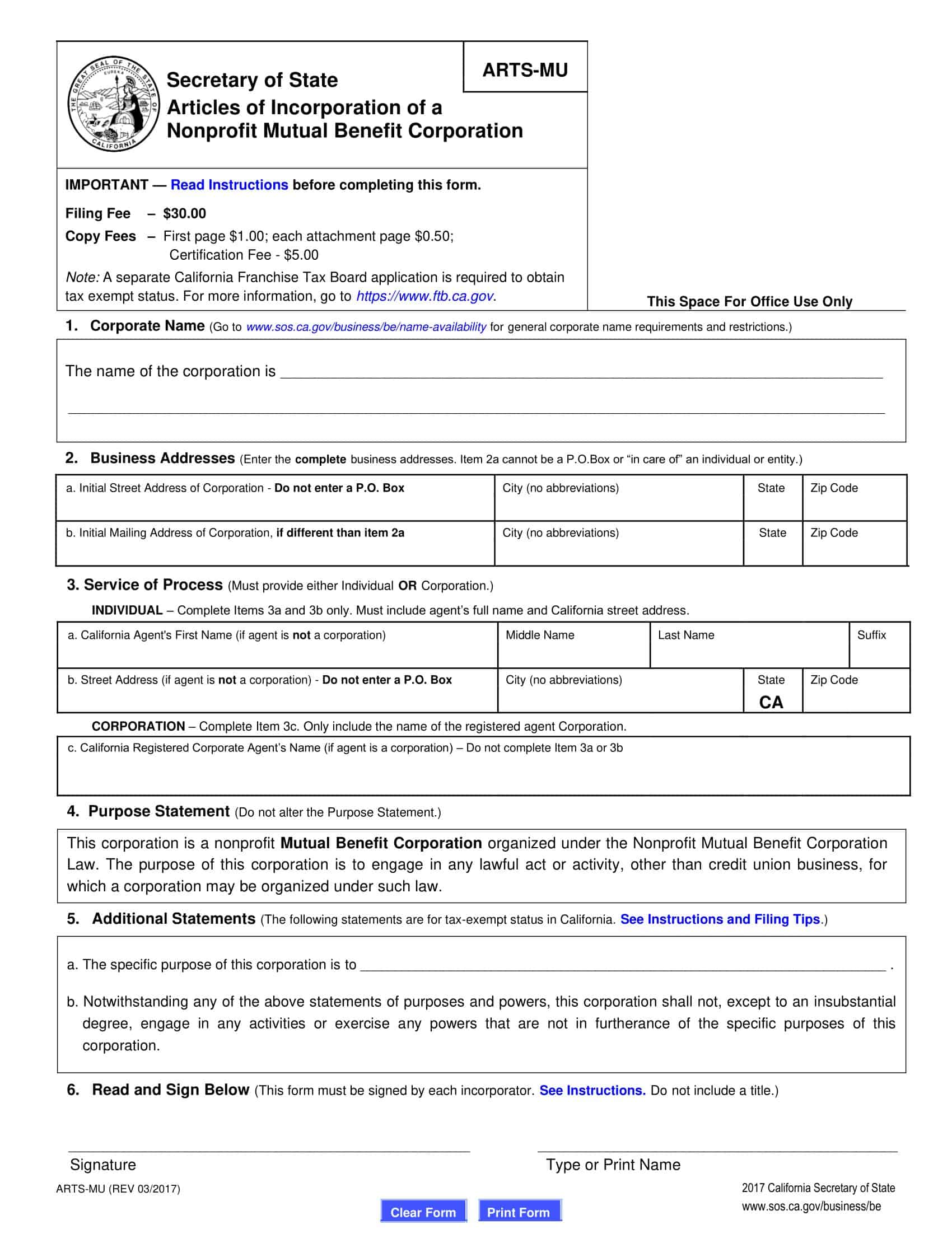

Non-Profit Corporations: A non-profit corporation is a type of corporation that is organized for a specific purpose other than generating profit, such as a charity or religious organization.

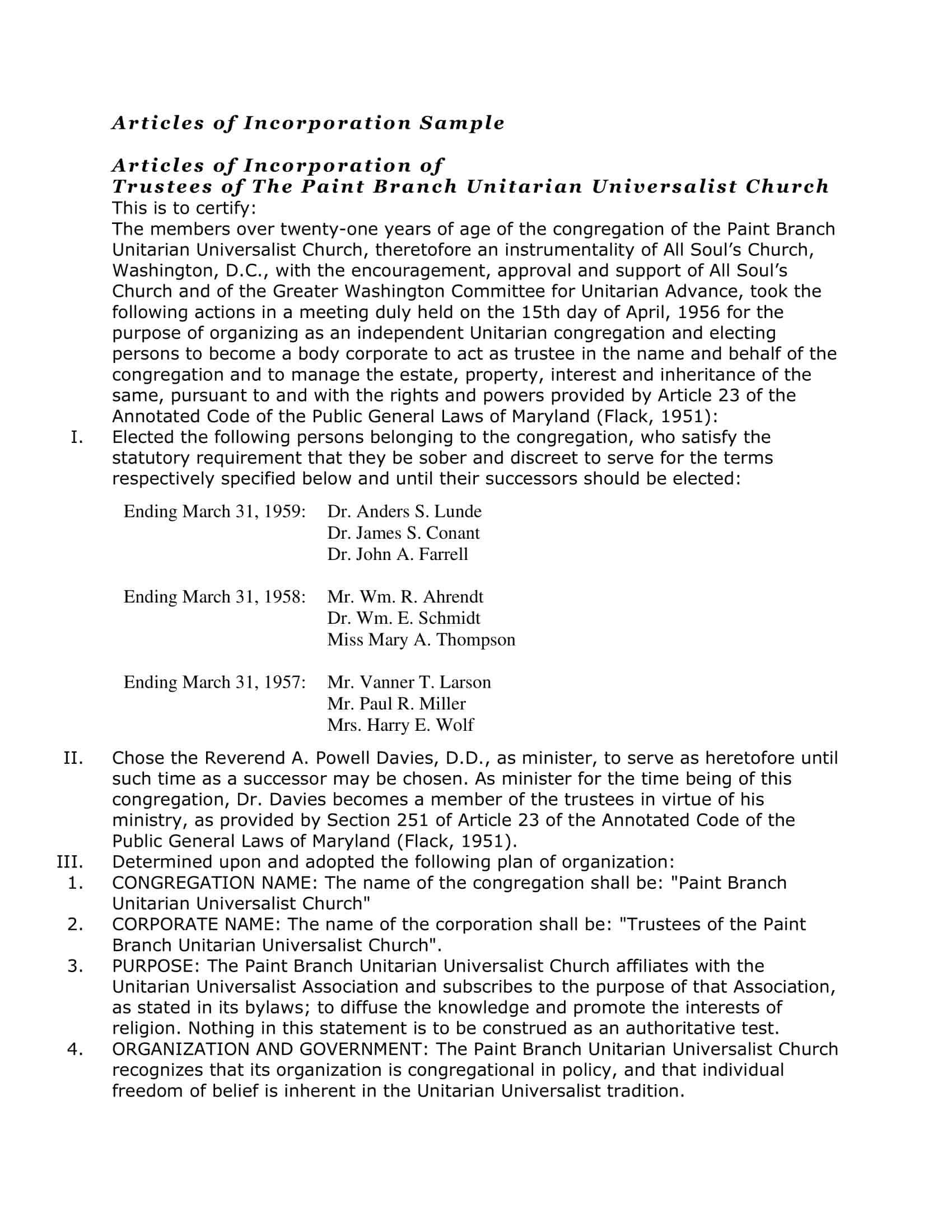

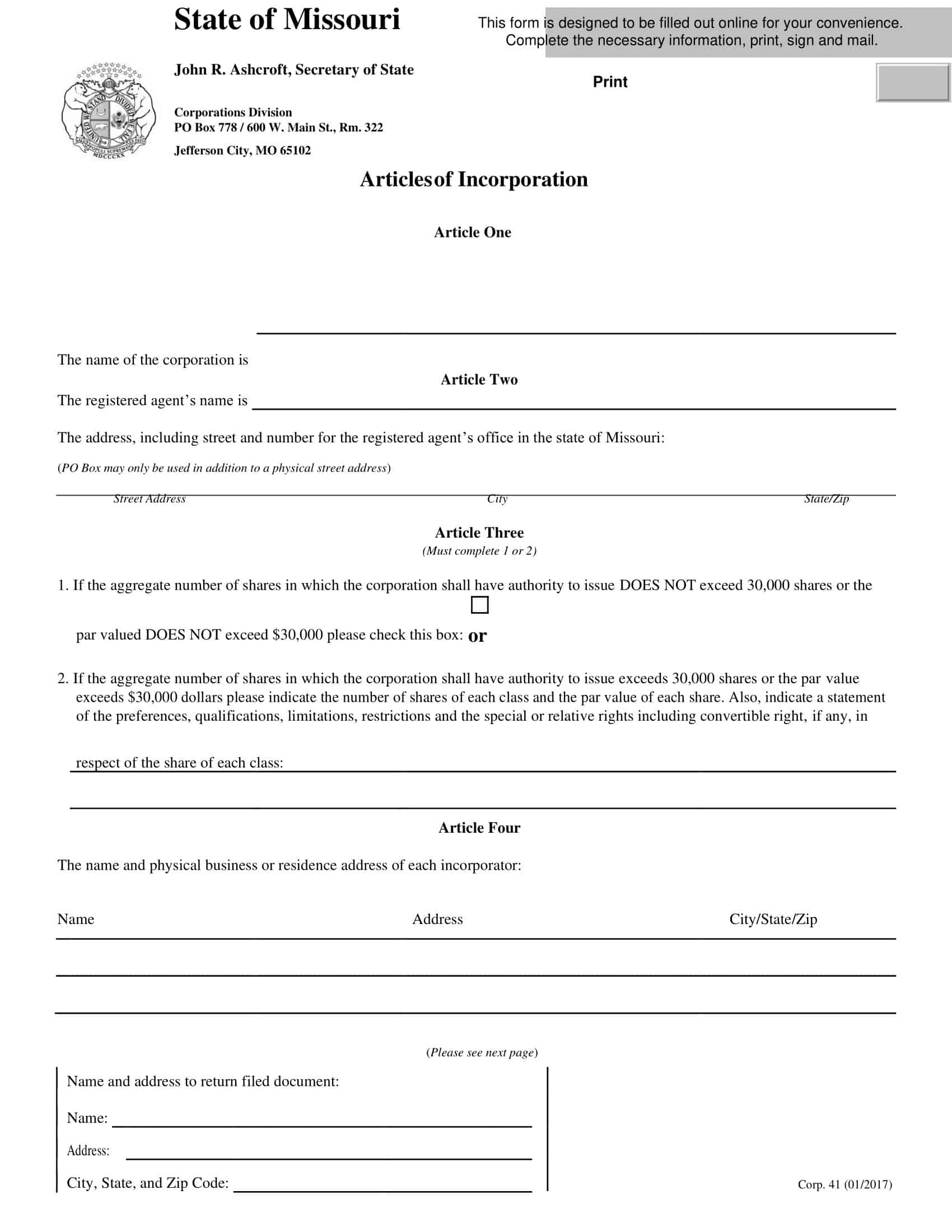

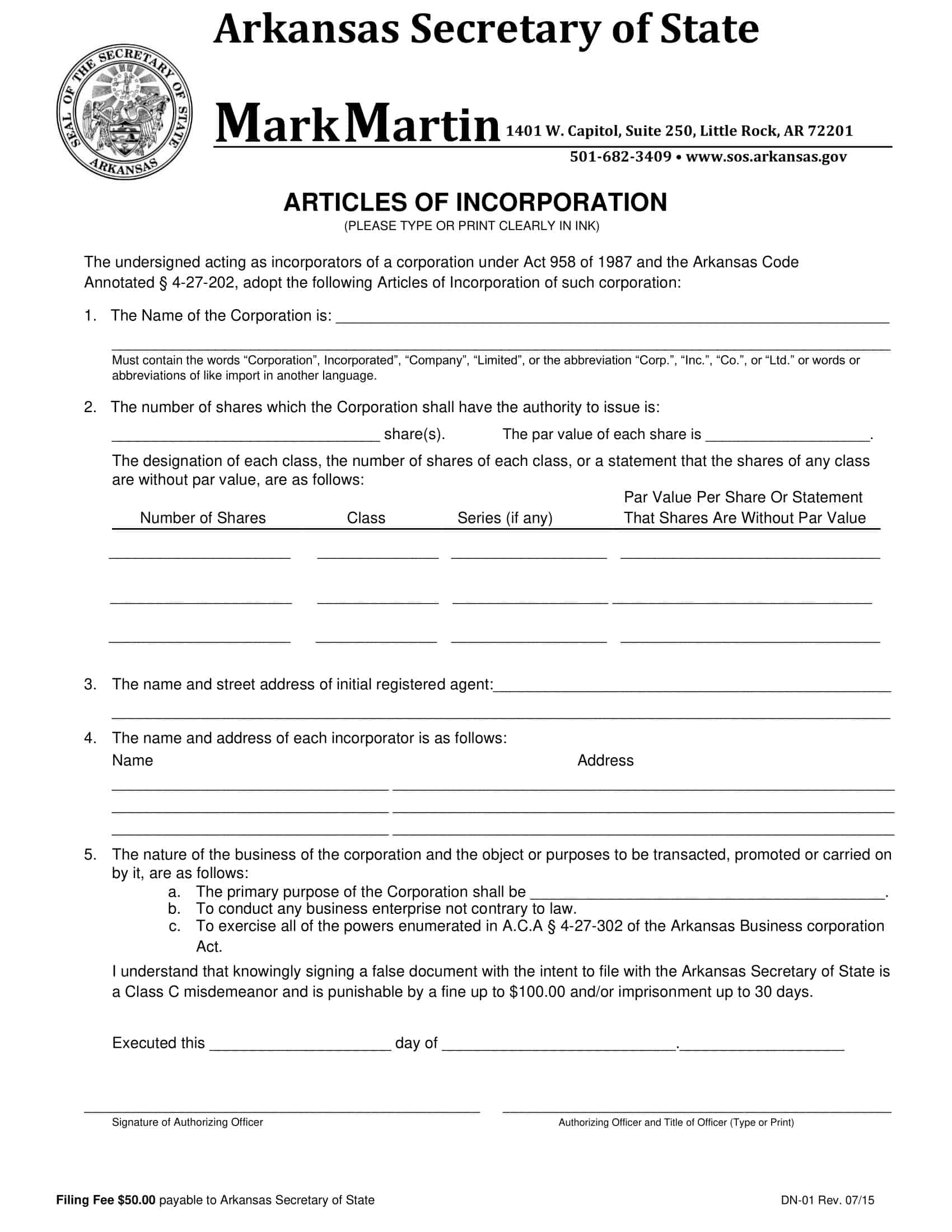

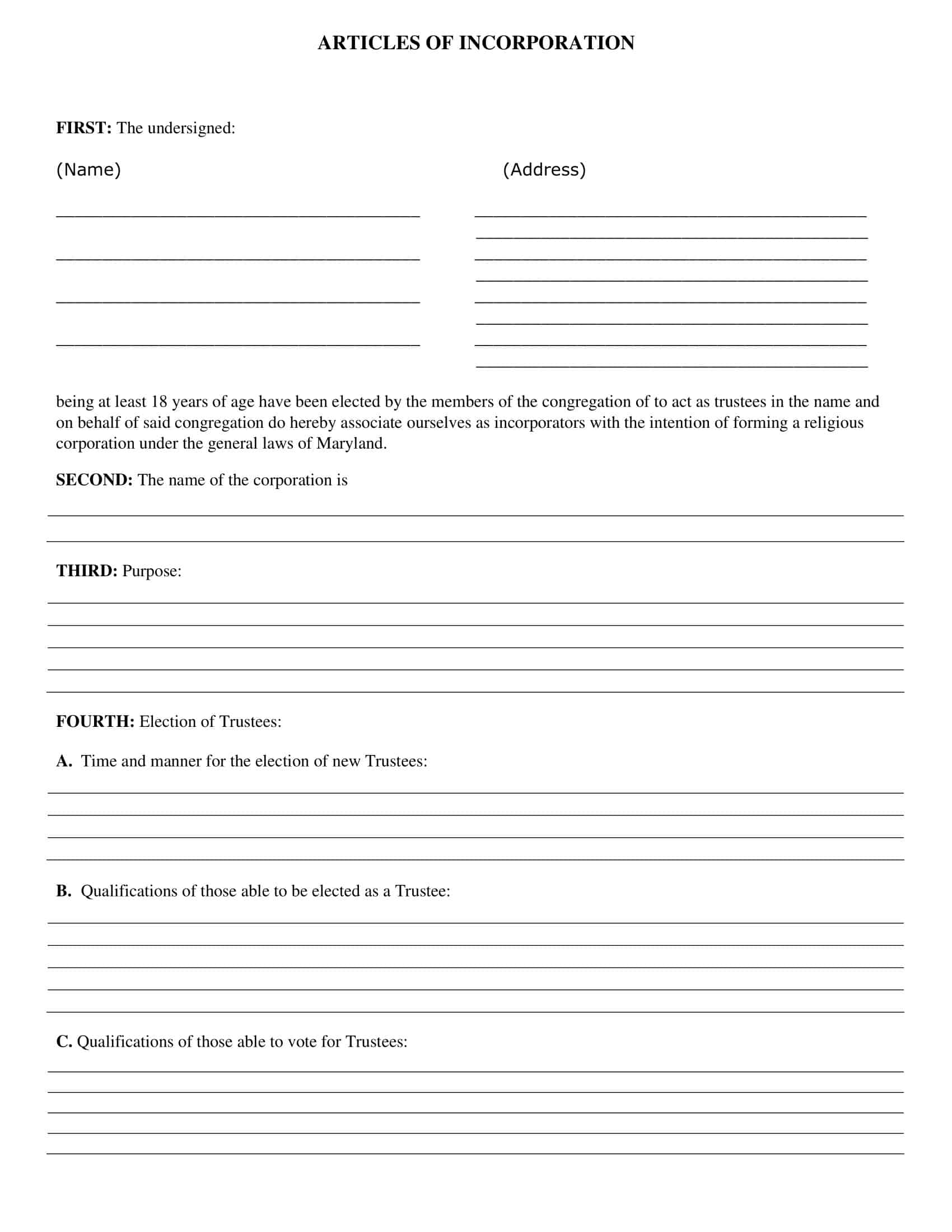

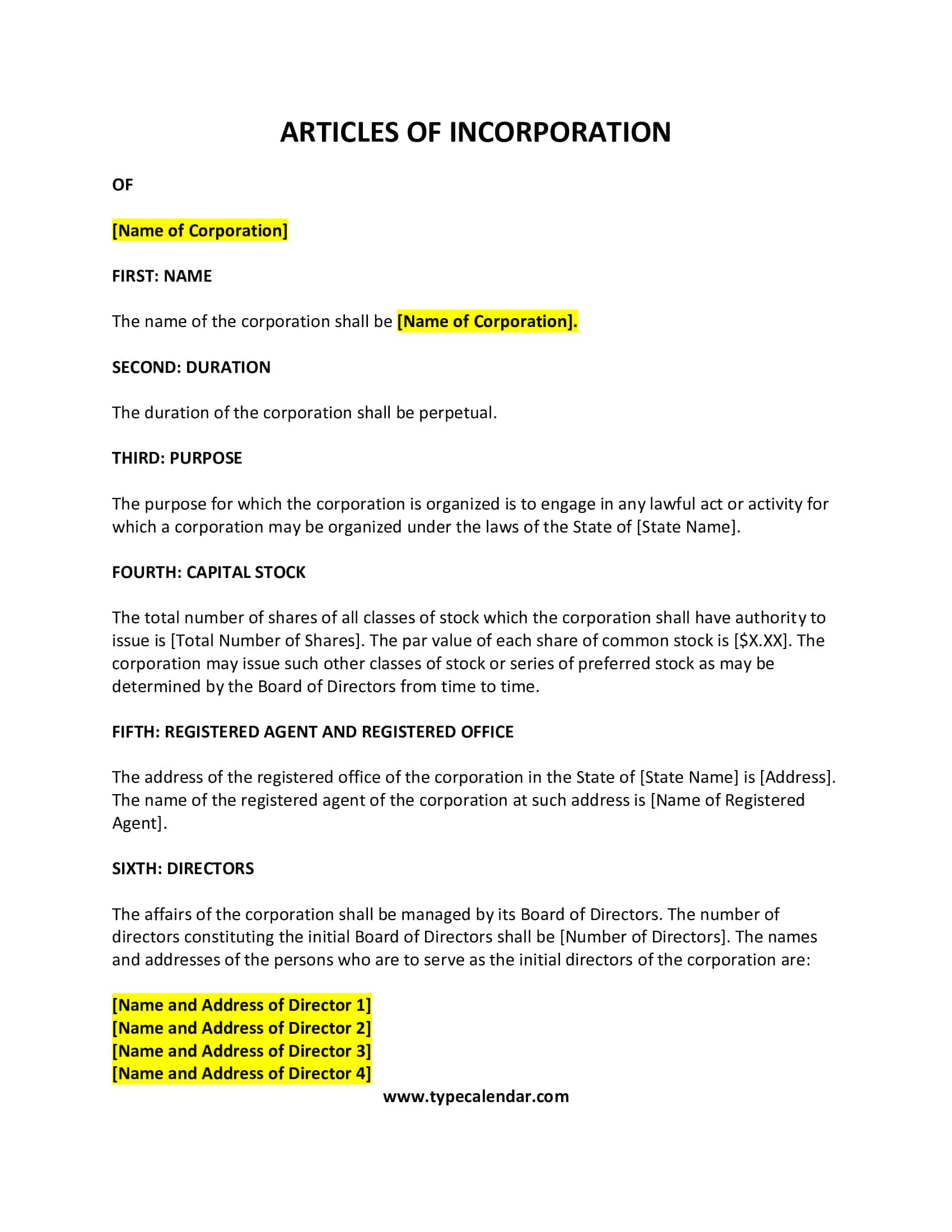

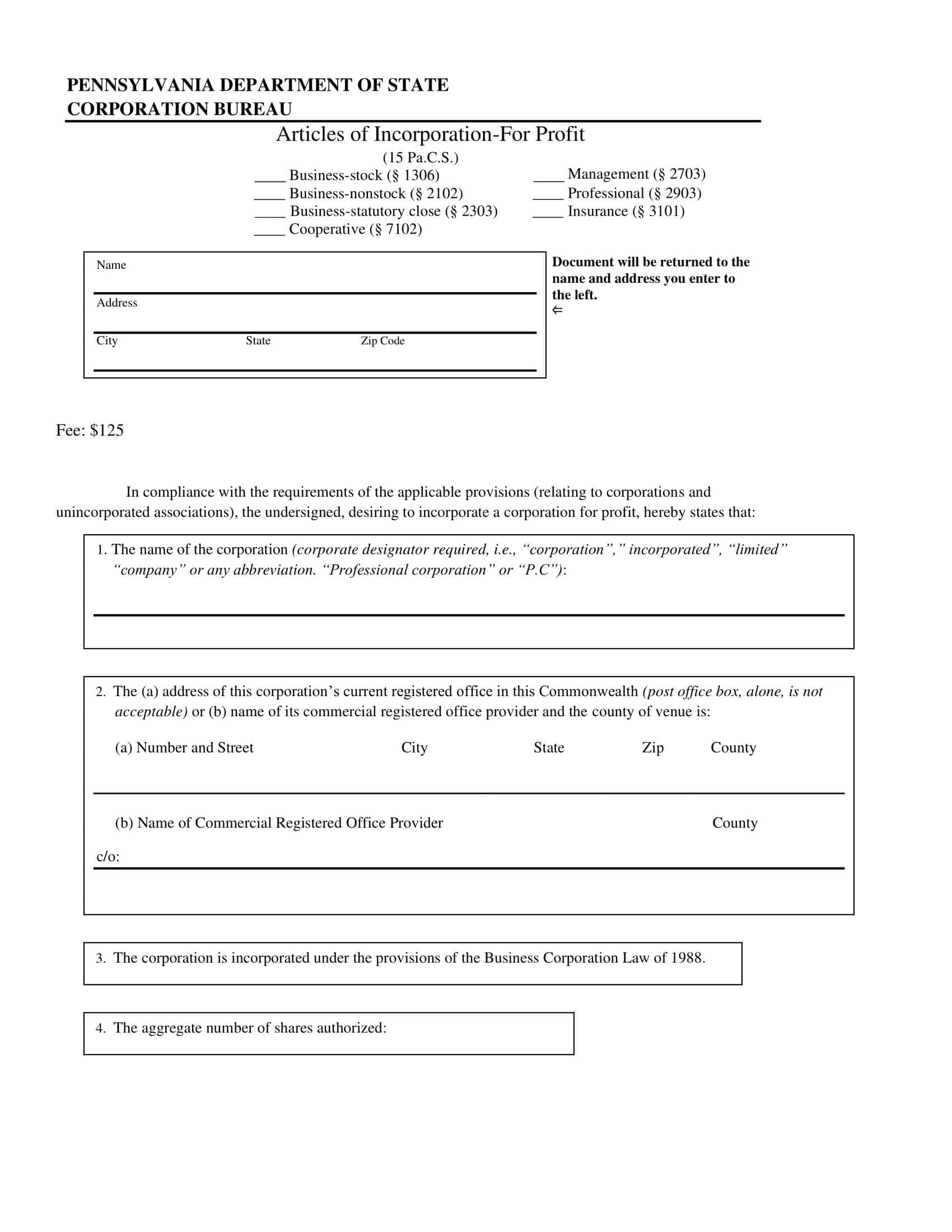

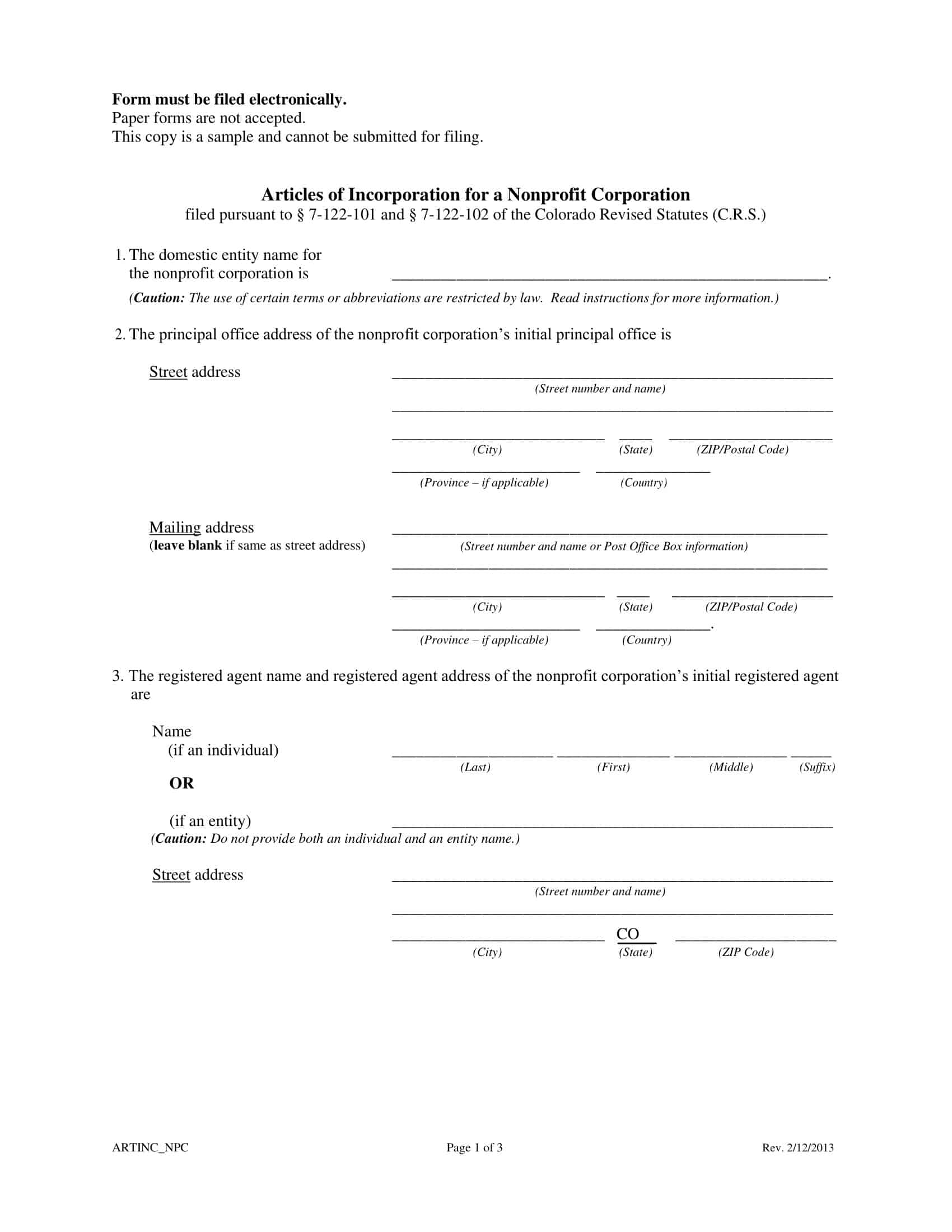

How to Fill Out Articles of Incorporation

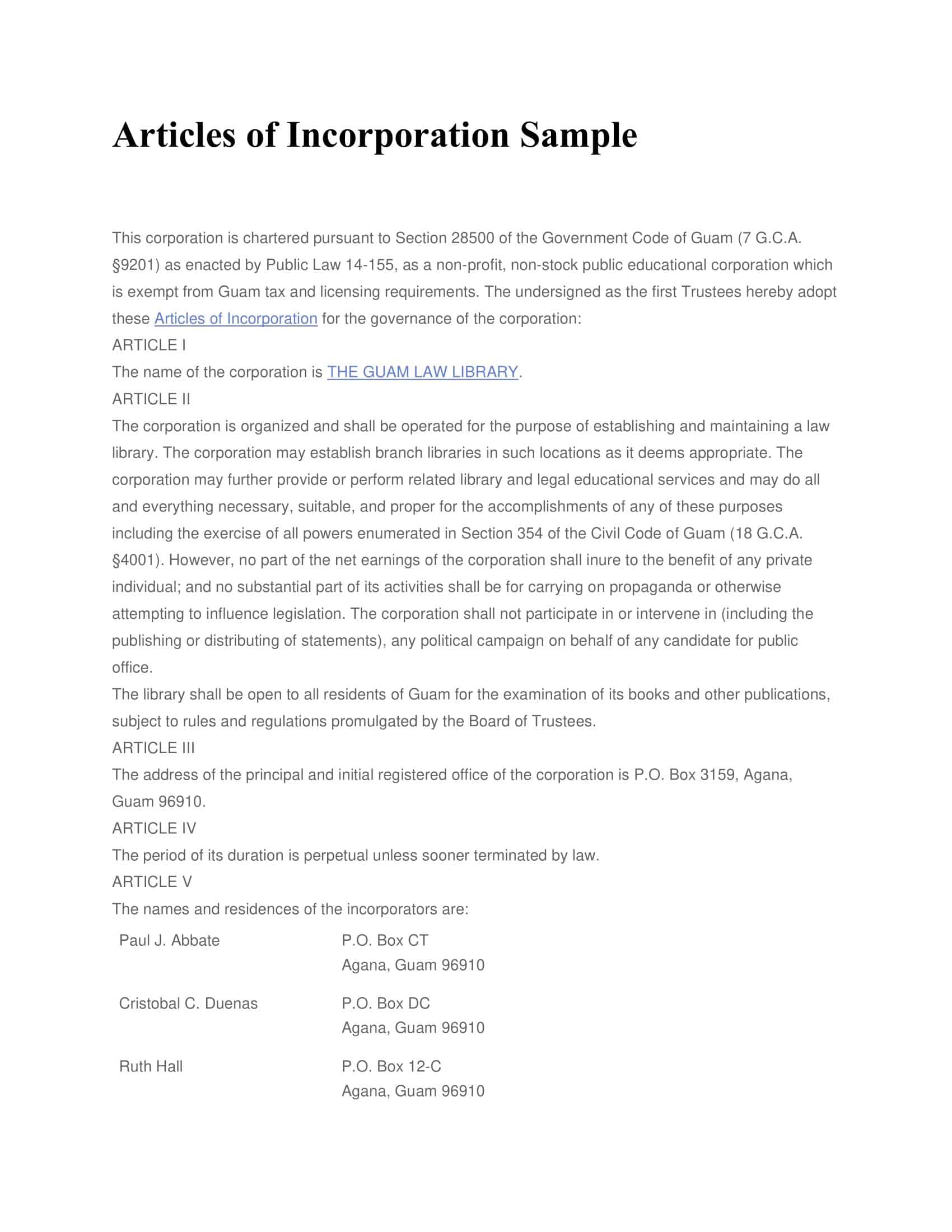

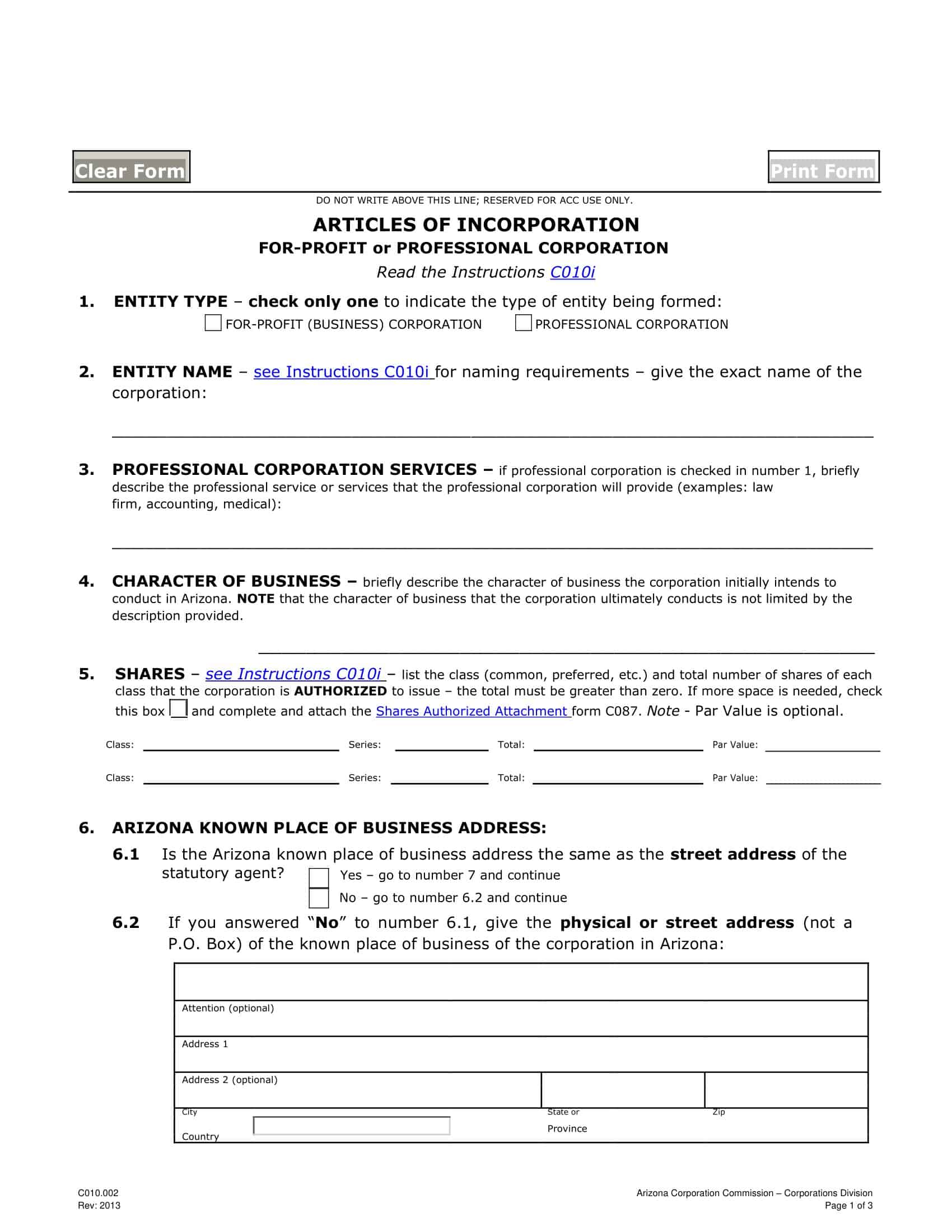

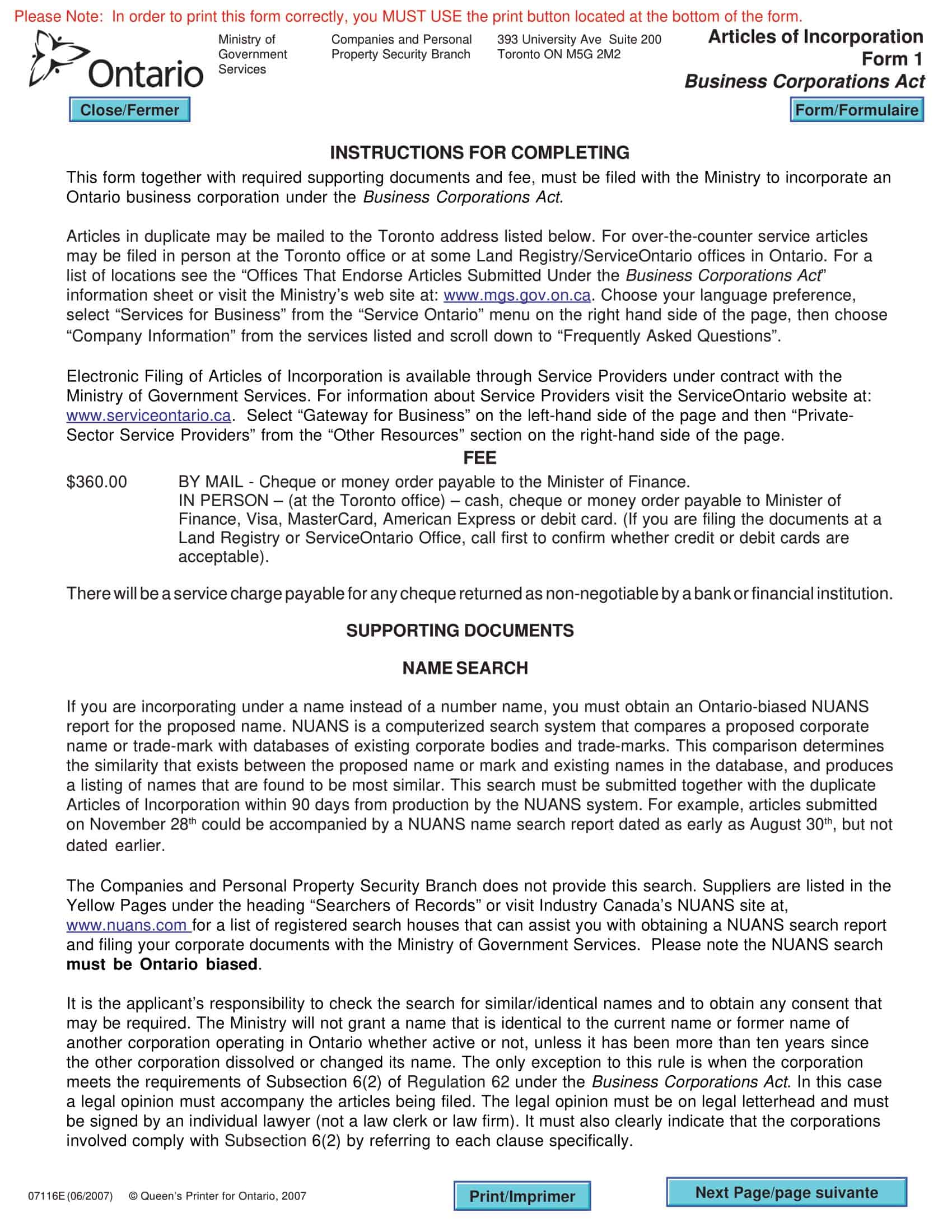

The process of filling out articles of incorporation varies by state, but there are some common elements that are typically included in the document. Here is a general guide to help you fill out articles of incorporation:

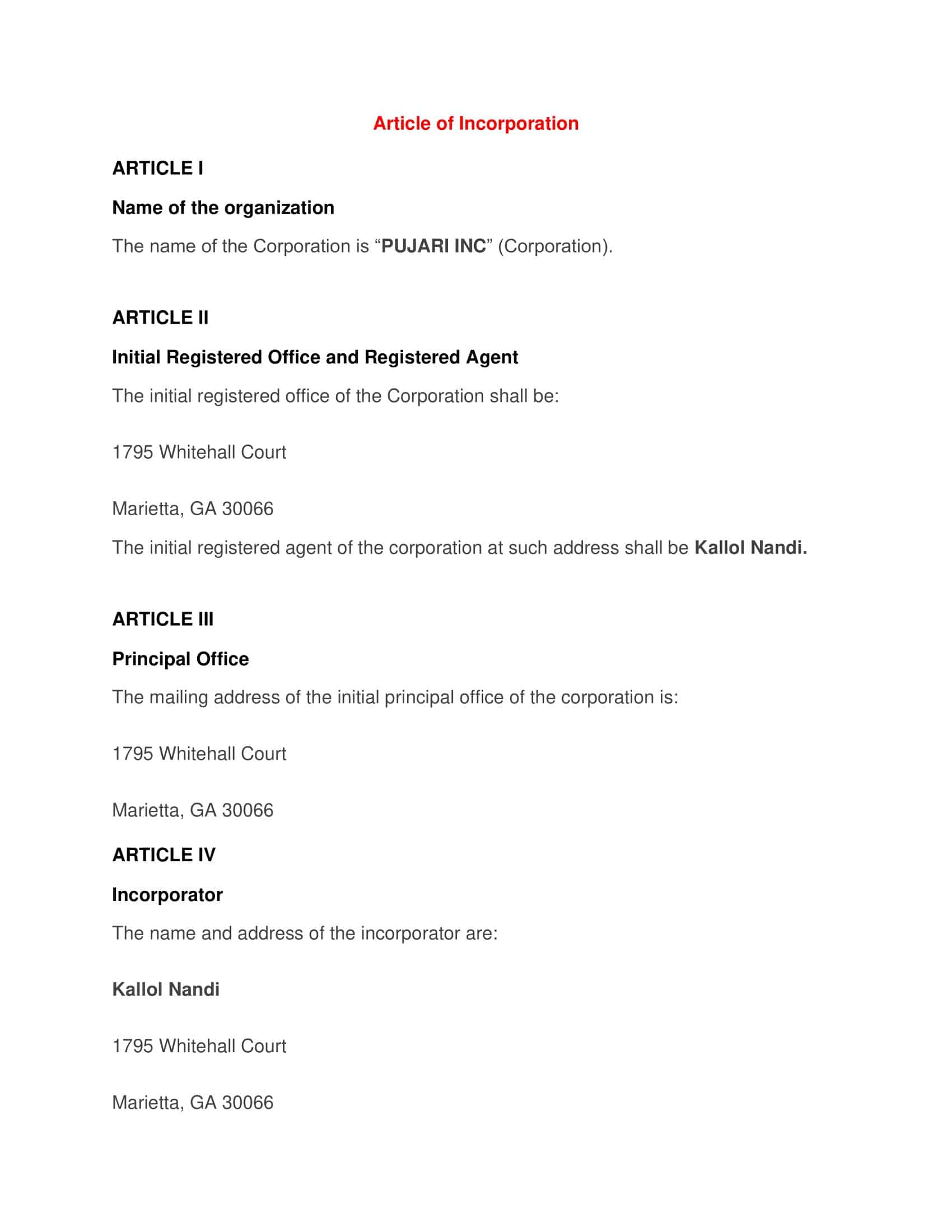

Business Name

The first step is to choose a name for your corporation that complies with your state’s naming rules. The name must be unique and cannot be similar to any existing corporation names.

Purpose of the Corporation

The purpose of the corporation is a statement that explains what the corporation intends to do. This can be a broad statement, such as “to engage in any lawful business activity,” or a specific statement, such as “to operate a bakery.”

Registered Agent and Office

The registered agent is the person or entity designated to receive legal documents on behalf of the corporation. The registered office is the physical address where the registered agent can be located.

Incorporators

The incorporators are the individuals who are responsible for filing the articles of incorporation and creating the corporation. The incorporators must provide their names and addresses.

Capital Structure

This section outlines the number of authorized shares of stock the corporation is allowed to issue and the par value of each share.

Directors

The articles of incorporation should specify the number of directors the corporation will have and the method for electing directors.

Duration

This section specifies the length of time the corporation will exist. If no duration is specified, the corporation will exist in perpetuity.

Dissolution

This section explains the process for dissolving the corporation if the business is no longer viable.

Signatures

The articles of incorporation must be signed by the incorporators and filed with the state government, typically with the Secretary of State.

FAQs

How long does it take to process Articles of Incorporation?

The processing time for Articles of Incorporation varies by state, but it typically takes several weeks to several months to receive approval.

Is there a fee to file Articles of Incorporation?

Yes, there is typically a fee associated with filing Articles of Incorporation, which varies by state.

What happens after the Articles of Incorporation are filed and approved?

Once the Articles of Incorporation are filed and approved, the corporation is officially established and the incorporators can move forward with creating bylaws, issuing stock, and conducting business.

Are Articles of Incorporation required to operate a corporation?

Yes, filing Articles of Incorporation is a requirement for legally establishing a corporation.

Can Articles of Incorporation be changed after they are filed?

Yes, the Articles of Incorporation can be amended to reflect changes in the corporation’s structure, purpose, or governance. However, the process for amending the articles varies by state and typically requires a vote by the shareholders and approval by the state government.

Who can file Articles of Incorporation?

The incorporators, who are the individuals responsible for creating the corporation, typically file the Articles of Incorporation with the state government.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)