At various points in time, you may find yourself needing to move money between different banks. This could involve transferring funds from one of your accounts to another account held with a different financial institution, or even sending money to someone else’s account at another bank. Several methods can facilitate this process, such as writing a check, utilizing a third-party service, or conducting a wire transfer.

Among these options, wire transfers are often the preferred choice for individuals and businesses seeking a quick and efficient money transfer. To ensure a seamless wire transfer experience, it’s essential to gather comprehensive information about the recipient. By completing a wire transfer request form, you’ll provide the necessary instructions to facilitate the transaction.

Table of Contents

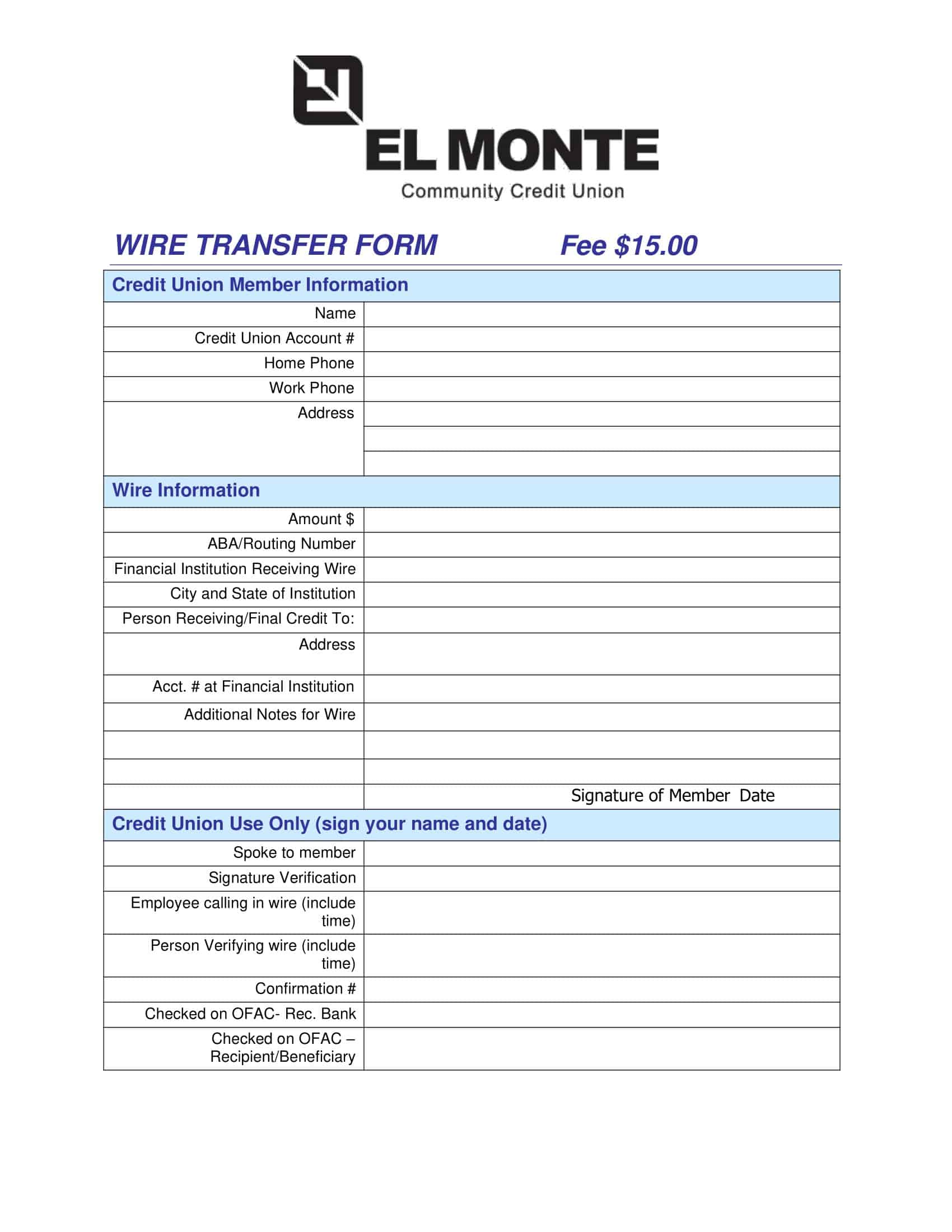

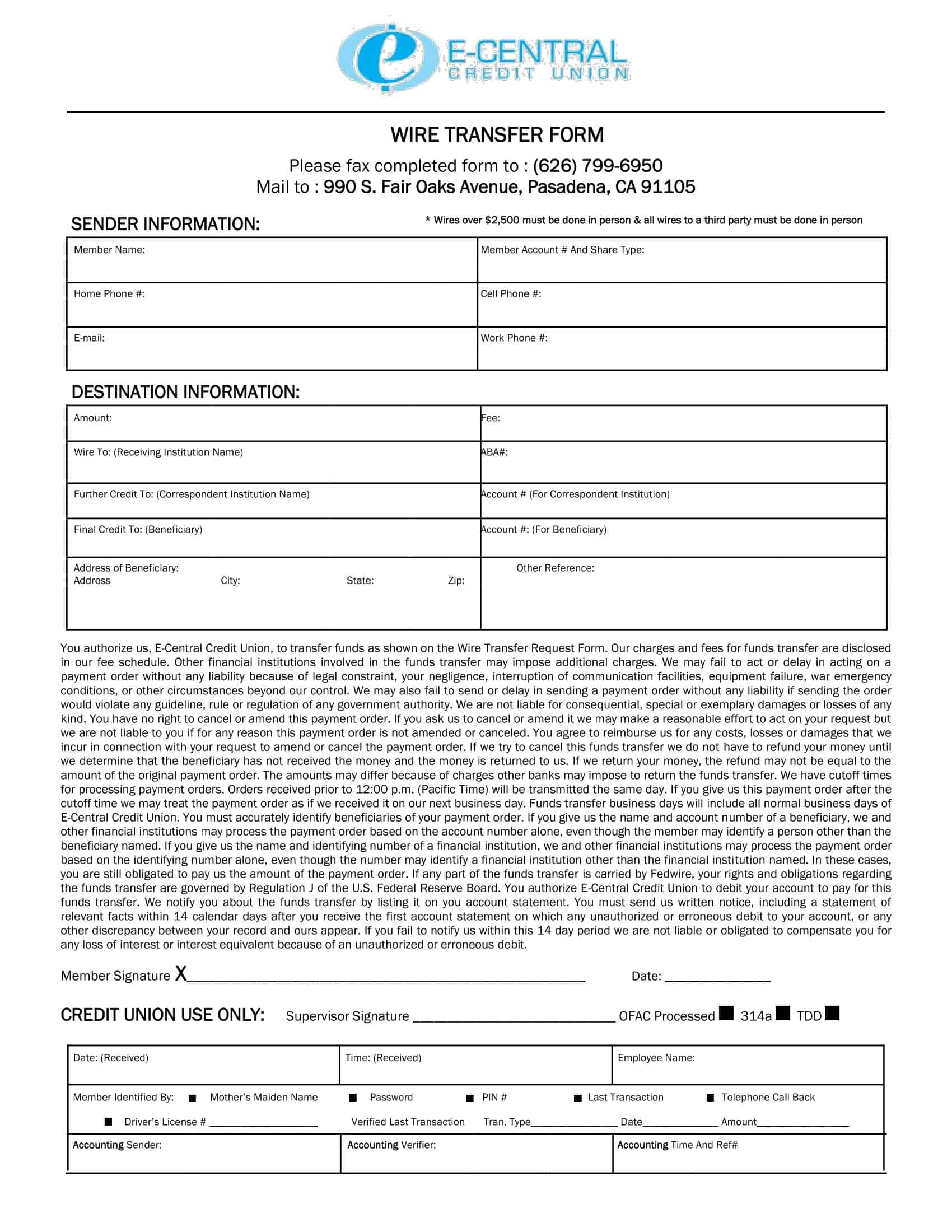

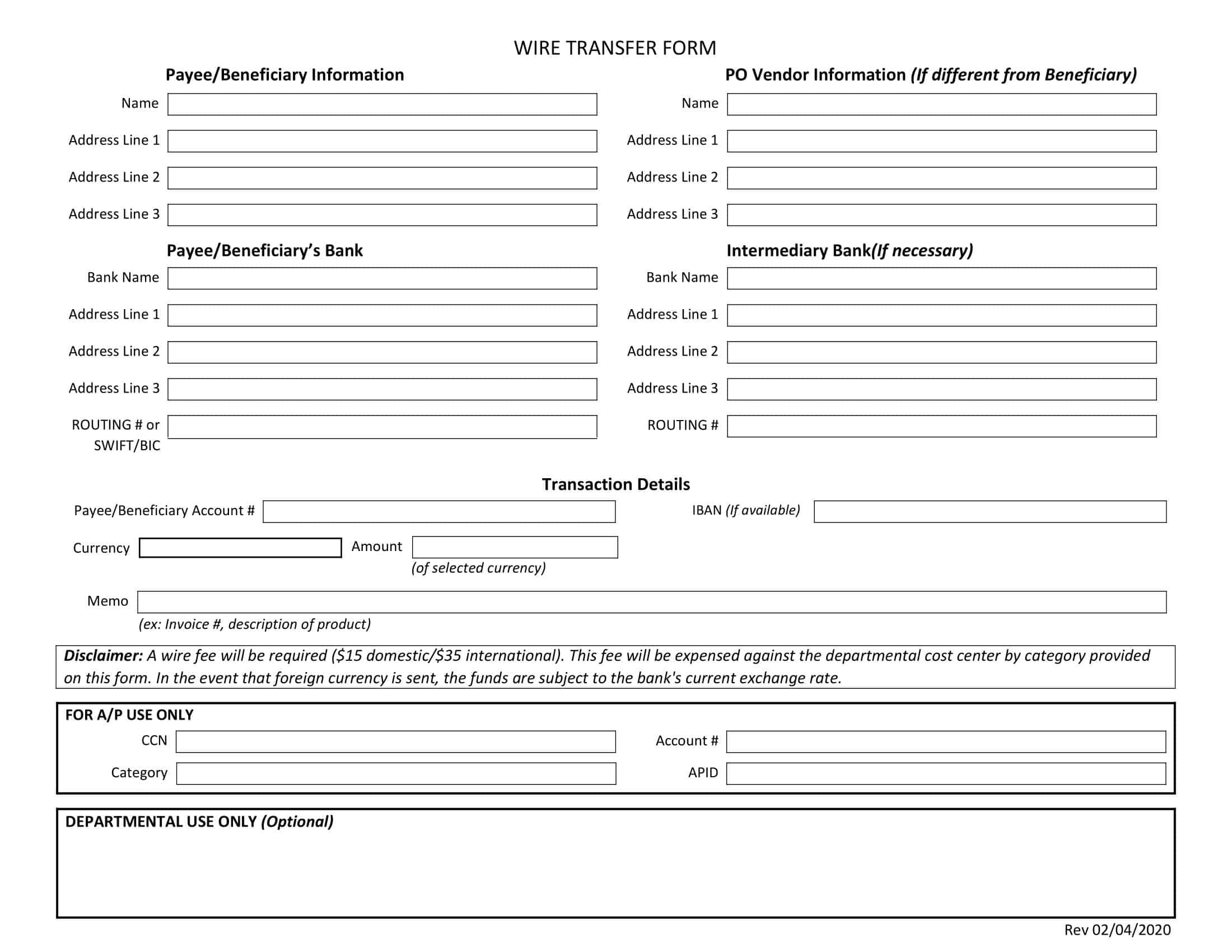

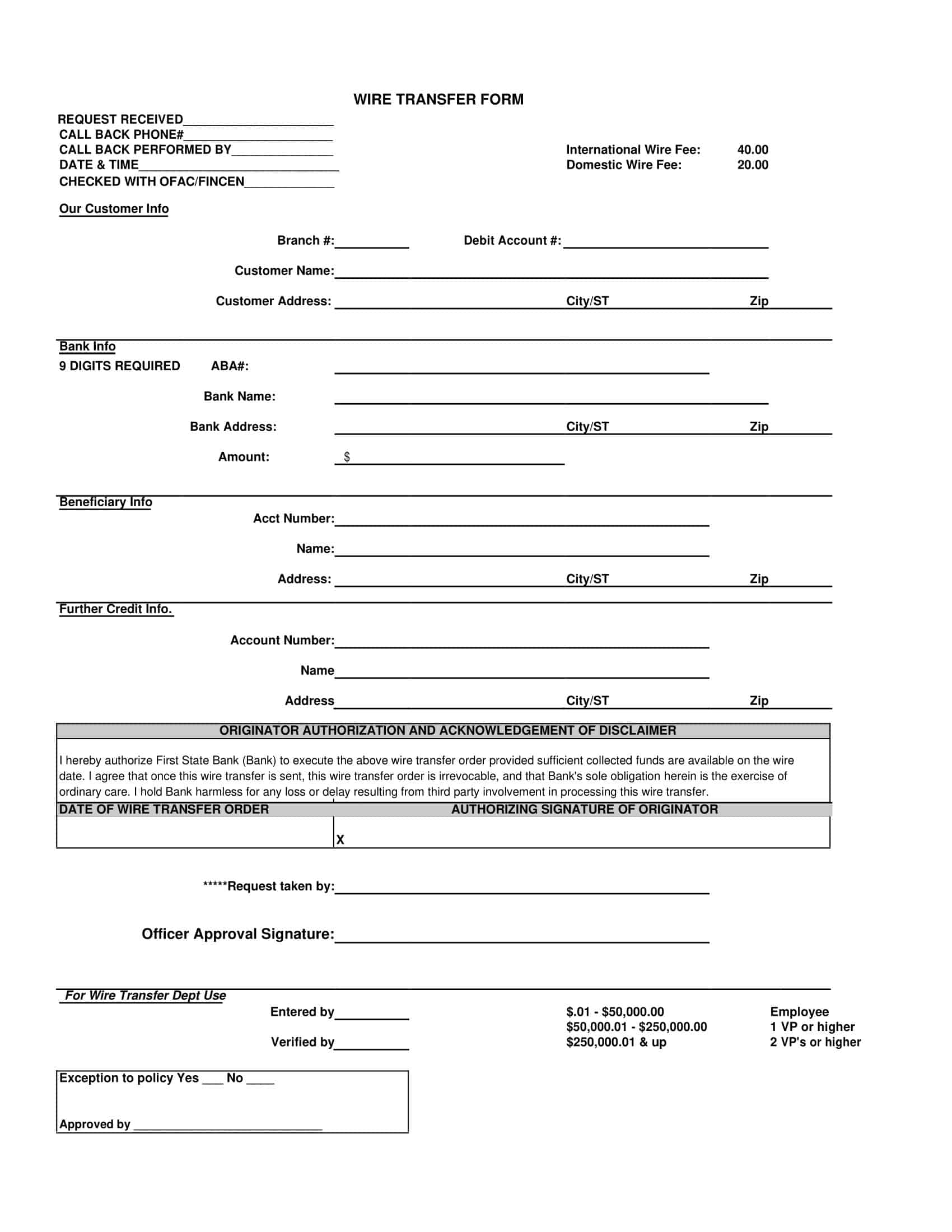

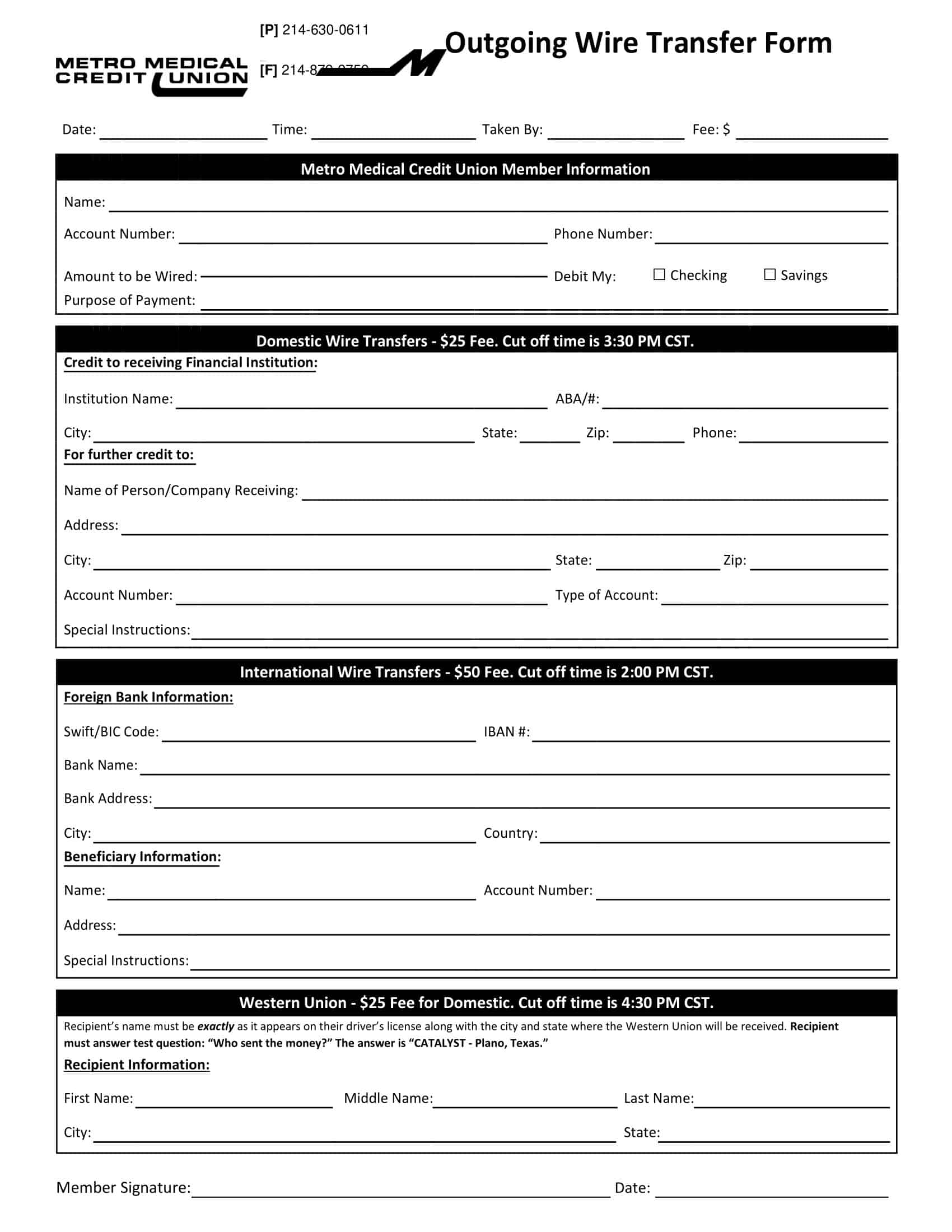

Wire Transfer Form Templates

Wire Transfer Form Templates are standardized documents used by individuals and businesses to facilitate the seamless transfer of funds between bank accounts. These templates serve as a framework for capturing and organizing essential information required for wire transfers, ensuring accuracy, compliance, and efficiency throughout the process.

Wire Transfer Form Templates offer a standardized and systematic approach to streamline the process of initiating wire transfers. They eliminate the need for individuals to create transfer instructions from scratch, reducing the chances of errors and omissions. Moreover, these templates ensure that all the necessary information is provided in a consistent format, allowing banks and financial institutions to process the transfer swiftly and accurately.

These templates can be obtained from banks, financial institutions, or online platforms that offer banking-related resources. They are often available in both physical and digital formats, providing flexibility for users to choose the most convenient option. Many templates are customizable, enabling users to incorporate their organization’s branding or tailor the form to their specific requirements.

By utilizing wire transfer form templates, individuals and businesses can simplify and expedite the process of transferring funds securely and reliably. These templates promote adherence to compliance regulations, mitigate the risk of errors, and provide a structured framework for effective communication between senders, beneficiaries, and financial institutions involved in the transfer process.

What is a wire transfer request form?

A wire transfer request form is a document used by individuals or businesses to initiate a wire transfer between banks or financial institutions. This form provides the necessary instructions and information required to transfer funds from one bank account to another securely and efficiently.

Typically, a wire transfer request form includes details such as the sender’s name, account number, and contact information, the recipient’s name, account number, and bank routing number, as well as the amount to be transferred and any additional instructions or notes. By filling out and submitting this form to the sending bank, the person or entity initiating the transfer authorizes the bank to process the transaction and transfer the specified funds to the designated recipient’s account.

Types of wire transfers

Wire transfers are electronic transfer of funds from one bank or financial institution to another, either domestically or internationally. They are a fast, secure, and reliable method of transferring money. There are several types of wire transfers, including:

Domestic Wire Transfers: These transfers occur between financial institutions within the same country. Domestic transfers are generally faster and less expensive than international transfers.

International Wire Transfers: These transfers involve sending money from one country to another. They typically take longer to process and incur higher fees due to exchange rates and additional intermediary banks involved.

SWIFT Transfers: SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging network that facilitates international wire transfers. SWIFT transfers use a standardized system of codes to transmit information between financial institutions.

SEPA Transfers: SEPA (Single Euro Payments Area) transfers are a standardized method of transferring money within the European Union (EU) and a few other European countries. SEPA transfers are designed to be fast, secure, and cost-effective.

ACH Transfers: ACH (Automated Clearing House) transfers are a type of domestic wire transfer in the United States. These transfers are usually less expensive and slower than traditional wire transfers, as they are processed in batches rather than individually.

CHAPS Transfers: CHAPS (Clearing House Automated Payment System) is a UK-based system for transferring large amounts of money between financial institutions. CHAPS transfers are typically used for high-value transactions and are processed in real-time.

Fedwire Transfers: Fedwire is a real-time gross settlement system operated by the United States Federal Reserve Banks. This system facilitates high-value domestic wire transfers between participating banks in the United States.

RTGS Transfers: RTGS (Real-Time Gross Settlement) transfers are a type of wire transfer system used in various countries, such as India (RTGS – Reserve Bank of India) and the United Kingdom (CHAPS). RTGS transfers are processed in real-time and are used for high-value transactions.

Wire Transfer – Overview – How it works

A wire transfer is a method of electronically transferring funds from one bank or financial institution to another. The process typically involves the following steps:

Initiation

The sender initiates the wire transfer by providing the necessary information to their bank. This information includes the recipient’s name, account number, bank name, and bank routing number or SWIFT code (for international transfers).

Verification

The sender’s bank verifies the provided information and may ask for additional identification or authorization, depending on the bank’s policies and the transaction’s size.

Transmission

Once the sender’s bank has verified the information, it sends a secure electronic message to the recipient’s bank using a financial messaging network (e.g., SWIFT for international transfers). This message contains the transfer details, including the amount to be transferred and the recipient’s account information.

Intermediary banks (if applicable)

In some cases, especially for international wire transfers, one or more intermediary banks are involved in the transaction. These banks facilitate the transfer by forwarding the transaction message to the recipient’s bank.

Intermediary banks may charge additional fees for their services.

Receipt

The recipient’s bank receives the electronic message, verifies the transaction details, and deposits the funds into the recipient’s account. In some cases, the recipient’s bank may also verify the recipient’s identity before releasing the funds.

Confirmation

Once the funds have been deposited into the recipient’s account, both the sender and the recipient may receive confirmation from their respective banks, either through a notification or by checking their account statements.

The entire process typically takes a few hours to a few days, depending on the banks involved, the type of wire transfer, and the time it takes for banks to process the transaction. Domestic wire transfers are generally faster than international transfers, which can take longer due to differences in time zones, additional verification steps, and intermediary banks.

Structure of Domestic and International Wire Transfer Form Templates

A domestic wire transfer form template and an international wire transfer form template may differ slightly in the information required, as international transfers typically involve additional details to ensure a smooth transaction across borders. Here’s what each form template might look like:

Domestic Wire Transfer Form Template:

Sender’s Information:

- Name

- Account Number

- Address

- Phone Number

- Email Address (optional)

Recipient’s Information:

- Name

- Account Number

- Bank Name

- Bank Address

- Bank Routing Number (ABA)

Transfer Details:

- Transfer Amount

- Transfer Date

- Transfer Purpose or Description (optional)

- Additional Instructions (if applicable)

Fees and Charges:

- Wire Transfer Fee (if applicable)

Authorization:

- Sender’s Signature

- Date

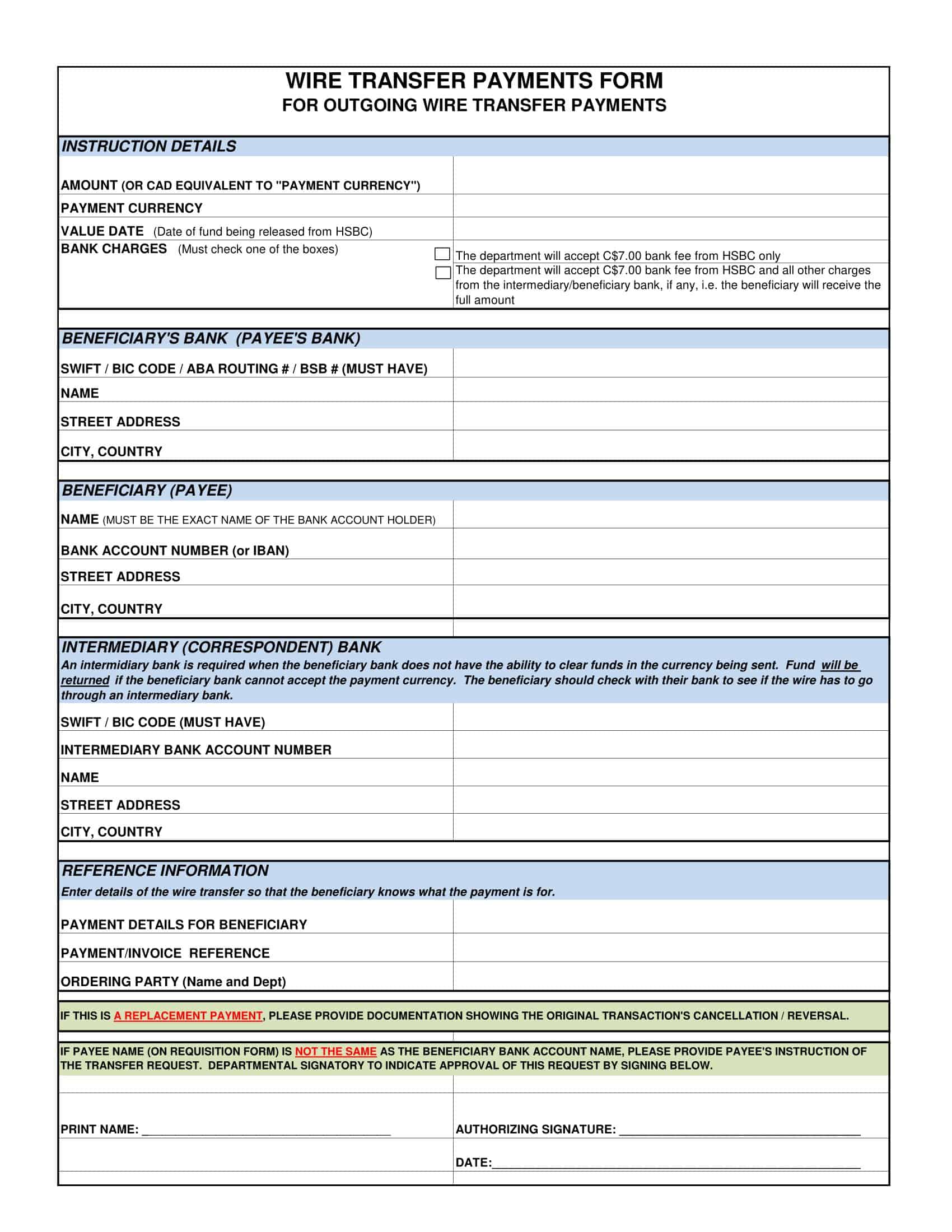

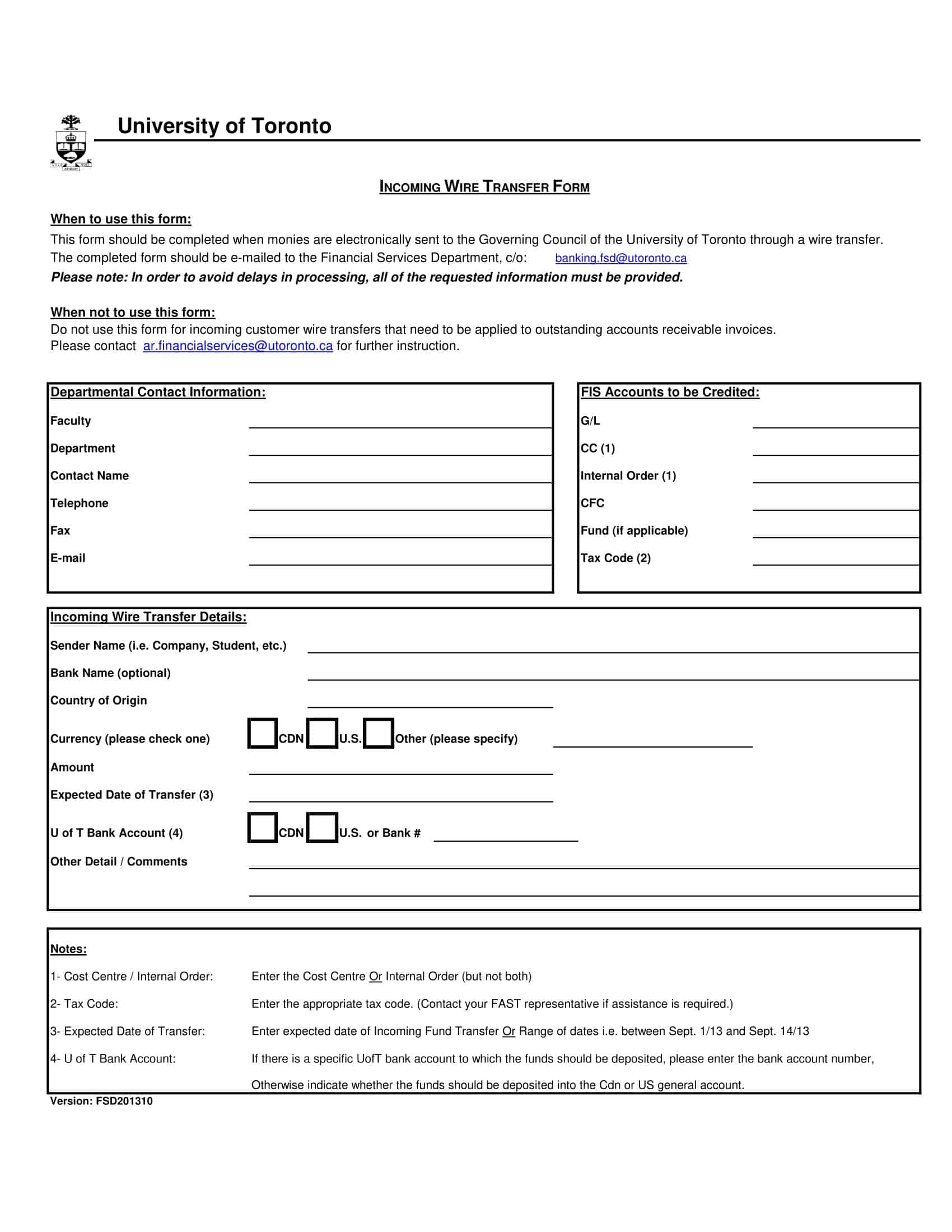

International Wire Transfer Form Template:

Sender’s Information:

- Name

- Account Number

- Address

- Phone Number

- Email Address (optional)

Recipient’s Information:

- Name

- Account Number

- Bank Name

- Bank Address

- Bank SWIFT/BIC Code

- IBAN (for European transfers)

Correspondent/Intermediary Bank Information (if applicable):

- Bank Name

- Bank Address

- Bank SWIFT/BIC Code

Transfer Details:

- Transfer Amount

- Transfer Currency

- Exchange Rate (if applicable)

- Transfer Date

- Transfer Purpose or Description (optional)

- Additional Instructions (if applicable)

Fees and Charges:

- Wire Transfer Fee (if applicable)

- Correspondent/Intermediary Bank Fees (if applicable)

Authorization:

- Sender’s Signature

- Date

It is essential to note that different banks and financial institutions may have their own wire transfer form templates with additional or slightly different fields. Some banks may also require that you fill out these forms online or through their mobile app, while others may still accept paper forms. Always check with your specific bank for their requirements and guidelines.

How Safe is a Wire Transfer?

Wire transfers are generally considered safe and secure methods of transferring money between banks or financial institutions. However, it is crucial to be aware of potential risks and take precautions to ensure the safety of your transactions. Here are some reasons why wire transfers are considered safe and some potential risks:

Safety Features of Wire Transfers

Encryption and secure messaging: Wire transfers use encrypted electronic messages to transmit transaction details between banks, making it difficult for unauthorized parties to intercept or access this information.

Verification and authentication: Banks typically require verification of the sender’s identity and authorization before initiating a wire transfer. This process helps ensure that only authorized individuals can send funds.

Bank-to-bank communication: Since wire transfers occur between banks, they are subject to the security measures and regulatory oversight of the participating financial institutions.

Limited reversibility: Once a wire transfer has been completed, it is difficult to reverse, which can protect the sender from chargebacks or fraudulent transactions.

Potential Risks and Precautions

Fraud and scams: Scammers may use various tactics to trick people into sending wire transfers, such as impersonating a friend or family member in need or posing as a legitimate business. To protect yourself, verify the recipient’s identity and legitimacy before sending a wire transfer.

Human error: Providing incorrect account or routing numbers may result in the wire transfer being sent to the wrong account. Double-check all information before initiating a wire transfer.

Lack of transaction protection: Unlike credit card transactions, wire transfers do not generally offer built-in protection for disputes or unauthorized transactions. Ensure you trust the recipient and have verified their information before sending a wire transfer.

Phishing and cyberattacks: Cybercriminals may attempt to gain access to your bank account information through phishing emails or other malicious tactics. Be cautious when clicking on links in emails or entering your bank account information online.

In conclusion, wire transfers are generally safe, but it is essential to take precautions and be vigilant about potential risks. Always verify the recipient’s information, avoid sharing your banking details with untrusted parties, and monitor your bank account for suspicious activity.

Essential Documentation for Wire Transfer Transactions

When it comes to wire transfers, the required documentation may vary depending on the amount of money involved and the source of funds. For smaller amounts, banks and nonbank wire transfer institutions typically do not request supporting documents. However, when larger amounts are involved, you may be required to provide proof of how you acquired the funds.

The primary reason for requesting documentation during wire transfers is to prevent fraud and comply with local and international anti-money laundering laws. Most financial institutions will ask for documentation when the transfer amount exceeds $10,000. The required documents will depend on the source of the funds, which may include:

- Property sale contract

- Asset sale agreement

- Brokerage commission agreement

- Salary slips

- Inheritance letters

- Loan approval documents

- Grant letters

Below are examples of documents required for various sources of funds:

Documents for Property Sale

If the funds are from a property sale, such as land or a house, you will be required to provide the following information:

- Date of transaction

- Value of transaction

- Signed documents by both parties

- Address of the property sold

- Detailed description of the property sold

- Duration of property ownership

The required documents may include:

- Property register copies

- A letter from a solicitor or auditor

- Bank statement showing the received funds

- Sales contract signed by both buyer and seller

- Documents for Loan Proceeds

If the funds are from a loan, you need to provide the following information:

- Total borrowed amount

- Date when the funds were transferred

- Name and address of the lending institution or individual

- Reason for borrowing

Provide the following documents:

- Copies of the loan agreement

- Loan statement (for at least the last three months)

- Bank statement showing the received funds

- Documents for Business Profits

If the funds are from your business operations, provide the following information:

- Name of your business

- Dates of transactions

- Amounts involved in each transaction

- Names of clients

- Recipient name

Provide the following documents:

- Bank statements for the last three months

- Documents for Investment Income

If the funds are from an investment, provide the following information:

Investment type

Parties involved

Amount involved

Signed documents between parties

In conclusion, the required documents for a wire transfer may vary depending on the amount involved and the source of funds. It is essential to be prepared with the necessary documents to ensure a smooth and compliant wire transfer process. Always check with your specific financial institution for their requirements and guidelines.

Filling Out a Wire Transfer Form(A Step-by-Step Guide)

Filling out a wire transfer form may seem daunting, but it’s a simple process once you know the required information. Follow this step-by-step guide to ensure a smooth and error-free wire transfer experience.

Step 1: Gather necessary information

Before filling out the form, gather the following information:

- Your personal information (name, address, phone number, email)

- Your bank account number

- Recipient’s name and address

- Recipient’s bank account number

- Recipient’s bank name and address

- Recipient’s bank routing number (ABA) for domestic transfers or SWIFT/BIC code for international transfers

- Intermediary bank details (if applicable)

- Transfer amount and currency

- Purpose of the wire transfer (optional)

Step 2: Obtain a wire transfer form

Visit your bank’s website or local branch to obtain a wire transfer form. Some banks may offer an online form or mobile app to initiate the transfer.

Step 3: Fill out sender’s information

Complete the sender’s information section with your personal details, such as your name, address, phone number, email, and bank account number.

Step 4: Fill out recipient’s information

Fill in the recipient’s information, including their name, address, bank account number, bank name, and bank address. For domestic transfers, provide the bank routing number (ABA), while for international transfers, include the SWIFT/BIC code. If the recipient’s bank requires an IBAN (International Bank Account Number), include that as well.

Step 5: Provide intermediary bank details (if applicable)

If an intermediary bank is involved in the transfer, particularly for international transactions, provide the bank’s name, address, and SWIFT/BIC code.

Step 6: Fill out transfer details

Enter the transfer amount, currency, and desired transfer date. You may also include a description or purpose for the wire transfer (optional) and any additional instructions, if necessary.

Step 7: Review fees and charges

Review the wire transfer fees and charges associated with the transaction. These fees may vary depending on your bank, transfer type, and amount. Make sure you understand and agree to these charges before proceeding.

Step 8: Sign the form and submit

Review the information you’ve entered on the form to ensure accuracy. Once you’re confident everything is correct, sign and date the form. Submit the completed form to your bank, either in person, online, or through the bank’s mobile app, depending on your bank’s requirements.

Step 9: Keep a copy for your records

Retain a copy of the completed wire transfer form and any confirmation or receipt provided by your bank for your records.

Step 10: Monitor your account

Monitor your bank account and check for any notifications or confirmations from your bank regarding the wire transfer. Contact the recipient to confirm receipt of funds once the transfer is complete.

Important Terms about Wire Transfer

Here are some common terms and definitions related to wire transfers:

SWIFT (Society for Worldwide Interbank Financial Telecommunication): SWIFT is a global network that enables financial institutions to securely send and receive information about financial transactions. It facilitates the exchange of standardized financial messages between banks and other financial institutions worldwide.

BIC (Bank Identifier Code): BIC, also known as the SWIFT code, is a unique code used to identify a specific bank in international transactions. It consists of 8 or 11 characters, including a combination of letters and numbers, and helps route the wire transfer to the correct recipient bank.

IBAN (International Bank Account Number): IBAN is an internationally standardized system for identifying bank accounts across national borders. It is primarily used in European countries and consists of up to 34 alphanumeric characters, including the country code, check digits, bank code, and account number. IBAN is used to facilitate the processing of cross-border transactions and reduce the risk of transcription errors.

BSB (Bank State Branch): BSB is a unique 6-digit code used in Australia and New Zealand to identify the specific branch of a bank or financial institution. It is similar to the routing number in the United States and is used in domestic transactions to route funds to the correct bank and branch.

Intermediary Bank: An intermediary bank, also known as a correspondent bank, is a financial institution that facilitates the transfer of funds between two banks that do not have a direct relationship. Intermediary banks are often used in international wire transfers, where they act as an intermediary to ensure the funds reach the recipient’s bank. These banks may charge additional fees for their services.

ABA (American Bankers Association) Routing Number: The ABA routing number, also known as the bank routing number, is a 9-digit code used in the United States to identify the specific bank or financial institution involved in a transaction. It is used in domestic transactions to route funds to the correct bank.

Fedwire: Fedwire is a real-time gross settlement system operated by the United States Federal Reserve Banks. It enables financial institutions to electronically transfer funds within the United States, providing a secure and reliable method for domestic wire transfers.

CHAPS (Clearing House Automated Payment System): CHAPS is a same-day payment system in the United Kingdom that allows high-value, time-sensitive transfers between participating financial institutions.

SEPA (Single Euro Payments Area): SEPA is an initiative by the European Union that aims to harmonize electronic payments across the Eurozone. It allows for efficient, low-cost cross-border transfers within participating European countries.

Receiving Bank: The receiving bank, also known as the beneficiary bank, is the financial institution that holds the recipient’s account and receives the wire transfer funds on their behalf.

Wire Transfer Fees

The cost of a wire transfer can vary depending on several factors, such as the financial institution, transfer type (domestic or international), transfer amount, and the relationship between the sending and receiving banks. Here is a general overview of the costs associated with wire transfers:

Sending Bank Fees: The bank or financial institution initiating the wire transfer typically charges a fee for their services. These fees can range from $15 to $45 for domestic transfers and $30 to $65 for international transfers. Some banks may offer discounted fees for preferred customers or account holders with specific types of accounts.

Receiving Bank Fees: The receiving bank, also known as the beneficiary bank, may charge a fee for processing the incoming wire transfer. These fees can range from $0 to $25, depending on the bank and the type of account the recipient holds.

Intermediary Bank Fees: In some cases, especially for international wire transfers, an intermediary bank may be involved in facilitating the transaction. These intermediary banks may charge additional fees for their services, which can range from $10 to $30 or more.

Currency Conversion Fees: When sending money internationally, there may be currency conversion fees if the transfer involves exchanging one currency for another. Banks typically add a markup to the exchange rate, which can be around 1% to 3% of the transaction amount.

Additional Service Fees: Some banks may charge extra fees for additional services, such as expedited transfers, third-party fees, or initiating the transfer over the phone or in-person rather than online.

How Long Does a Wire Transfer Take?

The time it takes to complete a wire transfer depends on various factors, such as the type of transfer (domestic or international), the financial institutions involved, time zones, and the cut-off times for processing transactions. Below is a detailed guide outlining the general timeframes for wire transfers.

Domestic Wire Transfers

Domestic wire transfers typically take 1-2 business days to be completed. Factors that can influence the processing time include:

Cut-off times: Banks have specific cut-off times for processing wire transfers. If you initiate a transfer after the cut-off time, the transaction will be processed on the next business day.

Bank holidays: Wire transfers are not processed on bank holidays, which can lead to delays.

Verification procedures: Banks may take extra time to verify the details of a transaction, especially for large amounts or if they suspect fraudulent activity.

International Wire Transfers

International wire transfers generally take longer than domestic transfers, usually 3-5 business days, although they can take up to 7 business days or more in some cases. Factors affecting the processing time of international wire transfers include:

Intermediary banks: International wire transfers often involve intermediary banks, which can add extra processing time to the transaction.

Time zones: Differences in time zones between the sending and receiving banks can cause delays in processing wire transfers.

Currency conversion: When transferring funds in a different currency, the conversion process can add time to the transaction.

Regulatory requirements: International wire transfers are subject to various regulatory requirements, such as anti-money laundering and counter-terrorism financing checks, which can cause delays.

Bank holidays and weekends: Just like with domestic transfers, international wire transfers are not processed on bank holidays or weekends, leading to potential delays.

Tips to Expedite Wire Transfers:

Initiate the wire transfer early in the day and before the cut-off time to ensure it is processed on the same business day.

Double-check all the information, including account numbers, routing numbers, and recipient details, to avoid delays due to errors.

Use online or mobile banking services when possible, as they may have later cut-off times than in-person transactions.

Maintain clear communication with the recipient to ensure they provide accurate information and confirm receipt of funds.

Generally, the time it takes to complete a wire transfer depends on several factors, such as the type of transfer, the banks involved, and the cut-off times for processing. Domestic transfers typically take 1-2 business days, while international transfers can take 3-5 business days or longer. Following the tips above can help expedite the wire transfer process and ensure a smooth transaction.

Common Pitfalls to Steer Clear of When Completing a Wire Transfer Form

Be mindful of these common mistakes when filling out a wire transfer form to ensure a seamless transaction:

Misidentifying the destination country or city: Accurate destination details are crucial for a successful wire transfer. Double-check the country and city names to prevent any issues.

Neglecting the recipient’s bank address: Including the recipient’s bank address is essential for proper routing of the funds. Ensure you have the correct information.

Omitting the recipient’s bank name: The recipient’s bank name is a key piece of information. Confirm that you have entered it correctly.

Entering an incorrect account number for the recipient: An accurate account number is crucial for the funds to reach the intended beneficiary. Verify the account number before submitting the form.

Providing an incorrect SWIFT/IBAN code: The SWIFT or IBAN code is necessary for routing international wire transfers. Double-check the code to avoid routing issues.

Specifying an unsupported or incorrect foreign currency: Ensure that you choose a supported currency for the transfer and that it is correctly entered to prevent conversion or processing complications.

Even minor errors can lead to significant delays or failed transactions. For instance, an incorrect SWIFT code can result in funds being sent to the wrong country, making reversal extremely difficult or even impossible. To avoid such issues, always verify the information on your wire transfer form before submitting it.

FAQs

What is a wire transfer template?

A wire transfer template is a form that contains the fields and formats required to send a domestic or international wire transfer. Templates allow you to more easily fill out the key details like recipient name/address, bank names/addresses, routing/account numbers, and transfer amount. Some include sample text and instructions. Templates help ensure information completeness and accuracy.

How do I fill out a wire transfer form?

To fill out a wire transfer form, you need the receiving party’s full name and address, their bank name and address, the routing and account numbers, your account information, and the transfer amount. Enter the details clearly and double-check for accuracy. Sign and date the completed form. Your bank may require additional ID or documents depending on the amount.

What is the difference between a bank transfer and a wire transfer?

A bank transfer moves funds electronically between accounts at the same bank, while a wire transfer moves funds between accounts at different banks. Wire transfers send money more quickly, usually within 1-2 days domestically and 3-5 days internationally. They have higher fees but offer more security features. Bank transfers are slower with lower fees, taking 2-3 business days on average.

Is there a limit on Chase wire transfers for $25,000?

For personal Chase accounts, outbound domestic wire transfers between $3,000-$25,000 can be completed online or by phone/in-person with ID verification. Wires above $25,000 must be initiated at a Chase branch with additional ID and potential documentation. Limits vary by account type. There are also daily/monthly caps on transfer amounts unless previously arranged. International wires have different limits.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)