For medical practices, using a superbill template streamlines administrative tasks and billing. However, creating a customized superbill from scratch is time-consuming. This is where pre-made printable superbill templates come in handy! These templates allow you to instantly generate superbills tailored to your practice and needs.

In this article, we’ll explain what a superbill is and how practices use them for easier coding and billing. We’ll also provide free downloadable superbill templates in Word and Excel formats ready to customize with your codes and preferences. With these templates, medical offices, clinics, and individual providers can improve workflow efficiency related to claim submission. Say goodbye to hassling over superbill formatting and focus on patient care.

Table of Contents

What Is a Superbill?

A superbill is a form used by healthcare providers that lists common medical procedures, services, and diagnosis codes used in a practice. The superbill serves as a template containing preset codes that providers circle or check-off during patient visits to facilitate billing and submissions to insurance companies.

The selected codes correlate to the services rendered, diagnoses made, and orders placed for the patient. Superbills save time by eliminating the need to look up codes and fill out claim forms for every encounter. Providers simply select the relevant codes on the superbill for expedited charge capture, insurance filing, and practice analytics. Customized to each provider, superbills are an invaluable administrative tool for streamlining visits and billing in medical practices.

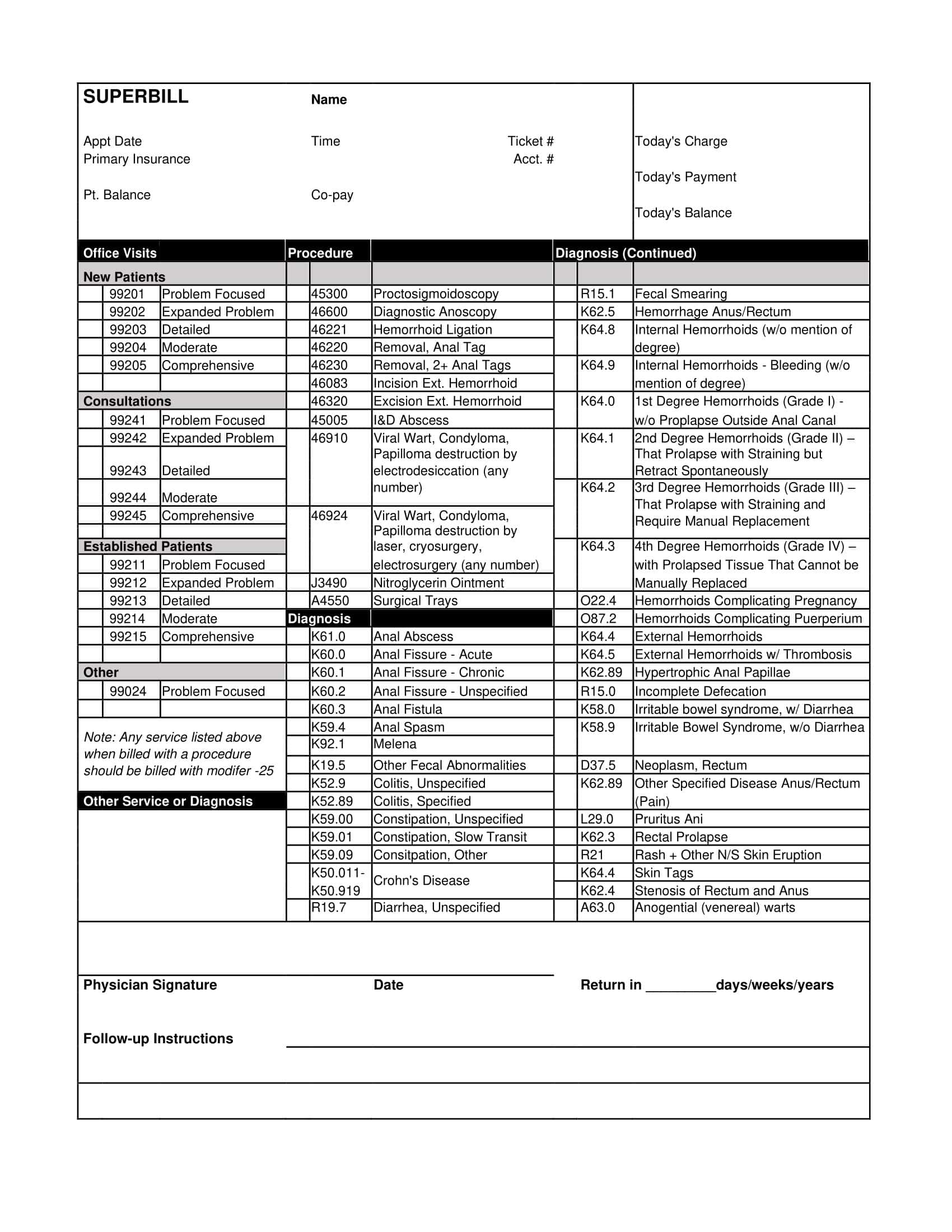

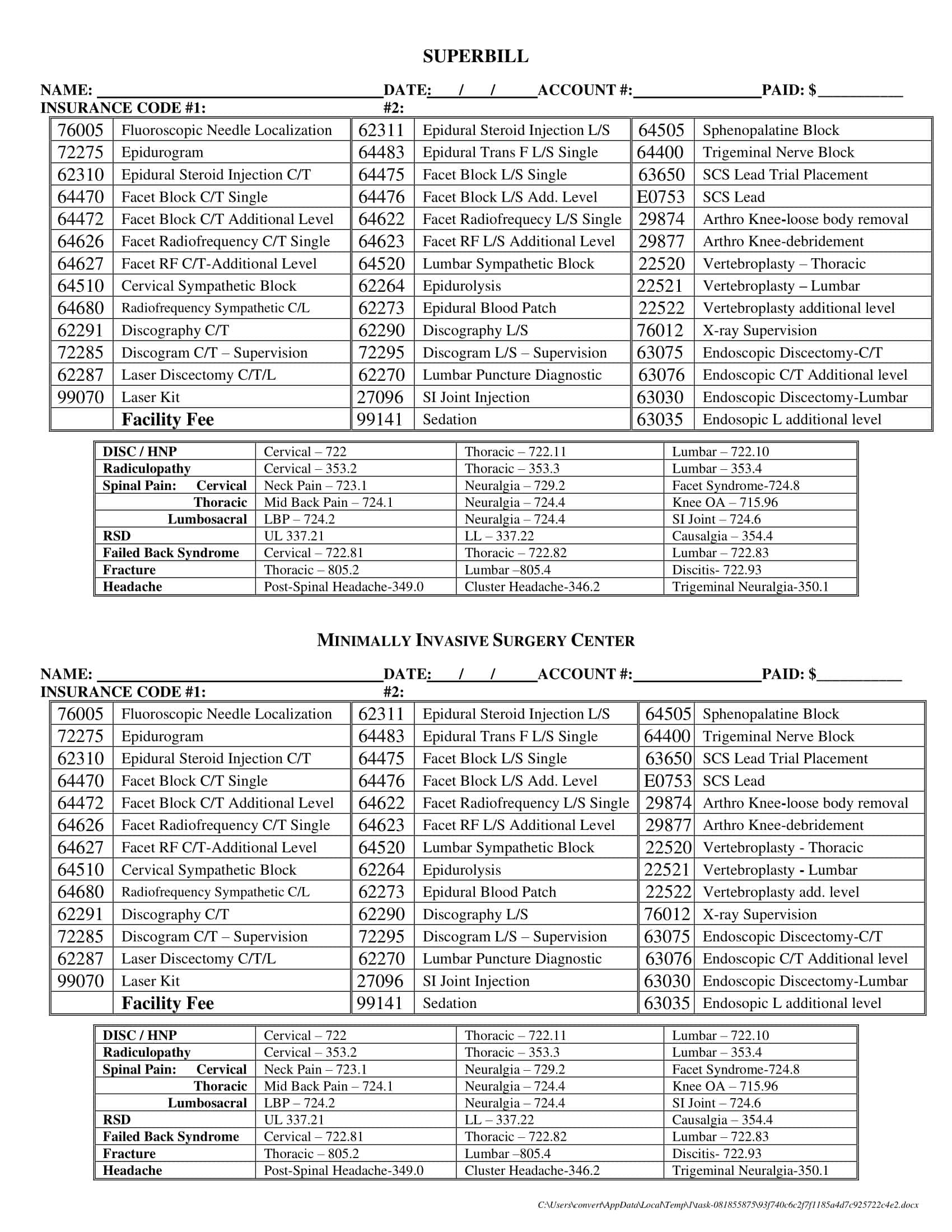

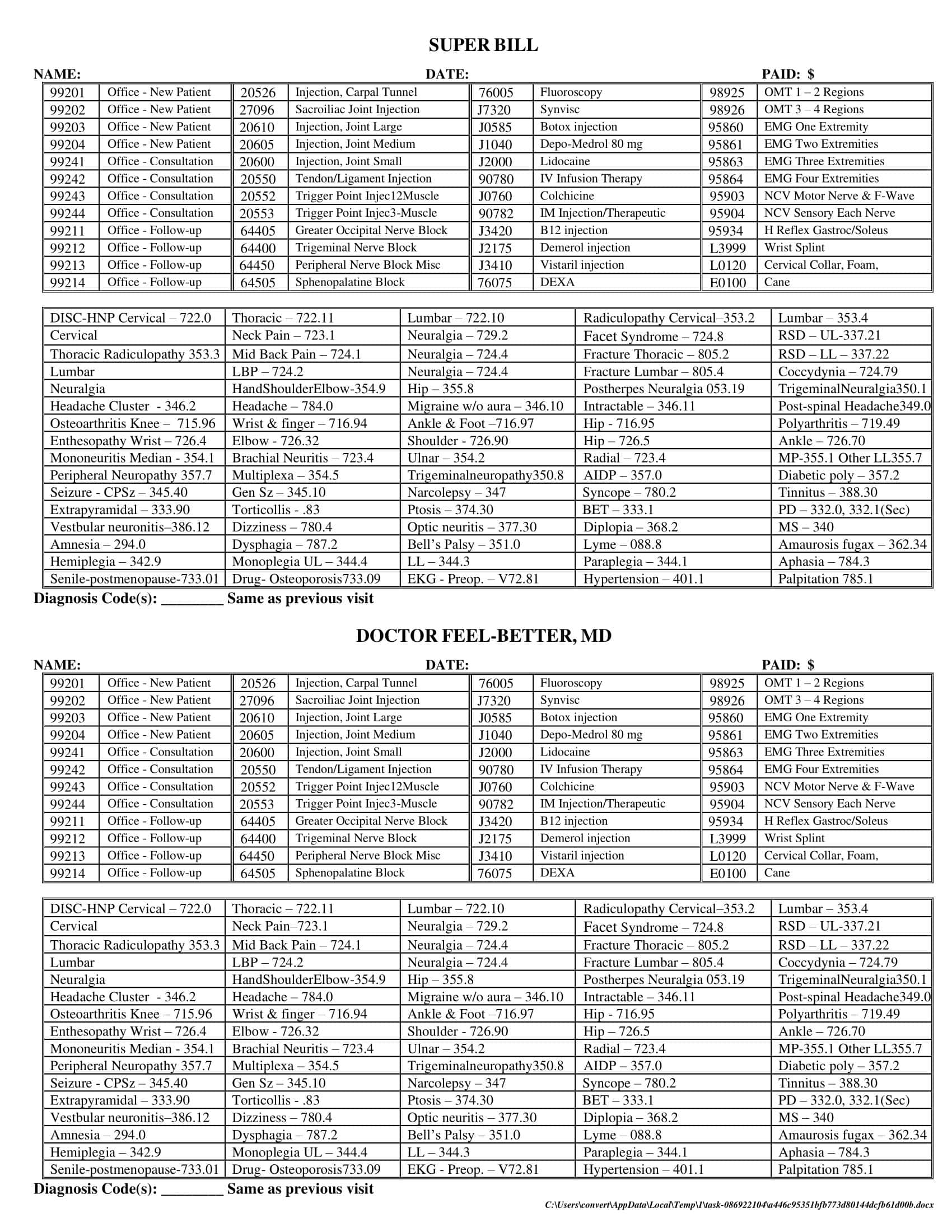

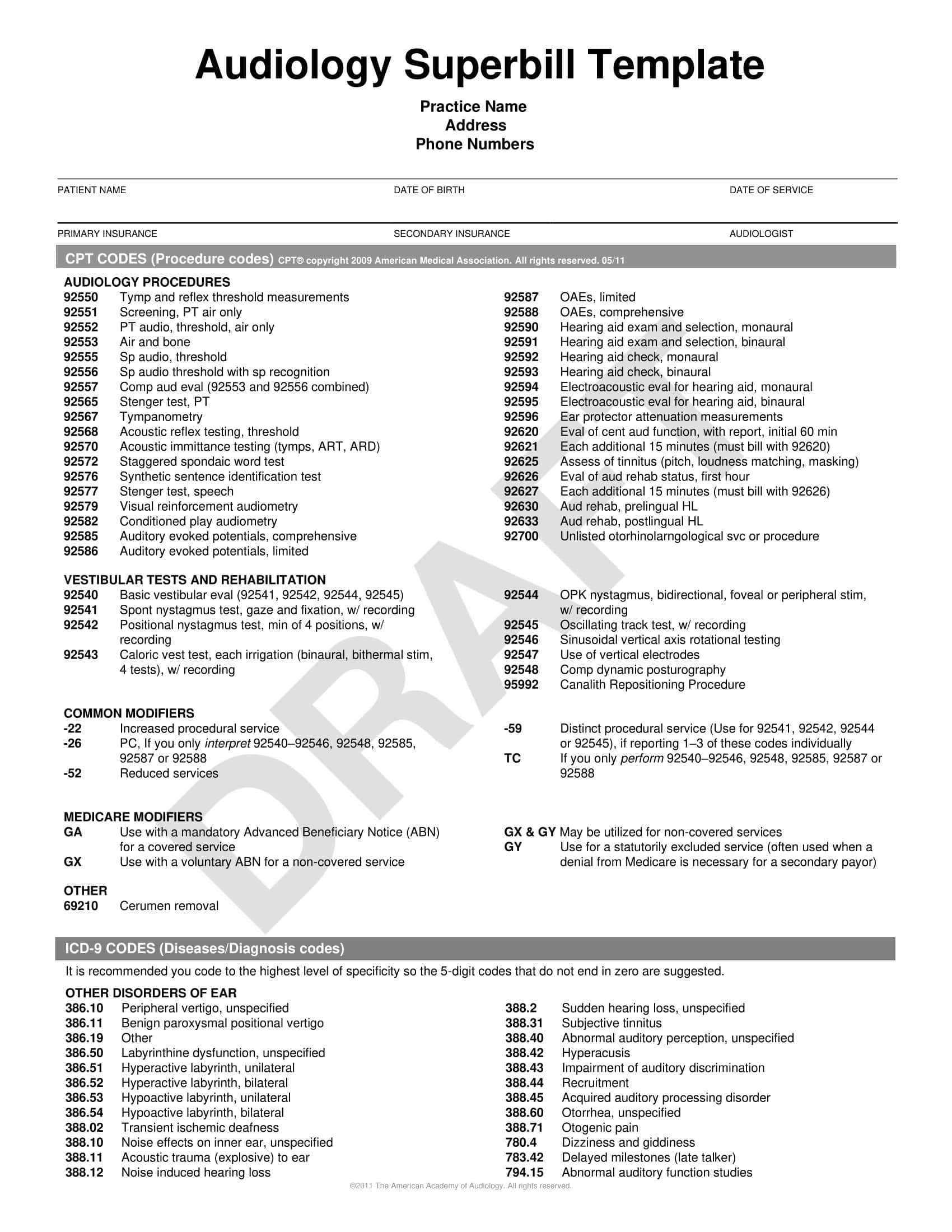

Superbill Templates

A superbill is a customized template used in medical practices to streamline billing and insurance reimbursement. The template lists common diagnosis codes, procedure codes, and patient visit information.

The top portion includes spaces to enter the practice name, provider information, patient name, date of service, and more. The body of the superbill template is the code lists. These are customized to the specific provider’s common diagnoses and procedures.

Having the codes pre-populated saves time looking them up during patient visits. The provider simply circles or checks off the relevant codes for that visit. Some superbills have space for notes and detailed descriptions of the services rendered. This additional information may be required by some insurance companies.

In the medical billing process, the superbill template becomes the main source document that billing staff use to prepare insurance claims. It ensures all required procedure and diagnostic codes are transmitted. The customized superbill helps practices optimize their insurance reimbursement while saving ample time during patient visits.

Who Creates a Superbill?

A superbill is created by healthcare providers or their administrative staff. Specifically, the following individuals or entities are typically involved in its creation:

- Healthcare Providers: This includes physicians, nurse practitioners, therapists, chiropractors, acupuncturists, mental health professionals, and other licensed healthcare practitioners who offer medical services to patients. After providing care, they identify the services rendered and the appropriate diagnosis and procedure codes.

- Medical Coders: In some practices, especially larger ones, there may be dedicated professionals known as medical coders. These individuals are trained to translate the patient’s treatment and diagnosis details into standardized codes that are then used on the superbill.

- Billing or Administrative Staff: In many healthcare settings, especially smaller practices, the administrative or billing staff play a role in the superbill creation process. After a patient’s visit, they often compile the details of the services rendered, ensuring that the right codes are applied, and then generate the superbill.

- Medical Billing Software: Many modern medical practices use electronic health record (EHR) systems or medical billing software. These systems often have functionalities that facilitate the automatic generation of a superbill based on the treatments and diagnoses entered into the system by the provider.

Why Is Superbills Important?

Superbills are an integral part of the healthcare billing system, particularly in the United States. They play a critical role in facilitating reimbursement to healthcare providers for services rendered to patients. Below is a detailed explanation of why superbills are important:

- Documentation of Services Rendered: At its core, a superbill is a detailed form that itemizes the services provided to a patient. It includes descriptions of each service, associated codes (like CPT, HCPCS, and ICD-10 codes), and the fees for each service. This documentation serves as an essential record for both the provider and the patient of what was done during a particular visit.

- Facilitates Reimbursement from Insurers: One of the primary purposes of a superbill is to serve as a basis for submitting claims to insurance companies. When healthcare providers seek payment from insurance companies, they rely on the codes and descriptions on the superbill to justify the claim. Without a properly filled out superbill, providers might not get reimbursed for their services.

- Helps Patients Understand Charges: A superbill provides patients with a detailed breakdown of the services they received. This can be helpful if patients need to understand their treatments or if they have questions about charges.

- Ensures Accurate Coding: Proper coding is essential for a variety of reasons, from ensuring that providers get reimbursed the correct amount to maintaining the accuracy of medical records. Superbills help ensure that every service is coded accurately and consistently.

- Assists in Auditing and Compliance: Healthcare providers can be audited by insurers or governmental entities to ensure that they’re billing appropriately for their services. A well-maintained superbill can serve as proof of the services rendered and the appropriateness of the charges. It can also help providers stay compliant with various regulations related to healthcare billing.

- Analytical Tool: Providers can use superbills to analyze their practice patterns, such as the most commonly provided services or treatments. This data can be used for various purposes, including business planning, budgeting, and identifying areas for potential training or specialization.

- Promotes Transparency: In an age where patients are becoming more involved in their healthcare decisions, transparency in billing is more important than ever. Superbills help promote this transparency by providing a clear and detailed record of every service a patient received and how much each service costs.

- Ease of Communication: Superbills provide a standardized way for providers to communicate with insurance companies. Since the format and the codes used are consistent across the healthcare industry, it helps avoid misunderstandings and facilitates smoother communication between providers and payers.

- Risk Management: In cases of disputes or malpractice claims, a superbill can serve as evidence of the care provided. It can support the provider’s case or help in understanding the sequence of events and the care that was delivered.

- Efficiency in Practice Management: Having a structured and systematic approach to billing, as facilitated by superbills, can significantly improve the efficiency of a healthcare practice. It reduces the chances of missed billings, helps track pending reimbursements, and aids in reconciling payments received.

What Is Included in a Superbill Template?

A superbill template contains preset procedure codes, diagnosis codes, and other billing details that healthcare providers select from during patient visits. But what key pieces of information should an effective superbill template include? There are several important components that make up a complete superbill that is customized for a provider’s practice and optimized for smooth billing and coding. Having the right components adds to the efficiency and usefulness of the superbill. Here are the key items that a comprehensive superbill template should contain:

- Provider Information:

- Provider’s Name: The full name of the medical professional providing the service.

- Provider’s Address: The physical location where the services were provided.

- Phone Number: Contact number for the practice or provider.

- National Provider Identifier (NPI): A unique 10-digit identification number for covered healthcare providers.

- Tax Identification Number (TIN): Used for tax purposes and often required by insurance companies.

- License Number: The professional license number of the provider, if applicable.

- Patient Information:

- Patient’s Name: Full name of the patient receiving the services.

- Date of Birth: Patient’s birth date.

- Address: Patient’s home address.

- Phone Number: Contact number for the patient.

- Insurance ID Number: The identification number assigned to the patient by the insurance company.

- Date of Service: The specific date(s) when the services were rendered.

- Services Provided:

- Procedure Codes (CPT/HCPCS codes): These are standardized codes that describe medical, surgical, and diagnostic services. They’re used to communicate to insurers what procedures were done.

- Modifiers: Additional codes used with CPT/HCPCS codes to provide more detail about a procedure, such as if a service was bilateral or if multiple procedures were performed during a single visit.

- Description of Service: A brief description of each service rendered.

- Fee: The charge for each service.

- Diagnosis Information:

- Diagnosis Codes (ICD-10 codes): These codes represent the patient’s diagnoses. They give insurers context for the billed services, indicating why a particular procedure or treatment was necessary.

- Description of Diagnosis: A brief description or name of the diagnosis.

- Additional Information:

- Referring Physician: If another doctor referred the patient, their name and possibly NPI might be included.

- Place of Service Code: Indicates where the service was provided (e.g., in an office, hospital outpatient setting, inpatient setting, etc.).

- Type of Service: This could be consultation, lab work, surgery, etc.

- Payment Information:

- Total Charge: The cumulative amount charged for all services rendered during the visit.

- Amount Paid: If the patient made a payment at the time of the visit, this would be recorded.

- Balance Due: Amount remaining to be paid after any initial payments.

- Miscellaneous:

- Notes/Comments: Any additional notes or comments the provider feels are essential to add, possibly about the patient’s condition, any special circumstances, or follow-up needed.

- Release of Information Authorization Checkbox: A section where the patient or their representative authorizes the release of the medical information to process the claim.

When To Request For A Superbill

After a medical appointment, you may need to request a superbill from the healthcare provider for insurance or billing purposes. But how do you know when it is appropriate to ask for this important document? There are certain key situations and reasons that require a patient to obtain a copy of the superbill related to their visit. Understanding when you need this form will ensure you get the documentation necessary for your records and submitting claims. With this knowledge, you can better determine if and when to request this billing form after receiving care. Here are common times when you should request a superbill:

For Out-of-Network Services or Self-Pay Patients

Often, patients might choose to see a provider who isn’t part of their insurance network, either because of the provider’s expertise or due to personal preferences. In such cases, the insurance company might not directly deal with the healthcare provider. The patient pays the provider out-of-pocket and then seeks reimbursement from their insurance company. To do this, the patient needs a detailed account of the services they received, and that’s where the superbill comes into play. It offers a comprehensive overview of the services, making it easier for patients to file a claim with their insurance provider. Thus, anytime a patient sees an out-of-network provider or pays the entire bill upfront, they should request a superbill.

When Dealing with Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

These accounts allow individuals to set aside money, pre-tax, for medical expenses. To ensure that the funds from HSAs or FSAs are used correctly, there’s often a need to provide documentation of medical expenses. Superbills act as that proof. They detail the medical services received, allowing individuals to justify their withdrawals from these accounts. If a patient is utilizing an HSA or FSA for healthcare expenses, it’s imperative to ask for a superbill to ensure they have a clear record of their expenditures.

In Cases of Ambiguous Coverage

Insurance plans come with their intricacies. Sometimes, it might not be clear whether a particular service is covered or to what extent. When patients undergo treatments or consultations, and there’s any ambiguity about whether the insurance will cover it, obtaining a superbill can be beneficial. With a superbill in hand, they can approach their insurance company to clarify coverage. It acts as a detailed receipt, making discussions about coverage more transparent and straightforward.

For Tax Purposes

Medical expenses can be significant, and in some jurisdictions, they might be tax-deductible. For those who itemize their deductions, keeping track of medical costs is essential. Superbills serve as an official record of these expenses, ensuring patients can accurately account for their medical expenditures during tax time. If someone plans on claiming medical expenses on their tax return, it’s wise to request a superbill for each medical visit to maintain accurate financial records.

How To Submit The Superbill To The Insurance Company?

Submitting a superbill to an insurance company is a crucial process that ensures you get reimbursed for the medical services you’ve paid for, especially if you’ve seen an out-of-network provider. Here’s a step-by-step guide on how to do this:

Step 1: Obtain the Superbill from Your Provider

After your appointment, request a detailed superbill from your healthcare provider. Ensure it includes all necessary information, such as the provider’s details, your details, procedure codes, diagnosis codes, and the total amount charged.

Step 2: Review the Superbill for Accuracy

Before submitting, review the superbill to ensure that all details are accurate. Check the services listed, the charges, and your personal information. Any inaccuracies can lead to your claim being denied or delayed.

Step 3: Make Copies

Always make a copy of the superbill and any other related documents for your records. It’s essential to have a backup in case there are any disputes or if the original gets lost in the mail.

Step 4: Obtain a Health Insurance Claim Form

Contact your insurance company and request a health insurance claim form. Some insurance companies also have these forms available for download on their websites.

Step 5: Fill Out the Claim Form

Complete the health insurance claim form, providing all requested information. This will typically include your personal details, policy number, information about the medical services received, and details about the provider. Attach the superbill to this form.

Step 6: Write a Cover Letter (Optional)

While not always necessary, it’s sometimes helpful to include a brief cover letter explaining the reason for your claim. This can provide clarity, especially if there are unique circumstances surrounding your visit or treatment.

Step 7: Submit the Claim

Send the claim form, along with the superbill and any other required documentation, to your insurance company. This can often be done by mail, fax, or electronically, depending on the company’s preferences. Ensure you send it to the correct address or portal specified for claims.

Step 8: Track Your Claim

After submitting your claim, track its status. Some insurance companies provide online portals where you can check the progress of your claim. If not, mark a date on your calendar to follow up if you haven’t received a response within a specific timeframe (usually 30 days).

Step 9: Respond Promptly to Any Inquiries

Your insurance company may reach out for additional information or clarification. Respond promptly to avoid delays in processing your claim.

Step 10: Review Reimbursement Details

Once your claim has been processed, you’ll receive an Explanation of Benefits (EOB) from your insurance company. This document will detail what portions of the claim were covered and what, if anything, you still owe. Review it carefully to ensure accuracy.

Step 11: Address Any Discrepancies

If you believe there’s an error in the reimbursement or if your claim was unjustly denied, contact your insurance company to dispute the decision. Be prepared to provide additional documentation or clarification as needed.

Step 12: Save All Documentation

Keep a file with the superbill, claim form, any correspondence with the insurance company, and the EOB. This is crucial for future reference, especially in case of disputes or for tax purposes.

Conclusion

Having a properly formatted superbill customized to your practice is invaluable for streamlining administrative workflows and billing. In this article, we’ve discussed the key components of effective superbill templates and how they are used to simplify coding and claims submission. With the downloadable and editable superbill templates provided, you can now easily customize superbills containing the procedure and diagnosis codes specific to your own practice’s needs.

Simply input your codes, details, and branding to create personalized superbills for more efficient patient visits and billing events. Keep these superbill templates on file for administrative staff to print and providers to use during appointments. With these free, professionally designed templates, your practice can improve efficiency and take the hassle out of superbills.

FAQs

Can I submit a superbill to my insurance company for reimbursement?

Yes, a superbill is designed for this purpose. If you’ve paid for services out-of-pocket or have seen an out-of-network provider, you can submit the superbill to your insurance company to claim reimbursement.

How is a superbill different from a regular bill or invoice?

While both provide details on services rendered and associated costs, a superbill includes standardized medical codes for diagnoses and procedures, which are crucial for insurance claims. Regular bills or invoices might lack this specific coding information.

How long should I keep a copy of my superbill?

It’s a good practice to retain medical documents for at least several years. Hold onto your superbill until you’re sure the claim has been settled, and even then, you might want to keep it for tax or personal record purposes.

Are superbills used outside the U.S.?

While the concept of documenting medical services is universal, the specific format and usage of superbills are more typical of the U.S. healthcare system. Other countries might have different systems and terminologies in place.

Do all insurance companies accept superbills?

While most insurance companies do accept superbills, especially for out-of-network claims, policies can vary. It’s essential to check with your specific insurance provider about their requirements and processes.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)