Sustainable profitability in the markets does not arise from a single lucky trade, but from a repeatable decision process. To meet that need, TypeCalendar has prepared 46+ Trading Journal templates and sample sets for different styles and markets. This collection offers separate backbones for intraday, swing, options, futures and crypto strategies, combining the steps of writing down the plan, recording the execution and evaluating the result with evidence in a single flow. This way, you go beyond the profit/loss numbers and make the real goal, decision quality, visible.

Table of Contents

What Is a Trading Journal Template?

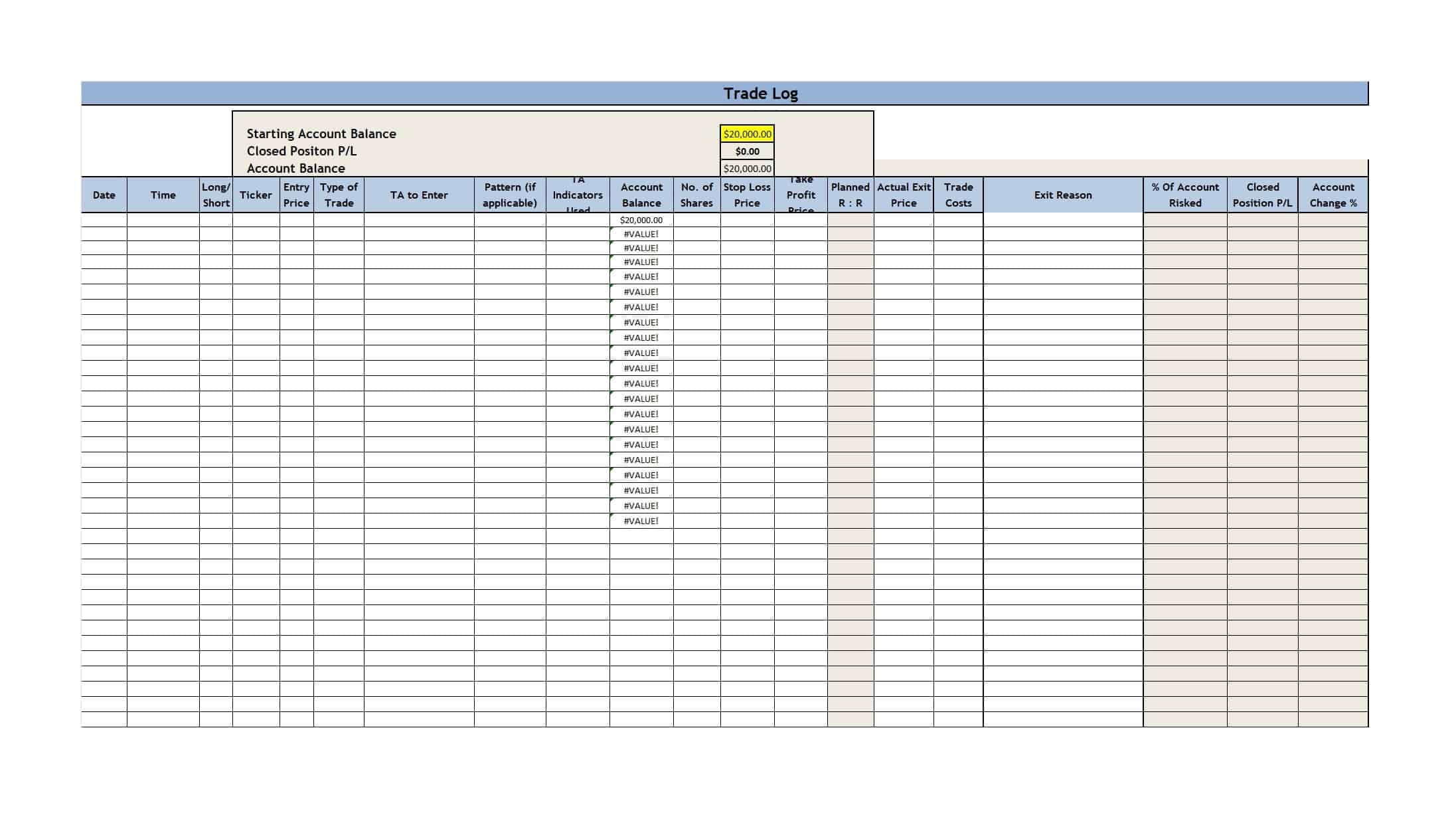

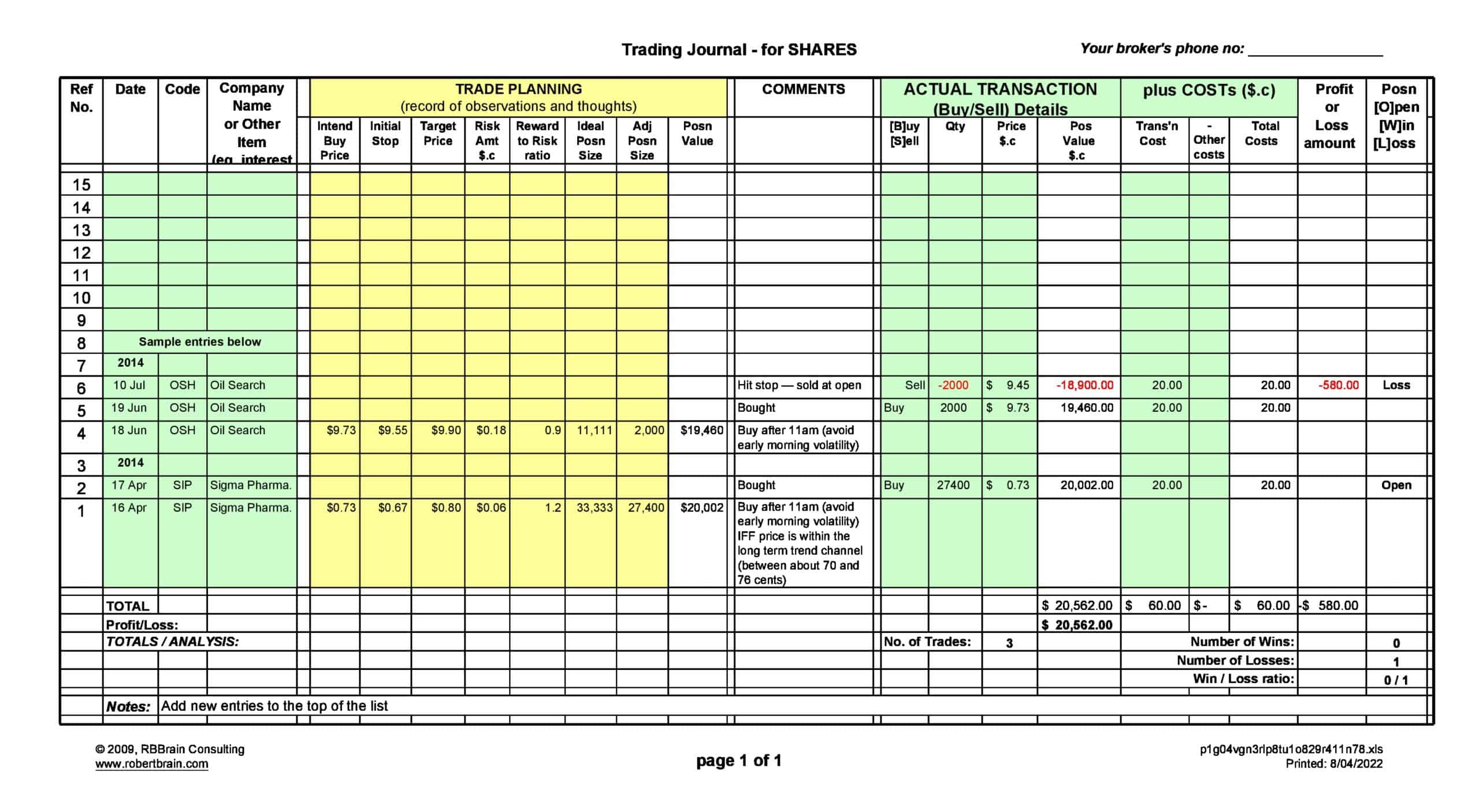

A trading journal is a structured decision log that documents each trade in the context of “before–during–after”. Before entering the trade, the thesis, setup, entry–stop–target levels, expected risk/reward ratio and position sizing are clarified; order execution, slippage and costs are noted during the trade; after the trade is closed, the result is measured on an R basis and what is seen and felt on the screen is converted into short comments. This frame is “what happened?” while answering the question with data, “why did it happen?” and “how can I do it again?” it also makes it possible to answer your questions on the same page.

Why Use a Trading Journal?

The main gain of journaling is discipline. As the plan–execution distinction becomes clearer, off-plan trades made on an “instantaneous whim” become visible; serial measurement reveals the expected value of the strategy and statistically confirms which time, day, instrument or setup you are strong in. This visibility reduces the tendency to overtrade, makes it easier to adhere to your risk ceilings, simplifies your game plan in the medium term and helps you only bring positive expectancy patterns into your “playbook”. The result is a more consistent performance curve and a more controlled emotional state.

Scope: 46+ Templates and Samples

The collection includes different levels of depth, from simple journals for beginners to detailed risk and metric boards for professionals. Intraday variants add timestamps and session context; swing adds daily/weekly thesis fields; options add strike, expiration, IV/Greeks; futures/crypto add volatility regime and funding/basis notes. Placeholders and sample entries let you complete your first journal in minutes; over time you deepen the same backbone into your own methodology.

File Types and Ease of Use

All Trading Journal templates are available in Excel (XLSX), Word (DOCX) and PDF formats. Excel sheets are ready with R and position size formulas, drop-down lists, and conditional formatting; pivot and chart areas are intended for weekly/monthly reports. Word templates standardize the narrative with daily–weekly–monthly evaluation texts and “error classification” pages; PDF versions are prepared with fixed layout for quick browsing and archiving on mobile. Screenshot URL fields easily map to your cloud folders.

Download: Improve Decision Quality with a Disciplined Trading Journal

Successful traders measure and improve the process before the profit. TypeCalendar’s 46+ Trading Journal Template and sample collection takes the hassle out of data retention and turns it into learning; it makes your plan–execution–evaluation cycle speak the same language. Choose the variant that suits you, start filling it today, see your first insights after a week and move on with only positive expectation patterns after a month.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)