Saving and budgeting money can be a struggle, but what if a fun challenge could help build your financial discipline? The 100 Envelope Challenge offers just that – a way to systematize your savings while adding some excitement. This goal-oriented challenge involves stuffing 100 envelopes with increasing cash amounts over 100 days. We’ll break down exactly how the interactive challenge works, its unique benefits, and tips to succeed.

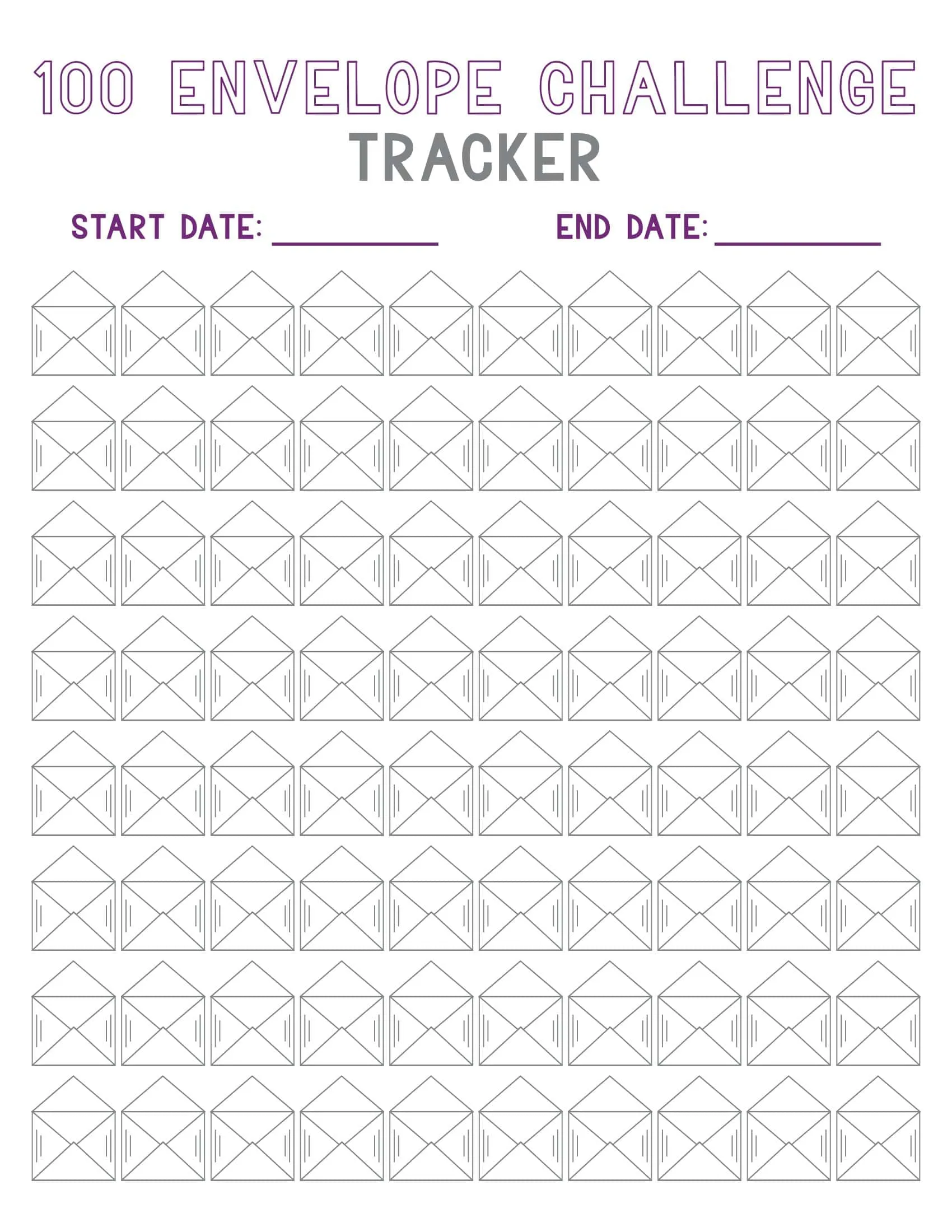

To support the process, this article includes a free downloadable 100 Envelope Challenge template you can print to start stuffing cash. Discover how this viral savings challenge can help motivate you to save over $5,000 in 100 days while learning positive financial habits. With a simple yet powerful concept, the 100 Envelope Challenge makes saving money engaging.

Table of Contents

What Is the 100 Envelope Challenge?

The 100 Envelope Challenge is a viral personal finance activity that helps people save over $5,000 dollars in 100 days. Participants number 100 envelopes from 1 to 100. Each day for 100 days they stuff the corresponding numbered envelope with that dollar amount.

On day 1 they stuff $1, day 2 they stuff $2 and so on until day 100 when they stuff envelope 100 with $100. In total over the 100 days they will have saved $5,050 by systematically building their cash savings in increasing increments. The interactive challenge makes saving money fun while helping instill consistent savings habits.

100 Envelope Challenge Templates

The 100 Envelope Challenge is a budgeting strategy laid out in a motivating pdf. This financial challenge encourages saving money through small incremental amounts in 100 envelopes. The pdf guides users to label 100 envelopes with monetary amounts ranging from $1 to $100.

The pdf details how to proceed with the challenge. To start, the user will put the designated cash amount into each envelope. Then they randomly select an envelope each day and deposit or save the money inside. As envelopes accumulate, so do savings.

Following the 100 Envelope Challenge pdf provides a concrete system to put aside money. Seeing the amounts add up over time offers positive reinforcement. The sense of accomplishment can promote lasting budgeting skills. Working through all 100 envelopes results in $5,050 saved. The pdf provides an engaging approach to meet savings goals and build wise money habits.

Benefits Of 100 Envelope Challenge

The 100 Envelope Challenge offers a variety of benefits, touching on both financial well-being and personal development. Here are some of the key advantages:

Structured Savings Plan

The challenge provides a structured way to save money, breaking down the process into manageable steps. With specific amounts allocated to each envelope, it eliminates guesswork and provides a clear pathway towards achieving a significant savings goal.

Incremental Growth

The 100 Envelope Challenge encourages incremental financial growth, allowing participants to start small and gradually build up to larger contributions. This approach can make the task of saving a substantial amount of money feel less daunting and more achievable.

Flexible Time Frame

The challenge offers flexibility in how quickly you can complete it. Whether you decide to fill envelopes daily, weekly, or at any other frequency, you can tailor the challenge to fit your financial situation and lifestyle.

Financial Discipline

Committing to filling envelopes consistently encourages financial discipline. It demands planning, budgeting, and setting aside funds regularly, helping you develop valuable money management skills that can benefit you long after the challenge ends.

Boosts Financial Literacy

The process of regularly setting aside money and tracking your progress can increase your awareness of your spending habits, your income streams, and your overall financial health. This heightened awareness can be an educational experience, fostering greater financial literacy.

Sense of Accomplishment

Completing the challenge gives you a tangible sense of achievement. Saving $5,050 is a significant accomplishment that can boost your confidence in your ability to set and meet financial goals, providing emotional and psychological rewards in addition to financial gains.

Encourages Goal Setting

The challenge’s structured approach to saving can inspire you to set other financial or personal goals. The discipline, planning, and incremental growth strategies you practice can be applied to other areas of your life, from paying off debt to pursuing career advancements or personal projects.

Community Support

Many people undertake the 100 Envelope Challenge as part of a community, whether online or among friends and family. This community can offer support, encouragement, and accountability, making it easier to stay committed and reach your savings goal.

Emergencies and Opportunities

Having a nest egg of $5,050 can be immensely helpful in case of emergencies like unexpected medical expenses or car repairs. Alternatively, it can provide the financial freedom to take advantage of opportunities that require a lump sum, such as travel or investment.

Customizable

The challenge can be adjusted to suit your financial capabilities. If the standard $1 to $100 range is too ambitious, you can adjust the amounts or extend the time frame to make it more manageable.

Fun and Engaging

Last but not least, many people find the 100 Envelope Challenge to be a fun and engaging way to save money. The act of physically filling envelopes and seeing your progress can make the often-dreary task of saving more enjoyable.

How Does The 100 Envelope Challenge Work?

The 100 Envelope Challenge is a savings strategy designed to help people incrementally build a savings fund over a specific period, usually ranging from a few weeks to several months. The challenge involves 100 envelopes, each labeled with a different amount of money ranging from $1 to $100. The goal is to fill each envelope with the corresponding amount of money, eventually accumulating a total of $5,050 when all envelopes are filled. Below is a detailed guide on how the challenge works:

Step 1: Gather Your Supplies

You’ll need 100 envelopes and a pen for labeling. Some people also like to use colored markers, stickers, or other decorative supplies to make the envelopes more visually appealing, but this is optional.

Step 2: Label the Envelopes

Label each envelope with a number from $1 to $100. This number represents the dollar amount you will place in that envelope. Once you’ve labeled all 100 envelopes, you’re ready to begin the challenge.

Step 3: Choose Your Time Frame

Decide on the time frame for completing the challenge. Some people spread it out over the course of a year, putting money into one or two envelopes per week. Others prefer a more condensed time frame, like 100 days. Your choice will depend on your financial situation and savings goals.

Step 4: Randomly Pick Envelopes

Each day, week, or any other time period you’ve decided on, randomly select an envelope and fill it with the amount of money written on it. For example, if you pick an envelope labeled “$47,” you will put $47 into that envelope.

Step 5: Record Your Progress

Keep track of which envelopes you’ve filled so you can see your progress. This can be as simple as keeping a list or marking off filled envelopes on a chart. Some people also find it motivating to keep a running total of how much they’ve saved.

Step 6: Store Envelopes Safely

Make sure to store the envelopes in a safe place, such as a locked safe or another secure location. This ensures that your savings remain intact throughout the challenge.

Step 7: Optional Variations

There are several ways to adapt the challenge to better fit your needs:

- Reverse Order: Some people prefer to start with the higher amounts first, gradually working their way down to the smaller amounts.

- Double Up: If you want to increase the challenge, you can double the amounts on the envelopes, making the challenge range from $2 to $200 instead of $1 to $100.

- Custom Amounts: If the $1 to $100 range doesn’t work for you, you can customize the amounts to better fit your budget.

Step 8: Complete the Challenge

Once all 100 envelopes are filled, you’ll have $5,050 saved up! This money can be used for a special purchase, invested, or saved for emergencies.

Step 9: Celebrate!

Don’t forget to celebrate your achievement. Successfully completing the 100 Envelope Challenge is a significant financial milestone that takes discipline and commitment.

Step 10: Assess and Repeat

After completing the challenge, take some time to assess what worked well for you and what didn’t. If you found the challenge useful, you might consider doing it again, perhaps with some variations to keep things interesting.

How Much Do You Save With the 100 Envelope Challenge?

The 100 Envelope Challenge is designed to help you save $5,050 over the course of completing the challenge. This amount is calculated by summing up all the numbers from 1 to 100, which is the range of amounts you’ll be putting into the envelopes. The challenge consists of 100 envelopes labeled with amounts ranging from $1 to $100. Each envelope should be filled with money corresponding to the amount written on it. Once you’ve filled all 100 envelopes, you’ll have saved a total of $5,050.

The challenge can be done on your own timeline, allowing you to control how quickly or slowly you accumulate the savings. Some people opt to complete the challenge over a year, contributing to one or two envelopes per week. Others aim for a more accelerated approach, completing it in 100 days by filling one envelope per day. The flexibility in the timeline makes the challenge adaptable to different financial situations and savings goals.

Beyond the basic $5,050 you save, the challenge can also serve as a stepping stone to more extensive saving and investment activities. Once you’ve built this nest egg, you may choose to invest the sum in a high-yield savings account, a retirement fund, or any other investment vehicle that aligns with your financial objectives. In this way, the $5,050 can serve as not just an endpoint but a launching pad for broader financial planning and security.

Pros and Cons of the 100 Envelope Challenge

The 100 Envelope Challenge, like any savings or investment strategy, comes with its own set of pros and cons. Here’s a detailed breakdown:

Pros:

1. Structured Saving

The 100 Envelope Challenge offers a highly structured approach to saving, making it easy for individuals who struggle with financial discipline to stick to a plan. The specific amounts designated for each envelope remove any ambiguity or guesswork.

2. Achievable Milestones

The challenge breaks down a seemingly large savings goal into smaller, achievable milestones. This incremental approach helps prevent feelings of overwhelm and fosters a sense of accomplishment along the way.

3. Flexibility

You can tailor the timeline to fit your needs. Whether you wish to complete the challenge in 100 days or spread it out over a year, the challenge accommodates different timelines and financial situations.

4. Financial Education

The challenge offers an opportunity to improve your financial literacy. Tracking your progress and managing your money to fill each envelope can be an educational experience that helps you better understand budgeting and saving.

5. Community Support

If you’re participating in the challenge with friends or online communities, you benefit from a support system that can help you stay committed. This community aspect can add accountability and encouragement.

6. Tangible Results

The challenge provides immediate, tangible results in the form of filled envelopes. Unlike digital savings methods, the physical act of filling envelopes can offer a more concrete sense of progress.

7. Customization

You can easily customize the challenge to suit your financial capabilities. You could, for instance, halve the amounts if the standard $1 to $100 range is too high for your current situation.

Cons:

1. Lack of Interest

Unlike a high-yield savings account, the money in the envelopes does not earn interest. This means you’re missing out on potential earnings over the time you’re saving.

2. Risk of Loss or Theft

Keeping large amounts of cash in envelopes poses a security risk. It’s crucial to have a secure place to store the envelopes to protect your savings.

3. Inconsistency

The random nature of selecting envelopes could make it challenging for people who prefer predictable, consistent savings amounts. Some weeks could be financially tighter than others, depending on which envelopes you pick.

4. Not Digitally Tracked

For those who prefer digital budgeting tools and apps, the analog nature of this challenge may feel cumbersome or outdated. It also means you need to manually track your progress, which some may find inconvenient.

5. Requires Physical Space

You’ll need a location to store 100 envelopes safely. For those with limited space or who are concerned about clutter, this could be a drawback.

6. Not Suitable for All Financial Situations

The challenge demands a certain level of financial stability. Those who are living paycheck to paycheck may find it difficult to set aside money consistently.

Conclusion

Budgeting and saving money can feel like a chore. But the 100 Envelope Challenge introduces an intriguing process to make building your savings more engaging. Simply stuffing envelopes with increasing amounts of cash over 100 days can lead to over $5,000 in new savings. Beyond the quantifiable results, the challenge rewards persistence and mindfulness around your finances. Our free printable templates help you implement the process seamlessly. As the cash accumulates in those envelopes, celebrate the positive financial behaviors you are reinforcing. With the right focus, the 100 Envelope Challenge makes achieving your savings goals more tangible and more exciting. Let it inspire you to embrace new budgeting habits that have an impact long after you complete all 100 envelopes.

FAQs

Do I have to start with the lowest amount?

No, you can pick envelopes in any random order. The challenge is designed to be flexible, allowing you to contribute based on your current financial situation.

What do I do if I can’t afford to fill an envelope?

You can opt to skip that envelope and pick another one with a more manageable amount. You can return to the skipped envelope when you’re better able to afford it.

What kind of financial benefits will I get?

You will save a total of $5,050 by the end of the challenge. However, since the money is stored in envelopes, it won’t earn interest like it would in a savings account.

Can I do the challenge with a partner or group?

Yes, doing the challenge with a partner or group can add a layer of accountability and make it more fun. Each person can have their own set of envelopes, or you can work together to fill a communal set.

What should I do with the money after completing the challenge?

Once you’ve saved the $5,050, you can use it for various purposes like an emergency fund, a special purchase, or investment. The choice is yours!

Is there a risk of losing money?

The primary risk is the physical loss of the envelopes due to theft or misplacement, which is why it’s crucial to store them securely.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Envelope Address Templates [Word, PDF] 3 Envelope Address](https://www.typecalendar.com/wp-content/uploads/2023/05/Envelope-Address-1-150x150.jpg)