Sending a professional invoice is a key part of running a successful consulting business. But creating an effective invoice format tailored to your consultancy services isn’t always straightforward. You want your invoices to clearly communicate what services you provided and their value, while also encouraging prompt payment from clients. At the same time, a cluttered or confusing invoice can leave clients unsure of exactly what they’re paying for. Having a well-designed template makes the invoicing process smoother for both you and your clients.

This article will guide you through the elements every consulting invoice needs, with tips on formatting and writing invoice items for maximum clarity. We’ll also cover how to set up easy recurring invoices for ongoing client engagements. With an adaptable consulting invoice template, you’ll be able to quickly bill clients while presenting your work in the best possible light. Let’s walk through creating professional invoices that instill confidence in your services and keep cash flow steady.

Table of Contents

What Is A Consulting Invoice?

A consulting invoice is a bill sent to clients detailing the services provided and fees owed for a consultant’s work over a specific period of time. Consulting invoices clearly outline the scope of work, time spent, rates charged, expenses incurred, taxes, and total amount due.

They serve as formal documentation requesting payment from a client for advisory services rendered, such as strategic planning, financial analysis, technology implementation, marketing, HR consulting, and more. Well-designed consulting invoices present the services in a clear, professional manner and ensure prompt payment for consultants. Creating customized invoices tailored to the type of consulting work makes billing seamless while substantiating the value delivered to each client.

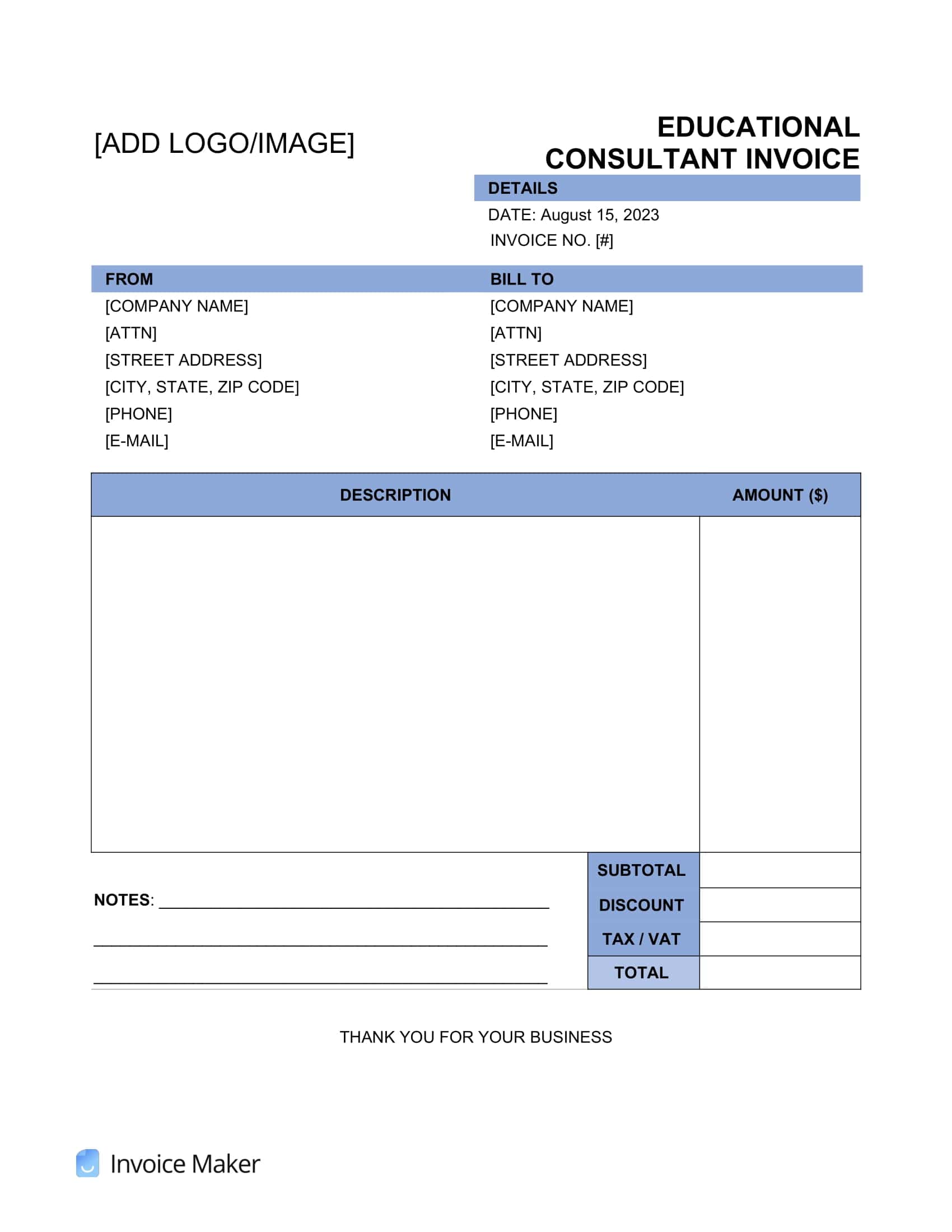

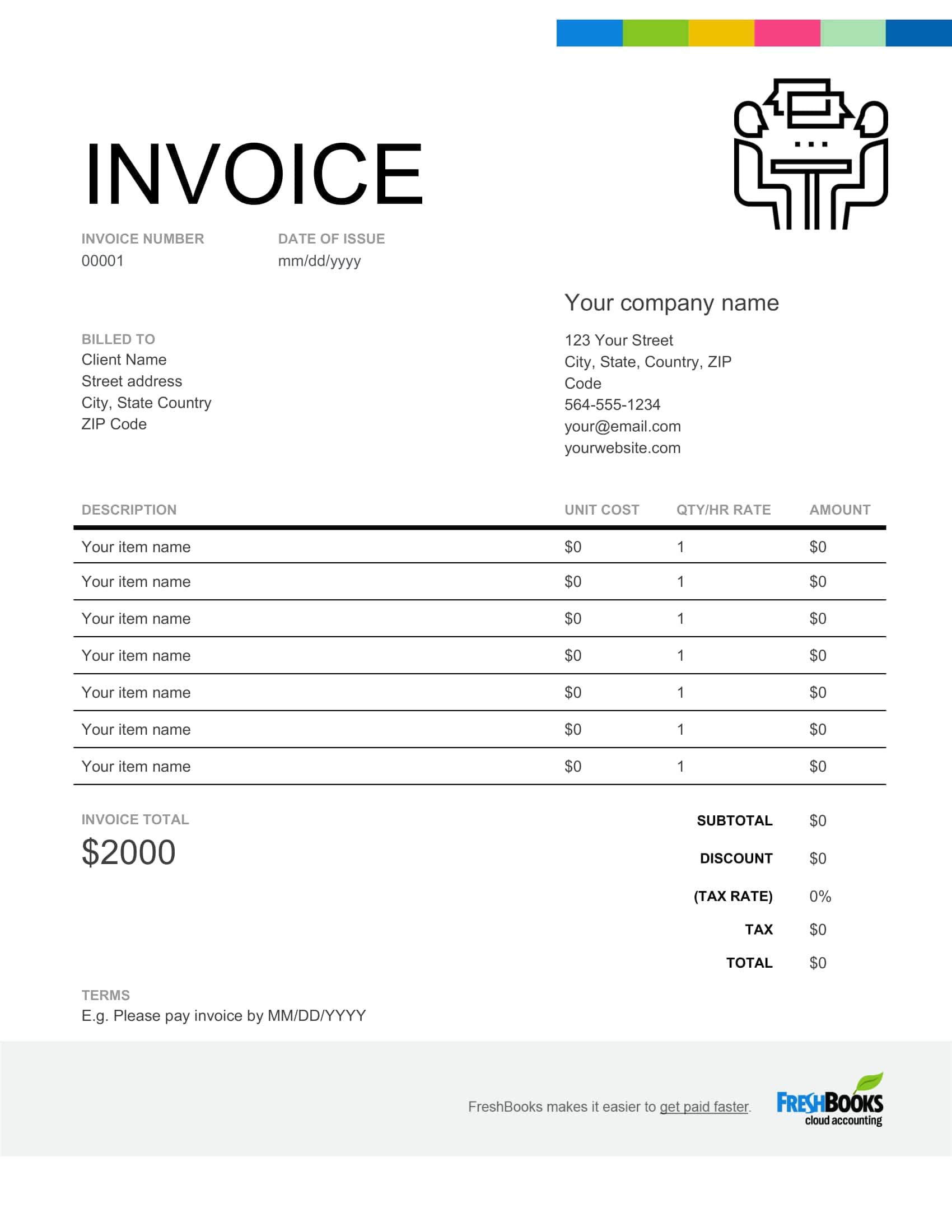

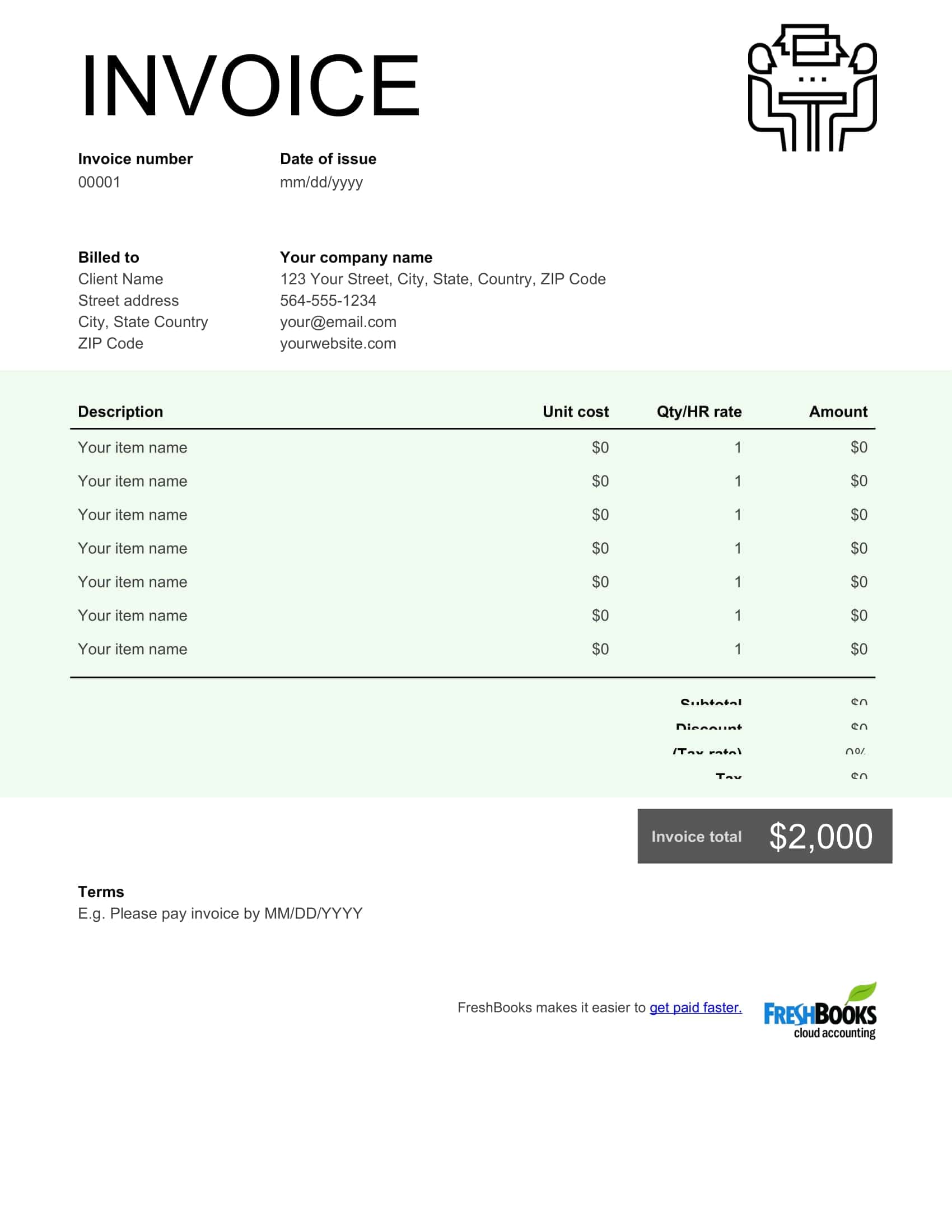

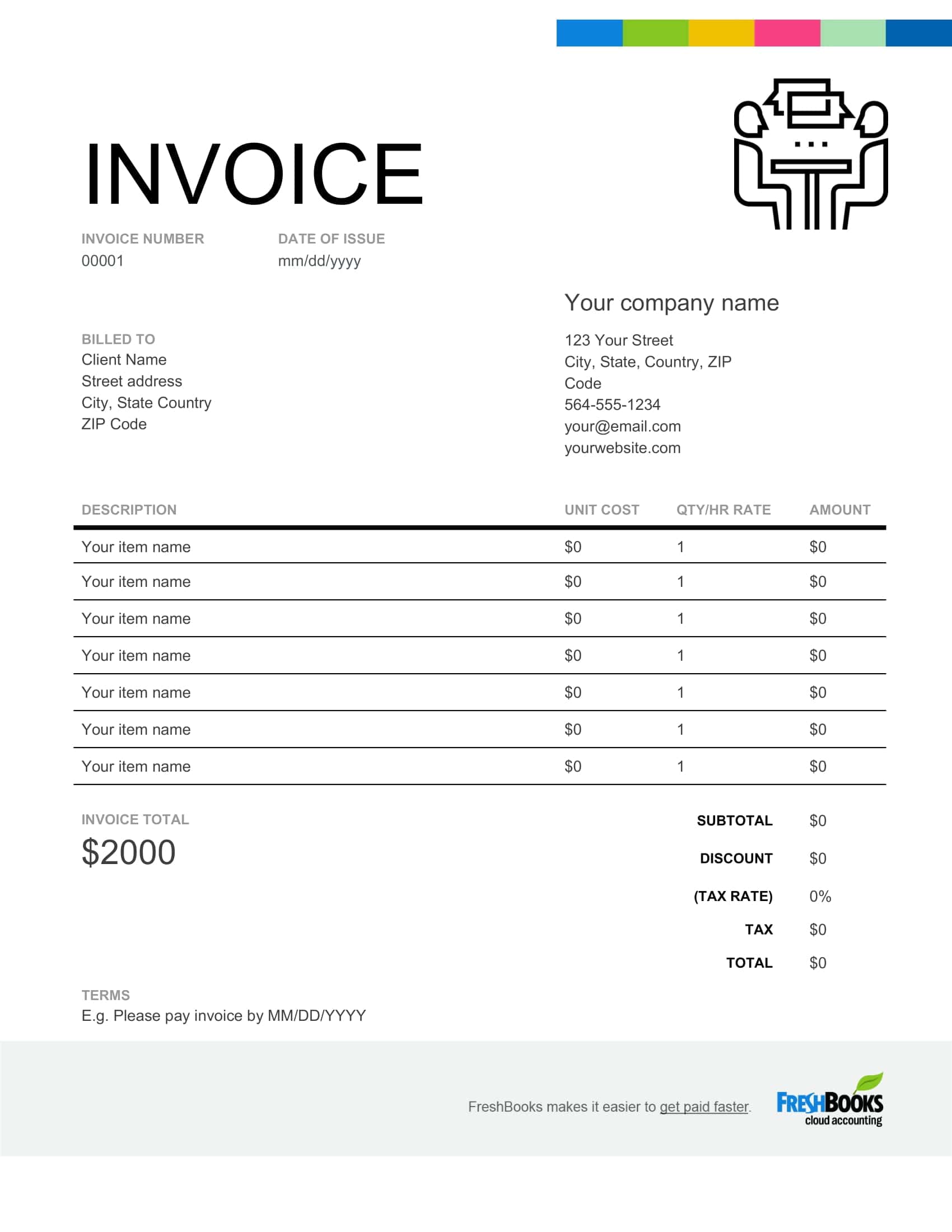

Consulting Invoice Templates

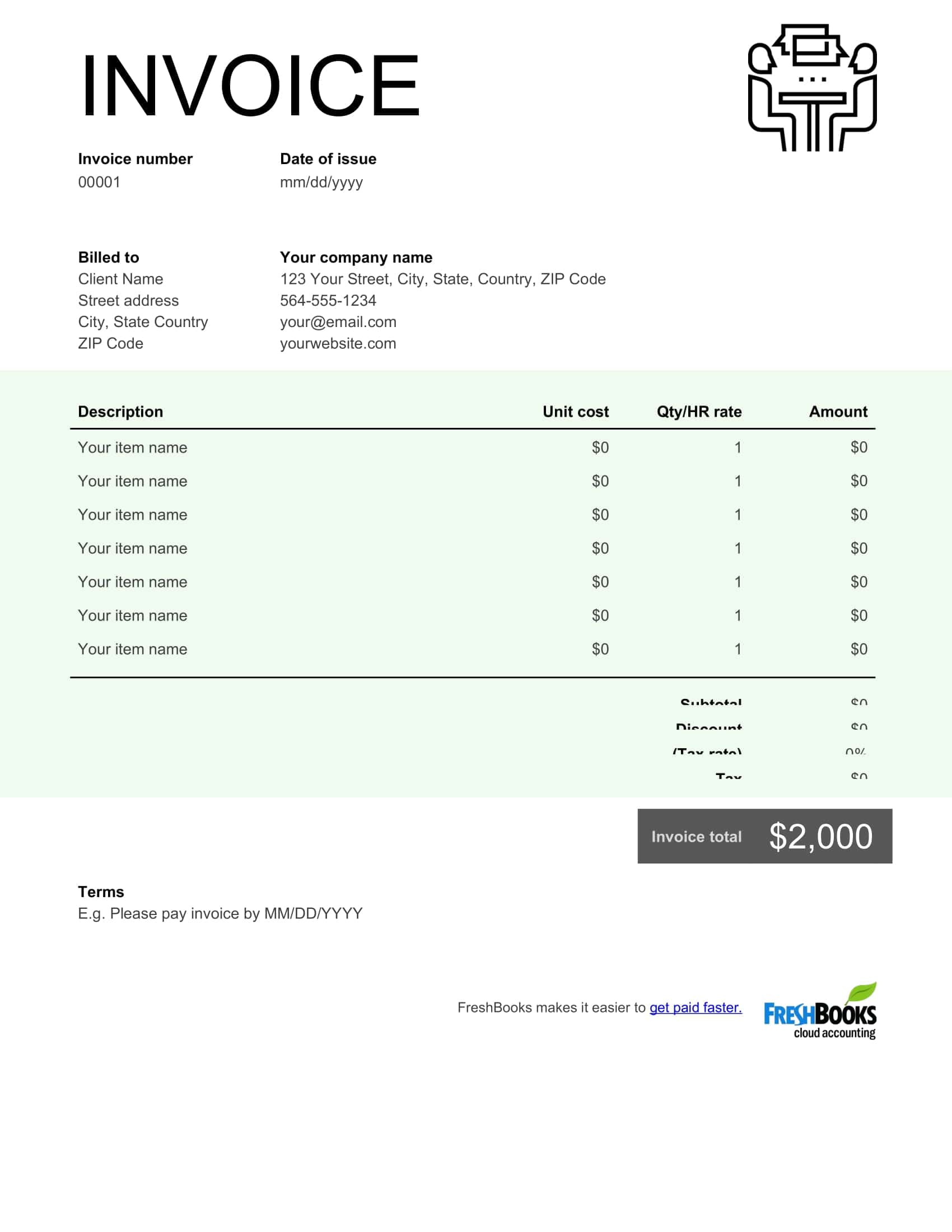

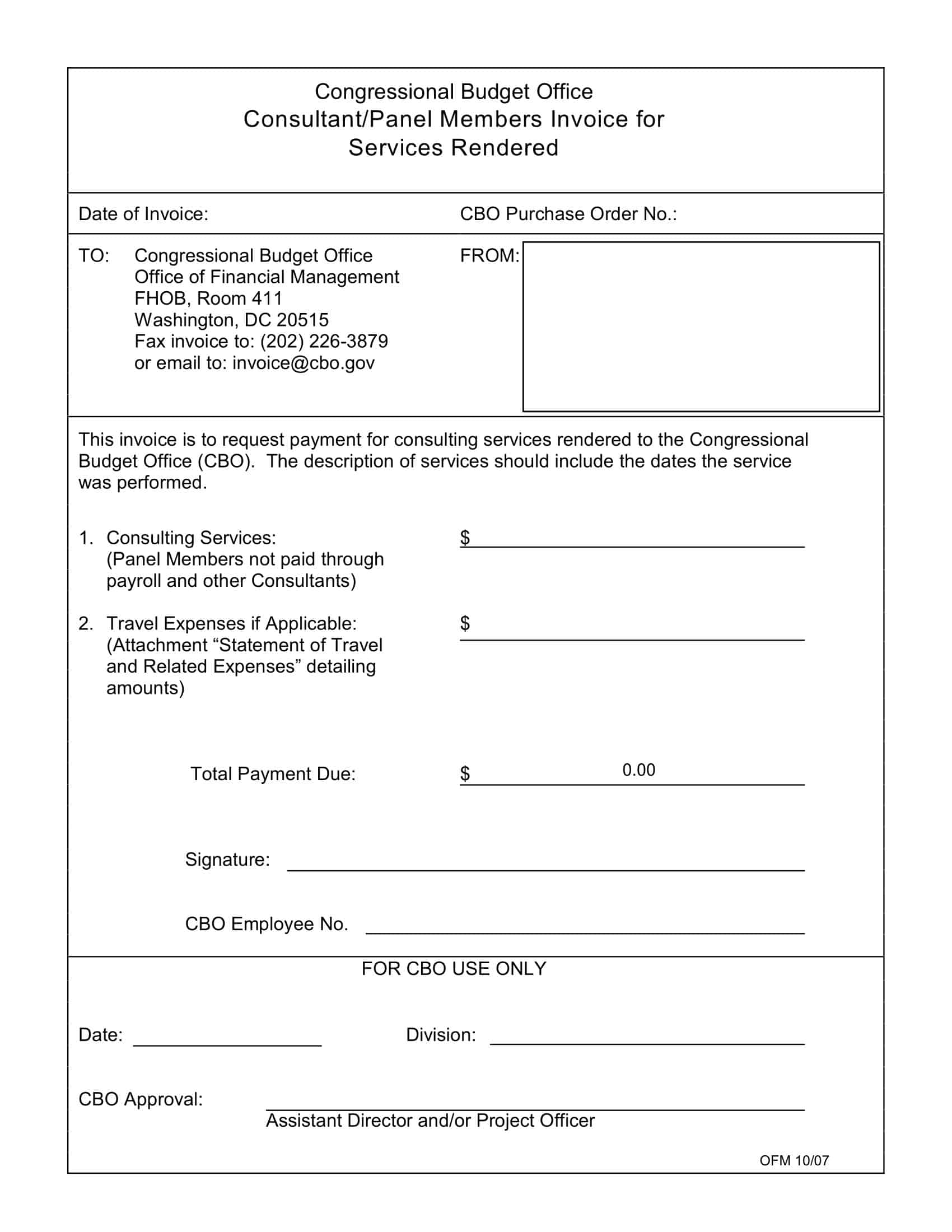

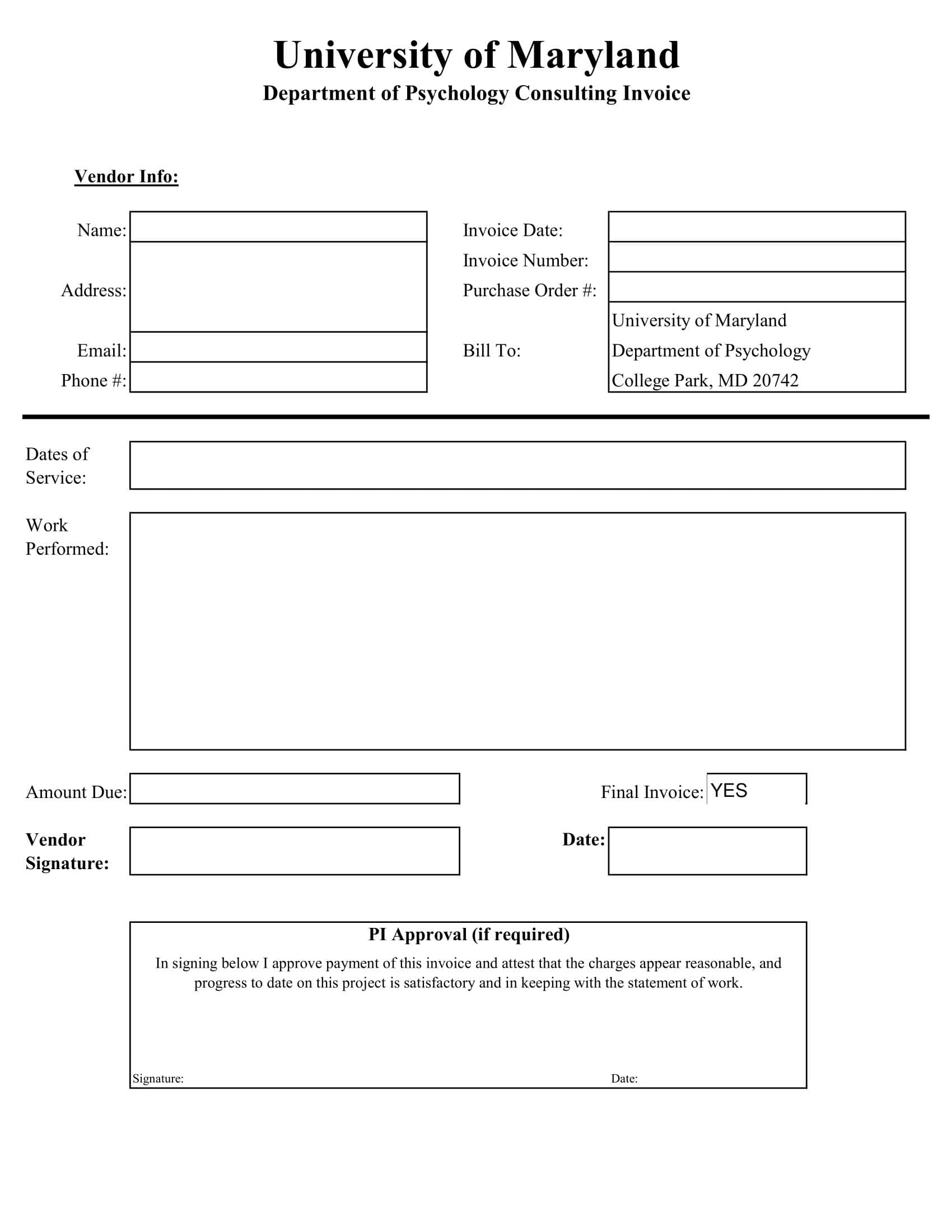

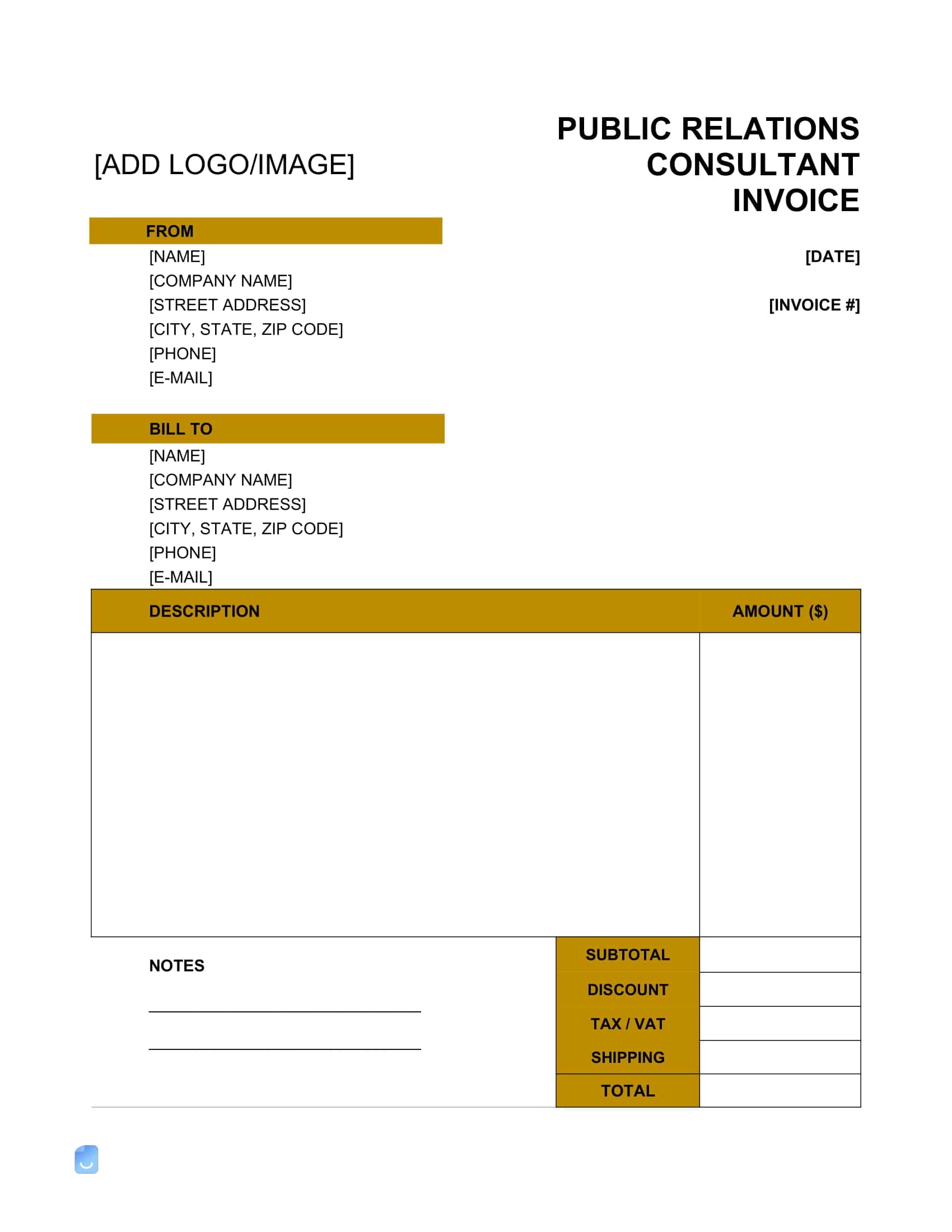

A consulting invoice template is a document a consultant uses to bill clients for services. The template clearly outlines the work completed, fees charged, and payment terms so both parties understand expectations.

The consulting invoice template has the consultant’s name, address, and contact information at the top. Underneath is a table listing the services provided such as consulting, coaching, training, etc. The table states the service description, date or date range completed, number of hours worked, and the hourly rate charged. Subtotals and total owed are calculated.

The bottom of the consulting invoice template covers payment terms, typically net 30 days, and due date. Information about accepting checks, bank transfers, or credit cards is included. The consultant’s signature and company details are at the bottom to make the template official. The detailed consulting invoice template allows the consultant and client to easily track services performed and payments owed for the work.

The Importance of Sending a Consulting Invoice

Invoicing is a critical part of a consultant’s relationship with clients. Let’s take a closer look into the importance of sending a consulting invoice:

- Proof of Service Rendered:

- An invoice is a record that the consultant has provided a specific set of services to a client. This prevents any ambiguity about whether the consultant worked for the client or not.

- Professionalism:

- Submitting an organized and detailed invoice demonstrates professionalism. It shows the client that the consultant runs a meticulous business operation, which can increase trust and the likelihood of repeat business.

- Legal and Contractual Obligations:

- In many cases, the requirement to submit an invoice might be dictated by the consulting contract itself. Not sending an invoice might breach the terms of the contract.

- Facilitates Payment:

- Invoices are tools for requesting payment. They often include details like payment terms (e.g., net 30 days), payment methods, and late fee policies. Without an invoice, the client might not know how or when to pay the consultant.

- Record Keeping:

- For both the consultant and the client, invoices serve as a financial record. This is essential for accounting, tax compliance, and budgeting purposes.

- Tax Purposes:

- Invoices provide the necessary documentation for tax deductions. For the consultant, they can verify income, and for businesses, they can justify expenses.

- Dispute Resolution:

- If there’s ever a dispute between the consultant and the client regarding payment or the scope of services rendered, a detailed invoice can serve as evidence to help resolve the disagreement.

- Cash Flow Management:

- For consultants, especially those operating as independent contractors or running small businesses, cash flow is crucial. Regular invoicing ensures a steady inflow of cash, which helps in managing business expenses and investments effectively.

- Business Analytics:

- Over time, accumulated invoices can offer insights into business trends, client preferences, most profitable services, seasonality, etc. This can be invaluable data for making informed business decisions.

- Clarity and Transparency:

- Detailed invoices break down the services provided, hours worked, expenses incurred, and the rates charged. This level of transparency can prevent misunderstandings and reinforce the client’s confidence in the value they’re receiving.

- Branding and Marketing:

- A well-designed invoice that includes branding elements (like a logo, business name, and contact details) acts as a touchpoint and a reminder of the consultant’s professional identity. It can subtly serve as a marketing tool, reminding clients of the consultant’s services for potential future engagements.

- Encourages Timely Payment:

- When an invoice includes clear payment terms and due dates, it sets an expectation for the client to adhere to these terms. It can motivate clients to make payments promptly, reducing the waiting period for consultants.

What to Include in a Consulting Invoice

When you’re providing consulting services, it’s essential to have a clear and comprehensive invoice to ensure you are compensated accurately for your work, and so your clients understand the services they’re paying for. Here’s a detailed breakdown of what to include in a consulting invoice:

- Header:

- Your Company’s Information: Include your business name, address, phone number, email address, and any other relevant contact information.

- Client’s Information: Name of the client’s company, address, contact person’s name, phone number, and email address.

- Invoice Number: A unique identifier for tracking and reference. It’s useful for both your records and the client’s.

- Invoice Date: The date you issued the invoice.

- Due Date: The date by which the payment should be made. This could be upon receipt, net 30 days, etc., depending on your agreement with the client.

- Consulting Services Description:

- Itemized List of Services: Describe each service provided in detail, e.g., “Market Research Analysis,” “Business Strategy Session,” etc.

- Date of Service: The date or date range when each service was provided.

- Hours Worked: If you’re billing hourly, specify the number of hours worked for each service.

- Rate: Your hourly or per-service rate.

- Subtotal: The total cost for each service (rate multiplied by hours or the fixed fee for that service).

- Expenses:

- If you’ve incurred expenses on behalf of the client that you’ve agreed to pass on, list them here. This might include travel expenses, software or tool purchases, and more.

- Attach receipts or a breakdown of these expenses when necessary.

- Total Amount Due:

- Calculate the total amount by adding up the subtotals of all the services and any additional expenses.

- If applicable, apply discounts or add taxes.

- Clearly state the final amount the client owes.

- Payment Terms:

- Accepted Payment Methods: Mention whether you accept bank transfers, checks, credit cards, online payment systems (like PayPal), or other methods.

- Late Payment Policy: Specify any interest or fees for late payments.

- Bank Account Details: If you accept wire transfers, include your bank’s name, account number, routing number, IBAN, BIC/SWIFT code, etc. Make sure you’re comfortable with the level of detail you’re sharing; some consultants only share this upon request.

- Notes/Comments:

- Provide any additional information or clarification about the invoice or services. For instance, if part of the project will be invoiced later, note that here.

- A thank-you note or message to maintain positive relations and professionalism with the client.

- Terms and Conditions:

- Briefly outline any contractual terms related to the payment, e.g., confidentiality clauses, dispute resolution methods, etc.

- Footer:

- Consider adding any licensing or registration numbers, especially if legally required in your jurisdiction.

- Your website URL or other contact avenues if they weren’t mentioned at the top.

Industries Hiring Consultants

Consultants are sought after across practically every industry as organizations seek outside expertise to improve their operations and strategy. Some top sectors that actively hire consulting services include:

- Financial services – Consultants help banks, insurance companies, and other financial institutions with services like risk management, compliance, data analytics, customer segmentation, and more.

- Healthcare – Consultants assist hospitals, health systems, and clinics with business strategy, process improvement, IT implementation, patient experience, and transitioning to value-based care models.

- Technology – Tech companies leverage consultants for market analysis, product development, engineering services, cybersecurity, and strategic partnerships.

- Manufacturing – Manufacturers engage consultants to increase operational efficiency, overhaul supply chains, integrate automation, and enter new markets.

- Retail – Retailers use consultants for branding, omnichannel strategies, logistics, customer analytics, and competitiveness against e-commerce disruption.

- Nonprofits – Nonprofits hire consultants for fundraising, grant writing, event planning, social media, and designing impactful programs.

The specialized skills and outside perspective consultants offer make them a go-to resource for organizations in every sector.

How to Create a Consulting Invoice

Creating a consulting invoice is essential for professionals who offer consultation services. An invoice not only formalizes the demand for payment but also serves as a record for both the consultant and the client. Here’s a step-by-step guide to help you create a consulting invoice:

Step 1: Choose a Template or Software

Decide whether you’ll use invoicing software, a dedicated application, or a simple template in a program like Microsoft Word or Excel. Many invoicing software platforms offer features like automatic numbering, tracking, and reminders, making the process streamlined. If you choose to use a template, ensure it looks professional and is easy to customize.

Step 2: Include Essential Header Information

At the top of your invoice, include your name or business name, address, phone number, email address, and any other relevant contact information. This makes it clear who the invoice is from and provides multiple avenues for the client to contact you if they have questions or concerns.

Step 3: Include Client’s Information

Just below your contact information or on the opposite corner, detail the client’s name, company (if applicable), address, and other pertinent contact details. This section identifies who is being billed and ensures the invoice reaches the appropriate individual or department.

Step 4: Add Invoice Details

This includes the invoice number (important for record-keeping), the date the invoice was created, and the payment due date. If you’re using software, the invoice number might be generated automatically. Ensure your due date is consistent with the terms agreed upon with the client – whether it’s net 30, net 45, or another timeframe.

Step 5: Detail Your Consulting Services

Create a clear, itemized list of all the services you’ve provided during the billing period. For each service, include a brief description, the date or date range when you performed the service, the rate (e.g., hourly or flat fee), the number of hours (if applicable), and the total amount for that service.

Step 6: Calculate and Display the Total Amount Due

After listing all services, sum up the total amount due. Ensure this figure is prominently displayed so the client knows exactly how much they owe. Check your calculations twice to prevent any discrepancies.

Step 7: Mention Payment Terms and Methods

Clearly state your preferred methods of payment, whether it’s a bank transfer, credit card, check, or any other method. Include details like your bank account number or a link to an online payment portal. Additionally, specify any late fees or interest rates that will apply if the payment isn’t received by the due date.

Step 8: Add a Personal Note (Optional)

A brief thank you note or a reminder about upcoming consultations can add a personal touch to your invoice, helping maintain a positive relationship with the client.

Step 9: Review and Send

Proofread your invoice for any errors in descriptions, calculations, or client details. Once you’re sure everything is accurate, send it to the client. Depending on your agreement, this could be via email, postal mail, or through an invoicing platform.

Step 10: Follow Up and Track

Keep a record of all invoices sent and mark them once they’ve been paid. If the due date passes without payment, send a polite reminder to the client. Maintaining a system, whether manual or digital, will help you track outstanding invoices and ensure consistent cash flow.

Invoicing Tips for Consulting Services

When you’re offering consulting services, invoicing plays a critical role not just in getting paid, but also in projecting a professional image and managing client relationships effectively. Here are some tips to keep in mind when invoicing for consulting services:

1. Set Clear Payment Terms from the Start:

Before you commence any work, discuss and agree upon payment terms with your client. This could include the payment method, frequency (e.g., monthly, upon project completion), and any late fees or discounts for early payments.

2. Use Detailed Descriptions:

Each line item on your invoice should have a detailed description. Instead of simply listing “consulting services,” break down what these services entailed, such as “strategy session,” “market analysis,” or “project management.”

3. Avoid Jargon:

Ensure that your descriptions are clear and free from industry jargon unless you’re certain the client will understand. Your client should be able to comprehend the services rendered without needing further clarification.

4. Include an Itemized Breakdown:

If you’re charging by the hour, include the number of hours worked next to each service, the rate per hour, and the total for that service. This transparency helps clients understand the value they’re getting.

5. Number Your Invoices:

Use a consistent numbering system for your invoices. This not only helps you keep track of them but also aids in any communication with clients about specific invoices.

6. Be Prompt:

Send out invoices promptly after the services are rendered or as per the agreed schedule. This not only hastens the payment process but also reflects professionalism.

7. Offer Multiple Payment Methods:

In today’s digital age, consider offering various methods like bank transfers, credit card payments, online payment platforms, or even mobile payment solutions. This makes it convenient for clients and may expedite your payment.

8. Use Professional Software:

Consider investing in professional invoicing software. Many platforms can automate certain aspects of invoicing, send reminders to clients, and even provide insights into your cash flow.

9. Clearly State Due Dates:

It’s essential to clearly indicate when the payment is due on the invoice. This sets clear expectations and reduces the chances of late payments.

10. Follow Up on Late Payments:

If a client hasn’t paid by the due date, send a polite reminder. Automated invoicing software can help with this by notifying you of overdue payments.

11. Keep Records:

Maintain detailed records of all invoices, payments, and any communication regarding them. This can be helpful for both tax purposes and any potential disputes.

12. Personalize Your Invoices:

Add a personal touch, whether that’s by using your branding (logo, color scheme) or by adding a thank-you note. It makes the experience more pleasant for the client and reinforces your brand identity.

13. Stay Open to Feedback:

Sometimes, clients may have suggestions or preferences about the invoicing process. Listen to their feedback, and where feasible, consider incorporating it.

14. Set Clear Boundaries:

If a client consistently pays late or poses challenges in the payment process, you might need to revisit your terms with them or consider whether the relationship is mutually beneficial.

Get Customizable Consulting Invoice Templates

Consultants require adaptable invoice templates that can be tailored to meet each client’s needs, whether charging by hourly rate or project fee.

Simplify your billing and look professional by using TypeCalendar’s free consulting invoice templates. Choose a template relevant to your consultancy and customize it fully to match your business requirements.

These flexible invoice templates work for solo consultants or large firms across all consulting specialties. Modify details to provide clients clear documentation of services rendered and fees owed.

Access the template in your preferred format – Word, Excel, PDF, Google Docs or Google Sheets. Download now and streamline invoicing so you can focus on providing top-notch consulting services.

FAQs

How often should I invoice my clients?

The frequency of invoicing depends on the agreement between the consultant and the client. Some consultants invoice monthly, others after project milestones, and some upon project completion. It’s essential to establish this upfront in your consulting agreement.

What if a client doesn’t pay my consulting invoice?

If a client doesn’t pay, first send a polite reminder. If they still don’t respond, consider implementing late fees (if mentioned in your agreement). In extreme cases, you might need to consult with legal counsel or use a collections agency to recover the funds.

Should I charge taxes on my consulting services?

This depends on the local regulations of where you operate and where your client is based. It’s advisable to consult with an accountant or tax advisor familiar with your industry and region to ensure compliance.

How do I handle expenses on a consulting invoice?

Out-of-pocket expenses incurred during a project, such as travel costs or specific tools, should be itemized separately on the invoice. Ensure you’ve discussed and agreed upon these expenses with the client beforehand.

Is it necessary to send an invoice if my consulting services are free?

It’s good practice to send an invoice even for pro bono work, marking the cost as “zero” or “no charge”. This provides a clear record of the work done and its value, and can be useful for both parties for documentation purposes.

How do I handle partial payments?

If a client makes a partial payment, send them an updated invoice showing the amount paid and the remaining balance. Clearly indicate any new due dates or terms for the outstanding amount.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)