Saving money is a common goal for many people, but it can be challenging to actually put funds aside consistently. The 52 Week Money Challenge provides a structured approach to saving that makes it easier to build your savings over time. With this method, you save a little more each week over the course of a year, putting aside anywhere from $1 up to $52 depending on the week.

By the end of the 12 months, you will have saved $1,378! To help you implement this savings plan, this article includes free printable 52 Week Money Challenge templates you can use to track your progress. Whether you are hoping to save for a vacation, build up an emergency fund, or work toward another financial goal, the 52 Week Money Challenge can put you on the path to effectively growing your savings.

Table of Contents

What Is the 52 Week Money Challenge?

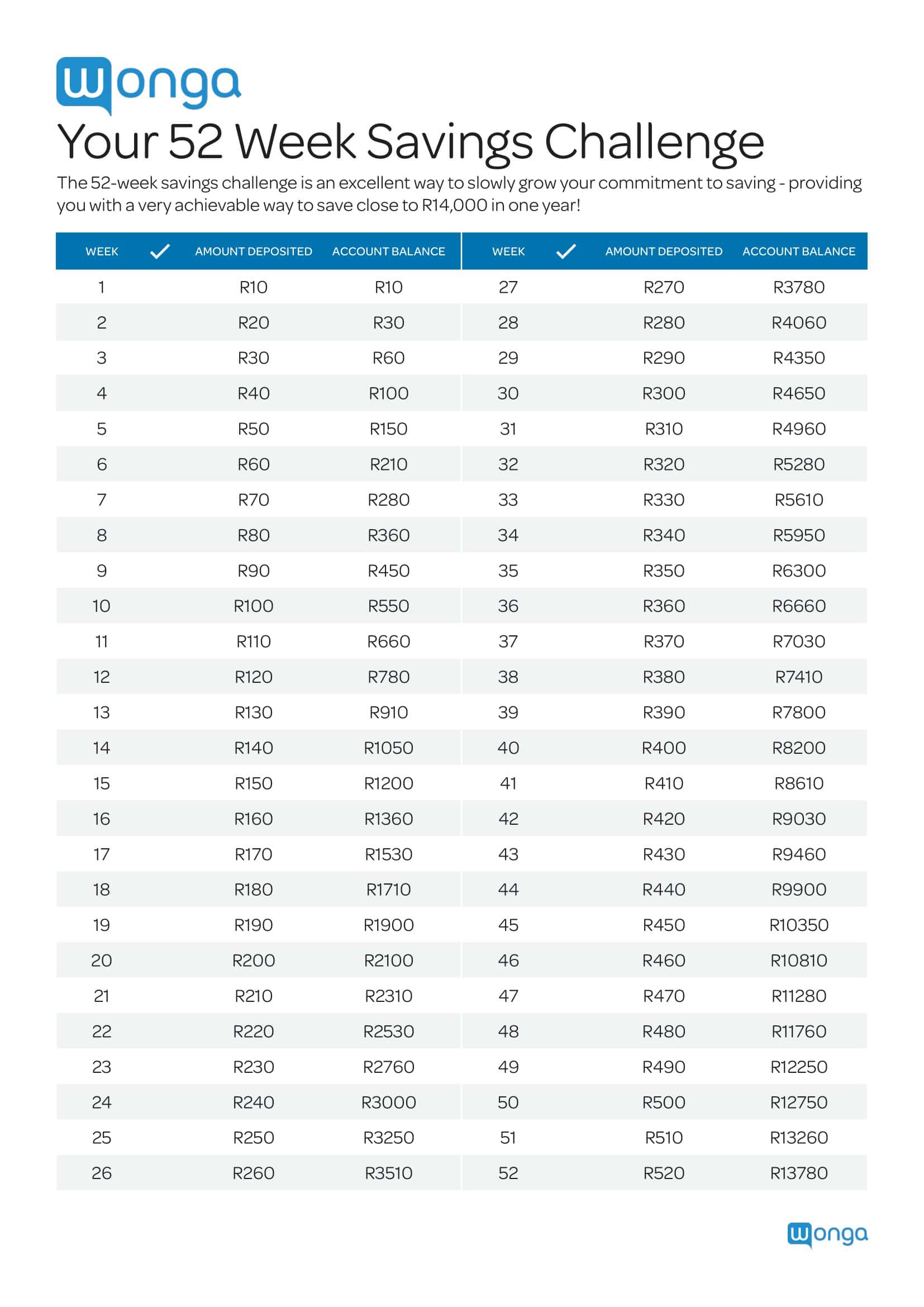

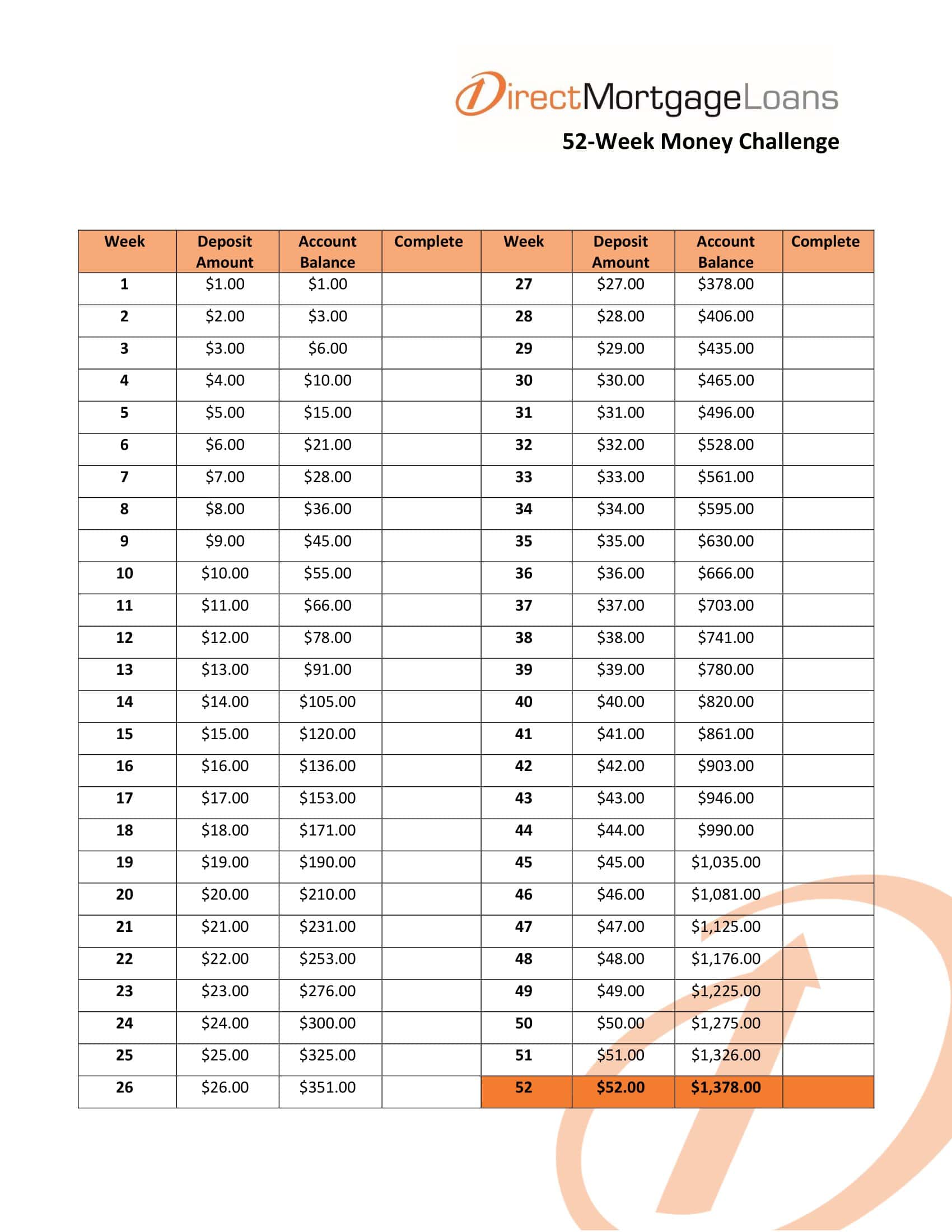

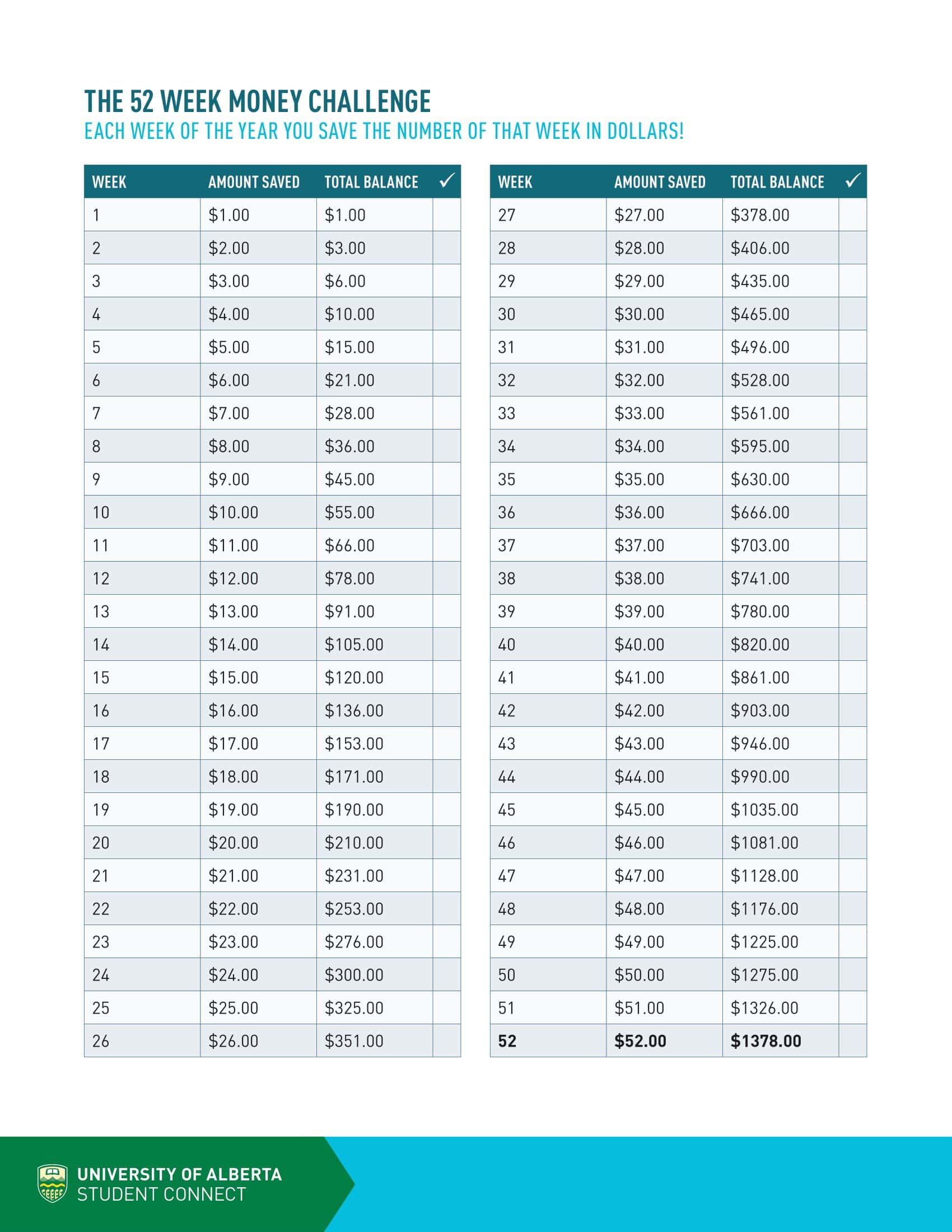

The 52-Week Money Challenge is a popular savings strategy that encourages individuals to save incrementally larger amounts of money each week for an entire year. The challenge starts with saving just $1 in the first week, followed by $2 in the second week, $3 in the third week, and so on, until you save $52 in the 52nd week.

By following this pattern, participants will have saved $1,378 by the end of the 52-week period. This straightforward, yet effective, method is designed to make saving money more manageable and habitual, ultimately helping people build a significant emergency fund or savings cushion over the course of a year.

52 Week Money Challenge Templates

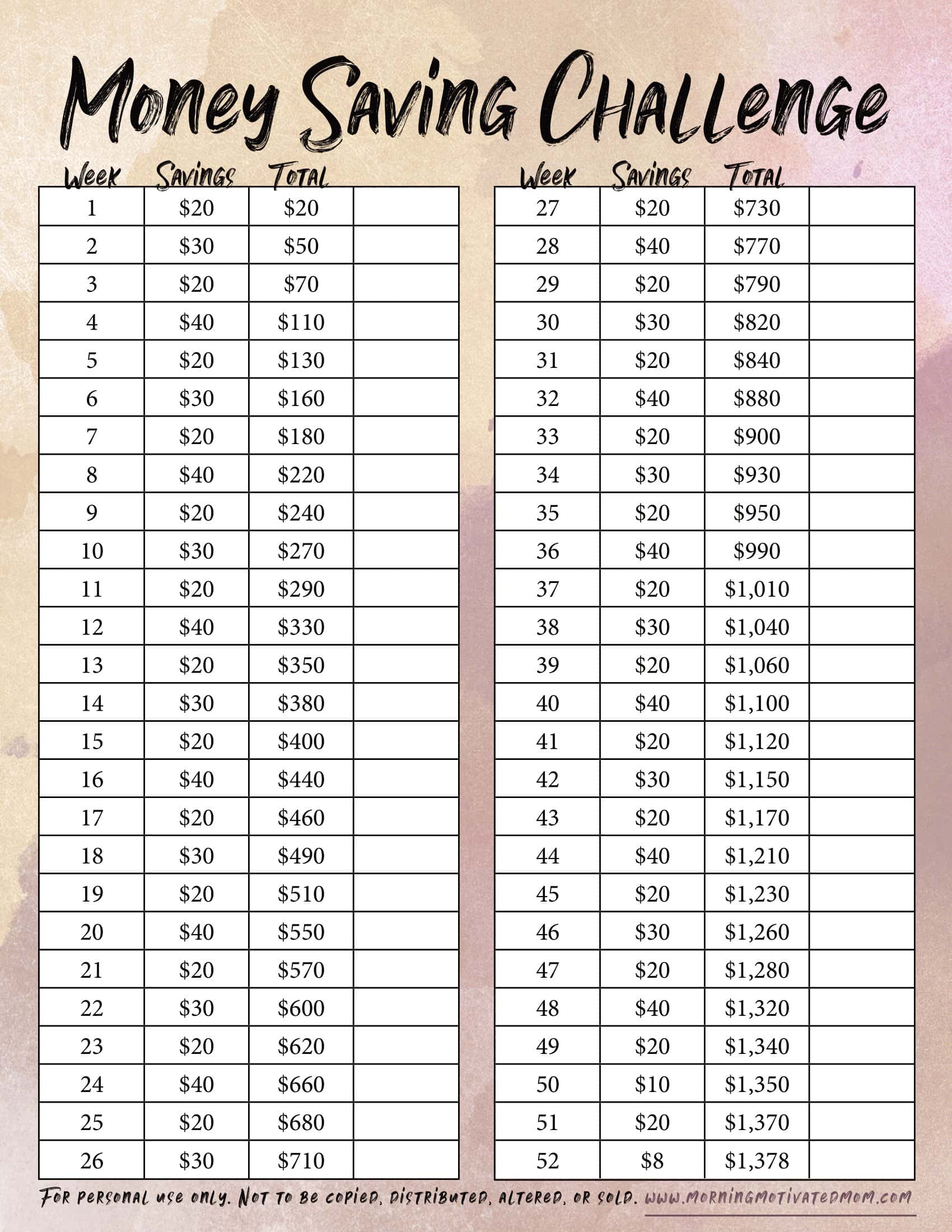

A 52 week money challenge PDF provides a structured savings plan for setting aside money each week. Saving progressively larger amounts builds savings for important goals. The pdf outlines the weekly targets for saving over the year-long challenge.

The document lists savings amounts beginning with $1 the first week progressing up to saving $52 in week 52. Total savings by year end reach $1,378 following this schedule. Some PDFs allow customizing weekly amounts or starting points to tailor the plan.

Following the 52 week money challenge PDF develops discipline in saving. Checking off each week’s target provides motivation. Completing the year-long challenge yields a substantial fund for vacations, debts, emergencies or other plans. A thoughtfully crafted 52 week money challenge PDF makes reaching savings goals achievable through steady progression.

Benefits of the 52-Week Money Challenge

The 52-Week Money Challenge offers a range of benefits that can help individuals of varying financial literacy levels and incomes. One of the most compelling advantages is its simplicity. The framework is easy to understand and execute; you start by saving just one dollar in the first week and increase the amount by a dollar each subsequent week. This ease of use makes it accessible to almost anyone, including those who are new to the concept of saving money. You don’t need a financial advisor or sophisticated budgeting tools to participate; all you need is the will to save and a jar or bank account to store the money.

Another benefit lies in the psychological reinforcement this challenge provides. Because the increments are small, they don’t feel burdensome. You’re not diving headfirst into a strict and difficult savings regime; instead, you’re easing into it, making it more likely that you’ll stick to the plan. Each week that you successfully save feels like a win, and these wins accumulate into a heightened sense of financial responsibility and awareness. This sense of achievement can spur you on to undertake other financial tasks, like budgeting or investing, with increased confidence.

Financially, the benefits are also significant. By the end of the challenge, you’ll have $1,378, which is a substantial sum for many people, particularly those who found it hard to save in the past. This could serve as an emergency fund, a down payment for a significant purchase, or even seed money for an investment. Many people underestimate the power of having a financial cushion until they encounter an unexpected expense. Having this money set aside can provide a sense of security and reduce stress levels associated with financial instability.

Moreover, the challenge promotes a disciplined approach to financial management. For many, the concept of saving is understood in theory, but not put into practice regularly. The 52-Week Money Challenge obliges participants to set aside money consistently, thus inculcating a savings habit. This is an invaluable life skill that extends beyond the duration of the challenge. Once the 52 weeks are over, the behavioral changes induced by regular saving can set the foundation for more advanced financial planning and decision-making.

Last but not least, the challenge is versatile. You can tailor it to meet your specific needs or constraints. For example, if saving $52 in the last week of the year feels too daunting, you can start in reverse, saving $52 in the first week and working your way down to $1 in the 52nd week. Alternatively, you can match the weekly savings amounts to your pay schedule or even double the savings if you find the challenge too easy. In essence, while the basic structure provides a framework, the adaptability ensures that it can fit a broad range of financial situations and goals.

How does the 52-week challenge work?

The 52-Week Money Challenge is a structured but flexible approach to saving money over the course of a year. It works on a weekly cycle, beginning with Week 1 and ending with Week 52. Here’s how it operates in detail:

Week 1:

You start the challenge by saving just $1 during the first week. This could mean setting aside a single dollar bill, or transferring $1 to a dedicated savings account, depending on how you prefer to save.

Week 2:

In the second week, you increase your savings amount to $2. Again, you can set this aside in cash, or transfer it to a savings account.

Week 3 and Beyond:

As you move into the third week, you save $3, and the pattern continues, with the savings amount increasing by $1 each week. So, for Week 4, you’ll save $4, for Week 5, it will be $5, and so on.

Cumulative Savings:

As you progress through the weeks, the savings amounts accumulate. So, by Week 2, you’ll have $3 saved ($1 from Week 1 and $2 from Week 2). By Week 3, you’ll have $6 ($1 from Week 1, $2 from Week 2, and $3 from Week 3), and the total continues to grow in this manner.

Week 52:

By the time you reach the 52nd week, you’ll be setting aside $52. This culminates the year-long effort and brings your total savings to $1,378.

Tracking Your Progress:

It’s crucial to keep track of your savings to ensure you’re sticking to the plan. You can do this manually by keeping a ledger, or you could use a spreadsheet or dedicated app. Some people find it motivating to mark off each completed week on a calendar as a visual representation of their progress.

Methods of Saving:

You have flexibility in how you save the money. Some people use a cash jar and physically place the designated amount in it each week. Others prefer to use a separate savings account and set up automated transfers corresponding to the weekly amounts.

Flexibility and Adaptation:

If you find that saving larger amounts becomes financially stressful later in the year, you can adapt the challenge to fit your circumstances. Some people reverse the process by starting with $52 in Week 1 and working backward to $1 in Week 52. Alternatively, you can “shuffle” the amounts; for example, if you can’t afford $50 in Week 50, you can switch it with a smaller amount from an earlier week that you skipped or saved ahead for.

Wrap-up:

Once you’ve reached the end of the 52-week cycle, you can choose to use the accumulated sum for a specific purpose, like an emergency fund, a down payment, or an investment. Many people also choose to roll over the challenge into the next year, either sticking to the same framework or adapting it to be more challenging.

The 52-Week Money Challenge provides a structured yet adaptable blueprint for cultivating a consistent savings habit, allowing you to accrue a sizable sum by the end of a year. Its strength lies in its simplicity, accountability, and the psychological rewards that come with watching a small, manageable effort grow into a significant financial achievement.

Practical Tips To Generate More Cash For The 52-week Savings Game

The 52 Week Money Challenge is a great way to systematically grow your savings over the course of a year. But coming up with the incrementally larger amounts to set aside each week can still feel challenging at times. The good news is there are practical strategies you can use to generate more cash flow for your 52-week savings game. Here are some tips to help boost your savings efforts:

At Home

- Declutter and Sell: Go through your belongings and sell items you don’t need on eBay, Craigslist, or Facebook Marketplace.

- Meal Prep: Cooking at home is usually cheaper than eating out. The money you save can be added to your 52-week fund.

At Work

- Overtime and Extra Shifts: If your job offers the opportunity for overtime or additional shifts, taking advantage could give you extra money.

- Freelance or Consulting: Use your professional skills to offer consulting or freelance services during your free time.

Online

- Online Surveys or Reviews: Some websites pay for taking surveys or writing product reviews.

- Remote Gigs: Websites like Upwork, Fiverr, or Freelancer offer a variety of remote jobs that can fit around your existing commitments.

In Your Community

- Pet Sitting/Dog Walking: Offer to take care of pets or walk dogs in your neighborhood for a fee.

- Tutoring: If you are good at a particular subject, offering tutoring sessions can be a way to earn and save.

- Handyman Services: Offer to mow lawns, shovel snow, or perform minor repairs for neighbors.

Investments and Savings Account

- High-Interest Savings Account: Consider putting your 52-week money into a high-interest savings account to earn more over time.

- Invest in Stocks: If you are familiar with the stock market, consider small investments. However, be cautious, as investing carries risk.

Cut Costs

- Budget: Keep a keen eye on your budget and identify areas where you can cut costs. Redirect the money saved into your 52-week fund.

- Cancel Unused Subscriptions: Whether it’s a gym membership you never use or a streaming service you’ve forgotten about, cancelling can free up some extra cash.

- Use Public Transport: If possible, use public transport instead of owning a car, which comes with expenses like fuel, insurance, and maintenance.

- Coupons and Cashback: Use coupons for groceries and take advantage of cashback offers on credit cards or apps.

Miscellaneous

- Gifts and Bonuses: Whenever you receive a financial gift or bonus, consider putting a portion into your savings pot.

- Automate Savings: If possible, set up an automatic transfer to your savings account each week to make sure you don’t miss any contributions.

- Accountability: Partner with a friend or family member to keep each other accountable for saving every week.

- Round-Up: Some banking apps offer a ’round-up’ feature that rounds up your purchases to the nearest dollar and saves the difference.

- Adjust the Challenge: If you find the latter weeks too challenging, you can adjust the amounts or even ‘reset’ back to a lower week and work up again.

Conclusion

The 52 Week Money Challenge presents a simple yet effective way to systematically grow your savings over the course of a year. By incrementally increasing your weekly savings, you can accumulate over $1,000 without feeling like you need to dramatically slash your spending all at once. Whether you are working to build an emergency fund, save for a vacation, or work toward another financial goal, this method makes consistent saving achievable.

To help you implement this savings approach, we have included free printable 52 Week Money Challenge templates you can use to track your progress. The templates provide options to save $1,000, $5,000, $10,000 or even $20,000 – so you can scale the savings challenge to meet your needs. With just a little planning and dedication, the 52 Week Money Challenge templates provide a structured framework to help you successfully boost your savings. Give it a try and let the savings grow!

FAQs

Can I start the 52-Week Money Challenge at any time?

Absolutely! While many people start the challenge at the beginning of a new year, you can start it at any point. Just make sure to follow it for 52 weeks to complete the challenge.

Do I have to start with $1? Can I start with more?

You can definitely customize the challenge to better fit your financial situation. Some people start with $2, $5, or even more, and increment accordingly each week.

Is the money meant to be saved in cash or can it be digital?

The money can be saved in whatever form is most convenient for you—cash, a savings account, or even an investment account. The key is to make regular contributions.

What if I miss a week?

If you miss a week, you can either make it up the following week, redistribute the amount over the remaining weeks, or reset back to a lower week and work your way back up.

Can I do the challenge in reverse?

Yes, some people prefer to start with the highest savings amount ($52) in the first week and work their way down to $1. This is often more manageable after receiving end-of-year bonuses or holiday gifts.

How much money will I have saved by the end?

If you complete the challenge without any modifications, you’ll have saved $1,378. If you customize the challenge to start with higher initial amounts, you’ll have saved even more.

Is the 52-Week Money Challenge effective?

Many people find the challenge effective for building a savings habit and accumulating a modest savings pot. It’s a straightforward and incremental way to start saving, which can make it less intimidating.

Are there any variations of the 52-Week Money Challenge?

Yes, there are various adaptations of the challenge to suit different needs. Some variations include the “bi-weekly challenge” for people paid bi-weekly, the “reverse challenge” where you start with $52 and work backward, and the “custom challenge” where you set your own weekly savings amounts.

Can I use the money before the 52 weeks are up?

While the primary goal is to not touch the money until the end of the challenge, life happens. You can use the money if absolutely necessary, but try to replace it as soon as possible to stay on track.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)