DJs know that mixing great music is just one element of running a successful business. Properly invoicing clients and tracking payment terms is equally important. A professional DJ invoice clearly documents charges for services, equipment rentals, and other fees to clients. It protects both DJ and customer by outlining expected payments and timelines. Yet creating polished invoices from scratch can be time consuming for busy DJs.

This is where using a DJ invoice template saves effort. In this article, we provide free printable DJ invoice templates that can be customized to your business needs. Whether you’re a mobile DJ performing gigs or run a DJ business full-time, these downloadable templates help you craft professional invoices quickly. Read on for steps to fill out invoices accurately and compile payment details. With professionally designed DJ invoice templates, you can focus on music while avoiding payment hassles.

Table of Contents

What Is A DJ Invoice ?

A DJ invoice is a bill sent by a DJ or DJ business to clients detailing charges owed for services provided. It itemizes any DJ fees, equipment rental fees, travel expenses, or other agreed upon costs related to an event performance. The DJ invoice states the total amount due and relevant payment terms and timeline.

It serves as a formal request for payment and an official record in case of disputes. Having a clear, professional DJ invoice protects both the DJ by documenting payments and ensures clients understand all charges in writing. For mobile and full-time DJs, invoices are important business documents for getting paid fairly for services.

DJ Invoice Templates

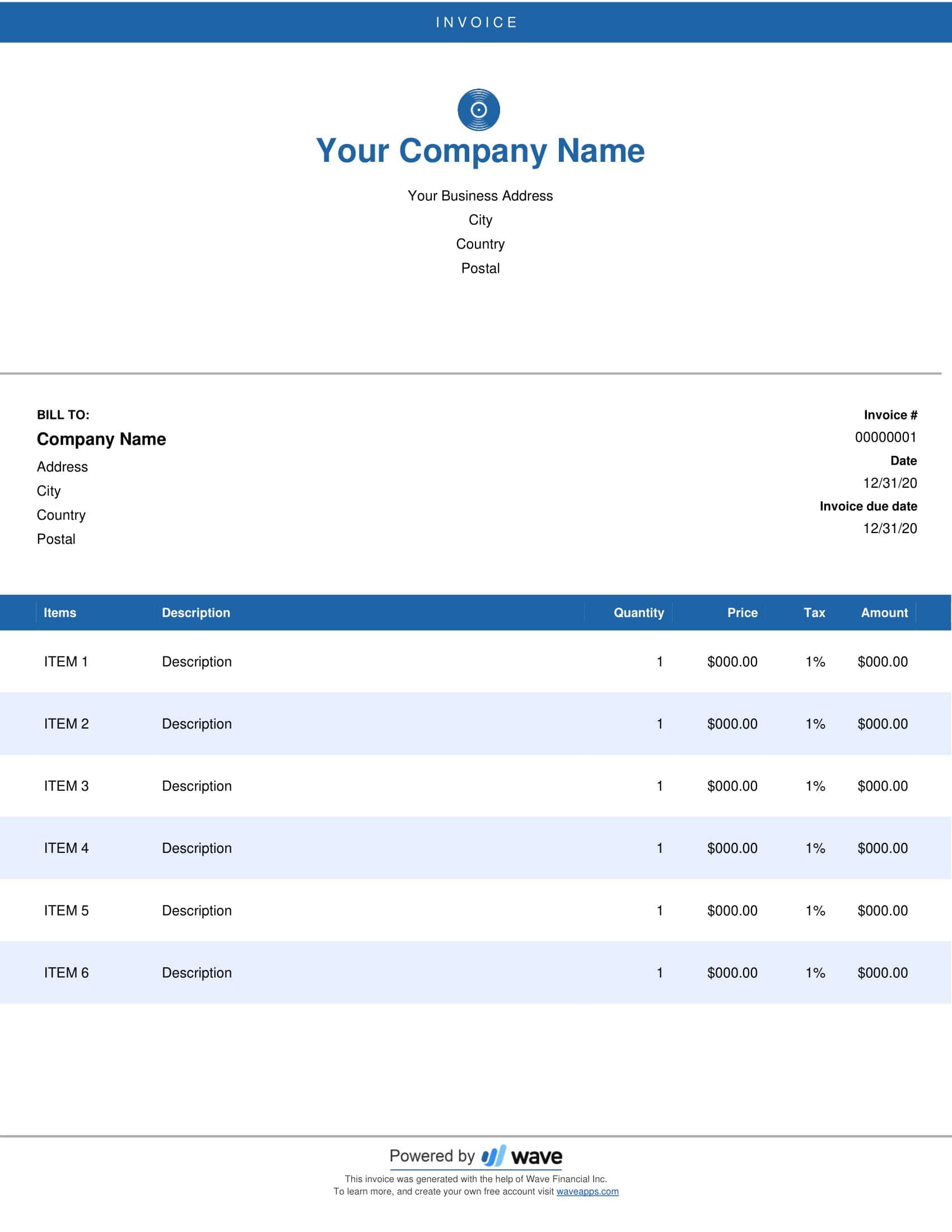

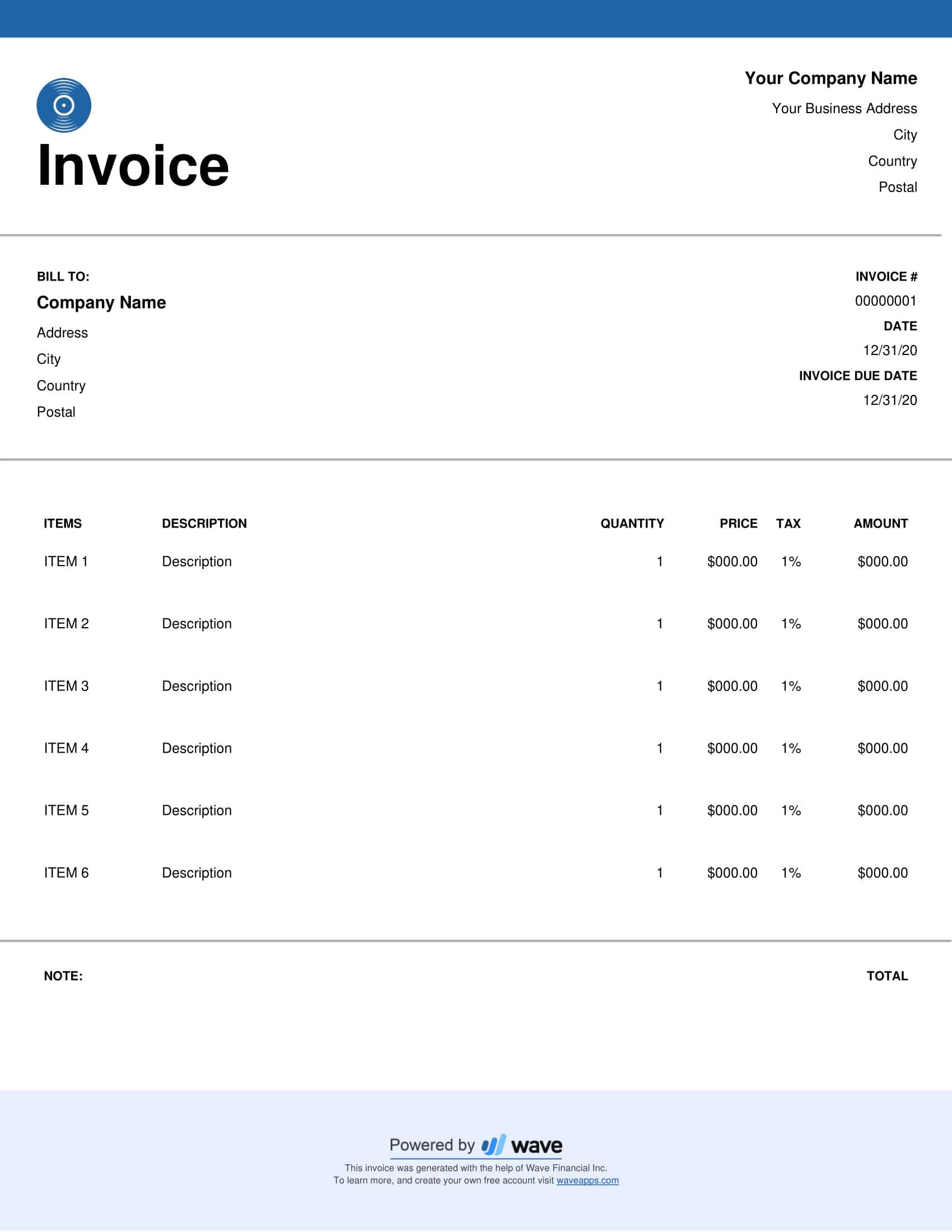

The DJ invoice template is a document used by mobile disc jockeys and DJ companies to bill clients for services. The template provides a clear format for outlining the services provided and fees charged.

The template contains sections to capture the DJ’s details, client information, invoice number, date, payment terms, and an itemized list of services rendered. Details include event dates, descriptions of services like music performance, equipment rentals, lighting, and amount due. Calculations are done for subtotal, taxes, discounts, and total balance owed.

Overall, the DJ invoice template allows DJs to quickly generate professional invoices to get paid for events worked. The organized structure clearly communicates the charges to clients. Having an on-hand template brings consistency to invoicing regular clientele. DJs can customize the template by adding their branding, services, and payment details. This enables efficiently billing for music performance, equipment rentals, and other services.

Benefits Of Using a DJ Invoice Template

Using a DJ invoice template offers several benefits, both for the DJ as a service provider and the client receiving the service. Here are some of the notable benefits:

- Professional Appearance: An invoice template gives a DJ a professional image. When a client sees a well-organized invoice, it enhances the perception of the DJ as a business professional.

- Time-saving: Instead of creating an invoice from scratch each time, DJs can quickly fill in the necessary details on a template. This can significantly speed up the billing process.

- Standardization: Using a template ensures that all invoices have the same format. This makes it easier for DJs to keep track of their invoicing and for clients to understand the bill they receive.

- Clarity: A good invoice template will clearly list out the services provided, the cost for each service, the total amount, any taxes applied, payment terms, and more. This transparency reduces the risk of misunderstandings or disputes.

- Branding: Customizable templates allow DJs to incorporate their branding elements, like logos or color schemes, which helps in reinforcing their brand identity.

- Record Keeping: Using a consistent invoice template makes it easier to maintain and organize records for accounting and tax purposes.

- Legal Compliance: Many regions have legal requirements about what must be included on an invoice. Using a template can ensure that all necessary elements (like tax numbers or business registration details) are consistently present.

- Prompt Payments: A clear and professional invoice can encourage timely payments. If clients understand what they’re being charged for and see a structured, easy-to-read invoice, they are more likely to pay promptly.

- Reduction of Errors: Pre-filled fields or drop-down options in certain electronic templates can reduce the chances of making errors. Also, having a consistent format ensures you don’t forget to include essential details.

- Customization: Most invoice templates allow for customization. So, while they provide a basic structure, DJs can still tailor them to fit specific needs or preferences.

- Integration with Other Tools: Many digital invoice templates can be integrated with accounting software or client management tools, streamlining the whole process of billing, tracking, and accounting.

- Environmentally Friendly: Digital invoice templates reduce the need for paper invoices, which is a more eco-friendly approach, especially if a DJ has a significant number of clients.

What Should A DJ Invoice Template Include?

Creating a detailed, professional DJ invoice ensures you receive proper payment for services while clearly communicating fees and expectations to clients. But knowing what to include on a DJ invoice template can be challenging. You want to provide all relevant details without creating an overly complicated or confusing document.

There are several important elements that should be incorporated into any well-designed DJ invoice template. By covering these key details, your invoice will paint a complete picture of the services provided and payments owed.

Here are the main elements that a DJ invoice template should include:

- DJ/Business Name and Contact Info – List your or your business name, address, phone, email, website, etc.

- Client Name and Contact Info – Include the client’s billing details.

- Invoice Number – Each invoice should have a unique number for tracking.

- Invoice Date – The date the invoice is created/sent.

- Event Details – Date, location, venue, type of event performed.

- Itemized Fees – Breakdown of all DJ service fees, equipment fees, travel fees etc. with line totals.

- Taxes – Any relevant taxes on services provided.

- Total Amount Due – The total of all itemized fees and taxes.

- Payment Terms – Such as due date, late fees, payment methods accepted.

- Remittance Info – Where and how payments should be sent.

- DJ Signature/Approval – Sign off on the invoice issuance.

How To Create A DJ Invoice?

Creating a DJ invoice requires capturing essential details about your services, the event, and the agreed-upon payment terms. Here’s a step-by-step guide to help you create an effective DJ invoice:

Step 1: Choose a Suitable Template or Software

Before starting, decide whether you want to use an invoice template available in programs like Microsoft Word or Excel, or invest in specialized invoicing software. Software solutions, especially those designed for freelancers or small businesses, can simplify the invoicing process by saving client information, automating calculations, and setting up payment gateways. If you opt for a template, choose one that looks professional and offers clear sections for all necessary details.

Step 2: Insert Your Personal and Business Information

At the top of the invoice, include your name or your DJ business name, if applicable. Also, list your address, phone number, email address, and any other relevant contact information. If you have a logo, place it prominently at the top. This personalization not only adds professionalism but also makes it easier for your clients to identify and contact you.

Step 3: Include Client Details

Below your information, specify details about your client. This typically includes their name or the name of the organization hiring you, their address, contact number, and email. By clearly listing client details, you ensure that the invoice reaches the correct person, and you establish a record of who was billed for the services.

Step 4: Assign a Unique Invoice Number and Date

Each invoice should have a unique number to help you and your client track payments and services. This number can be sequential or based on a system that you devise. Also, include the date when the invoice is issued. If you’re offering payment terms (like “due within 30 days”), the date will help determine the payment deadline.

Step 5: Detail Your Services

List the services you provided during the event. This could include music mixing, equipment rental, lighting, or any other additional services. For each service, provide a brief description, the rate (hourly or flat), the number of hours/days, and the total cost. Make sure everything is clear to avoid confusion or disputes.

Step 6: Mention Additional Costs

If there are other expenses that the client needs to cover, such as travel expenses, accommodation, or special equipment rentals, list these separately. Provide a brief description and the amount for each.

Step 7: Calculate and Present the Total Amount

After detailing all your services and additional costs, calculate the total amount due. If you’ve received a deposit or advance payment, mention it and subtract it from the total to show the remaining balance.

Step 8: Specify Payment Terms

Clearly outline your payment terms, such as how many days the client has to pay the invoice (e.g., “Due within 30 days”). Also, mention acceptable payment methods, like cash, check, bank transfer, or online payment platforms. If there are any penalties for late payment, be sure to include that information.

Step 9: Add a Personal Touch

Consider adding a brief thank you note at the bottom of your invoice. This gesture can foster a positive relationship with your client and encourage timely payments.

Step 10: Review and Send

Before sending out your invoice, review it to ensure all details are accurate. Any errors could lead to disputes or delays in payment. Once reviewed, send the invoice to your client. Depending on your agreement, this could be via email, post, or handed in person.

Sending your DJ invoice

Here are some tips on the optimal timing for sending DJ invoices to clients:

Send Immediately After the Event

Ideally, DJ invoices should be sent to clients very soon after completing an event, such as within a few days. Sending the invoice promptly while the performance is still fresh in the client’s mind helps securely lock in payment. The faster a DJ gets their invoice in, the higher chance the client processes payment before other vendors.

Allow Time for Client Approval

While promptness is important, invoices should not be sent until after the client has signed off on all final details like hours worked or additional equipment rented. Sending an invoice too hastily before finalizing all charges can cause confusion and delays.

Outline Payment Due Date

The invoice should clearly state the payment due date, typically net 15 or net 30 days from the invoice date. This sets clear payment expectations while giving reasonable time for processing. Follow up closer to the due date if unpaid.

Avoid Month End Rush

Some clients are on monthly billing cycles and can get inundated at month end. If possible, time the invoice submission to avoid getting lost in an invoice backlog. Mid-month invoicing improves visibility.

Use Reminders Judiciously

If nearing the due date with no payment, a friendly reminder is appropriate. But take care not to badger clients with excessive, premature notices as this can damage the relationship.

Invoicing Tips for DJ Services

Proper invoicing is crucial for any profession, including DJs, to ensure smooth transactions and maintain professionalism. Here are some invoicing tips and best practices tailored for DJ services:

1. Stay Organized:

- Use a consistent numbering system for your invoices. This helps track payments and manage your financial records.

- Organize your invoices in a systematic way, either digitally or in a physical folder, so you can easily access them when needed.

2. Be Clear and Detailed:

- Specify exactly what the client is being charged for. This could include music mixing, equipment rental, setup time, or travel expenses.

- Offer a brief description for each service to avoid any ambiguity.

3. Set Clear Payment Terms:

- Clearly indicate your payment terms, such as “Due within 15 days” or “Payment upon receipt.”

- If you offer early payment discounts or impose late fees, ensure these are prominently displayed.

4. Offer Multiple Payment Options:

- The easier you make it for clients to pay, the faster you’re likely to get your money. Consider accepting payments via credit card, bank transfer, digital wallets, or other online platforms.

5. Promptly Send Your Invoice:

- Don’t wait for weeks after the event to send the invoice. Ideally, send it within a day or two post-event, so the services are fresh in the client’s mind.

6. Use Professional Software:

- Consider investing in invoicing software. This can automate several aspects of the process, provide templates, and help track payments and overdue invoices.

7. Personalize Your Invoices:

- Adding a logo and using a professional design reflects positively on your brand. It also ensures the client remembers who you are.

8. Stay Proactive with Follow-ups:

- If the payment deadline is nearing and you haven’t received payment, send a gentle reminder. This can be done via email, phone, or a messaging platform. A reminder often prompts clients who might have overlooked or forgotten the invoice.

9. Maintain Transparency:

- If there are any potential extra charges that might arise (e.g., overtime fees), make sure to discuss these with the client beforehand and mention them in the invoice.

10. Build Relationships:

- A simple “Thank you for your business” at the bottom of your invoice can go a long way in fostering positive client relationships. Clients are more inclined to work with and recommend DJs they have a positive relationship with.

11. Secure Deposits When Necessary:

- For bigger events or new clients, it’s not uncommon to ask for a deposit upfront. This ensures you’re compensated for initial costs and reduces the risk of non-payment.

12. Keep Digital Backups:

- Even if you work with paper invoices, always have a digital backup. This is useful for referencing, sharing, and in case of any physical document loss.

13. Clearly Indicate Paid Invoices:

- Once a client has paid, either mark the invoice as “PAID” or send a receipt. This reduces confusion and disputes down the line.

14. Stay Open to Feedback:

- If a client has suggestions or feedback regarding your invoicing, be open to it. Continuous improvement is beneficial for both parties.

Conclusion

After completing a successful music performance, receiving fair payment is contingent on sending clients a clear, professional invoice. As a busy DJ, creating invoices from scratch can be a hassle. Our free printable DJ invoice templates save you time while providing polished documents to send clients. These templates allow DJs to quickly customize invoices with event details, fees, and payment terms.

We provide the templates in multiple formats like Word, Excel, and PDF for flexibility. With ready-to-use DJ invoices, you can submit billing details to clients promptly and efficiently. Simply download our free DJ invoice templates, input your specifics, and send to get paid faster. Be sure to outline payment timelines and follow up near due dates for best results. With professional templates, DJs can spend less time invoicing and more time mixing great music.

FAQs

Can I charge a deposit on my DJ invoice?

Yes, it’s common for DJs to charge an upfront deposit, especially for larger events or new clients. This deposit should be mentioned in the invoice, with the remaining balance clearly indicated.

What if the client doesn’t pay by the due date?

If the client misses the due date, you can send a friendly reminder. It’s essential to establish clear payment terms initially and mention any late fees or interest that might accrue if the payment is delayed.

Do I need special software to create a DJ invoice?

While there are many invoicing software options available that can make the process more streamlined, you don’t necessarily need them. DJ invoices can also be created using templates in programs like Microsoft Word or Excel.

How do I handle additional expenses that weren’t previously agreed upon?

Any additional costs or changes in services should be communicated to the client as soon as they arise. Once the client agrees, you can include these in the final invoice. Transparency is crucial to maintain trust.

Can I send electronic invoices?

Yes, electronic invoicing is becoming more popular due to its convenience. You can send invoices via email or through various online platforms, many of which also allow clients to make payments directly.

Should I keep copies of my invoices?

Absolutely! Keeping copies, whether digital or physical, is essential for tracking payments, resolving disputes, and maintaining financial records for tax purposes.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Landscaping Invoice Templates [PDF, Word with Examples] 3 Landscaping Invoice](https://www.typecalendar.com/wp-content/uploads/2023/03/Landscaping-Invoice-150x150.jpg)