All auditors require an audit report to deliver the audit report to their clients along with the financial statements. This audit report template aims to increase transparency within the business. This will enable better management and adequate documentation for future references by internal and external individuals.

Table of Contents

What is an audit report?

The audit report is a document prepared by the auditor for internal use. It provides an overview of the significant findings and observations made during the audit process concerning compliance against applicable laws or regulations and deficiencies observed in internal control systems.

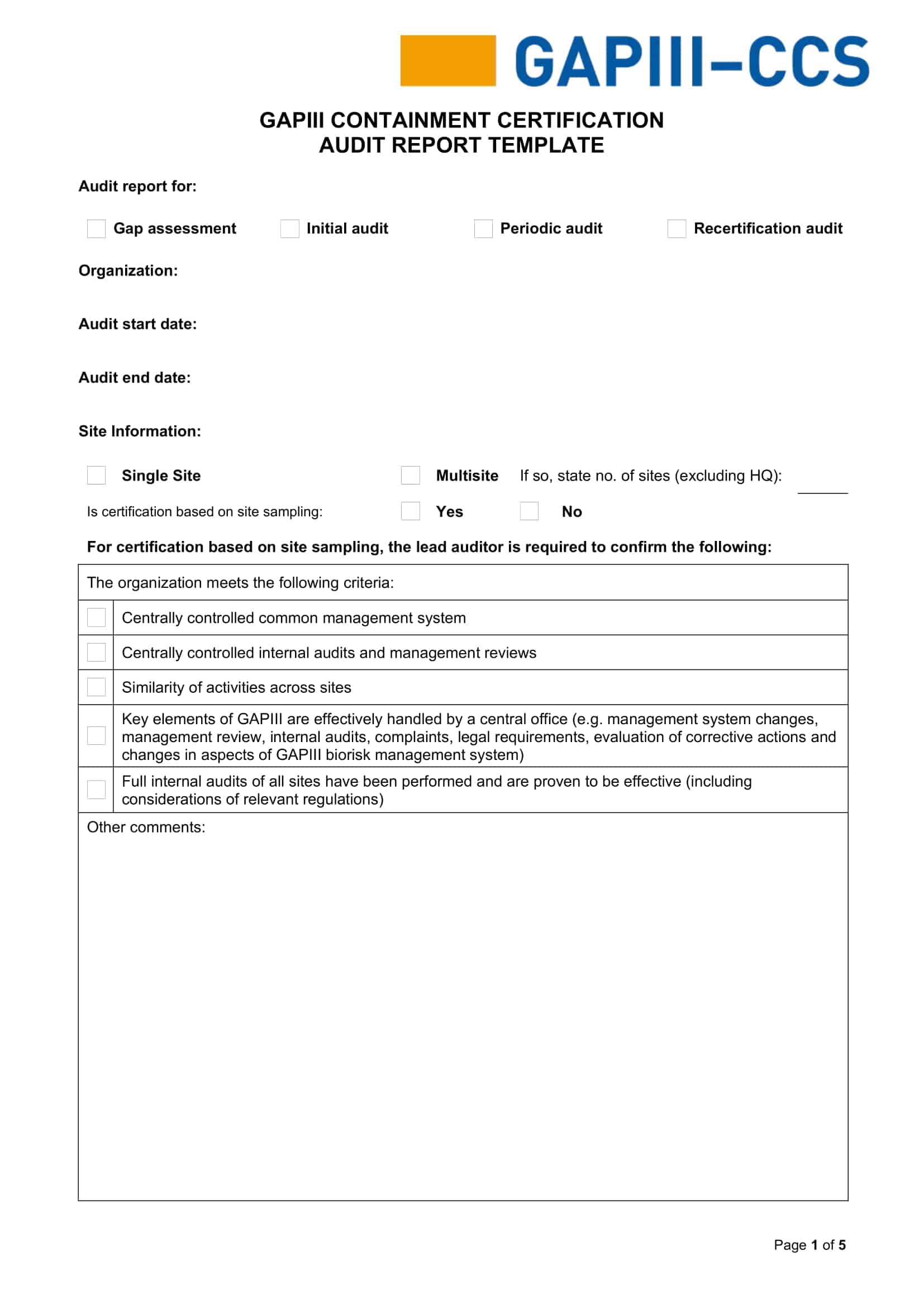

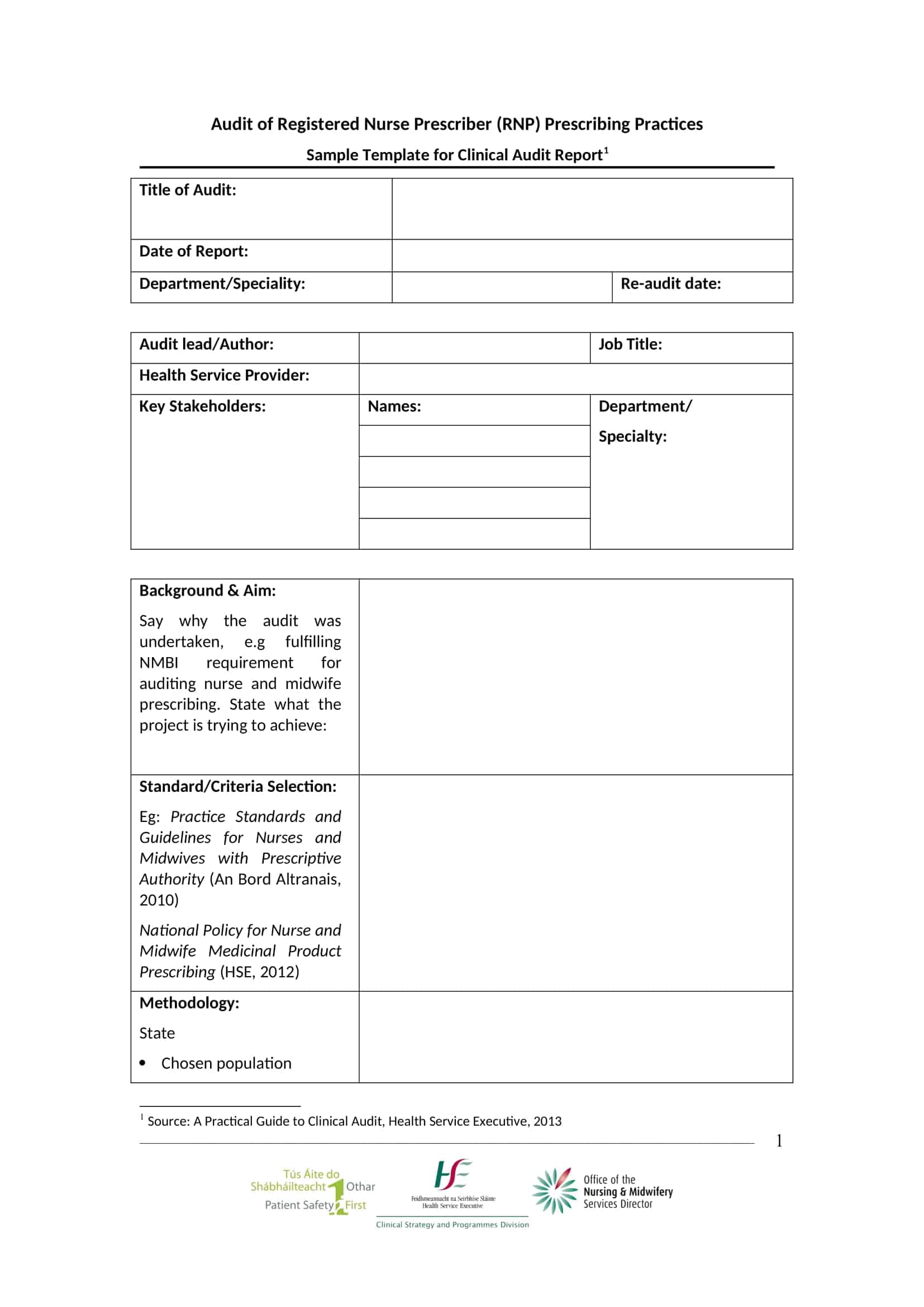

Audit Report Templates

Audit report templates are pre-designed documents used by auditors to present the findings and conclusions of an audit engagement. These templates provide a structured format for summarizing the results of an audit and communicating them to the relevant stakeholders.

Audit report templates typically include sections that cover the objective and scope of the audit, the methodology used, the key findings, observations, and recommendations. They may also include sections for management responses and action plans to address any identified issues or weaknesses.

Using an audit report template ensures consistency and uniformity in the presentation of audit results. It helps auditors organize their findings and conclusions in a logical and standardized manner, making it easier for stakeholders to understand and act upon the information provided.

When do you need an audit report?

As a business owner, you must understand when an audit report is necessary. The following are some instances where it is important to have your business audited:

- For tax purposes. You must provide certain documents when you file taxes with the Internal Revenue Service (IRS). You may be subject to penalties if you can’t prove that you have kept proper records of your income and expenses.

- When you want to sell your business, banks and investors will want to see proof of your financial health before giving their money or lending to your company.

- When the IRS asks for one, this does not happen often, but if the IRS has reason to believe that there may be tax fraud occurring within your company, they will ask for an audit report as part of their investigation process. If they find something suspicious in the audit report, they will further investigate possible tax fraud charges against your organization.

- A financial audit report will help potential investors decide whether they want to invest in a company. The report is also helpful for owners and managers who are looking for ways to improve their company’s performance and efficiency.

Essential elements of an audit report

An audit report is an important document created by the auditor to provide an objective opinion on the entity’s financial statements and internal controls.

The essential elements of an audit report are:

Title: This should be short yet easily understandable by all interested parties

Addressee: The addressee can be anyone from a shareholder to a consumer (the consumer is usually addressed directly)

Purpose: It explains why you are issuing this particular report

Background: It gives background information about your relationship with your client and also about your professional qualifications (if required)

Findings/Opinion: It highlights what you found during your inspection

Recommendations for Improvement: It suggests ways in which your client can improve their business.

Auditor’s responsibility

The auditor must issue an audit report clearly and professionally. This includes the auditor’s responsibility to the users of the financial statements. In this section, the auditor should state that they have complied with specific standards and regulations when issuing the audit report. The auditor should also state that he or she has not been compromised in any way and have no conflicts of interest that may compromise their objectivity.

Auditor’s signature:

The signature is usually placed at the bottom of the report and should match the signature on your license to practice as an auditor.

Place of the signature and date

The date, place, and signature should be placed at the end of an audit report example so that it can be easily identified as authentic by any reader of this document.

Opinions of audit report

The audit report is the opinion of the auditor on the financial statements. The audit report provides information about whether the financial statements are free from material misstatements.

The following are some of the opinions that can be expressed in an audit report:

Unmodified opinion

This means that the financial statements have been prepared following generally accepted accounting principles (GAAP) and have been audited without qualifying or modifying any of those principles. In other words, an unmodified opinion means that the financial statements are presented fairly in all material respects, in conformity with GAAP.

Modified opinion

This means that there is some departure from GAAP, and an auditor’s judgment was required to form an opinion on financial statements. For example, if material weaknesses make it difficult to prepare financial statements in conformity with GAAP or if there has been a change in accounting policy that materially affects comparability between the current period and prior periods, then the auditor will issue a modified opinion on such financial statement.

Adverse opinion

This type of opinion means that something is wrong with your financial statements, possibly due to fraud, error, or omission. If your auditor expresses an adverse opinion, then you will have to revise your financial statements before issuing them again.

Disclaimer of opinion

This type of opinion means that there are significant doubts about the accuracy and reliability of your financial statements, so they cannot be relied upon by investors or creditors to make decisions about investing in your company’s stock or lending money to it for operations. In this case, you’ll need to go back through your books and ensure everything is correct before issuing another set of audited financial statements.

Tips For Writing An Audit Report Template

You can use several tips to write an audit report template. These tips will help you ensure that your audit report is written professionally and meets all your organization’s requirements. The following list of tips will help you to write an audit report template:

Heading

Use headings and subheadings sparingly but strategically. Headings are used in an audit report template so readers can quickly find information within large blocks of text without having to read every word of every paragraph first for them to understand what is being discussed in each section of your report.

Know what information needs to be included in your report

The second step in writing an audit report template is knowing what information needs to be included in your final document. Several pieces of information should be included in every audit report, no matter which type of company or organization has been audited. For example, all reports should include the following:

- An introduction where you explain why you were asked to conduct the audit.

- A summary section where you give a brief overview of each section.

- A conclusion where you discuss how effective or ineffective management was during their tenure as directors.

Responsibilities

The auditor should clarify who they are and what authority their employer has given them to perform the audit.

Nature of the financial statements

The auditor should explain how the financial statements were prepared for inclusion in their report, including notes containing information about changes in accounting policies or estimates made. They should also provide any caveats or qualifications relating to the financial statements included in their report.

Basis of opinion

In the final part, the basis for the opinion should also be included in the introduction section of your audit report template. This can be done by stating whether internal auditors or external auditors performed it. It could also state how often they perform audits per year or how many audits they have performed throughout their career as an auditor.

Conclusion

Audit reports are best suited for financial or management processes. The templates in this article will provide information about a complete system’s strengths, weaknesses, and opportunities. There is a lot of data in these reports, so it can be difficult to decide where to start. These templates try to make that decision more accessible by using clear, colorful graphics to draw attention to important points. This information is valuable for those involved in auditing for long-term success.

FAQs

How do you write an audit report?

To write an audit report: Outline background, objectives, scope. Summarize procedures performed and evidence gathered. Provide observations and conclusions on compliance to standards. Give recommendations to address weaknesses. Include responses/action plans from auditees. Use a standard format like intro, executive summary, methodology, findings, appendices. Write clearly and objectively.

What are the 5 C’s of audit report writing?

The 5 C’s principle for effective audit report writing is:

- Clear – Use simple language, avoid jargon, explain technical terms

- Concise – Be brief and to the point, include only relevant details

- Complete – Cover all parts needed per standards without omissions

- Convincing – Support findings with sufficient, appropriate evidence

- Correct – Ensure accuracy in facts, figures, interpretations

What are the 4 C’s of audit report writing?

The 4 C’s of audit report writing are:

- Complete – Cover scope, objectives, background, procedures, findings

- Clear – Use plain language and define terms

- Concise – Be selective and succinct with information

- Convincing – Provide adequate evidence and context for conclusions

What are the 5 components of internal audit report?

The 5 key components of an internal audit report are:

- Introductory or background information

- Audit scope, objectives and methodology

- Summary of findings and conclusions

- Recommendations to address issues found

- Auditee responses and action plans

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)