A Risk Matrix is a tool used in risk management to visualize and evaluate potential risks in an organized and systematic manner. It provides a graphical representation of the likelihood and potential impact of identified risks, allowing organizations to prioritize and allocate resources effectively to mitigate or prevent potential losses.

The matrix categorizes risks based on their severity and probability, enabling decision makers to understand the overall risk exposure and develop informed strategies for risk mitigation. By using a Risk Matrix, organizations can proactively manage and control risks, improve their overall risk management process, and make informed decisions that will protect their interests and promote growth.

Table of Contents

Risk Matrix Templates

Effectively assess and manage risks with our comprehensive collection of Risk Matrix Templates. These customizable and printable templates provide a visual representation of potential risks, their likelihood, and their impact on your projects, operations, or business. With different risk levels plotted on a matrix, our templates allow you to prioritize risks, allocate resources, and develop appropriate risk mitigation strategies.

By utilizing our Risk Matrix Templates, you can enhance decision-making, identify potential areas of concern, and take proactive measures to minimize the impact of risks. Whether you’re a project manager, a risk analyst, or a business owner, our templates offer a valuable tool to ensure a systematic and comprehensive approach to risk management. Download now and gain a clear understanding of your risks to safeguard your success.

Why Is the Risk Assessment Matrix Important?

The Risk Assessment Matrix is important because it helps organizations to understand and manage potential risks in a comprehensive and effective manner. By visualizing the likelihood and impact of identified risks, the matrix provides a clear and concise picture of an organization’s risk exposure. This information is essential for effective risk management, as it enables organizations to prioritize and allocate resources to address the most critical risks. The matrix also helps organizations to communicate the risks and associated strategies to all stakeholders, including management, employees, and customers.

This transparency and accountability promote a culture of risk awareness and encourage organizations to continuously assess and improve their risk management processes. Ultimately, the Risk Assessment Matrix helps organizations to minimize the potential impact of risks, improve decision-making, and protect their long-term viability and success.

How Does the Risk Assessment Matrix Work?

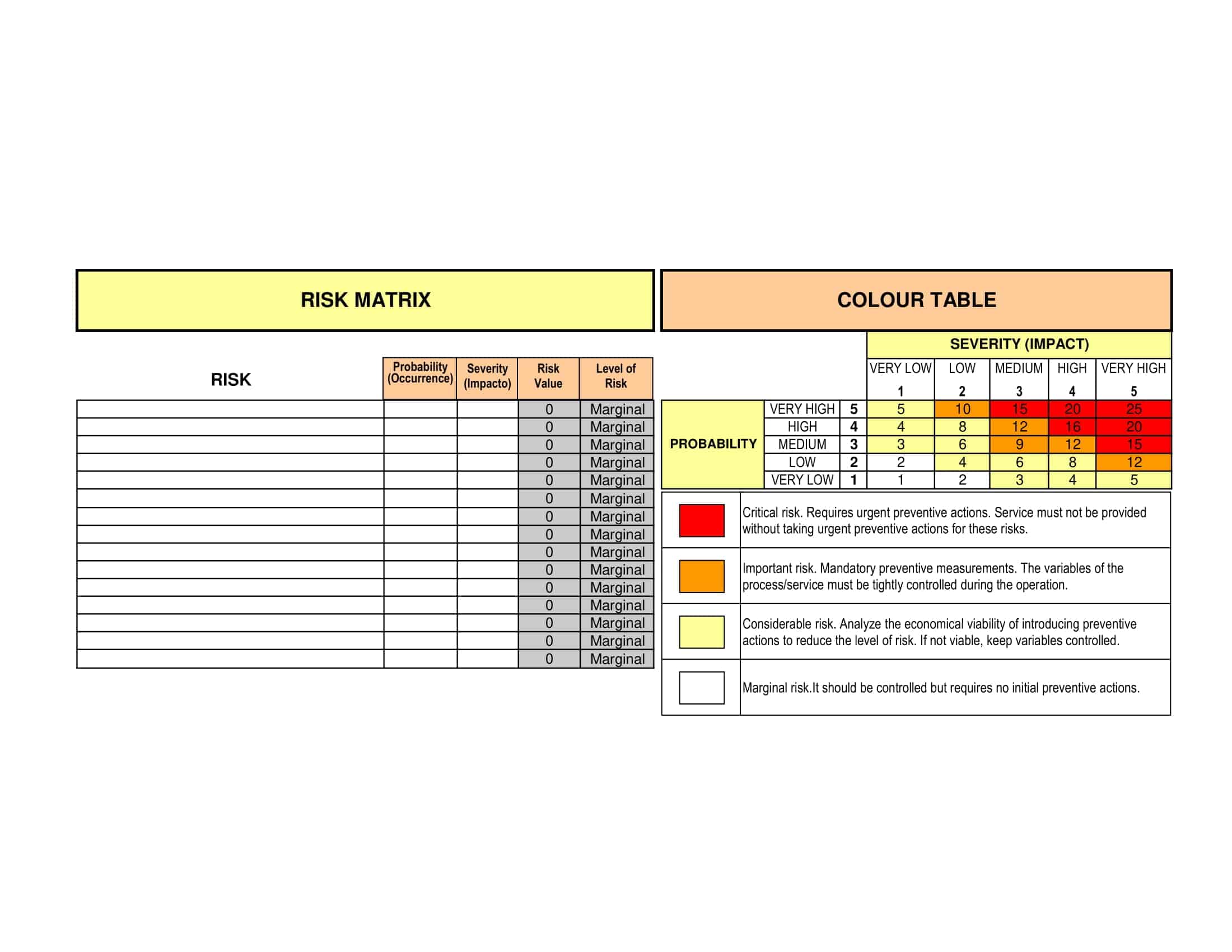

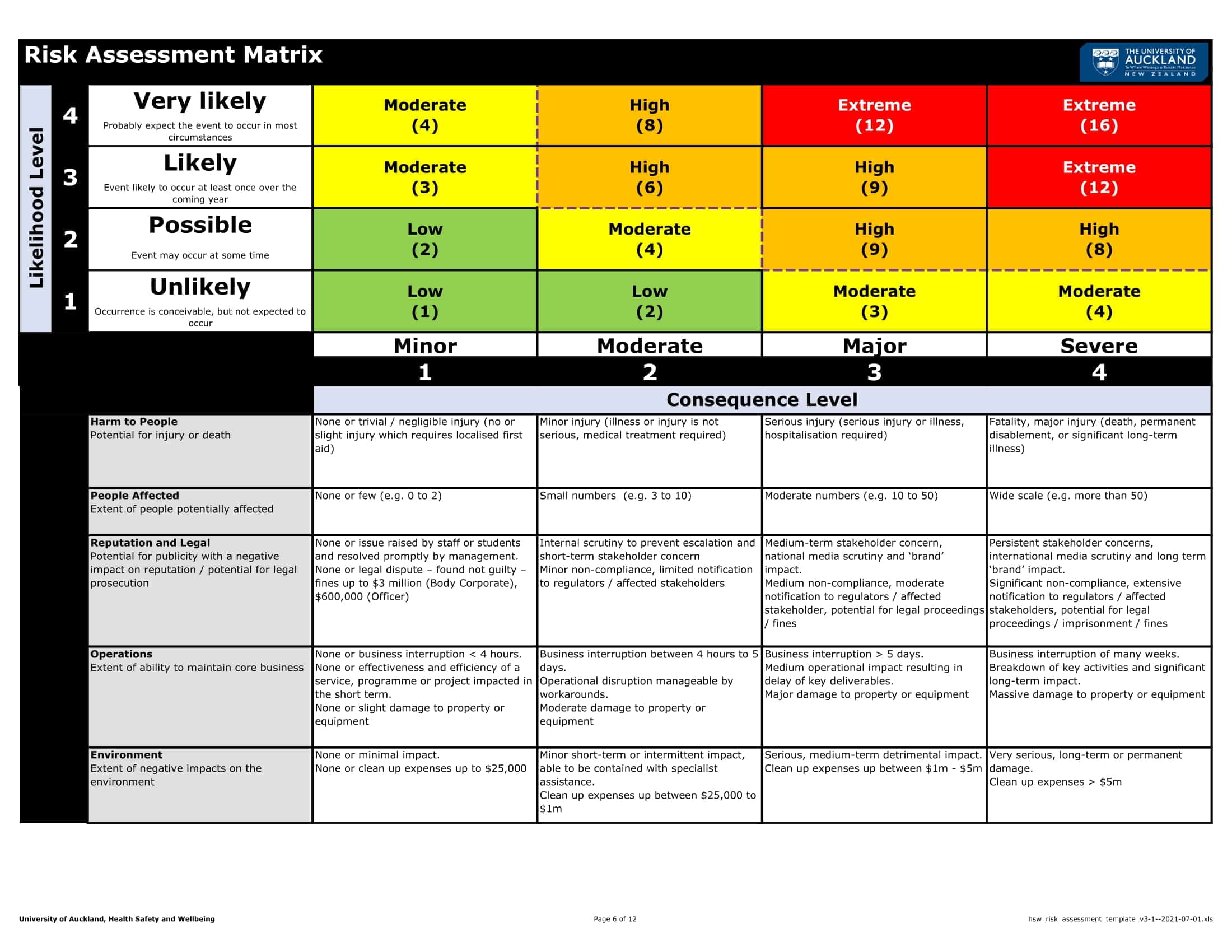

The Risk Assessment Matrix works by plotting the likelihood and impact of identified risks on a graph. The likelihood of a risk occurring is rated on a scale, such as low, medium, or high. The impact of a risk is also rated on a scale, such as minor, moderate, or major. These two ratings are then plotted on the matrix to determine the risk level. The resulting risk level can be used to prioritize and allocate resources for risk management activities.

For example, a risk with a high likelihood and high impact would be placed in the high risk quadrant of the matrix, indicating that this risk requires immediate attention and significant resources to mitigate or prevent. On the other hand, a risk with a low likelihood and low impact would be placed in the low risk quadrant, indicating that this risk may not require immediate action or significant resources.

By using the Risk Assessment Matrix, organizations can categorize risks based on their severity and prioritize their risk management activities accordingly. This enables organizations to make informed decisions, allocate resources effectively, and continually improve their risk management processes.

Benefits of a risk management matrix

There are several benefits to using a risk management matrix:

Prioritization of Risks: The matrix allows organizations to prioritize risks based on their likelihood and impact, which enables them to allocate resources effectively and address the most critical risks first.

Improved Communication: The matrix provides a clear and concise visual representation of risks, making it easier for organizations to communicate risk information to stakeholders, such as management, employees, and customers.

Better Decision Making: By categorizing risks based on their severity, the matrix provides organizations with the information they need to make informed decisions about risk management activities.

Increased Awareness: The use of a risk management matrix promotes a culture of risk awareness and encourages organizations to continuously assess and improve their risk management processes.

Consistency: The matrix provides a standardized and consistent approach to risk assessment, which helps to ensure that risks are evaluated and managed consistently across the organization.

Better Resource Allocation: By prioritizing risks, the matrix enables organizations to allocate resources more effectively, which can lead to improved risk management outcomes.

Improved Compliance: The use of a risk management matrix can help organizations to meet regulatory and compliance requirements, as well as demonstrate their commitment to responsible risk management practices.

Enhanced Reputation: By effectively managing risks, organizations can improve their reputation and enhance their overall competitiveness in their industry.

How to Make a Risk Assessment Matrix?

Creating a Risk Assessment Matrix is a critical step in managing risks effectively, and it requires careful planning and execution. Here is a step-by-step guide on how to create a Risk Assessment Matrix:

Step 1: Identify Risks

The first step in creating a Risk Assessment Matrix is to identify the risks facing your organization. This process can involve a comprehensive risk assessment, which typically includes conducting a thorough analysis of your organization’s operations, assets, processes, and the external environment. You can use techniques such as SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis or brainstorming sessions to identify potential risks.

Step 2: Evaluate the Likelihood and Impact of Risks

Once you have identified the risks, you will need to evaluate their likelihood and impact. The likelihood of a risk occurring should be rated on a scale, such as low, medium, or high. The impact of a risk should also be rated on a scale, such as minor, moderate, or major.

Step 3: Create the Matrix

The next step is to create the matrix, which will consist of a graph with a two-dimensional grid. The x-axis represents the likelihood of a risk occurring, and the y-axis represents the impact of the risk. The grid is divided into quadrants, with each quadrant representing a different level of risk. The specific number of quadrants and the definitions of risk levels will vary depending on the needs of your organization.

Step 4: Plot the Risks

Once you have created the matrix, you will need to plot the risks based on their likelihood and impact. This involves determining the risk level of each risk based on the ratings of likelihood and impact. Risks with high likelihood and high impact will be placed in the high risk quadrant, while risks with low likelihood and low impact will be placed in the low risk quadrant.

Step 5: Assign Risk Owners and Mitigation Strategies

The next step is to assign risk owners and develop mitigation strategies for each risk. The risk owner is the person responsible for managing the risk, and they should be the one responsible for implementing the mitigation strategies. Mitigation strategies can include activities such as reducing the likelihood of a risk occurring, reducing the impact of a risk, or transferring the risk to another party.

Step 6: Monitor and Review the Matrix

Finally, you will need to monitor and review the matrix regularly to ensure that the risks are being effectively managed. This can involve updating the matrix to reflect changes in the likelihood and impact of risks, as well as any changes to the mitigation strategies. It’s important to continuously assess and improve your risk management processes to ensure that you are proactively managing risks and protecting your organization’s interests.

In conclusion, a Risk Assessment Matrix is a critical tool for managing risks effectively, and its success depends on careful planning, execution, and continuous improvement. By following these steps, you can create a matrix that will help you prioritize and manage risks, improve decision making, and protect your organization’s long-term viability and success.

How to Determine the Likelihood of a Risk Occurring?

Determining the likelihood of a risk occurring is a critical step in managing risks effectively. The likelihood of a risk occurring is a measure of how likely it is that a risk will materialize. Here are some tips on how to determine the likelihood of a risk occurring:

Assess Historical Data: Look at historical data, such as past incidents, to determine the likelihood of a risk occurring. This data can be used to assess the likelihood of a similar risk occurring in the future.

Conduct a SWOT Analysis: A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis can be used to determine the likelihood of a risk occurring. This analysis can help you identify potential risks and the likelihood of those risks occurring.

Consider Expert Opinion: Consult with experts in your field, such as industry experts, to determine the likelihood of a risk occurring. These experts can provide valuable insights into the likelihood of a risk based on their experience and knowledge.

Use Probability Analysis: Probability analysis can be used to determine the likelihood of a risk occurring. This analysis involves using statistical models to estimate the likelihood of a risk occurring based on historical data or expert opinions.

Consider Subjective Judgments: In some cases, subjective judgments may need to be used to determine the likelihood of a risk occurring. This can include considering the opinions of those who are closest to the risk, such as employees, customers, or stakeholders.

It’s important to note that the likelihood of a risk occurring will often change over time and may need to be reassessed regularly. By regularly reassessing the likelihood of risks, you can ensure that your risk management processes are up-to-date and effectively protecting your organization’s interests.

FAQs

How is the likelihood of a risk determined in a risk matrix?

The likelihood of a risk occurring is determined by assessing historical data, conducting a SWOT analysis, considering expert opinion, using probability analysis, and considering subjective judgments. The likelihood of a risk can change over time, and it may be necessary to reassess it regularly.

How is the impact of a risk determined in a risk matrix?

The impact of a risk is determined by considering the potential consequences of the risk occurring, including financial, operational, and reputational impacts. The impact of a risk can be assessed on a scale, such as minor, moderate, or major.

How is a risk matrix updated and maintained?

A risk matrix should be updated and maintained regularly, to ensure that the risks are being effectively managed. This can involve updating the matrix to reflect changes in the likelihood and impact of risks, as well as changes to the mitigation strategies being used to manage those risks. Regular monitoring and review of the matrix is important to ensure that it continues to effectively support risk management efforts.

Is a risk matrix the only tool used in risk management?

No, a risk matrix is just one tool used in risk management. Other risk management tools include risk assessments, risk registers, and risk management plans. The choice of risk management tool will depend on the specific needs and goals of the organization, as well as the type and complexity of the risks being managed.

What are the limitations of a risk matrix?

The limitations of a risk matrix include subjectivity in determining the likelihood and impact of risks, difficulty in accurately predicting the likelihood of low probability/high impact events, and limitations in comparing risks across different industries or organizations. Additionally, a risk matrix can be limited by the data and information available, so it’s important to regularly reassess and update the matrix to ensure its accuracy and effectiveness.

What are the different types of risk matrices?

There are several different types of risk matrices, including simple risk matrices, color-coded risk matrices, and numerical risk matrices. The type of risk matrix chosen will depend on the specific needs and goals of the organization, as well as the type and complexity of the risks being managed.

What are the best practices for using a risk matrix in risk management?

The best practices for using a risk matrix in risk management include regularly reassessing and updating the matrix to reflect changes in the likelihood and impact of risks, using clear and concise language to describe risks and their likelihood and impact, and using a consistent methodology for assessing the likelihood and impact of risks. Additionally, it’s important to involve all relevant stakeholders in the risk management process, to ensure that the risk matrix accurately reflects the risk landscape.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Risk Register Templates [Word & Excel, PDF] 3 Risk Register](https://www.typecalendar.com/wp-content/uploads/2023/06/Risk-Register-150x150.jpg)