At the intersection of the rental agreement process lies a pivotal element – the security deposit receipt. This small but mighty document functions as a critical record for one of the most significant financial exchanges between a landlord and tenant. The simple act of issuing and maintaining this receipt can help mitigate disputes, clarify obligations, and foster a healthy rental relationship.

This article aims to explore the multi-faceted role of the security deposit receipt in the rental landscape. We’ll probe its essential characteristics, implications for both parties, and how it fits into broader legal and practical contexts. By illuminating its importance, we aspire to arm both landlords and tenants with the knowledge to navigate this often overlooked but crucial component of the rental process. In doing so, we also hope to foster greater understanding, fairness, and transparency in rental agreements.

Table of Contents

What is a security deposit receipt?

A security deposit receipt is a written acknowledgement provided by a landlord to a tenant as proof of receiving a specified amount as a security deposit. It’s an important document that verifies the tenant has indeed paid the amount they’re claiming, protecting both parties from potential disputes.

This receipt typically includes vital information such as the date of payment, the exact amount, the property’s address, and both the landlord’s and tenant’s names. In some cases, it may also specify conditions for refunding the deposit at the end of the lease term. Providing this receipt is not just a matter of good practice, but it’s legally mandated in many jurisdictions to ensure transparency and accountability in rental transactions.

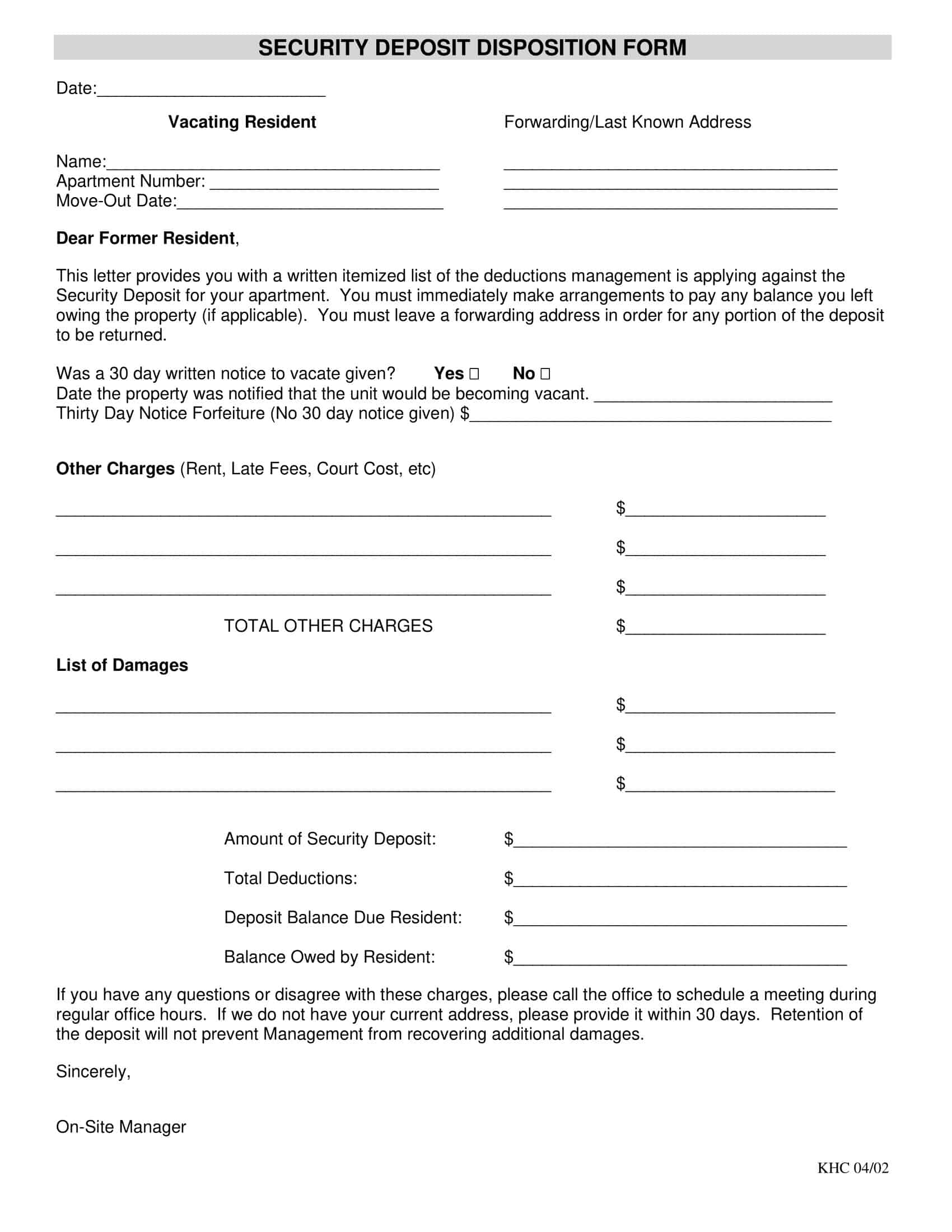

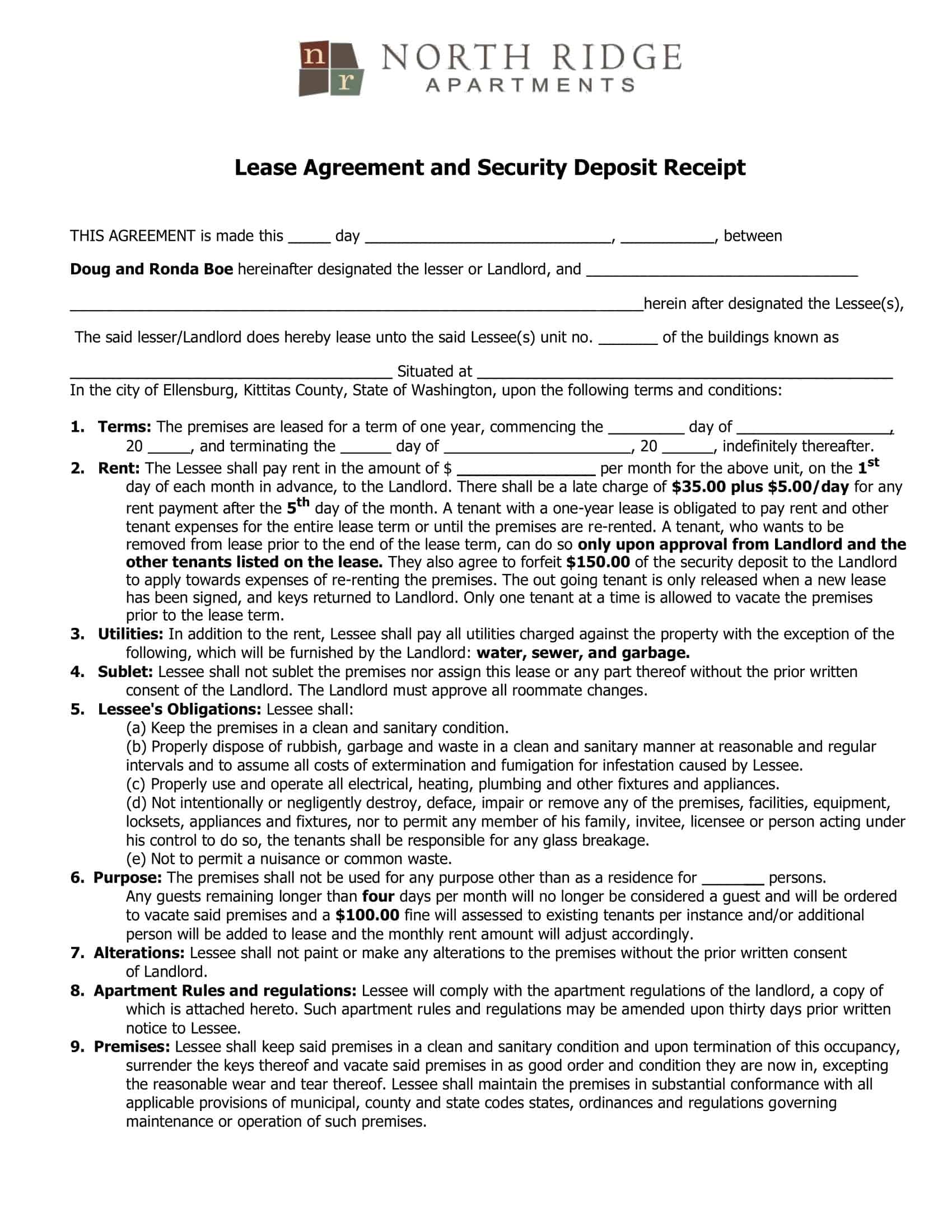

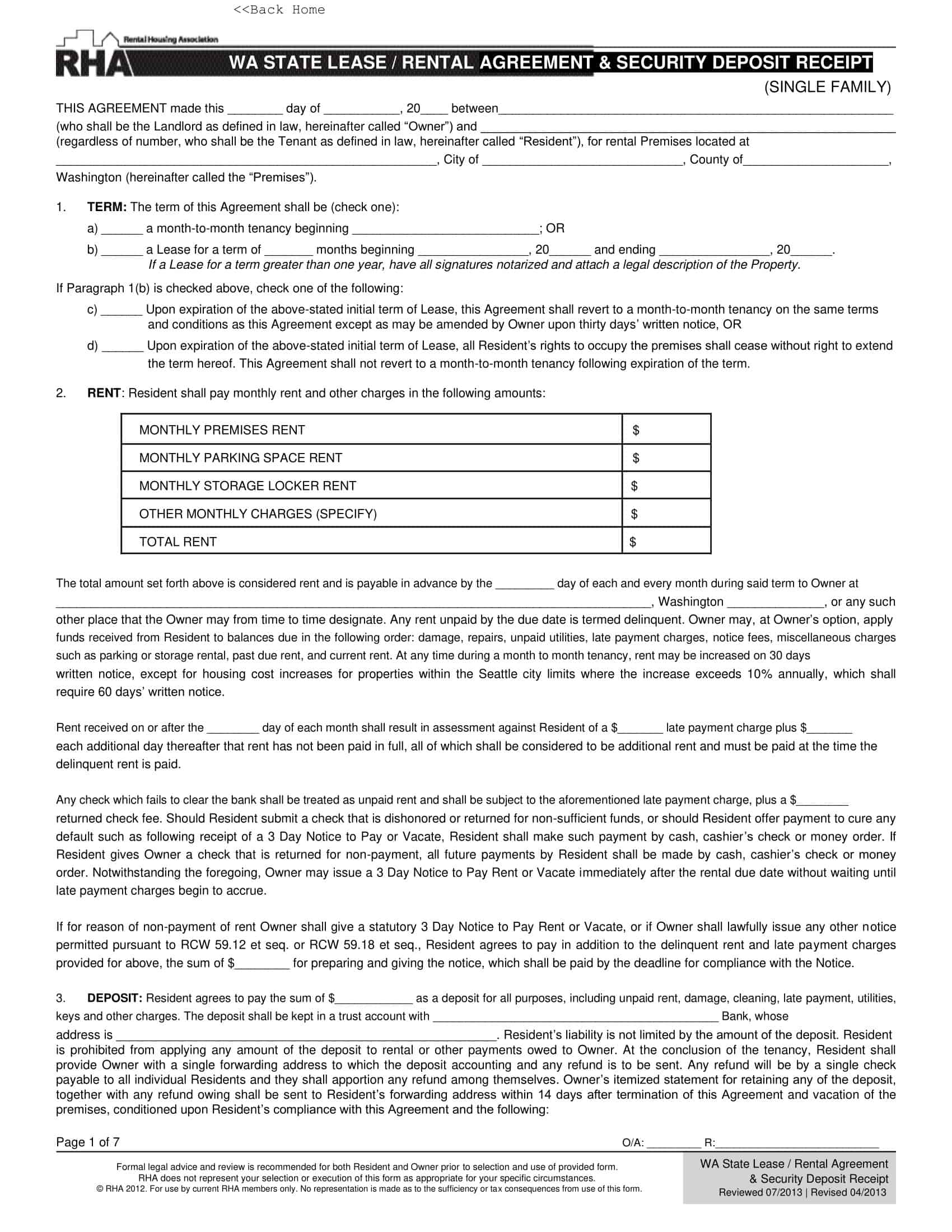

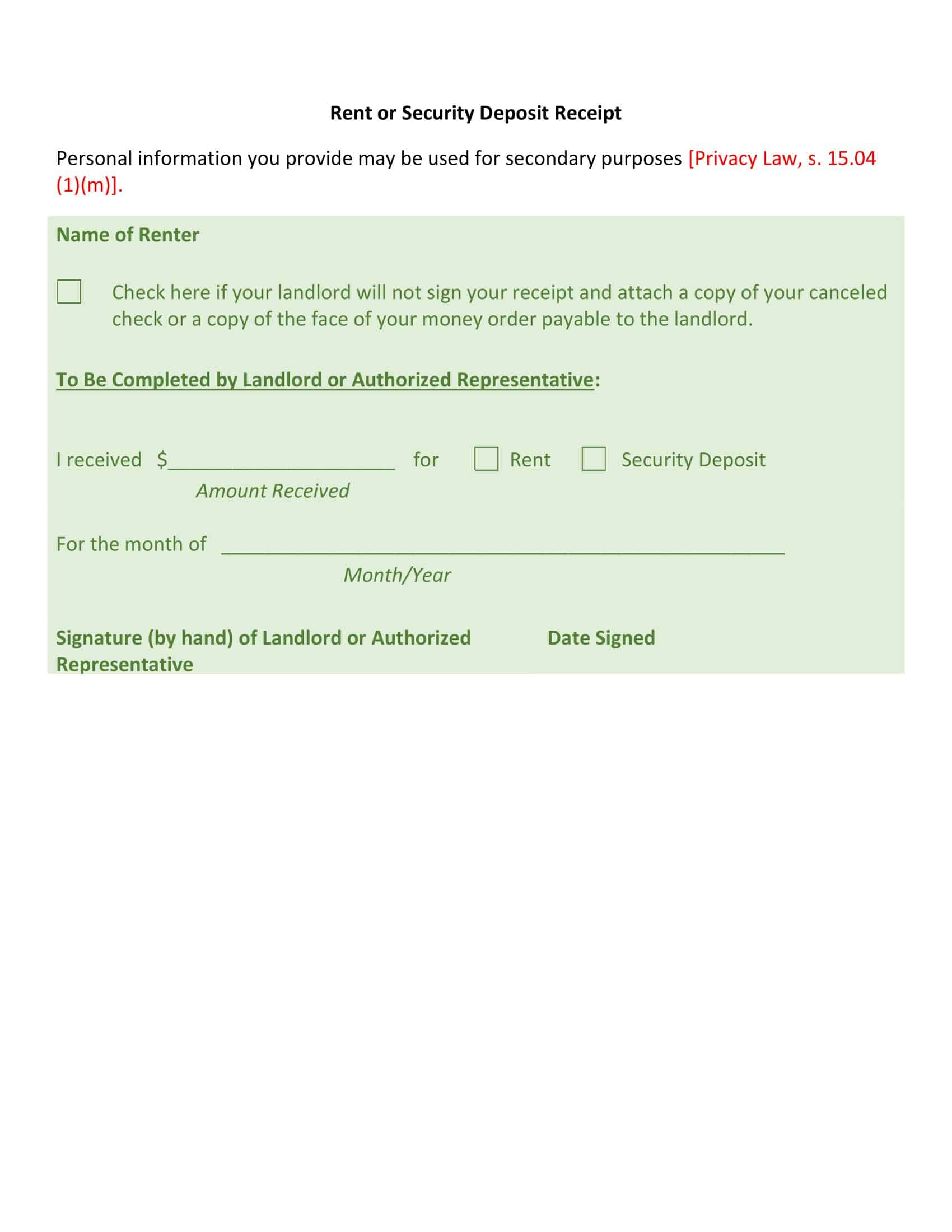

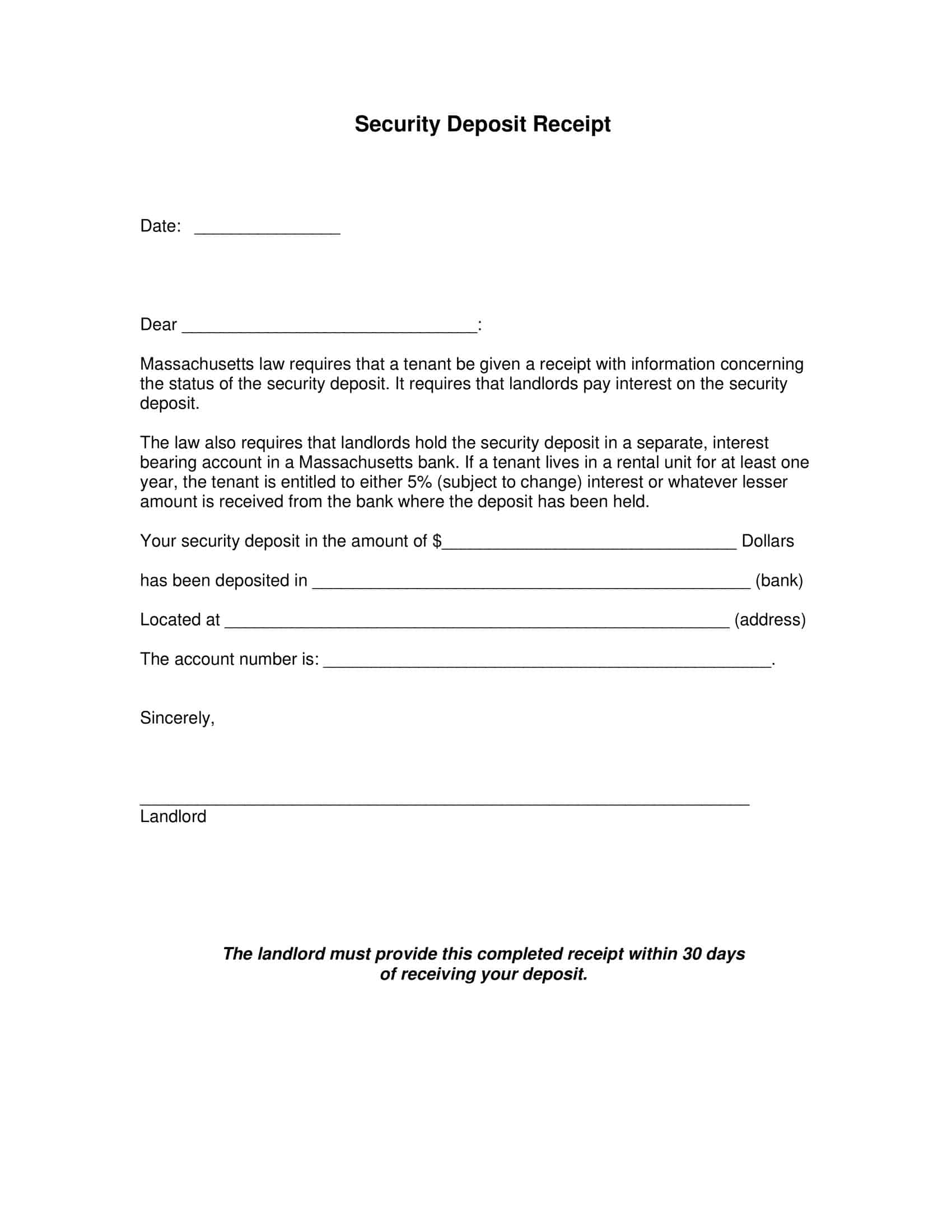

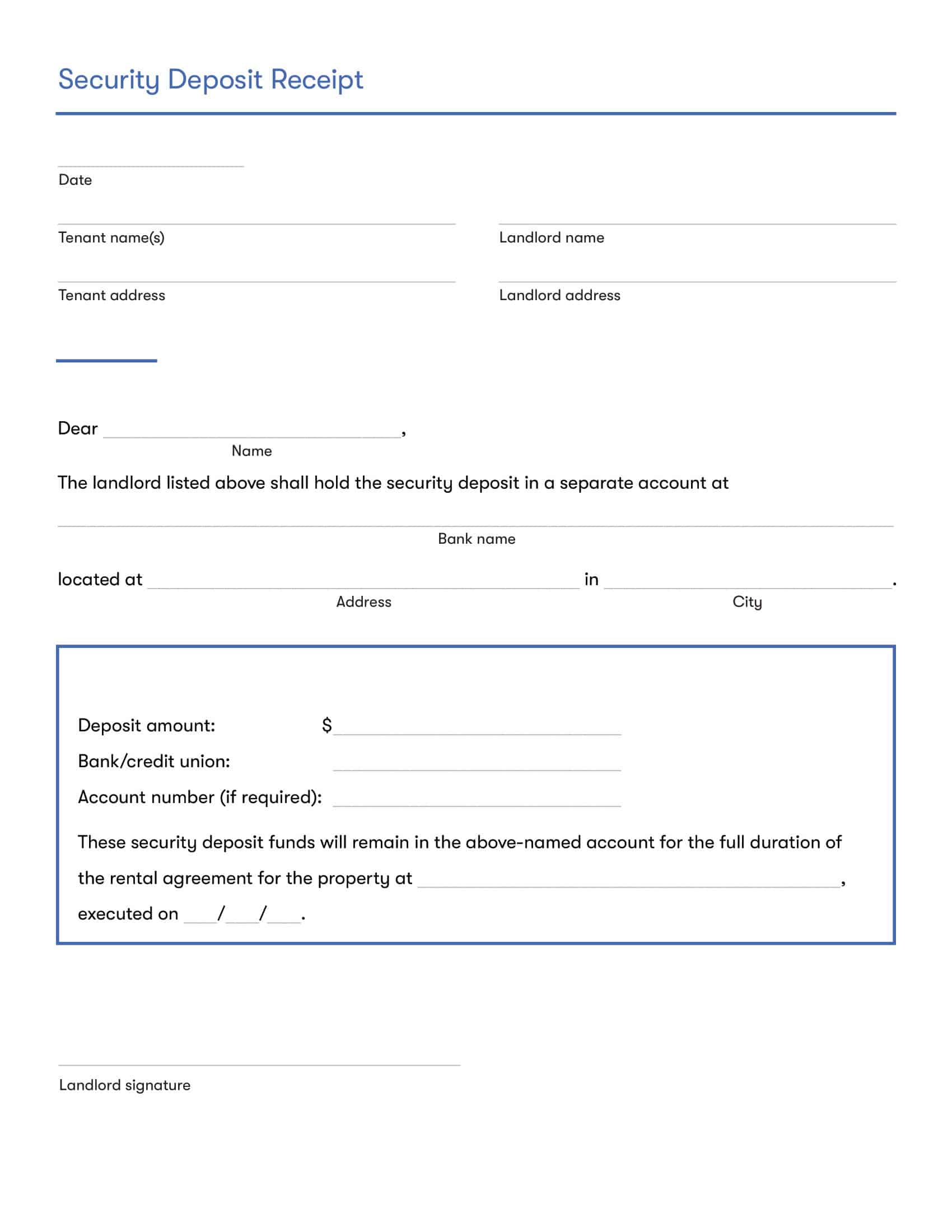

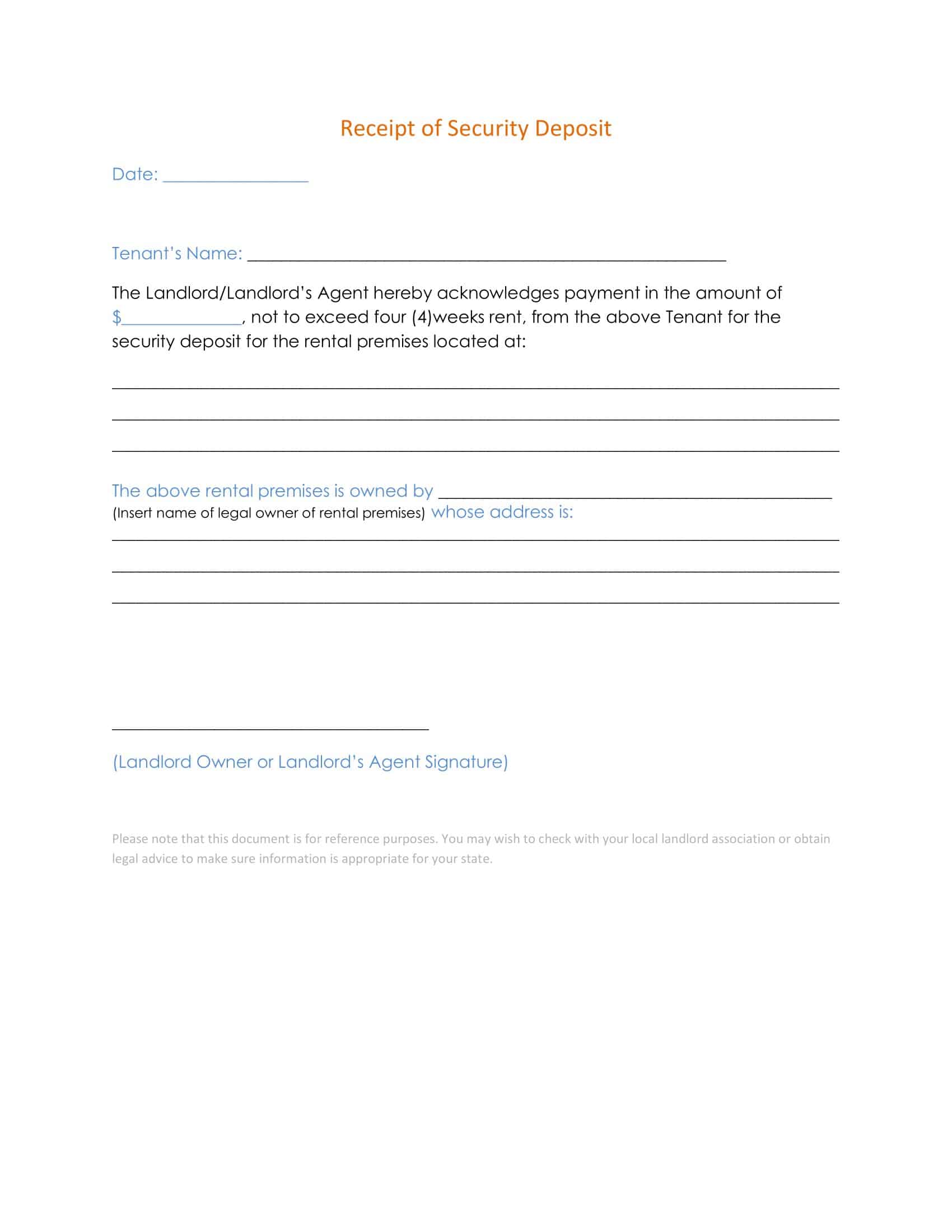

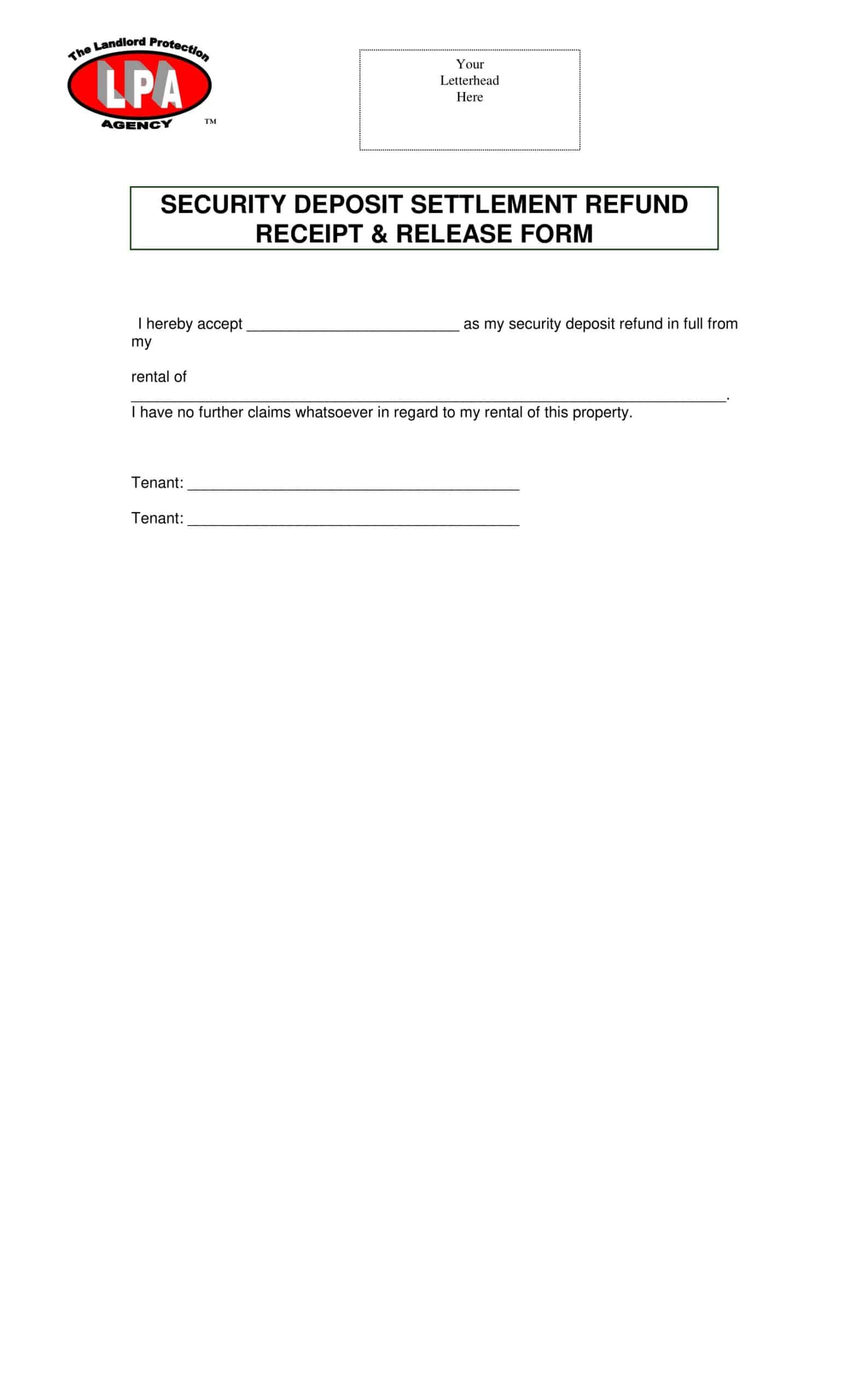

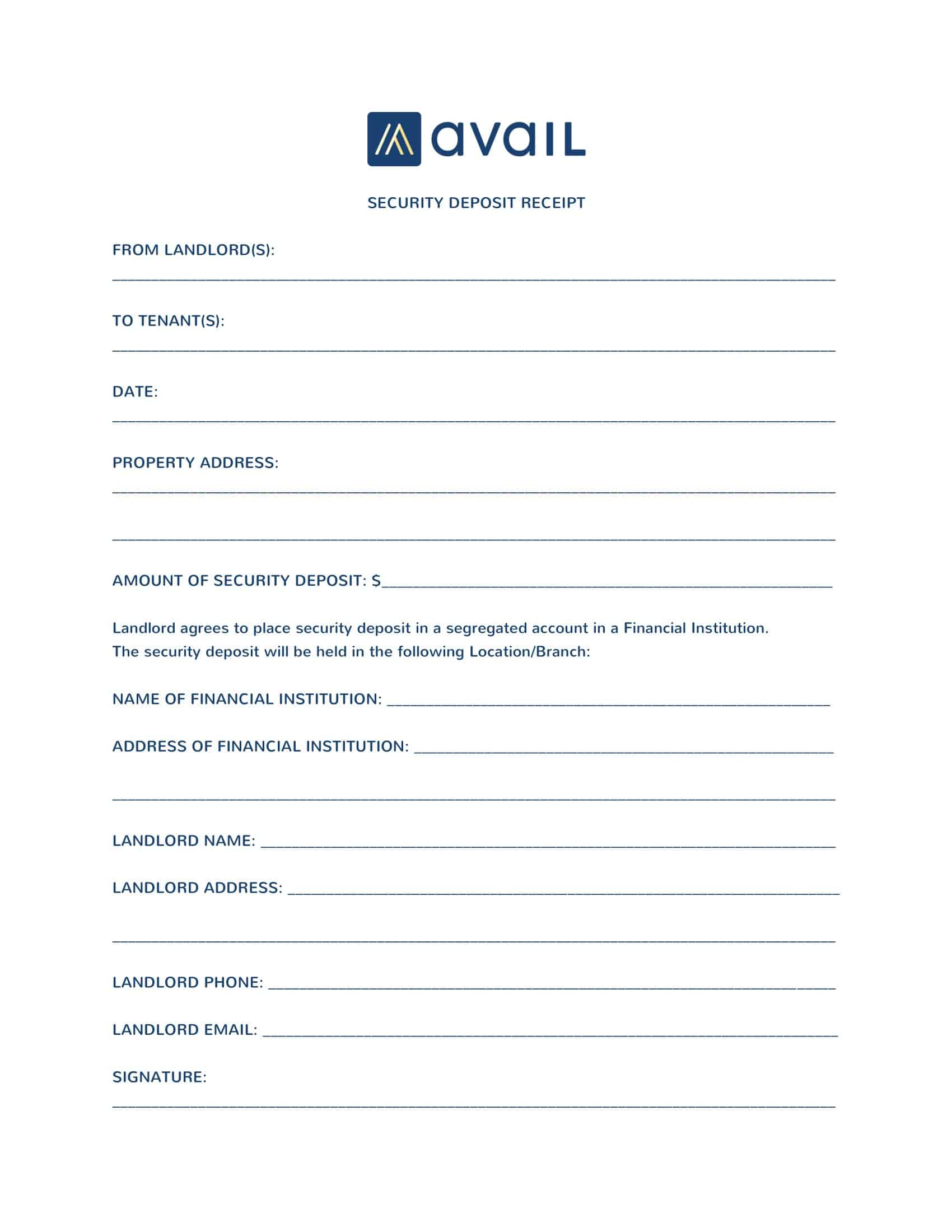

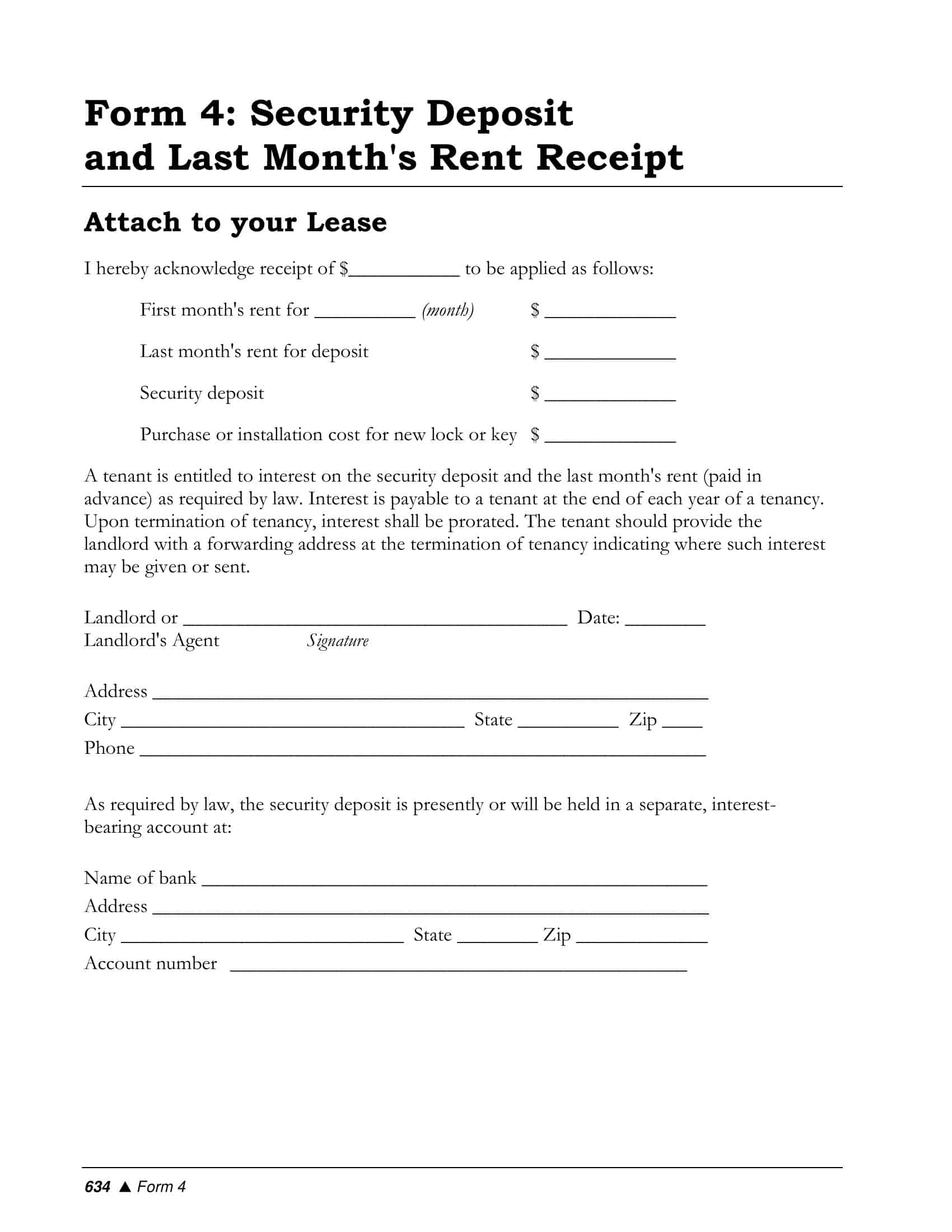

Security Deposit Receipt Templates

Security Deposit Receipt Templates offer a reliable and efficient way to manage property rental transactions. Ideal for landlords and property managers, these templates simplify the recording of deposits, acting as a mutual agreement between tenant and landlord.

Each template is designed for clarity, highlighting important information such as the tenant’s name, rental property address, deposit amount, and date. The templates are easy to use and can be customized according to specific needs, ensuring both parties have a clear, written record of the transaction. With our Security Deposit Receipt Templates, keeping track of rental security deposits is straightforward and stress-free.

Why Are Receipts Important For Landlords And Tenants

For Tenants: Proof, Protection, and Peace of Mind

Receipts in general, and specifically those for security deposits, play an integral role in providing a tangible record of financial transactions for tenants. They serve as an unambiguous proof of payment, ensuring there are no misunderstandings about whether, when, or how much was paid. In the event of a dispute, a receipt can be produced as concrete evidence.

Moreover, receipts can protect tenants from potential unscrupulous practices. If a landlord unjustifiably attempts to withhold the deposit, or claims that the deposit was never paid, a tenant can utilize the receipt to verify their payment and challenge such claims.

Lastly, receipts contribute to a tenant’s peace of mind. Knowing that there’s an official record of their payment can relieve potential stress and prevent conflicts. This becomes especially important when dealing with considerable amounts such as a security deposit.

For Landlords: Traceability, Trust, and Legal Compliance

For landlords, the issuance of receipts, including those for security deposits, creates a traceable paper trail for all financial transactions related to the rental property. This can simplify record keeping, and it can be particularly useful during tax season or in case of an audit.

In terms of building trust, when landlords provide receipts, it establishes a level of professionalism and integrity in their dealings with tenants. It shows that they respect the transaction process and are committed to maintaining clear and transparent records. This can help in establishing and maintaining a healthy landlord-tenant relationship.

Finally, providing receipts helps landlords stay compliant with the law. Many jurisdictions require landlords to provide tenants with a receipt for their security deposit. Non-compliance can lead to legal issues, fines, or even lawsuits. Therefore, it is crucial for landlords to understand and adhere to these legal obligations to protect themselves and their business.

What to include in the Security Deposit Receipt?

Creating a comprehensive security deposit receipt involves including several key pieces of information. A detailed and accurate receipt not only provides a clear record of the transaction but also ensures legal compliance. Here are the crucial elements that should be included:

1. Landlord’s Information: The full legal name of the landlord or the property management company should be clearly stated. This includes the contact information such as physical address, phone number, and email address.

2. Tenant’s Information: Just like the landlord’s information, the full name of the tenant should be included. If the property is being leased by multiple tenants, each tenant’s name should be listed.

3. Property Details: The receipt should specify the address of the rental property, including unit number if applicable. Other relevant details about the property could be included as well.

4. Date of Transaction: The exact date when the security deposit was received by the landlord. This helps to establish a timeline for future reference.

5. Amount of Security Deposit: The exact amount that was received as the security deposit should be clearly stated. If the deposit was paid in installments, each installment should be documented separately with the respective dates and amounts.

6. Method of Payment: Whether the deposit was paid via check, cash, electronic transfer, or any other method, it should be specified in the receipt. If the payment was made by check, include the check number as well.

7. Purpose of Payment: It should be clearly stated that the payment was made as a security deposit for the specified rental property.

8. Terms of Deposit Return: If there are specific conditions under which the deposit would be refunded or deductions might be made, these should be outlined. This could include property damage beyond normal wear and tear, unpaid rent, or cleaning costs, among others.

9. Signature: The receipt should be signed by the landlord or the authorized person who received the security deposit. The signature confirms that the payment was received.

10. Receipt Copy: It’s always a good idea for the landlord to keep a copy of the receipt. This helps maintain their own records and could be necessary for resolving any future disputes.

How Much Should a Landlord Charge for a Security Deposit?

The amount a landlord should charge for a security deposit can vary greatly depending on several factors, and it is often governed by local and state laws. As a general guideline, landlords typically charge between one and two months’ rent as a security deposit. However, it’s crucial for landlords to familiarize themselves with the specific regulations applicable in their region, as charging more than the legal limit can result in penalties.

Here are some key considerations and conditions that can impact the amount of a security deposit:

1. Local and State Laws: This is the most critical factor. Different states and cities have different laws regarding how much a landlord can charge for a security deposit. In some states, there’s no maximum limit, while others may cap it at one or two months’ rent. Certain laws may also differentiate between unfurnished and furnished properties or long-term and short-term leases.

2. Property Value and Rental Rate: The value of the property and the amount of rent being charged can affect the security deposit amount. A property with a higher rental rate will generally command a higher security deposit.

3. Tenant’s Credit History: If a tenant has a lower credit score or a history of late payments, a landlord might charge a higher security deposit to mitigate the risk. However, this practice must be within the constraints of local laws and regulations.

4. Pet Policies: If the landlord allows pets, they may require an additional pet deposit to cover any potential damage caused by the pet. Again, some jurisdictions have specific laws about pet deposits, so it’s essential to check the local regulations.

5. Customizations: If a tenant requests specific customizations to the property that require a significant investment from the landlord, an increased security deposit might be charged.

6. Furnished vs. Unfurnished: Generally, landlords charge a higher security deposit for furnished apartments to protect against potential damage to the furniture.

It’s also important to remember that the security deposit is refundable, provided that the tenant meets all the obligations of the lease. Clear communication about the deposit amount, the conditions under which it may be partially or fully retained, and the process for returning it at the end of the lease, helps foster a good landlord-tenant relationship.

How Is a Security Deposit Returned?

The return of a security deposit typically occurs at the end of a lease agreement, once the tenant has moved out of the property. The landlord will conduct a final inspection to assess any potential damage beyond normal wear and tear. Any necessary deductions for unpaid rent, cleaning costs, or property damage are made from the deposit, and the remainder is returned to the tenant.

The specifics of this process, including the timeline for returning the deposit, can vary based on local and state laws. In many cases, the landlord is required to provide an itemized list of deductions along with the balance of the deposit, if the full amount is not returned. It’s crucial for both landlords and tenants to understand their rights and responsibilities in this process to ensure a smooth transition and avoid disputes.

How do I write a security deposit receipt?

Writing a security deposit receipt involves a straightforward process. Follow these steps to create a clear, comprehensive, and professional receipt:

Step 1: Choose a Format:

Decide whether you want to write the receipt by hand, use a digital template, or a receipt book. Depending on your method, the subsequent steps might differ slightly, but the information to be included remains the same.

Step 2: Start with Basic Information:

Begin by writing the full legal name and contact information (address, phone number, and email address) of the landlord or the property management company. Following this, include the tenant’s name and contact information.

Step 3: Provide Property Details:

Include the address of the rental property. Be sure to include any specifics, such as the unit or apartment number, if applicable.

Step 4: Specify the Date:

Write the date on which the security deposit was received. This establishes a timeline for when the deposit must be returned at the end of the lease.

Step 5: State the Amount:

Clearly indicate the amount received as the security deposit. If the deposit was paid in multiple installments, each payment should be noted separately with its own date and amount.

Step 6: Indicate Payment Method:

Specify the method by which the payment was made – whether it was cash, check, or electronic transfer. If it was a check, make sure to include the check number.

Step 7: Define the Purpose:

Clearly state that the payment was made as a security deposit for the rental property.

Step 8: Detail Return Conditions:

Outline the conditions under which the deposit will be refunded. This includes details about potential deductions, such as damage repair or unpaid rent.

Step 9: Sign the Receipt:

The landlord or the authorized person should sign the receipt. The signature acts as confirmation that the payment was received.

Step 10: Make a Copy:

Keep a copy of the receipt for your own records. This is important for maintaining a paper trail and could be necessary in case of a dispute.

Security Deposit Laws by State

| State | Amount Limits | Deadline for Return | Acceptable Reasons for Deductions | Maintenance of Funds |

| Alabama | No limit | 60 days after vacancy | Unpaid rent, damages, utilities, legal expenses | Held in escrow account, itemized deductions |

| Alaska | Up to 2 months rent | 14 days after vacancy | Unpaid rent, damages, utilities, attorney fees | Held in trust in Alaska, accrues interest |

| Arizona | 1.5 times monthly rent | 14 days after vacancy | Unpaid rent, repairs, utilities, storage fees | Held in approved institution, itemized statement |

| Arkansas | 2 months rent | 60 days after vacate | Unpaid rent, damages, breach expenses | Held in escrow |

| California | 2-3 times monthly rent | 21 days after vacate | Unpaid rent, cleaning, repairs | Held in trust |

| Colorado | No limit | 1 month after lease end | Unpaid rent, damages, storage fees | Held in separate account |

| Connecticut | 2 months rent | 30 days after lease end | Unpaid rent, damages, storage fees | Held in escrow |

| Delaware | 1 month rent | 20 days after vacate | Unpaid rent, damages, legal fees for eviction | Held in approved financial institution |

| Florida | No limit | 15-60 days after vacate | Unpaid rent, damages, cleaning, storage fees | Held in separate non-interest account |

| Georgia | No limit | 1 month after vacate | Unpaid rent, damages, fees, utilities, legal expenses | Held in escrow |

| Hawaii | 1 month rent | 14 days after vacate | Unpaid rent, damages, cleaning, legal fees | Held in trust |

| Idaho | No limit | 21 days after vacate | Unpaid rent, damages, cleaning, repairs, utilities, storage fees | Held in trust |

| Illinois | No limit | 45 days after vacate | Unpaid rent, damages, cleaning, legal fees | Held in approved financial institution |

| Indiana | No limit | 45 days after vacate | Unpaid rent, damages, utilities, legal fees | Held in escrow |

| Iowa | 2 months rent | 30 days after vacate | Unpaid rent, damages, utilities | Kept separate from landlord’s assets |

| Kansas | No limit | 30 days after vacate | Unpaid rent, damages, cleaning, reletting costs | Held in trust |

| Kentucky | No limit | 60 days after vacate | Unpaid rent, damages, storage fees | Held in separate account |

| Louisiana | No limit | 1 month after vacate | Unpaid rent, damages, reasonable cleaning and repairs | Held in trust or escrow account |

| Maine | 2 months rent | 21 days after vacate | Unpaid rent, damages, cleaning, storage fees | Held in separate interest-bearing account |

| Maryland | 2 months rent | 45 days after vacate | Unpaid rent, damages, utilities, breach fees, court costs | Placed in escrow |

| Massachusetts | 1 month rent | 30 days after vacate | Unpaid rent, damages, reasonable cleaning | Held in separate interest-bearing account |

| Michigan | 1.5 months rent | 30 days after vacate | Unpaid rent, damages, utilities, cleaning, legal fees | Held in regulated financial institution |

| Minnesota | 1 month rent | 3 weeks after vacate | Unpaid rent, non-ordinary damages | Held in trust |

| Mississippi | No limit | 45 days after vacate | Unpaid rent, damages, reasonable charges | Held in separate account |

| Missouri | 2 months rent | 30 days after vacate | Unpaid rent, damages, utilities | Held in landlord’s trust account |

| Montana | No limit | 30 days after vacate | Unpaid rent, damages, cleaning | Held in trust |

| Nebraska | 1 month rent | 14 days after vacate | Unpaid rent, damages, utilities, restoration costs | Held separately in trust |

| Nevada | 3 months rent | 30 days after vacate | Unpaid rent, repairs, cleaning, utilities | Kept in trust |

| New Hampshire | 1-1.5 months rent | 30 days after lease end | Unpaid rent, damages, reasonable cleaning | Kept in separate account |

| New Jersey | 1.5 months rent | 30 days after vacate | Unpaid rent, damages, reasonable cleaning | Held in interest bearing account |

| New Mexico | 1 month rent | 30 days after vacate | Unpaid rent, damages, utilities | Held in trust |

| New York | 1+ months rent | 14 days after vacate | Unpaid rent, damages, reasonable cleaning | Held in trust |

| North Carolina | 2 months rent | 30 days after vacate | Unpaid rent, damages, utilities, cleaning | Held separately with itemized records |

| North Dakota | 1 month rent | 30 days after vacate | Unpaid rent, damages, cleaning | Held in separate account |

| Ohio | No limit | 30 days after vacate | Unpaid rent, damages, utilities | Held in separate account |

| Oklahoma | No limit | 30 days after vacate | Unpaid rent, damages, cleaning, utilities | Held separately in escrow |

| Oregon | 1 month rent | 31 days after vacate | Unpaid rent, damages, utilities | Held in separate account |

| Pennsylvania | 2 months rent | 30 days after vacate | Unpaid rent, damages, utilities | Held in separate escrow account |

| Rhode Island | 1 month rent | 20 days after vacate | Unpaid rent, damages, storage fees | Held in separate account |

| South Carolina | No limit | 30 days after vacate | Unpaid rent, damages, utilities | Held in separate trust account |

| South Dakota | 1 month rent | 2 weeks after vacate | Unpaid rent, damages, cleaning | Held in trust |

| Tennessee | No limit | 60 days after vacate | Unpaid rent, damages, reasonable charges | Held separately |

| Texas | No limit | 30 days after vacate | Unpaid rent, damages, utilities | Refunded with itemized deductions |

| Utah | No limit | 30 days after vacate | Unpaid rent, damages, cleaning, utilities | Held separately with detailed records |

| Vermont | Up to 1 month rent | 14 days after vacate | Unpaid rent, damages, reasonable charges | Held in separate escrow account |

| Virginia | 2 months rent | 45 days after vacate | Unpaid rent, damages, utilities, breach fees | Held in interest bearing account |

| Washington | No limit | 21 days after vacate | Unpaid rent, damages, cleaning, utilities, attorney fees | Held in trust account |

| West Virginia | 1 month rent | 60 days after vacate | Unpaid rent, damages, reasonable charges | Held separately with itemized deductions |

| Wisconsin | No limit | 21 days after vacate | Unpaid rent, damages, utilities | Held in trust or escrow account |

| Wyoming | No limit | 30 days after vacate | Unpaid rent, damages, utilities | Refunded with itemized deductions |

FAQs

Is a landlord legally required to provide a security deposit receipt?

The legal requirement for providing a security deposit receipt varies depending on the local laws and regulations. In some jurisdictions, landlords are legally required to provide a receipt whenever they receive a security deposit. To be sure, check the specific rental laws in your area.

What happens if a landlord does not provide a security deposit receipt?

If a landlord does not provide a security deposit receipt, it can lead to potential disputes or legal issues. Without a receipt, a tenant may have difficulty proving they paid a deposit in the event of a dispute. Again, the exact consequences depend on local rental laws.

Can a security deposit receipt be digital?

Yes, a security deposit receipt can be digital. The important aspect is that it contains all the required information and is provided to the tenant in a way that they can store and retrieve it if needed. However, the acceptance of digital receipts can depend on local laws, so it’s important to verify what is acceptable in your jurisdiction.

How can I verify that my security deposit receipt is valid?

A valid security deposit receipt should contain crucial details such as the landlord’s full name (or property management company’s name), the tenant’s name, the property’s address, the date, the amount paid, and a unique receipt number. It should also be signed by the landlord or property manager. If any of these details are missing, you might want to request a new receipt.

Can I use a security deposit receipt for tax purposes?

As a tenant, your security deposit isn’t typically tax-deductible since it’s considered a refundable amount. For landlords, security deposits aren’t counted as income when received (since it’s a liability that may have to be repaid) unless it’s used to cover unpaid rent or damages and isn’t returned to the tenant. In such cases, it becomes taxable income. Always consult with a tax professional or CPA for accurate information.

What if there’s a mistake on the security deposit receipt?

If there’s a mistake on your security deposit receipt, such as an incorrect amount or date, you should inform your landlord or property manager immediately. Request a corrected receipt to ensure accurate records.

What should I do with my security deposit receipt after receiving it?

Keep your security deposit receipt in a safe place where you can easily retrieve it. You might need it when you move out to confirm the original deposit amount or to settle any disputes that may arise about the deposit.

I lost my security deposit receipt. What should I do?

If you lose your security deposit receipt, contact your landlord or property manager as soon as possible. They should be able to provide you with a new copy. However, it’s best to avoid this situation by storing your receipt in a safe, secure place and considering making a digital copy.

My landlord refuses to give me a security deposit receipt. What can I do?

If your landlord refuses to provide a security deposit receipt, check your local rental laws. In some places, it’s mandatory for landlords to provide this receipt. If the law is on your side, you may need to seek legal advice or contact a local tenant’s rights organization. It may also be helpful to provide a written request for the receipt as evidence of your efforts.

Can a landlord charge for providing a security deposit receipt?

Typically, a landlord should not charge for providing a basic security deposit receipt. If your landlord attempts to do so, you should check local laws to determine whether this is permitted. It’s usually considered a part of their responsibilities.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)